$VELAAI Token Goes Live on BNB as Vela AI Prepares RWA Tokenization Ecosystem

Vela AI launches its $VELAAI token on BNB Chain in May 2025, with plans to develop an AI-driven Real-World Asset tokenization ecosystem connecting traditional assets with DeFi through AI curation, compliant tokenization, and community-driven liquidity.

Crypto Rich

May 20, 2025

Table of Contents

The Growing Demand for Real-World Asset Tokenization

High verification costs and transaction friction effectively freeze high-value assets in traditional finance, limiting economic potential worldwide. These frozen assets cannot circulate in global markets, while cross-border settlements depend on intermediaries—creating significant barriers for small and medium enterprises attempting to access international markets. Adding to these challenges, institutional monopolies maintain steep entry barriers that prevent efficient capital-asset matching.

Meanwhile, decentralized finance (DeFi) struggles with its own limitations. The absence of strong value anchors has allowed inflation-driven liquidity mining to foster speculative environments rather than sustainable ecosystems. Over 65% of users abandon DeFi platforms annually due to misaligned incentive structures, according to industry data. This exodus contributes to a liquidity death spiral: thin markets cause high slippage, which then accelerates capital flight.

Real-World Asset (RWA) tokenization presents a promising bridge between these two financial worlds, with the market projected to reach $16 trillion by 2030, according to recent industry reports. Yet three significant obstacles remain:

- Complex compliance requirements across multiple jurisdictions

- Limited technical interoperability between blockchain systems

- Inadequate mechanisms for activating liquidity

How Vela AI Transforms RWA Tokenization

Vela AI has built the world's first AI-driven Real-World Asset (RWA) tokenization platform with the $VELAAI token on BNB Chain, launching the token in May 2025. The platform components have been in development since earlier in 2025, leveraging BNB Chain's established DeFi ecosystem, low transaction costs, and EVM compatibility to address financial challenges through three groundbreaking technological innovations. Backed by a team of experts in financial engineering, quantitative trading, and compliance at Vela AI Technology Pte. Ltd., a Singapore-registered fintech leader, the platform aims to deliver robust implementation and industry-leading solutions.

AI Dynamic Risk Assessment Framework

The platform employs artificial intelligence to identify high-potential RWAs by analyzing market performance and industry trends. This systematic approach not only minimizes investment risks but also uncovers assets with strong growth trajectories that traditional analysis might miss.

"Our AI Curation Engine filters high-quality RWAs using advanced machine learning algorithms that analyze market data more efficiently than traditional methods," explains Carter, Co-Founder and CEO of Vela AI, who previously led multiple RWA tokenization projects at a major financial institution.

Modular Compliance Smart Contracts

One of tokenization's greatest challenges lies in navigating regulatory requirements across multiple jurisdictions. Vela AI's Smart Compliance Engine employs AI to address this complexity through modular smart contracts that adapt to specific regulatory frameworks in different regions.

This innovative approach drastically reduces the legal overhead typically associated with cross-border asset transfers while maintaining full regulatory compliance—a critical factor for institutional adoption.

Token Holder Crowdfunding Market-Making

Breaking from tradition, Vela AI introduces a community-driven approach to market liquidity where $VELAAI token holders participate directly in liquidity provision. This system enhances RWA market depth and reduces slippage, problems that have plagued earlier tokenization efforts.

The model democratizes market-making—historically dominated by large institutions—while simultaneously creating yield opportunities for individual token holders through V-POOL, a specialized decentralized liquidity protocol designed specifically for RWA tokens.

BNB Chain-Powered Ecosystem Components

At the heart of Vela AI's planned platform lies BNB Chain technology, selected for its fast transaction speeds, low costs, and EVM compatibility. This foundation is expected to enable efficient RWA tokenization and trading through three primary ecosystem components, all of which are currently in development and not yet live:

V-POOL: Decentralized Liquidity Protocol

V-POOL is intended to merge AI-powered market-making with community capital to enhance trading depth for RWA tokens. By reducing slippage and creating stable trading environments, it aims to address a critical weakness that has undermined many previous tokenization projects.

The protocol is designed to implement sophisticated algorithmic pricing models while allowing $VELAAI stakers to contribute liquidity and earn rewards proportional to their participation. This hybrid approach would balance centralized efficiency with decentralized participation, though public access is not yet available.

V-Earn: AI-Driven Yield Aggregator

For investors seeking passive income, V-Earn will offer diverse yield generation strategies including:

- RWA fixed-income opportunities from tokenized debt instruments

- Cross-market arbitrage between traditional and decentralized markets

- Volatility mining during market fluctuations

The system is designed to continuously adapt to changing market conditions, automatically optimizing returns without requiring constant user intervention, though it remains in development with no confirmed launch date.

Vbot: Mobile-First AI Trading Platform

To capture the attention of retail users, Vela AI is developing Vbot—a mobile application focused on algorithmic trading for MEME coins and popular cryptocurrencies. This user acquisition strategy aims to create a natural pathway from speculative crypto trading to more stable RWA investments, as profits generated through Vbot would flow directly into Vela's RWA staking pools. The application is currently in development phase according to roadmap documents.

Technical Architecture and Blockchain Integration

Three core technical modules form the backbone of Vela AI's proposed platform:

- AI Asset Curation Engine that aims to identify and filter high-quality RWAs

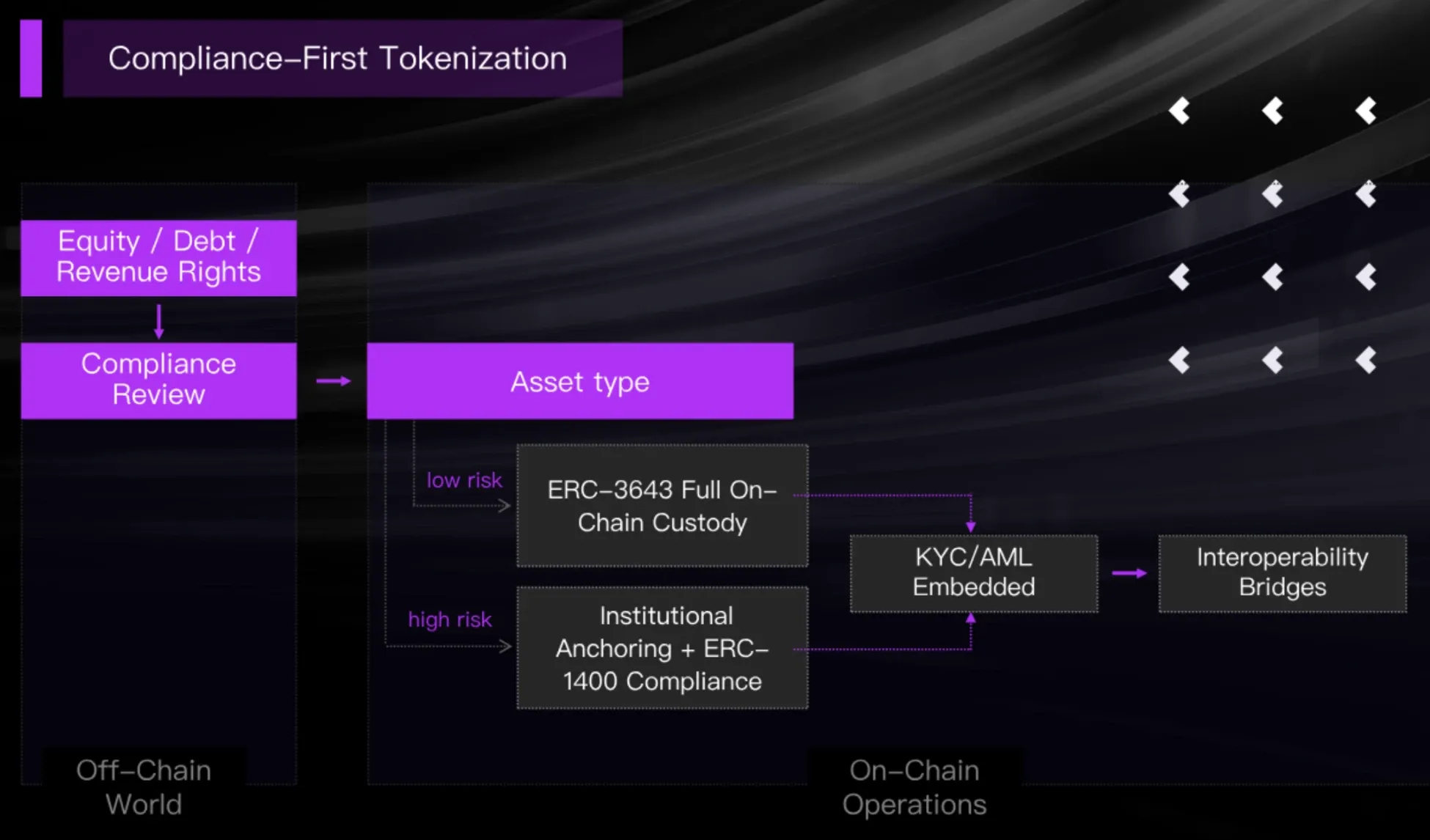

- Compliance-First Tokenization Framework designed to ensure regulatory adherence across jurisdictions

- Community-Driven Liquidity Network intended to enhance market depth through collective participation

BNB Chain's infrastructure provides the essential foundation for these systems, with its high transaction throughput and low fees. Beyond BNB Chain, the platform is planned to feature robust cross-chain interoperability protocols, leveraging cross-chain bridges to enable seamless asset transfers to Ethereum and possibly more blockchains, creating a fluid ecosystem for global asset circulation not confined to a single blockchain.

