How Pecunity Turns Idle Crypto Into Earnings Through Automated DeFi Strategies

Pecunity helps crypto holders earn passively through automated DeFi strategies, yield farming, and smart portfolio management—all without active trading.

BSCN

October 27, 2025

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCNews. The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. BSCNews assumes no responsibility for any investment decisions made based on the information provided in this article.

For cryptocurrency holders who prefer to avoid the constant churn of trading, options exist to put idle assets to work. Whether maintaining a long-term position in volatile tokens like Bitcoin or Ethereum, or parking funds in stablecoins during market dips, platforms like Pecunity offer ways to generate returns without selling.

This approach allows users to benefit from decentralized finance (DeFi) mechanisms, such as yield farming and automated strategies, while preserving their core holdings. Pecunity, a web-based application, simplifies these processes, enabling users to deploy capital efficiently and monitor performance in one place.

Understanding Pecunity's Core Structure

Pecunity operates as a web app designed to streamline access to Web3 functionalities. Users can sign up through familiar methods like social login via Google, Facebook, or Apple, or even email, which automatically generates a secure smart account contract. This setup handles ownership and security behind the scenes, eliminating the need for managing private keys or dealing with complex wallet configurations. For those with existing setups, integration with tools like MetaMask or Ledger is available, blending ease for newcomers with flexibility for veterans.

The platform addresses a common challenge in crypto: the gap between traditional user interfaces and DeFi's decentralized nature. By incorporating account abstraction technology, Pecunity ensures transactions occur without requiring native tokens for gas fees; instead, it sponsors many of these costs or allows payments in stablecoins like USDC. This means holders can engage in activities without the friction of fluctuating gas prices or the hassle of acquiring specific chain tokens.

Built by the German software company 3Blocks UG—a team of three blockchain developers led by CEO Florian Meiswinkel and COO Lars Berge—the project emphasizes transparency. It complies with MiCAR regulations, has undergone audits by Cyfrin, and maintains a fully doxxed team structure.

Key Features for Asset Management

Pecunity's portfolio control tools provide a centralized view for managing crypto holdings. Users can track their entire Web3 portfolio, execute swaps between assets, and monitor real-time performance metrics, including yield calculations and risk indicators. This is particularly useful for those hodling through market cycles, as it offers insights into how assets perform without needing to trade them actively. For instance, someone waiting in stablecoins for a price drop can use the dashboard to identify opportunities for reallocating portions of their funds into yield-generating positions, all while keeping the bulk intact.

Another component involves community chests, which function as shared reward pools. These allow users to participate in collective earning mechanisms, where rewards from platform activities are distributed among contributors. This fosters engagement without requiring individual trading; holders can lock assets or contribute to pools to earn additional tokens or yields, building on the idea of community-driven value.

The platform also offers multichain support. Launching initially on BNB Chain for its low fees and robust liquidity, Pecunity integrates with ecosystems like Base and Arbitrum from the start. This cross-chain capability means users can move assets seamlessly—say, from BSC to Arbitrum—to access better yields, without fragmenting their portfolio across multiple wallets. In practice, a holder could deposit stablecoins on one chain, deploy them into a strategy on another, and withdraw back as needed, all managed through a single interface.

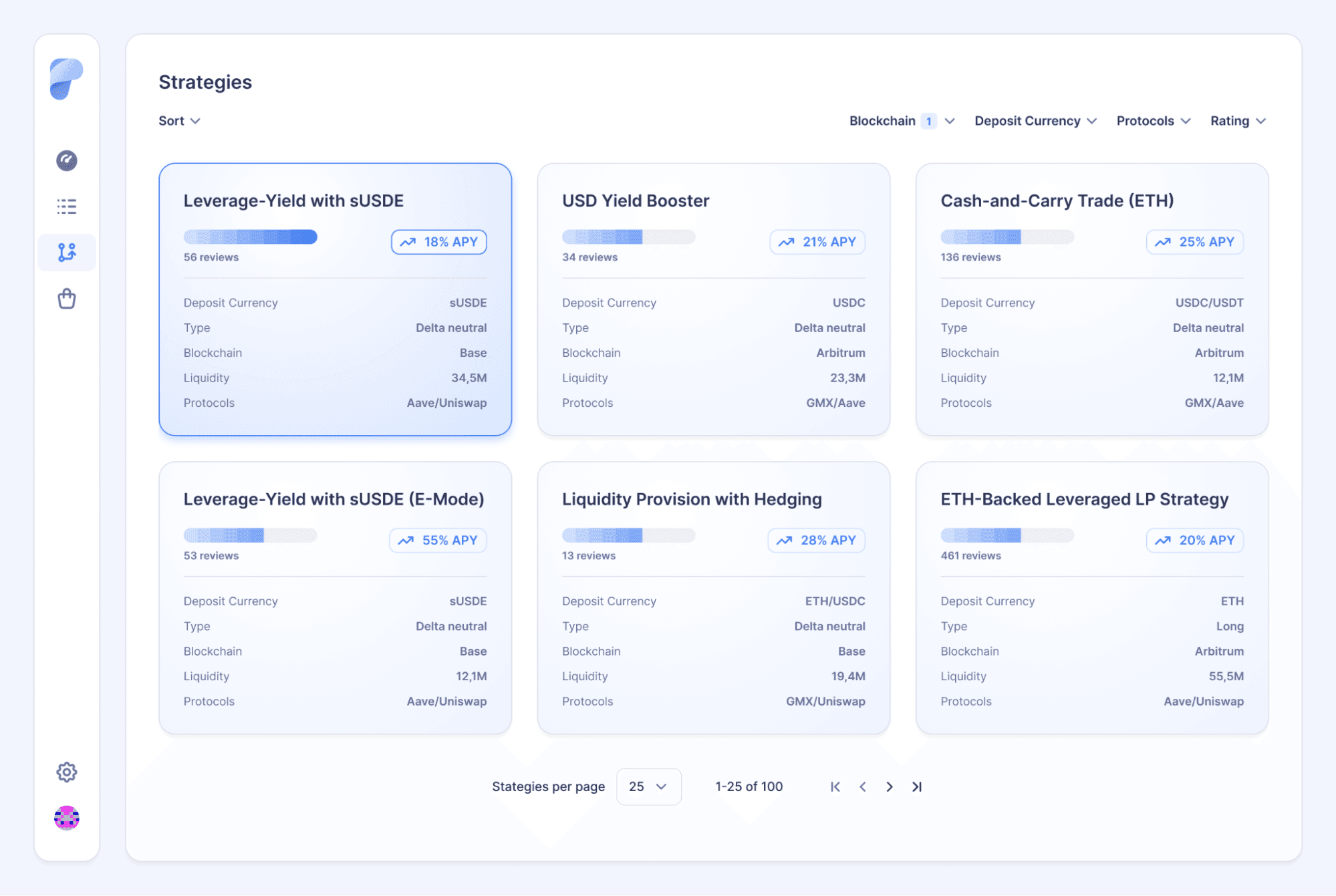

Exploring DeFi Strategies on Pecunity

One of Pecunity's strengths lies in its strategy offerings, which provide actionable ways to earn on held crypto. These are pre-built by experts but can be deployed with minimal input, making them suitable for passive approaches.

The Cash-and-Carry Strategy, for example, creates a delta-neutral position on tokens like HYPE, generating yields from both long and short market sides while minimizing directional price risk. It involves hedging to focus returns on yields rather than speculation, with an estimated annual percentage yield (APY) of 31.5%. Risks include basis discrepancies in hedging, which could lead to losses in volatile conditions, but the benefit is steady income independent of market trends—ideal for stablecoin holders awaiting dips.

Similarly, the ETH-Backed Leveraged LP Strategy uses Ethereum as collateral on Aave V3 to borrow stablecoins, then pairs them with ETH in a concentrated Uniswap V3 liquidity pool. This provides leveraged exposure to ETH's price while earning liquidity fees, aiming for a 40% APY. Leverage amplifies potential gains from price appreciation but also heightens liquidation risks if ETH drops, alongside impermanent loss in the pool. For long-term ETH holders, this strategy turns idle collateral into a productive asset without selling.

The Leverage-Yield Strategy with sUSDE on Aave focuses on stablecoin lending, looping collateral to compound yields automatically. Available in a standard version (22% APY, medium risk) and an E-Mode variant (55% APY, high risk), it reuses borrowed assets to boost returns without manual intervention. Interest rate changes or liquidation events pose risks, especially in the leveraged E-Mode, but it offers a way for stablecoin users to enhance baseline yields from protocols like Aave.

Beyond these, Pecunity includes a drag-and-drop strategy builder. Users can connect actions—like swaps or borrowing—with conditions that trigger based on market events, creating custom setups. For example, one might design a strategy to automatically rebalance if yields drop below a threshold, tailoring it to personal risk tolerance without coding knowledge.

The $PEC Token and Its Role

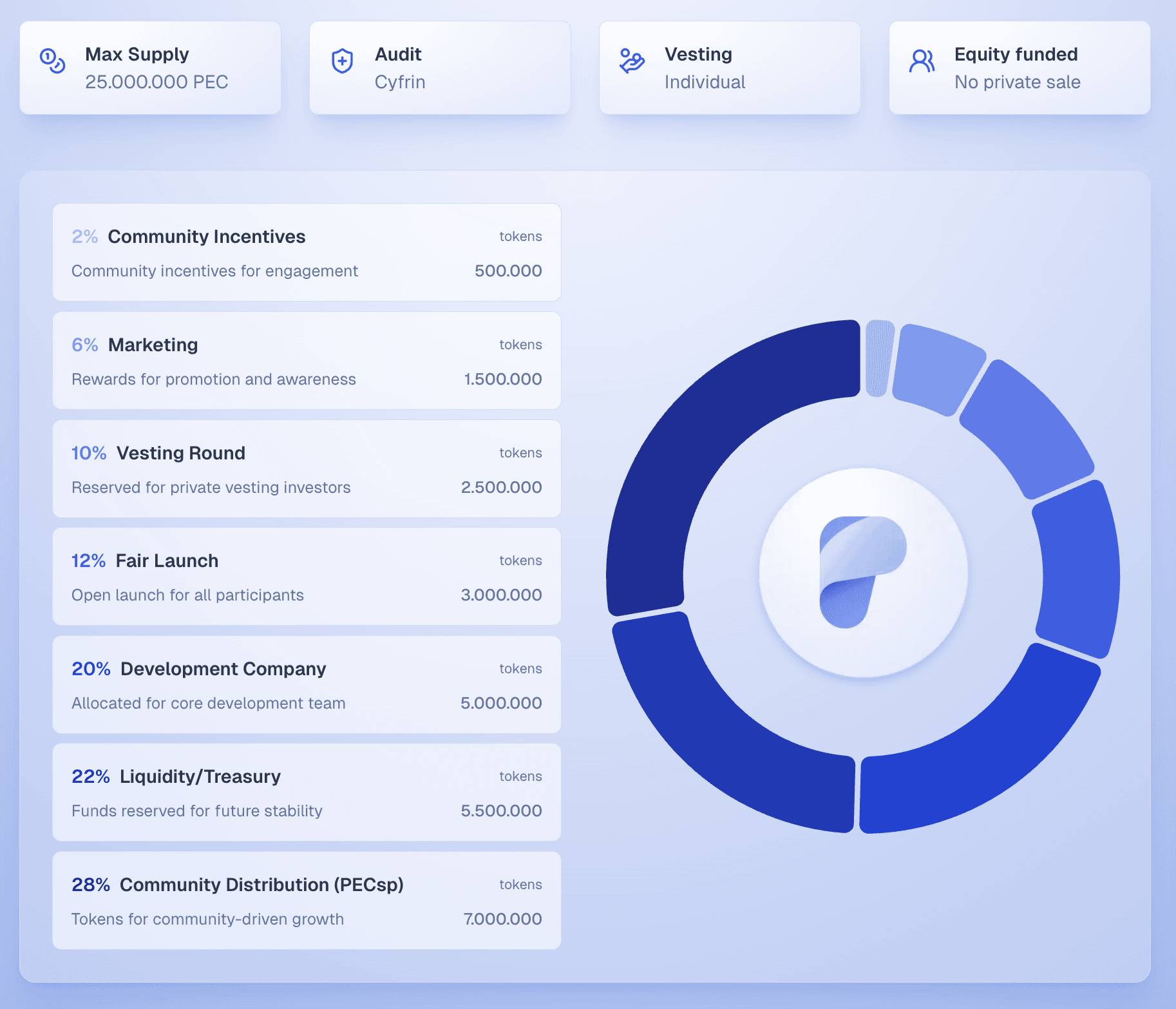

Powering the ecosystem is the $PEC utility token, built on BSC with a total supply of 25 million tokens. It facilitates participation without inflation or private sales, launching via a fair process on PinkSale in October 2025 at an approximate token generation event (TGE) price of $0.14, resulting in a fully diluted valuation of about $3.5 million.

Token allocation emphasizes community focus: 28% (7 million tokens) for community distribution via PECsp holdings; 20% (5 million) for the core development team; 10% (2.5 million) for vesting rounds; 12% (3 million) for the fair launch; 8% (2 million) for airdrops and marketing; and 22% (5.5 million) for liquidity and treasury.

This structure ties value to platform activity, with $PEC used for fee payments (potentially at reduced rates), locking for benefits like multipliers on rewards, and earning through activities such as transactions or referrals.

A burn mechanism removes a portion of tokens used in fees, promoting deflationary pressure as usage grows. Holders can lock $PEC to access fee reductions or exclusive features, aligning incentives for long-term engagement. While not positioned as an investment, $PEC enables functional interactions, such as discounted transactions, making it a practical tool for those deploying strategies on held assets.

Roadmap and Future Developments

Pecunity's development follows a phased approach, building toward broader utility.

Phase 1, set for November 2025, centers on the utility token launch, establishing listings on centralized exchanges and decentralized liquidity pools, with community-driven distribution.

Phase 2, planned for December 2025, introduces the full app release, including the initial automated strategies, portfolio dashboard, and risk tools.

Phase 3 adds an AI assistant for personalized strategy recommendations and market analysis.

Phase 4 expands to additional blockchains, incorporating Layer-2 solutions and cross-chain bridges for diversified yield opportunities.

Phase 5 integrates banking-as-a-service features, such as fiat ramps, crypto-backed cards, and automated investments, transforming Pecunity into a comprehensive financial hub.

These steps reflect a deliberate progression, starting from core DeFi access and scaling to everyday usability.

Why Pecunity Fits for Passive Crypto Management

Pecunity represents a developer-led initiative prioritizing utility over promotion. For holders, it provides specific paths to earn—through strategies, community pools, or token utilities—while waiting out market conditions. Users might, for instance, lock stablecoins in a leverage-yield setup to compound returns, or use the builder to automate shifts based on predefined rules, all without trading.

This not only preserves capital but also introduces educational elements, like real-time analytics, helping users make informed decisions. As the platform evolves, it could become a go-to for those seeking sustainable ways to activate their crypto beyond mere holding.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

BSCN

BSCNBSCN's dedicated writing team brings over 41 years of combined experience in cryptocurrency research and analysis. Our writers hold diverse academic qualifications spanning Physics, Mathematics, and Philosophy from leading institutions including Oxford and Cambridge. While united by their passion for cryptocurrency and blockchain technology, the team's professional backgrounds are equally diverse, including former venture capital investors, startup founders, and active traders.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens