Ondo Ecosystem Deep Dive: Revolutionizing Onchain Finance

Complete guide to Ondo Finance and Ondo Foundation - how they're building institutional-grade tokenized assets and decentralized governance.

Crypto Rich

July 15, 2025

Table of Contents

In six months, Ondo went from a DeFi yield project to settling transactions with America's biggest bank. Here's how they did it.

The transformation happened fast. What started as a solution for idle crypto assets has become a comprehensive platform bringing real-world assets onchain. But Ondo isn't just one company—it's actually two complementary organizations working in tandem. Ondo Finance handles the technical innovation, building products that tokenize everything from U.S. Treasuries to corporate bonds. Meanwhile, Ondo Foundation manages governance and community programs through a decentralized autonomous organization.

This setup gives Ondo the best of both worlds: the speed and focus of a traditional fintech company with the community governance that crypto users expect. Ondo Finance builds the tools, the Foundation makes sure they benefit everyone.

The strategy has paid off dramatically in 2025. Ondo launched its own blockchain network, acquired two strategic companies, and partnered with J.P. Morgan on groundbreaking cross-chain transactions. This analysis examines how both sides of Ondo work together to reshape onchain finance.

Origins and History

The story began in the early 2020s during DeFi's explosive growth. Billions of dollars in stablecoins were sitting in wallets, earning nothing. While traditional savings accounts offered minimal returns, crypto holders were missing out on yields entirely.

Ondo's founders spotted this gap and decided to bridge it. Their solution: tokenize high-quality traditional assets like U.S. Treasury bonds, making them accessible through blockchain networks. Instead of leaving money idle, crypto users could earn government-backed returns.

Building the Foundation

The breakthrough came in April 2022 when Ondo Finance secured $20 million in Series A funding. Founders Fund and Pantera Capital led the round, giving Ondo the credibility and cash needed to build products that institutions would actually trust.

One month later, the Community Access Sale through CoinList distributed ONDO tokens to early supporters. This wasn't just fundraising—it laid the groundwork for community governance that would later become Ondo Foundation's domain.

Product Development and Governance Evolution

Products followed quickly in 2023. OUSG launched in January as tokenized U.S. Treasury ETFs—one of the first tokenized securities to gain real traction. USDY and Flux Finance soon expanded the yield options available to users.

The governance structure was formalized in late 2023 when the Foundation proposed unlocking ONDO tokens from their initial restrictions. A DAO vote passed, making tokens transferable in early 2024. The Ondo Points program launched alongside, rewarding users for their participation.

2025: Explosive Growth Phase

Then 2025 happened. What had been steady progress became explosive growth.

January saw OUSG integrate with the XRP Ledger, targeting institutional adoption. February saw the launch of Ondo Chain—a dedicated blockchain for tokenized assets—plus a complete visual rebrand.

May delivered the biggest validation yet: a cross-chain transaction with J.P. Morgan's Kinexys platform and Chainlink. For the first time, a major bank was using Ondo's infrastructure for real settlement operations.

July capped off an incredible run. Ondo Finance acquired Oasis Pro for regulatory licenses and Strangelove Labs for blockchain expertise. The $250 million Ondo Catalyst investment fund launched. The Global Markets Alliance expanded with new partners.

By mid-2025, Ondo had transformed from a DeFi yield project into a full-stack financial infrastructure platform.

Ondo Finance: The Product Builder

Ondo Finance handles the technical heavy lifting—building products that actually work for institutions while remaining accessible to regular users. Their approach focuses on tokenizing real-world assets that people already understand and trust.

The Product Lineup

OUSG (Ondo U.S. Government Treasury Securities) Think of OUSG as Treasury bonds that live on blockchain. Users get exposure to U.S. government debt through tokenized ETF shares. The real breakthrough came in early 2025 when OUSG launched on XRP Ledger, enabling 24/7 trading and settlement using RLUSD, Ripple's U.S. dollar stablecoin.

USDY (Ondo U.S. Dollar Yield) USDY works like a high-yield savings account for crypto users. It's backed by Treasury bonds and bank deposits, offering steady returns while maintaining full liquidity. Available on Ethereum, Solana, and Mantle, users can earn interest without locking up their funds.

mUSD (Mantle USD) mUSD brings USDY functionality to the Mantle network. Users can convert between USDY and mUSD while providing liquidity on decentralized exchanges like FusionX.

Flux Finance This lending protocol lets users borrow against tokenized Treasury holdings. It's governed by the DAO (and ONDO token) and bridges traditional assets with DeFi lending markets. Users can lend stablecoins like USDC and earn competitive yields.

The Big Infrastructure Play: Ondo Chain

February 2025 marked Ondo's most ambitious move yet—launching their own blockchain network. Ondo Chain isn't trying to compete with Ethereum or Solana on general applications. Instead, it's purpose-built for tokenized assets and institutional needs.

The network uses proof-of-stake and focuses on what traditional finance actually needs: compliance tools, fast settlement, and easy integration with existing banking systems. The J.P. Morgan partnership proved this approach works in the real world.

Strategic Moves in 2025

Buying Regulatory Infrastructure The July acquisition of Oasis Pro Markets was all about compliance. Oasis Pro brings SEC-registered broker-dealer licenses, alternative trading systems, and transfer agent capabilities. Translation: Ondo can now legally offer tokenized stocks and bonds to U.S. investors.

Technical Expertise Acquisition Also in July, Ondo Finance acquired Strangelove Labs, a blockchain development firm known for building secure infrastructure across multiple networks. Strangelove's CEO joined as VP of Product, bringing deep expertise in protocol design and cross-chain operations.

Building an Alliance The Global Markets Alliance isn't just corporate partnership fluff—it's about creating unified standards for tokenized securities. Partners include major players like Solana Foundation, Jupiter Exchange, BitGo, CoinGecko, and Fireblocks. Recent additions like Bitget Wallet (80+ million users) and BNB Chain, one of the world's most widely used blockchain networks, significantly expand potential reach.

BNB Chain's joining in July 2025 will bring access to over 100 U.S. stocks, ETFs, and funds to its global user base. As Nathan Allman, Ondo Finance's CEO, noted: "BNB Chain's vibrant ecosystem and global reach make it a natural fit as we continue building the infrastructure for institutional-grade onchain capital markets."

Mainstream Adoption Through Wallets The Bitget Wallet integration, announced in July 2025, will enable users to self-custody tokenized stocks and ETFs directly in their wallets when Ondo Finance launches these products. With over 80 million users globally, this partnership could bring tokenized securities to mainstream crypto users for the first time.

Market Performance

The numbers speak for themselves. According to Messari data, Ondo controls about 60% of Solana's non-stablecoin tokenized asset market. Combined, OUSG and USDY manage hundreds of millions in tokenized Treasuries, making them foundational infrastructure for institutional cash management.

More importantly, these aren't just crypto-native experiments. Real institutions use OUSG as collateral across multiple DeFi protocols, proving that tokenized assets can bridge traditional and decentralized finance effectively.

Ondo Foundation: The Community Steward

While Ondo Finance builds products, the Foundation ensures those products serve the community's interests rather than just corporate priorities. It manages the DAO, oversees tokenomics, and runs programs that reward long-term participation.

How the Token System Works

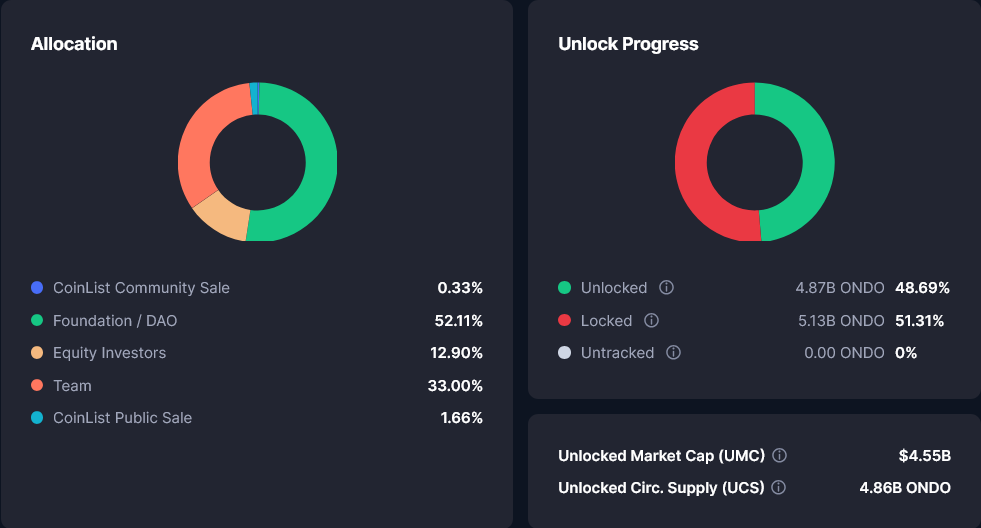

The Numbers

- Total Supply: 10 billion ONDO tokens.

- Currently Circulating: About 3.15 billion (31.5%) as of July 2025.

- Unlocked but Not Circulating: 4.86 billion (48.69%) tokens are available but not all in active circulation.

$ONDO tokens serve two main purposes: voting on governance proposals and earning rewards through various programs. Holders can vote on protocol changes, treasury decisions, and how tokens get distributed to the community.

Who Gets What The token distribution reflects careful long-term planning:

- Foundation/DAO (52.11%): Over 5.2 billion tokens for community programs, rewards, and partnerships

- Team (33.0%): 3.3 billion tokens for ongoing development and operations

- Early Investors (12.90%): Nearly 1.3 billion tokens that vest over five years

- Public Sales (1.99%): Combined CoinList community and public sale allocations

The Unlock Schedule Most tokens started locked to prevent market disruption. As of July 2025, about 48.69% are unlocked, with 51.31% still vesting. The schedule releases 20% annually, starting from January 2024 and concluding in 2029.

Interestingly, unlocked doesn't mean circulating—many tokens remain staked or held in reserves, explaining why only 3.15 billion are actively trading despite 4.86 billion being unlocked (source: CoinMarketCap).

Community Programs That Actually Work

The Points Game Ondo's points program isn't just marketing fluff—it rewards real participation. Users earn points for holding assets, providing liquidity, voting on proposals, and trying new products. Weekly updates keep things fresh, and retroactive rewards for early adopters have built genuine loyalty.

Getting Listed Everywhere The Foundation manages exchange listings through community votes rather than backroom deals. Major wins include Binance (approved by a DAO vote in April 2025) and regional expansion through platforms such as Ripio and Newton Crypto.

How Governance Really Works Voting occurs onchain through Tally, an onchain governance platform that enables proposal creation and voting. ONDO holders can propose changes, vote directly, or delegate their voting power to active community members. The Foundation ensures that proposals receive proper consideration and execution while maintaining a decentralized decision-making process.

When Two Becomes One: Major Wins

The real magic happens when Ondo Finance's innovation meets the Foundation's community focus. Several 2025 accomplishments show how effective this collaboration can be.

The J.P. Morgan Breakthrough

May 2025's cross-chain transaction with J.P. Morgan wasn't just a technical demo—it proved that major banks can actually use blockchain infrastructure for real settlements. Ondo Finance built the technology, but the Foundation's governance structure gave J.P. Morgan confidence in long-term stability.

Multi-Chain Success

Getting OUSG and USDY working across Ethereum, Solana, Mantle, and XRP Ledger required both technical execution (Ondo Finance) and community buy-in (Foundation). Each network offers distinct advantages, allowing users to choose the one that best suits their needs.

Industry Recognition

The 2.45 million ZK token allocation from zkSync in 2024 shows how other projects view Ondo's contributions to tokenized assets. These aren't just partnerships—they're validation that Ondo is setting standards others want to follow.

This recognition comes as tokenization gains momentum globally. Major banks are launching their own initiatives: HSBC recently issued bonds in the MENA region using blockchain infrastructure, while BBVA expanded crypto trading services. Ondo's early positioning in this wave has established them as an infrastructure that traditional finance can actually build on.

Real Adoption Numbers

Ondo Finance's products aren't just crypto experiments—they're being used by actual institutions. OUSG serves as collateral across multiple DeFi protocols, while the Foundation's governance provides the institutional confidence needed for serious adoption.

The points program has successfully onboarded users across product launches, with retroactive rewards creating genuine community loyalty rather than mercenary behavior. When users know that early participation is recognized, they tend to stay for the long term.

Through the Oasis Pro acquisition, Ondo now has the full regulatory infrastructure needed for U.S. securities. This positions both entities for compliant expansion into tokenized stocks and traditional securities.

What's Next for Ondo

Both sides of Ondo have ambitious plans for the rest of 2025 and beyond. The coordination between Ondo Finance's product development and the Foundation's community governance will be crucial for executing these initiatives.

The $250 Million Fund

Ondo Catalyst was launched in July 2025 with significant funding behind it. This isn't just Ondo investing in random projects—it's a strategic fund focused on building the infrastructure needed for widespread tokenized asset adoption. Pantera Capital's involvement adds both capital and expertise to the mix.

Tokenized Stocks Are Coming

Ondo Finance plans to launch tokenized stocks and ETFs on Ethereum later this year. The Oasis Pro acquisition provides the regulatory foundation, while the Global Markets Alliance handles distribution. This could bring blockchain benefits to traditional equity markets.

Ondo Chain Gets Serious

The Layer 1 blockchain will continue to develop features that traditional finance actually needs: better compliance tools, faster settlement, and deeper integration with existing banking systems. The J.P. Morgan partnership demonstrates that this approach works in practice.

Foundation's Role in Growth

The Foundation will manage the continuing token unlocks—20% annually until 2029. These releases could fund major new initiatives, while the vesting schedule helps prevent market shocks. Smart money management will be crucial as the unlock amounts get larger.

Community programs will expand with new points waves and strategic airdrops. The Foundation plans retroactive rewards for users of upcoming products, maintaining the pattern that's built such strong loyalty.

Expanding the Alliance

The Global Markets Alliance keeps growing, and for good reason. Bringing tokenized assets to new markets requires coordinated standards and shared infrastructure. Partners like Bitget Wallet provide access to millions of users who have never traded tokenized securities.

The timing couldn't be better. As major financial institutions worldwide embrace tokenization—from HSBC's blockchain bond issuances to BBVA's crypto trading expansion—Ondo's infrastructure becomes increasingly valuable. The J.P. Morgan collaboration opens doors for additional traditional finance partnerships. Other banks are closely watching this experiment—success here could significantly accelerate institutional adoption.

The Bottom Line

Ondo cracked the code on something most crypto projects struggle with: building useful products while maintaining genuine decentralization. The two-entity structure enables them to move fast on innovation while ensuring that community interests remain protected.

Their 2025 performance speaks volumes. Launching a blockchain, acquiring regulatory infrastructure, partnering with J.P. Morgan, and managing hundreds of millions in tokenized assets—that's the resume of a serious financial infrastructure company, not a DeFi experiment.

The dual approach addresses real-world problems for both crypto natives and traditional finance. Crypto users can earn yield on their holdings without complex procedures. Institutions can leverage the benefits of blockchain within familiar regulatory frameworks.

As tokenization moves mainstream, Ondo's early positioning pays off. They have built the infrastructure, established partnerships, and proven the concept works at scale. Whether they can maintain this momentum while staying true to decentralized principles will determine their long-term success.

For now, though, Ondo has shown how traditional finance and crypto can actually work together, not just in theory, but in practice with real money and real institutions. That's no small accomplishment in a space full of promises and short on delivery.

For more information, visit ondo.finance and ondo.foundation, or follow @OndoFinance and @OndoFoundation on X to stay updated on the latest news around Ondo.

Recent Ondo Finance Coverage:

- Ondo Finance Plans 24 Hour Trading for Tokenized US Stocks on Solana

- Ondo Finance Recent Updates: Regulation, Tokenized Markets & More

- Ondo Finance Joins State Street and Galaxy to Launch SWEEP

- US SEC Ends Ondo Finance Case With No Charges

- Ondo Gains EU Green Light for Tokenized Stocks and ETFs

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events