Richard Heart and the Claims of a Hidden Stablecoin Operation

An investigative look at Richard Heart, pDAI, and on-chain claims of a hidden stablecoin operation within the PulseChain ecosystem.

BSCN

February 9, 2026

Marcus Ellwood is an independent finance and blockchain researcher.

This article is based on over a year of research into the PulseChain and pDAI ecosystem.

The Stablecoin Trust Problem

Across much of the crypto industry, confidence in stablecoins has quietly eroded. Assets once marketed as decentralized representations of the dollar are now widely understood to be compliance instruments. Nearly every major stablecoin operates with blacklist and freeze functionality, allowing issuers or governing bodies to restrict addresses under regulatory or political pressure.

For critics, this marks a fundamental shift. Stablecoins increasingly resemble programmable bank deposits rather than neutral digital cash.

That perception intensified when the system formerly known as DAI was reorganized and rebranded under Sky. While the transition was framed as a move toward resilience and regulatory compatibility, many long-time users saw it as confirmation that even the most decentralized stablecoin would ultimately converge toward issuer control. Within parts of the crypto community, this has fueled the belief that the window for a truly decentralized stablecoin is closing.

Richard Heart’s Reputation in the Current Cycle

Within large segments of the crypto community, Richard Heart has become one of the most polarizing figures of the last market cycle. Critics increasingly associate him with aggressive fundraising and prolonged underperformance, while supporters argue he is being judged on timelines the market refuses to tolerate.

What is broadly undisputed is the scale of the losses.

Heart is best known as the founder of HEX, which at its peak reached an estimated market capitalization of roughly fifty billion dollars before declining by approximately ninety-nine percent from its highs. Losses extended across his wider ecosystem, including PulseChain and PulseX, leaving many participants in PulseChain’s billion-dollar fundraising deeply underwater. A more recent sacrifice-based raise connected to ProveX has further reinforced skepticism among critics, who see a recurring pattern of capital collection ahead of proven adoption.

Throughout this period, Heart has consistently denied wrongdoing, manipulation, or hidden coordination, stating that market outcomes should not be interpreted as evidence of intent.

Why pDAI Refuses to Disappear

pDAI is PulseChain’s fork of the original MakerDAO stablecoin system, launched in 2023 before DAI transitioned into Sky. From a technical standpoint, pDAI is widely regarded as broken, having suffered from inherited vulnerabilities, exploit-driven inflation, governance paralysis, and persistent liquidity issues. For long stretches, it traded near fractions of a cent.

By conventional metrics, pDAI should have disappeared from serious discussion. It did not.

Supporters argue that pDAI’s significance lies not in its mechanics, but in its position. Unlike issuer-managed stablecoins, it exists outside formal blacklist frameworks, making it a focal point in debates about whether issuerless stablecoins can still exist in an increasingly regulated environment.

Heart has publicly rejected this framing, repeatedly describing pDAI as exploited, broken, and unfit for use, and warning users against engaging with it.

The Conspiracy and the On-Chain Claims

The conspiracy surrounding pDAI is driven largely by on-chain interpretation rather than official statements.

A vocal subgroup within the PulseChain community believes that weakness across PulseChain-related assets had the effect of diverting attention away from pDAI while unknown parties accumulated supply. There is no evidence linking this dynamic to Heart, who has repeatedly denied any involvement, coordination, or influence over pDAI.

Speculation is reinforced by several on-chain observations frequently cited within the community. Analysts point to extreme supply concentration, with a large portion of pDAI controlled by a small cluster of wallets. Some estimates suggest concentration approaching ninety percent, though attribution remains speculative.

Another commonly cited data point is evidence suggesting pDAI-related contract interactions and liquidity movements occurred before PulseChain was officially launched. Supporters interpret this as pre-planned positioning, while critics argue it can be explained by testing activity or misinterpreted deployment data.

A key element involves the so-called vietdong extractor, wallets accused of exploiting pDAI liquidity. According to multiple on-chain analyses circulated within the community, transaction histories and wallet-clustering behavior link these extractor addresses back to wallets widely attributed to Richard Heart by independent analysts. Supporters describe these links as conclusive. Critics dispute the attribution, and Heart has categorically denied any ownership, coordination, or involvement.

A smaller group within the community, often calling themselves pioneers, has advanced a further claim that on-chain activity suggests the early construction of a MakerDAO-style system restart. No such restart has been confirmed, and no public documentation supports the claim.

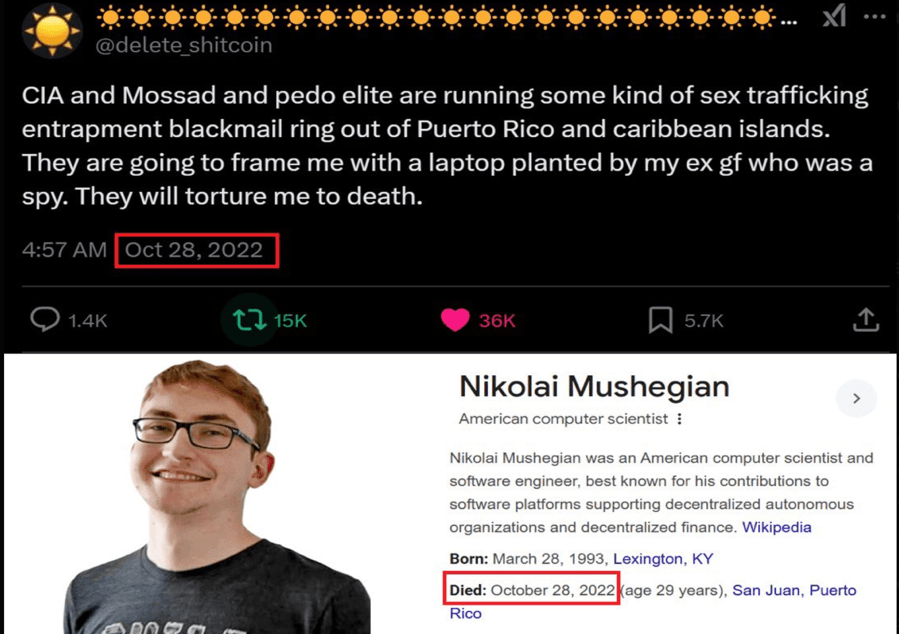

The same subgroup frequently references the death of Nikolai Mushegian, an early contributor to MakerDAO. Mushegian died in 2022 after drowning in Puerto Rico, a death ruled accidental by authorities. Some within these communities speculate that his opposition to adding freeze or control mechanisms to stablecoins made him a target. No evidence supports this claim, and no investigation has substantiated it.

Denials and an Unresolved Question

Heart has consistently denied any involvement with pDAI’s past, present, or future and has repeatedly warned users against trusting it, citing its exploit history and governance failures. We reached out to Heart and representatives associated with his ecosystem for comment on the claims outlined in this article. They declined to comment.

There is no confirmed evidence that Richard Heart is orchestrating a pDAI peg, manipulating PulseChain prices, or coordinating a hidden stablecoin operation. All such claims remain disputed and speculative.

As of February 2026, pDAI trades around $0.0013, requiring roughly a seven-hundred-and-fifty-times increase to reach a one-dollar peg.

Whether pDAI is a failed experiment, a warning about stablecoin centralization, or something intentionally left unfinished remains unresolved.

Read Next...

Disclaimer

Author

BSCN

BSCNBSCN's dedicated writing team brings over 41 years of combined experience in cryptocurrency research and analysis. Our writers hold diverse academic qualifications spanning Physics, Mathematics, and Philosophy from leading institutions including Oxford and Cambridge. While united by their passion for cryptocurrency and blockchain technology, the team's professional backgrounds are equally diverse, including former venture capital investors, startup founders, and active traders.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events