Note: Vela AI and its $VELAAI token are distinct from other projects with similar names, such as Velas (an EVM-compatible blockchain with the VLX token) and Vela Exchange (a decentralized perpetual trading platform using the $VELA token on BNB Chain).

Tokenomics and $VELAAI Utility

The $VELAAI token serves as the ecosystem's native utility token with a total supply of 1 billion tokens, as outlined in Vela AI's official documentation. While the original whitepaper referred to the token as "$VELA," the actual launched token is named "$VELAAI." Its design incorporates multiple use cases that are intended to support platform functionality while creating value for different stakeholders:

Token Allocation and Distribution

The token distribution follows a carefully balanced model:

- 90% (900 million tokens) dedicated to Burn Mining with a 10-year linear release schedule, dynamically adjusted based on network growth metrics

- 4% (40 million tokens) allocated to Foundation Reserve with a 2-year lockup period followed by linear release

- 3% (30 million tokens) designated for Private Sale and Operations with a 6-month lockup and 12-month linear release thereafter

- 2% (20 million tokens) reserved for Market Stabilization to address extreme volatility events

- 1% (10 million tokens) allocated for Exchange Liquidity with immediate circulation

Utility and Value Proposition

$VELAAI's utility is designed around three critical functions:

Ecosystem Value: Token holders can potentially participate in the platform's growth through staking and liquidity provision. The token is intended to serve as the medium for capturing value from cross-chain RWA transactions.

Liquidity Staking Credential: Holders will be able to stake tokens to become liquidity providers in the community-driven market-making model, earning rewards proportional to their contribution.

Governance & Voting Rights: Token holders are planned to gain decision-making power in the ecosystem's development, with governance voting weight corresponding to their holdings.

Stakeholder Advantages

The token model aims to deliver specific benefits to different participants:

For RWA Issuers: Eliminates the need for in-house market-making teams, as $VELAAI liquidity pools would offer plug-and-play depth for newly tokenized assets.

For Token Holders: Democratizes market-making participation with a low entry barrier (minimum 100 USD stake), providing access to a previously institution-dominated function.

For the Broader Ecosystem: $VELAAI staking pools are designed to function as cross-chain liquidity hubs, capturing value from multi-chain transactions and creating a network effect as the platform expands.

Future Roadmap

The platform's development unfolds across four distinct phases:

Launch Phase (Current)

The current phase focuses on establishing core infrastructure and gaining initial market traction through:

- Beta deployment of the AI Asset Curation Engine with live testing

- Introduction of V-POOL alongside completion of private $VELAAI token sale, though the protocol is not yet confirmed to be fully operational for public use

- Implementation of tokenomics mechanisms including burn/staking functions

- Strategic listings on decentralized exchanges (pending confirmation of live functionality)

- Development of the Compliance-First Tokenization Framework targeting five RWA classes: equity, debt, real estate, commodities, and royalty streams

- Public release of V-Earn and Vbot applications, with availability currently limited to beta testing or select users as of May 19, 2025

Expansion Phase (Next 6-12 Months)

Over the next 6-12 months, Vela AI will focus on:

- Deep integration with major liquidity sources, including Uniswap and PancakeSwap

- Formation of strategic partnerships with traditional financial institutions to bridge the TradFi-DeFi gap

Globalization Phase (12-24 Months)

The mid-term horizon will see Vela AI:

- Sourcing diverse RWAs across major global financial markets

- Enhancing cross-chain interoperability for maximum asset mobility

- Establishing formal partnerships with institutional investors and asset managers

Maturation Phase (Long-Term Vision)

The long-term ambition culminates in:

- Achievement of truly global liquidity coverage for tokenized assets

- Building an ecosystem surpassing $50 billion in managed assets

- Creating comprehensive infrastructure for seamless Web3-real economy fusion

Conclusion

Vela AI represents an ambitious attempt to advance the tokenization of real-world assets by integrating artificial intelligence, BNB Chain technology, and community-driven liquidity mechanisms. Through addressing the fundamental challenges of compliance, interoperability, and liquidity, the platform aims to open new pathways for both asset issuers and investors. Vela AI's compliance framework is designed to position it for long-term success.

The ecosystem's comprehensive approach combines sophisticated asset curation, regulatory-compliant tokenization, efficient trading mechanisms, and innovative yield generation strategies. Together, these elements are intended to create the infrastructure needed to connect traditional financial markets with decentralized finance in a way that respects regulatory requirements while enhancing market efficiency.

As Vela AI progresses through its multi-phase roadmap, its impact on global asset circulation and financial accessibility remains to be seen. The platform's vision—expressed in its slogan "Chains interconnected, Assets Symbiotic"—points toward a future where physical and digital assets flow seamlessly through an integrated global financial system.

For more information about Vela AI's platform, $VELAAI tokenomics, or to explore Vela AI, visit https://vela.ltd or follow them on X @VelaWeb3.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens