What is Axie Infinity, AXS and SLP? Full Guide

From a $625M hack to Atia's Legacy and a 99% token crash, explore Axie Infinity's journey through 2025 as the blockchain gaming pioneer fights to reclaim its former glory.

Crypto Rich

March 22, 2025

Table of Contents

In the summer of 2021, while the world was still grappling with pandemic lockdowns, thousands of players across the Philippines weren't worried about paying their rent. Unlike many scrambling for part-time work, these users logged into Axie Infinity for several hours each day, earning enough Smooth Love Potion (SLP) tokens to cover expenses and even help their families. Many players reported earning more from breeding and battling digital pets than they could make from traditional local jobs.

These stories were well-documented in media reports throughout 2021. At its peak, Axie Infinity transformed gamers into earners across Southeast Asia, introducing blockchain technology to millions who had never heard of cryptocurrency before. The game pioneered the "play-to-earn" model, promising a digital economy where players could genuinely own their assets and convert gameplay into real-world value.

Fast forward to 2025, and Axie Infinity's story has evolved dramatically. From meteoric rise to devastating crash and ongoing reinvention, the platform offers a perfect case study of blockchain gaming's promise and perils. This deep dive explores Axie's origins, current state, and uncertain future as it fights to reclaim its position in the increasingly competitive Web3 gaming landscape.

Axie Infinity Origin Story

When Sky Mavis officially launched Axie Infinity in March 2018, few could have predicted its eventual impact. The Vietnamese studio, founded by Nguyen Thanh Trung, Aleksander Larsen, Jeffrey Zirlin, Tu Doan, Andy Ho, and their small team, began with modest ambitions: create a blockchain game inspired by Pokémon and early NFT experiment CryptoKitties.

The early days weren't easy. Built initially on Ethereum's mainnet, players faced gas fees that sometimes exceeded $100 for simple actions like breeding Axies. "We had maybe a thousand dedicated players who believed in the vision enough to stomach those costs," Zirlin recalled in a 2023 interview.

Everything changed with the development of Ronin, Sky Mavis's custom Ethereum sidechain launched in February 2021. Transaction fees plummeted to cents instead of dollars, and actions that once took minutes processed in seconds. This technical breakthrough coincided perfectly with the COVID-19 pandemic, when millions of people—particularly in Southeast Asia—were searching for alternative income sources.

By July 2021, Axie Infinity was processing over $15 million in daily trading volume. Axies that once sold for $10 were trading for hundreds or thousands of dollars. At its absolute peak, Axie Infinity surpassed $4 billion in total NFT trading volume and attracted over 2.7 million daily active users. Axie Infinity secured $152 million in Series B funding at a $3 billion valuation in October 2021.

How Axie Infinity Works

Game Modes and Player Experience

Axie Infinity's core gameplay revolves around collecting, breeding, and battling fantasy creatures called Axies. The game offers several distinct ways to play:

- PvE (Adventure Mode): Players battle computer-controlled enemies to earn SLP tokens and Axie Experience Points (AXP). A typical player can earn approximately 50-75 SLP daily ($0.75-$1.25)—down significantly from the $10-15 daily earnings at the game's peak.

- PvP (Arena): The competitive heart of Axie Infinity pits players against each other in strategic card-based battles. Top-ranked players competing in high MMR brackets can earn up to 200 SLP daily with consistent wins.

- Origins: Introduced in 2022, this revamped battle system offers free-to-play starter Axies to ease onboarding. The initiative has brought in approximately 175,000 new players, though only about 30% remain active after one month.

For casual players in 2025, the daily "grind" takes approximately 90 minutes, reduced from the earlier 3-4 hours needed to complete all tasks. Implemented after player feedback about sustainability.

The Economic Ecosystem: AXS and SLP

Axie Infinity operates on a dual-token economy:

- SLP (Smooth Love Potion): Earned through gameplay and used primarily for breeding Axies

- AXS (Axie Infinity Shards): The governance token that allows holders to vote on game decisions and earn staking rewards

The AXS token serves multiple functions within the ecosystem:

- Governance: AXS holders can vote on proposals affecting the Axie universe and direct the usage of the Community Treasury

- Staking: Players can lock up their AXS tokens to earn additional AXS rewards, currently yielding approximately 5% APR

- Payment: AXS is accepted as currency within the Axie NFT marketplace and determines eligibility for certain sales and auctions

- Community Treasury: A portion of all fees generated from activities like marketplace trading and breeding flows into the Community Treasury, which is governed by AXS stakers

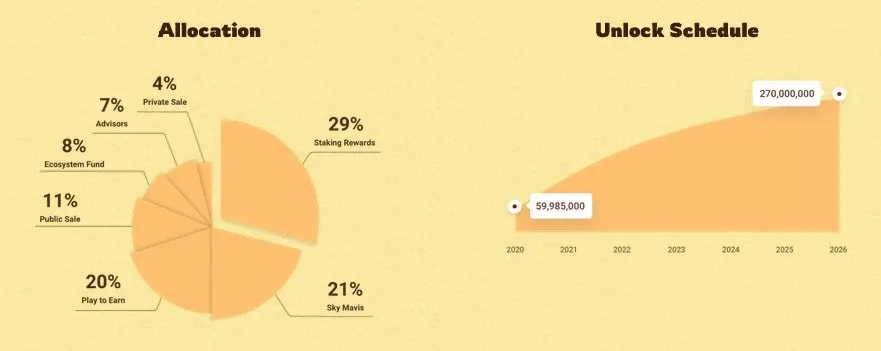

The token distribution follows a carefully designed allocation: 29% for staking rewards, 21% for Sky Mavis, 20% for Play-to-Earn initiatives, 11% for public sale, 8% for the Ecosystem Fund, 7% for advisors, and 4% for private sale participants. According to the unlock schedule, the full 270 million token supply will be in circulation by 2026.

Both SLP and AXS can be traded on centralized exchanges like Binance and KuCoin, as well as on decentralized exchanges (DEXs) such as PancakeSwap and Uniswap, connecting the game economy to the broader crypto market. AXS operates as a multichain token available on Ethereum, BNB Chain, Ronin, Solana, and Harmony. SLP is similarly multichain but excludes the Harmony Network.

The breeding process is central to the Axie economy. Combining two Axies now requires approximately 160 SLP and 0.3 AXS —a significant reduction from previous years meant to stimulate breeding activity. Each Axie can breed a maximum of 7 times, controlling inflation while allowing players to create new creatures.

The average floor price for a standard Axie in 2025 hovers around $20, with competitive teams costing $50-80. Marketplace volume has contracted significantly from its peak in 2021, though it still represents one of the more active NFT marketplaces in the blockchain gaming sector.

The Ronin Network

The Ronin Network facilitates transactions for Axie Infinity and other games in the ecosystem. However, the network's reputation was severely damaged in March 2022 when hackers—later identified as North Korea's Lazarus Group—stole $625 million after compromising validator nodes.

The hack triggered an immediate 25% drop in active users. Sky Mavis secured $150 million in funding and reimbursed affected users. It also implemented security upgrades, including expanding validator nodes from 9 to 21, implementing stricter multi-signature requirements, and creating a $1 million bug bounty program.

By 2025, Ronin has rebuilt trust and expanded to support other blockchain games, processing approximately 2 million daily transactions with fees under $0.01.

Recent Updates and Features

New Game Systems

Sky Mavis has introduced several key updates to enhance the Axie Infinity ecosystem:

- Forging System: Introduced in early 2025, allows Axies at level 30 or higher to burn materials to craft consumables (e.g., Super Cocochoco granting 15,000 AXP)

- Fortune Slips: Cooldown reduced from 72 to 24 hours in late 2024, boosting earning potential for collectors

- Meta Morph: Added in August 2024, enhances Axie card utility in Origins mode, providing more strategic battle options

- Roguelike Mode: Launched in 2024, players against NPC’s, includes special events offering tickets and new runes and charms

These updates reflect Sky Mavis's attempts to balance economic sustainability with engaging gameplay, shifting their focus from pure earning mechanics toward a more balanced play-and-earn model that emphasizes intrinsic fun alongside financial incentives.

Expanding the Ecosystem

Sky Mavis's most ambitious expansion is Atia's Legacy, an MMO announced in January 2025 and currently in pre-registration. Set in the same universe as Axie Infinity but 1,000 years in the future, the game promises more traditional gameplay with selective blockchain elements.

Over 17 million pre-registration sign-ups have already been received for Atia’s Legacy, suggesting significant interest despite the contraction of the crypto gaming market.

Other ecosystem improvements include USD pricing conversion added to the marketplace in 2024 and significant updates to Homeland, which saw the addition of an upgraded Passive Adventure mode, a new Avatar Mode, and fresh rewards through various events.

According to their official blog, the Sky Mavis team has even bigger ambitions for 2025: "There's only one way to say this: 2025 will be like nothing Lunacia has ever seen. We've spent the last year launching new features, fine-tuning games, and tying up loose ends — and we're ready for a new chapter of growth."

Challenges and Criticism

Despite its innovations, Axie Infinity faces several significant challenges:

- Economic Sustainability Questions: Critics argue the play-to-earn model resembles a pyramid scheme, requiring constant new player influx to sustain token value. This concern was validated when SLP crashed from its July 2021 peak of $0.40 to less than $0.002 by May 2022—a devastating 99.5% decline that eliminated earnings for many players.

- Accessibility Barriers: Despite free starter Axies in Origins mode, the full game experience still requires investment. A competitive team costs approximately $50-80 in 2025—more affordable than the $1,000+ entry point during the boom, but still substantial in developing economies. The onboarding process, while improved, remains complex with multiple steps, including wallet creation and cryptocurrency purchases.

- Security Concerns: The 2022 Ronin hack ($625 million stolen) severely damaged trust in platform security. Sky Mavis reimbursed users after securing $150 million in funding, but the incident highlighted vulnerabilities in blockchain gaming infrastructure.

- Gameplay Depth: Many players and analysts describe Axie as lacking strategic depth, with random number generation (RNG) often overshadowing skill in competitive play. Defenders point to Origins mode's combo mechanics and positioning as evidence of strategic elements.

- Developer Decision Controversies: Updates reducing PvE rewards or devaluing older Axies have sparked community backlash. The December 2023 decision to reduce Adventure Mode SLP rewards by 40% was particularly controversial, with many players expressing frustration about changing economic incentives.

Current State of Axie Infinity

Community Landscape

- Active Users: Approximately 300,000-400,000 monthly active users and 115,000 daily active users

- Regional Strength: Southeast Asia dominates with 68% of players (Philippines: 41%, Indonesia: 14%, Vietnam: 7%, Thailand: 6%)

- User Decline: Significant drop from the 2021 peak of over 2.7 million daily active users

- Guild Ecosystem: Major gaming guilds like Yield Guild Games (YGG) and Merit Circle continue supporting the game, though at reduced scale

The resilience of the Southeast Asian player base stems from several factors. Lower cost of living means even reduced earnings remain meaningful in local economies. Cultural familiarity with grinding mechanics in online games and strong community structures also support retention. Social bonds have proven surprisingly durable within the community. Many players who initially joined for economic incentives have remained active due to the social connections formed through the game, continuing to play even as earnings potential has decreased.

Strategic Direction

Sky Mavis continues to position Axie Infinity as the centerpiece of a Web3 gaming ecosystem. The company's focus has shifted toward three strategic pillars:

- Economic Sustainability: Balancing token emissions with utility and value creation

- Player Experience: Emphasizing fun and engagement over short-term earning potential

- Ecosystem Expansion: Developing new titles like Atia's Legacy to broaden appeal beyond crypto natives

This pivot reflects lessons learned from the boom-bust cycle. The company now emphasizes sustainable gameplay experiences over short-term financial incentives.

The Future of Axie Infinity

For Axie Infinity, the road ahead involves balancing economic opportunity with engaging gameplay. The development team must create experiences compelling enough to retain players regardless of token value fluctuations.

The expansion into new titles like Atia's Legacy demonstrates Sky Mavis's recognition that diversification is necessary. By leveraging the established Axie brand and community, the company aims to create an interconnected gaming universe with selective blockchain elements.

The team has been explicit about their ambitious plans for 2025 in recent blog posts, stating they're "consolidating forces" and "loading new artillery" for what they describe as "a new chapter of growth." Their promise to call on "each and every Lunacian to rise up" suggests a community-focused initiative that may seek to recapture some of the collective enthusiasm that propelled the game's initial success.

Competitors like The Sandbox, Illuvium, and Big Time have learned from both Axie's successes and failures, implementing more sustainable economic models from the start. This competitive pressure forces continued innovation at Sky Mavis.

Industry analysts remain divided on Axie's prospects. Some highlight the resilience the game has shown through crypto market downturns, while others point to the fundamental tension between creating engaging gameplay and maintaining token value. The "game first, crypto second" approach being adopted with Atia's Legacy represents a potential path forward for blockchain gaming more broadly.

Conclusion

Axie Infinity's journey embodies the blockchain gaming sector's evolution—from explosive growth and utopian promise to harsh economic realities and gradual maturation. Its rise introduced millions to the concept of player-owned digital assets, its fall demonstrated the challenges of sustainable tokenomics, and its ongoing reinvention may yet define the future of the industry.

The platform's legacy extends beyond financial metrics. Several documented cases show players who used their Axie earnings to pay for education, start small businesses, or support their families through economic hardship. Many users have shared that even as earnings declined, their introduction to blockchain technology and digital economies provided valuable skills and opportunities they wouldn't have discovered otherwise.

Whether Axie reclaims market leadership or serves as a historical milestone depends on how effectively Sky Mavis navigates the intersection of gaming engagement, economic sustainability, and technological innovation in the years ahead.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens