Union's $U Token Details: Tokenomics, Utility, Community Reactions, and More

Union Build's $U token details reveal a tokenomics model with a 10 billion supply, including utilities in gas, security, governance, and positive community reactions before the mainnet launch.

UC Hope

August 27, 2025

Table of Contents

After months of speculation sparked by earlier leaks, Union Build has released the details of its $U token, offering users a clear view of its tokenomics and utility. The announcement, shared through an X thread and blog post by the Union Foundation, addresses community questions about the native ERC-20 token's role in the zero-knowledge interoperability Layer 1 blockchain.

This move comes as the project prepares for its mainnet launch, with users expressing a mix of excitement and analysis in recent discussions on X, where posts highlight the total supply of 10 billion, the initial circulation of 19.19%, and allocations favoring community incentives at 12%.

$U is the major asset of the Union network, powering everything from security to governance, reflecting its integration into cross-chain operations. As expected, the token details have led to discussions about upcoming milestones, including allocation checkers and claims, indicating ongoing developments for the ecosystem.

Overview of Union Build and the $U Token

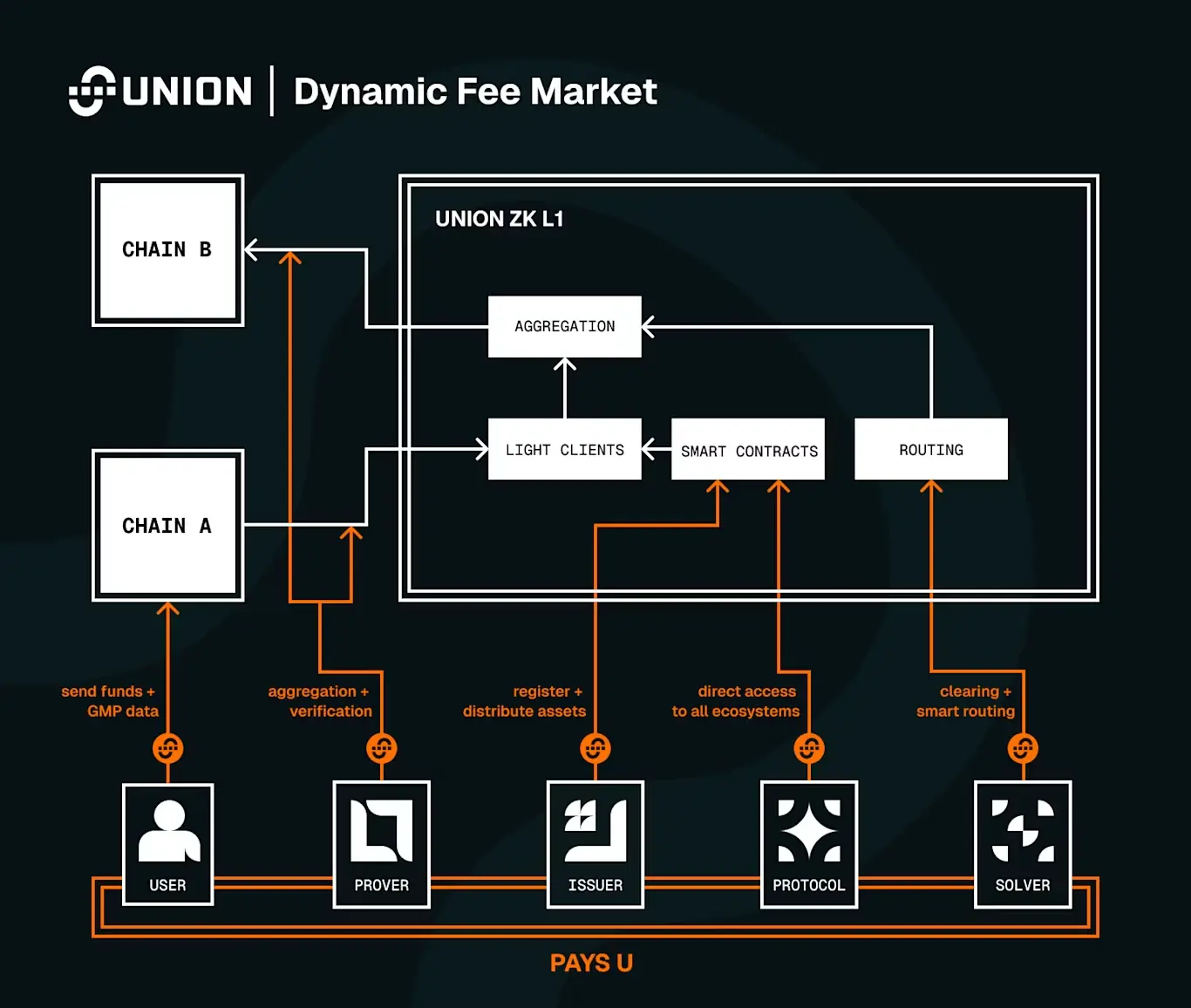

Union Build operates as a zero-knowledge interoperability Layer 1 blockchain that connects various blockchain ecosystems, including application-specific chains, Layer 1 networks, and Layer 2 solutions. The system utilizes a zero-knowledge framework to facilitate cross-chain tasks, including message passing, asset transfers, and non-fungible token movements. It connects networks, including Ethereum, Cosmos, and Bitcoin layers, through on-chain verification methods that utilize light clients and zero-knowledge proofs, thereby eliminating the need for centralized relayers or multi-signature setups.

Key components of Union's architecture include:

- CometBLS, which is an upgraded consensus engine tailored for zero-knowledge proving efficiency;

- Voyager, responsible for relaying Inter-Blockchain Communication packets;

- Galois, which generates zero-knowledge proofs.

This setup addresses user experience issues stemming from network fragmentation and promotes modularity, enabling developers to utilize execution environments such as Solidity, Rust, or Move.

The $U token, an ERC-20 compatible asset on the Ethereum network, serves as the primary economic element. The token coordinates incentives among users, developers, validators, and the broader ecosystem, with its value tied to network activity in zero-knowledge proof verification and cross-chain operations.

Union distinguishes itself by integrating with the Bitcoin Supercharged Network, which enhances security without relying excessively on token incentives. This includes Bitcoin-secured restaking for assets like Bitcoin liquid staked tokens. The network has undergone testing, with over 275 million transfers recorded on its testnet, demonstrating capacity for cross-chain activities.

What are the $U Token Utilities?

The $U token supports several core functions in the Union network, directly linked to operational demands.

Gas Token

As the gas token in the Dynamic Fee Market, $U covers costs for actions like aggregating and verifying zero-knowledge proofs, updating light clients, establishing or halting connections, setting routes, relaying transactions, registering assets, and direct interactions on the Union Layer 1. Participants can pay higher fees to prioritize tasks, creating a market-driven system for order flow. This ties token demand to the need for proof verification and cross-chain connectivity.

"The Union token is designed to link token demand to critical actions by network participants, which gives U intrinsic utility that’s aligned with the network’s core functions and goals," states the Union Foundation blog.

Network Security

In terms of network security, Union functions as a zero-knowledge-powered proof-of-stake blockchain. Validators stake $U to engage in consensus and block production, while holders delegate stakes to earn emissions.

This setup provides economic safeguards against malicious actions and maintains network liveness. Integration with the Bitcoin Supercharged Network reduces the need for high $U incentives for security. Liquid staking through partners like Escher Finance yields eU tokens, keeping staked assets liquid and usable across chains.

Cross-Chain Governance

For cross-chain governance, $U holders propose and vote on updates, fee adjustments, funding, and protocol changes. Voting can occur from connected chains, beginning with Ethereum via eU liquid staking. This facilitates participation without bridging assets, supporting decentralized decision-making over network elements such as upgrades, connections, and token configurations.

Additional Uses

Additional uses include settlement and liquidity for protocols and asset issuers. The token integrates with decentralized applications such as Dextr for cross-chain decentralized exchanges, Escher Finance for liquid staking, and Stargaze for non-fungible token marketplaces.

These enable trades, staking, and transfers across chains. Early stakers access incentives through a cross-chain vault on Tower DEX, with estimated rewards of 120-140% over the first 12 months, starting at the highest level at launch and declining thereafter.

Tokenomics of the $U Token

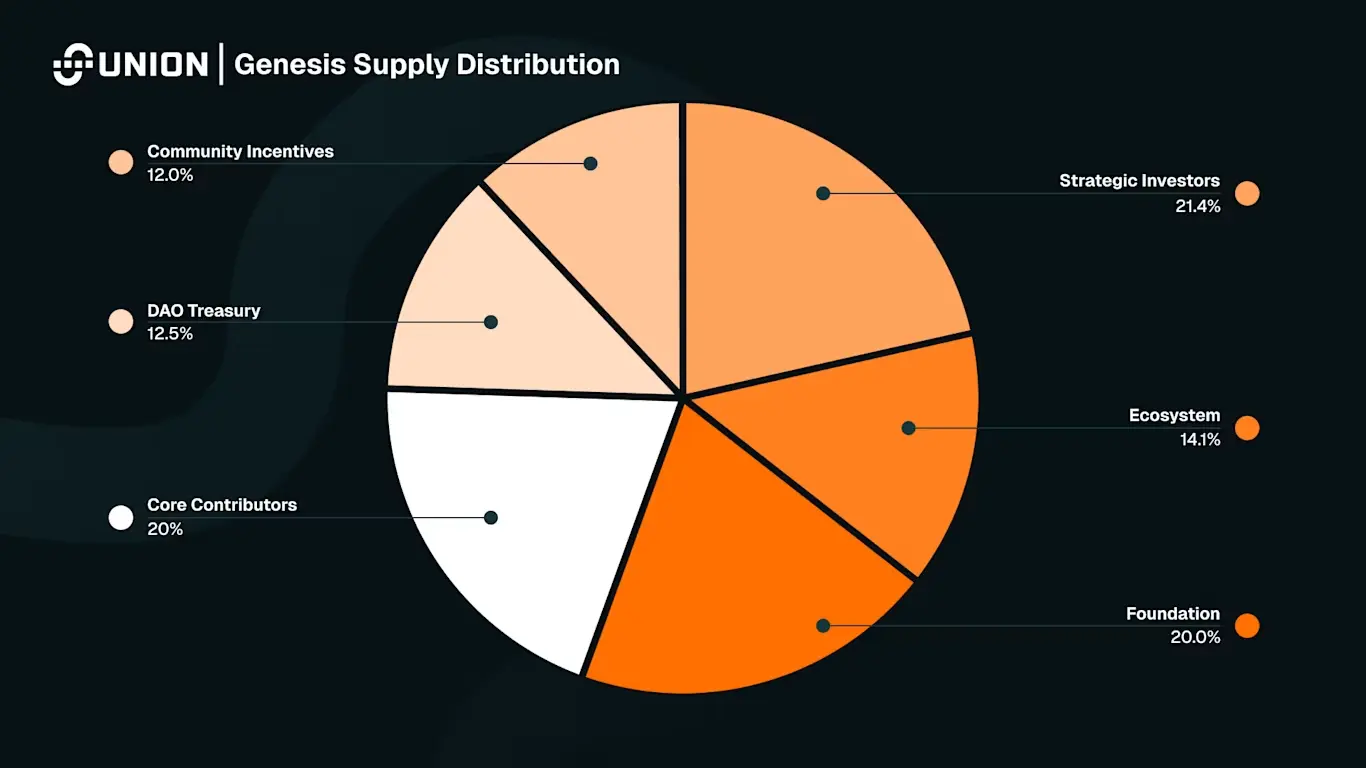

The $U tokenomics emphasize gradual distribution and alignment among stakeholders, with a genesis supply of 10 billion tokens and an initial circulating supply of 1,919,050,000, representing 19.19% of the pre-inflation total. The smallest unit is au, equivalent to 1e-18 $U.

Inflation and Emissions

Annual emissions begin at 6%, decreasing by 10% each year until they stabilize at 2%. Unlike some Cosmos SDK-based chains, emissions remain a fixed percentage regardless of staking levels, without a target stake ratio. This allows flexibility in token deployment across the ecosystem.

Staking rewards for core contributors and strategic investors remain locked for 12 months, aligning with their vesting schedules, and cannot be sold while unvested. Locked emissions are loaned to the Union Foundation for ecosystem support.

Genesis Allocation

The genesis allocation divides the 10 billion tokens into six categories:

- Community Incentives (12%): 4% for the genesis drop and testnet rewards, fully vested on distribution; 8% for future programs like converting experience points to $U.

- Ecosystem Fund (14.1%): For developer grants, accelerators, and fellowships; 40% unlocked at the token generation event, and the rest vesting linearly over two years.

- DAO Treasury (12.5%): Governed by $U holders for network initiatives; 12.5% unlocked at token generation event and three-year linear vesting on the remainder.

- Foundation Allocation (20%): For operations, marketing, and partnerships; 40% unlocked at token generation event and two-year vesting.

- Strategic Investors (21.4%): From seed and Series A rounds; no initial unlock, a one-year cliff, and then one-year linear vesting, totaling two years, plus 60-day staggered unlocks post-cliff.

- Core Contributors and Advisors (20%): No initial unlock, a one-year cliff, and two-year linear vesting, totaling three years, also with 60-day staggered unlocks.

Of the initial circulating supply, 11.19% goes to ecosystem and community efforts, and 8% to the foundation. Furthermore, the release schedule takes into account inflation and features gradual unlocks to mitigate supply chain impacts. Multi-year vesting and cliffs for major groups promote sustained involvement.

Governance Parameters

Governance parameters include a minimum deposit of 10 $U for proposals and 50 $U for expedited ones.

Launch and Incentives

Union's mainnet launch shifts from a testnet proof-of-authority to a proof-of-stake, utilizing $U as the gas token. A staking vault on Tower DEX, in partnership with Escher Finance, uses a price-constrained liquidity strategy for the U/eU pool. Users deposit $U to receive vU tokens, which represent their position.

The deposit process involves connecting an Ethereum wallet, depositing $U via the Escher/Union interface, minting eU from approximately 50% of the deposit (adjustable), transferring both to Babylon Genesis via Union's relayers, and deploying them into staking and liquidity. Withdrawals reverse this, burning vU and returning tokens plus rewards within 48 hours for fast paths or 21 days for secure ones.

Community programs include converting testnet experience points to $U, non-fungible tokens like Wandering Whale Sharks for bonus points, and U Combinator for incubating teams. The testnet's performance, including its role as a leading bridge in the Bitcoin finance sector, supports these efforts.

Nearly 60% of the supply directs toward users, builders, development, and governance, combining incentives, DAO control, and foundation support.

How the Community Reacted To Union Tokenomics?

Like every token in the pre-TGE phase, the $U tokenomics created notable discussion on X, which has been the go-to social media outlet for numerous blockchain platforms. As of the time of writing, community reactions remain largely positive, with users describing the tokenomics as "solid" and "bullish," emphasizing the 10 billion total supply, the 19.19% initial circulation, and community-focused allocations, such as 12% for incentives.

Posts highlight excitement over fair distributions, utilities such as Bitcoin restaking, and partnerships with entities like Babylon and Tower, alongside testnet successes as a top Bitcoin finance bridge.

Earlier leaks from March 2025 generated speculation, but the official details addressed changes after Series A funding. While some users expressed mixed feelings about the specifics of community rewards, the focus remains on utility rather than speculation, with anticipation building for eligibility checkers, allocations, and the upcoming token generation event.

Conclusion

With the $U token details now public, Union Build stands ready to advance its zero-knowledge interoperability framework. Users are monitoring for the next steps, particularly the token generation event date and the mainnet rollout, which will activate full network features and staking options. This anticipation centers on how these developments will shape cross-chain interactions and community involvement in the coming months.

Sources:

- Union Foundation Blog: https://union.build/blog/u-tokenomics

- Union Build X Thread: https://x.com/union_build/status/1960356635463032988

- Union Documentation: http://docs.union.build/u

Read Next...

Frequently Asked Questions

What is the total supply of Union's $U token?

The genesis supply of $U is 10,000,000,000 tokens, with an initial circulating supply of 1,919,050,000.

How does $U provide utility in the Union network?

$U acts as the gas token for fees, secures the network via proof-of-stake staking, and enables cross-chain governance voting.

What are the vesting schedules for $U allocations?

Community incentives are fully vested on distribution; ecosystem and foundation funds have partial unlocks at token generation event with two-year vesting; DAO treasury has three-year vesting; investors and contributors face one-year cliffs followed by linear vesting over one to two years.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens