A Closer Look at the ITLG Token: Tokenomics, Use Cases, and Benefits for Users

Detailed overview of the ITLG token explaining tokenomics, governance, utility, payments, verification model, and user benefits within the InterLink blockchain network.

UC Hope

January 23, 2026

Table of Contents

The InterLink Genesis Token, known as ITLG, sits at the center of the InterLink network, a human-centric blockchain project focused on building a large-scale verified human economy. Unlike many crypto networks that prioritize capital or speculative liquidity, InterLink is structured around proof of personhood and verified participation. ITLG is the mechanism through which that participation is measured, rewarded, and governed.

This article examines ITLG in detail, focusing on its tokenomics, technical design, real-world use cases, and the concrete benefits for users. The goal is to explain how the token functions today and its position within the InterLink ecosystem.

What Is the ITLG Token?

ITLG is the primary utility and participation token of the InterLink network, developed by InterLink. It is designed to represent verified human activity rather than financial stake alone. Tokens are minted through human verification and ongoing participation, not through capital investment or hardware-intensive mining.

The network uses proof-of-personhood mechanisms, including facial scanning and liveness detection, to ensure each participant represents a real individual. This approach is intended to reduce bot activity and sybil attacks, which have become more common as automation driven by artificial intelligence expands.

ITLG is held primarily by Human Nodes and miners, meaning verified users who contribute to the network by completing verification, referring new users, and engaging with applications built on InterLink.

ITLG Tokenomics Overview

The total supply of ITLG is capped at 100 billion tokens. Once this maximum supply is reached, the network does not automatically inflate further. Any decision to maintain the cap or increase supply would be made through a vote of a decentralized autonomous organization, with ITLG holders determining the outcome.

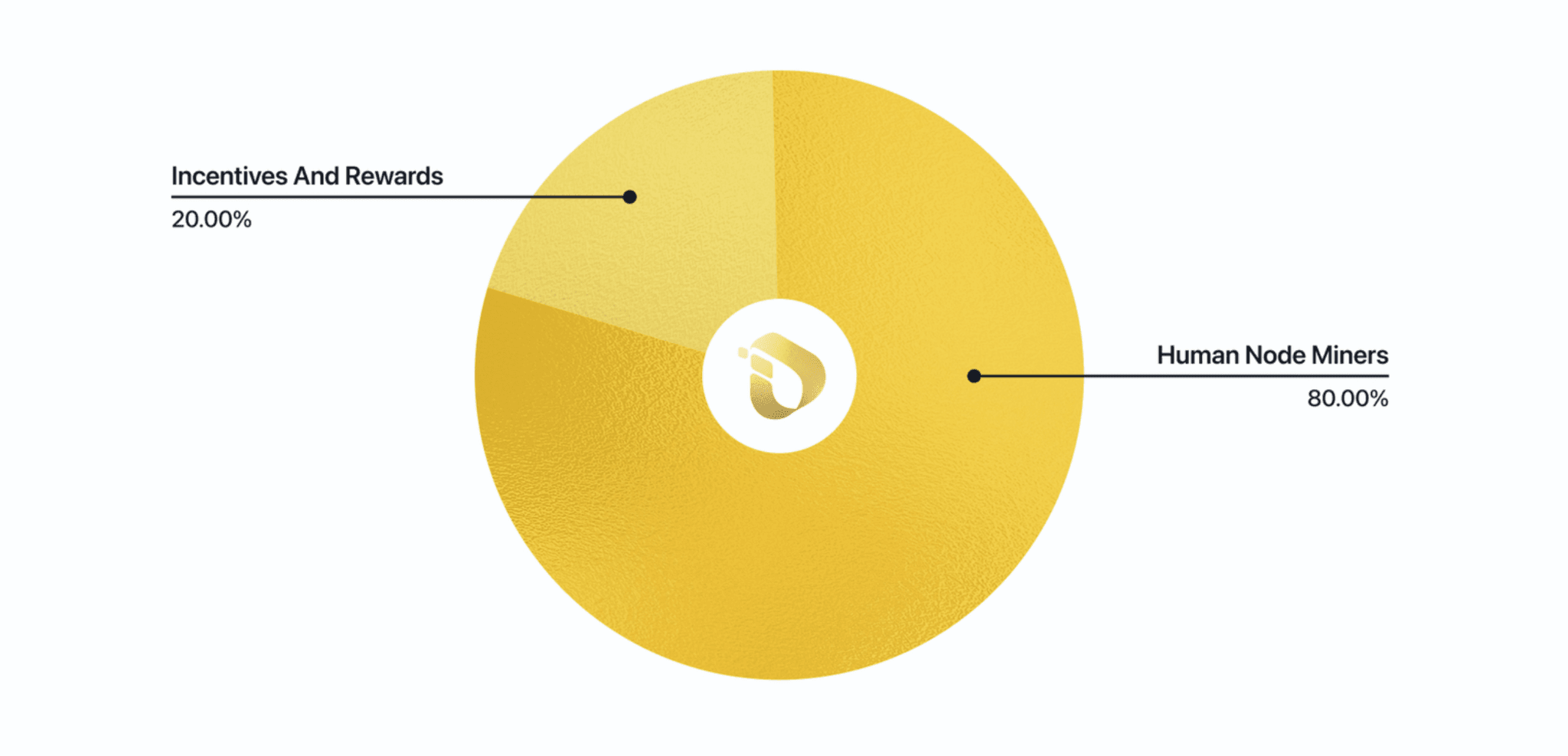

Distribution Structure

Eighty percent of the total supply is allocated to Human Node miners. These are verified users who earn tokens through app-based activity, including daily participation, referrals, and engagement with mini apps.

The remaining twenty percent is reserved for ecosystem incentives. This allocation supports development, partnerships, governance initiatives, and network growth. Notably, the structure avoids large venture capital allocations or early insider unlocks, reducing the risk of concentrated sell pressure.

Earning Mechanism

ITLG is earned through a mobile application. There is no requirement for specialized hardware or upfront financial investment. Emissions are tied directly to verified human activity rather than market demand or speculative trading volume.

The system includes mechanisms to boost efficiency, such as streaks, which reward consistent participation. Tokens must also be verified through the Human Credit System to unlock full utility. Unverified or inactive balances can be subject to burn or redistribution, reinforcing the expectation of ongoing engagement.

Deflationary Features

The tokenomics include several deflationary controls. Inactive or unverified tokens may be burned or reallocated to active participants. Supply adjustments are linked to levels of human participation rather than fixed time schedules. When participation slows, emission rates contract. When verified activity grows, emissions expand in proportion.

This activity-based halving model ties scarcity to network health rather than speculative cycles. Vesting schedules and lockups further limit sudden increases in circulating supply.

What is the Relationship Between ITLG and ITL?

InterLink operates a dual token system. ITLG serves as the utility and participation token, while ITL functions as the reserve and institutional token.

Verified ITLG can be staked to generate ITL without principal loss or slashing. ITL has a total supply of 10 billion tokens, with half allocated to ITLG stakers. ITL is used for treasury operations, long-term reserves, and higher-level governance functions.

Treasury companies acquire ITL through over-the-counter market purchases rather than direct issuance from the core team. This structure is intended to create buy-side demand without diluting existing holders and to separate user incentives from institutional liquidity.

Core Use Cases of ITLG

Governance and DAO Participation

ITLG holders participate directly in governance. Verified tokens grant voting rights on proposals that affect supply parameters, integrations, token burns, and ecosystem priorities. This governance model is designed to limit centralized control and align decision-making with active participants.

Ecosystem Incentives

Projects building on InterLink can distribute incentives to ITLG holders based on activity and participation levels. These incentives may include airdrops, revenue sharing, and staking rewards tied to ITLG and ITL interactions.

Payments and Transactions

ITLG functions as a medium of exchange within the InterLink ecosystem. It is used for transaction fees on the ITLX exchange, payments within mini apps, and peer-to-peer transfers. The network supports real-world payments through integrations such as Visa cards and QR-based systems in select regions.

These features enable use cases including cross-border transfers, humanitarian aid distribution, and compensation for data contributions, all using standard smartphones.

Access and Network Privileges

Holding and verifying ITLG provides early access to launchpads, whitelists for new applications, reduced transaction fees, and premium features within the ITLX wallet. Certain participation thresholds also qualify users to act as payment hubs within the network.

Network Security and Expansion

ITLG underpins the Human Node system. Verified users contribute to network security through identity validation and referrals. Reputation data linked to ITLG holdings can be used to ensure fair distribution of rewards and reduce manipulation in airdrops and staking programs.

Benefits for Users

Fair Access and Inclusion

Users can earn ITLG without capital investment or specialized equipment. This model lowers barriers to entry and supports inclusion, particularly for unbanked populations. Anti-bot controls reinforce a one-person-one-node principle.

Direct Governance Influence

Verified users have a measurable voice in network decisions. This reduces reliance on centralized administrators and aligns governance outcomes with active participation.

Economic Structure Focused on Durability

Deflationary mechanics, activity-based emissions, and treasury purchases create conditions where value is tied to sustained network use rather than short-term trading. Accumulation is rewarded through participation rather than speculation.

Practical Utility

Reduced fees, access privileges, and real-world spending options give ITLG practical value beyond on-chain activity. Users can interact with applications, services, and payment tools within a unified ecosystem.

Security and Privacy

Biometric verification is implemented with privacy protections such as hashing and decentralized storage. This allows Sybil resistance without exposing raw personal data.

Risks and Constraints

The model is not without risks. A large total supply requires sustained adoption to support value stability, and strict verification requirements may discourage some users. Additionally, network performance and adoption timelines remain dependent on successful mainnet deployment, currently targeted for early 2026.

These factors underscore the importance of execution and user experience in determining long-term outcomes.

Conclusion

ITLG is designed as a functional token that reflects verified human participation within the InterLink network. Its tokenomics prioritize activity-based distribution, controlled supply growth, and governance by real users rather than capital concentration. Use cases span governance, payments, incentives, and network security, with a consistent emphasis on practical utility.

Rather than positioning ITLG as a speculative asset, InterLink frames it as infrastructure for a human-verified digital economy. The effectiveness of this approach will depend on adoption, verification reliability, and the network’s ability to support real-world use at scale.

Sources:

- Interlink Whitepaper: Key Details About Genesis Token (ITLG)

- Interlink Medium Blog: How ITLG, Verified ITLG, and ITL build sustainable, compliant global payments

- Website: Interlink Blog posts

Read Next...

Frequently Asked Questions

What makes ITLG different from other utility tokens

ITLG is minted through verified human activity rather than capital investment or hardware mining. Its distribution and governance are tied to proof of personhood.

How do users earn ITLG?

Users earn ITLG through a mobile application by completing verification and participating in network activities such as referrals and mini-app engagement.

What happens when ITLG reaches its maximum supply

Once the 100 billion token cap is reached, ITLG holders vote through the DAO to decide whether to maintain the fixed supply or approve a strategic increase.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events