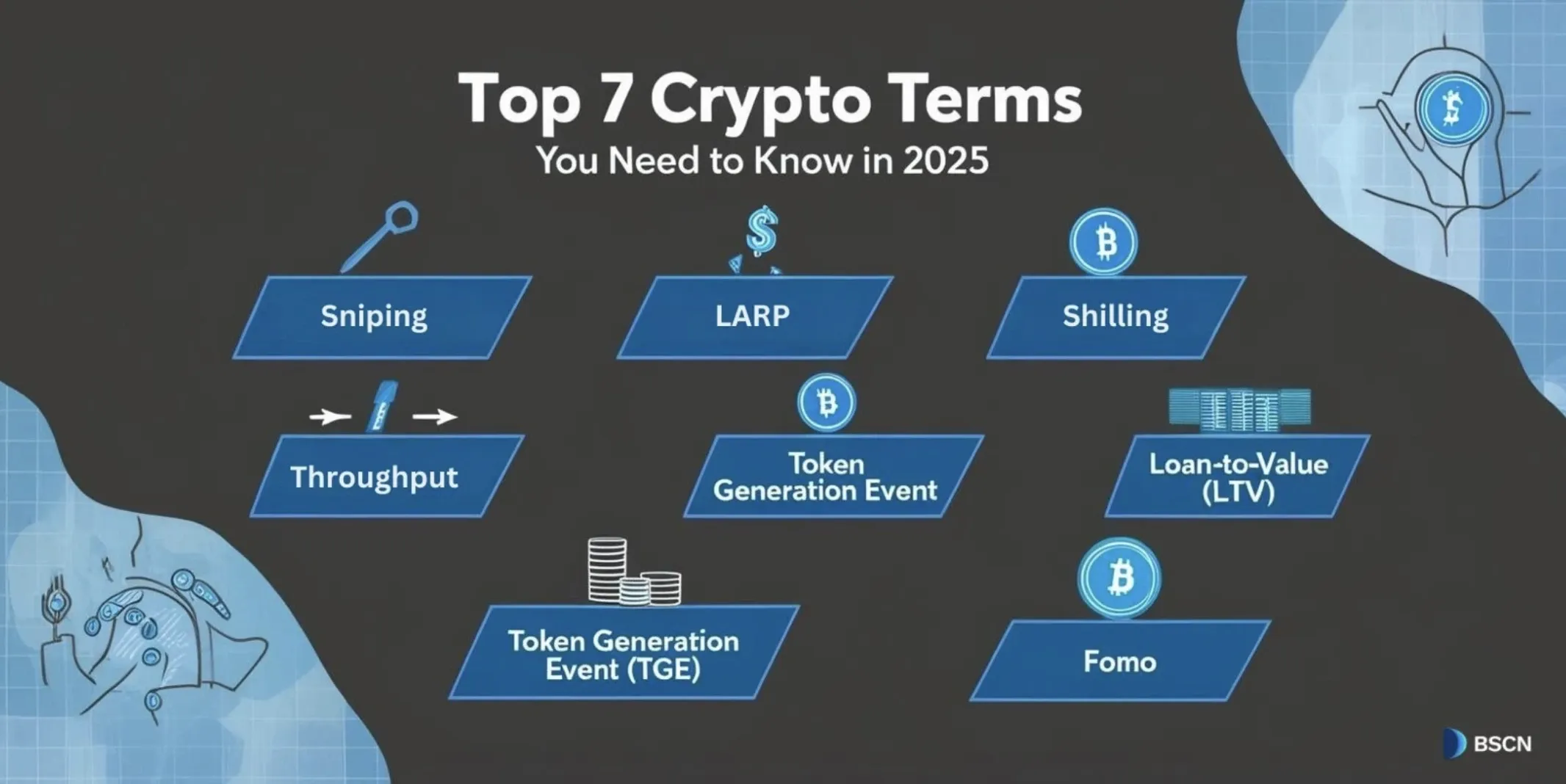

Top 7 Crypto Terms You Should Know in 2025

Sniping, shilling, TGEs, and more. This guide breaks down 2025's most-searched crypto terms in a simple, clear way.

Miracle Nwokwu

March 14, 2025

Table of Contents

Despite the unpredictable market conditions, interest in cryptocurrency keeps growing. Many people are eager to understand the concepts that drive this space, from simple trading strategies to the latest trending jargon. If you're looking to expand your knowledge, this guide is for you.

Here's a breakdown of the seven key terms people are searching for in 2025, explained in a clear and beginner-friendly way.

1. Sniping in Crypto

What is Crypto Sniping?

Crypto sniping is a trading method where traders act quickly to take advantage of market opportunities. This can involve buying or selling tokens within seconds using automated bots. Crypto snipers often focus on new token launches or price differences across platforms.

How Does It Work?

Traders use bots to monitor the blockchain for key events, such as new listings or sudden changes in liquidity. When a bot spots an opportunity, it executes a trade immediately. For example, snipers may buy a token the moment it launches, hoping for a quick price jump.

Types of Sniping Strategies

- Token Launch Sniping: Buying newly-listed tokens to sell them when prices rise.

- Liquidity Sniping: Trading tokens when large amounts of liquidity are added.

- Arbitrage Sniping: Profiting from price differences for the same token across platforms.

- MEV Sniping: Rearranging blockchain transactions to gain an advantage, common in Ethereum trading.

Risks to Consider

Sniping can be risky. Failed trades, high competition, or network issues can result in losses. Plus, using bots may carry ethical concerns since they give certain traders an unfair advantage.

2. LARP in Crypto

What Does LARP Mean?

In crypto, LARP (short for "Live Action Role Playing") is when individuals pretend to have expertise or insider information to influence others. Their goal is often to manipulate token prices for personal gain.

Common Tactics

LARPers may create hype about a project, promise groundbreaking features, or claim massive profits. This creates FOMO (fear of missing out), pressuring others to invest. For example, someone might falsely claim a token is about to skyrocket due to a "secret" partnership.

How to Protect Yourself

To avoid falling for LARPs:

- Verify claims from multiple sources.

- Be cautious of anonymous accounts or vague promises.

- Look for evidence rather than hype.

If something sounds too good to be true, it likely is.

3. Crypto Shilling

What Is Shilling?

Shilling is when someone heavily promotes a cryptocurrency or project, often exaggerating its potential. The goal is to create excitement and drive up demand, usually so the promoter can profit.

How Does It Work?

Promoters—often social media influencers or project founders, talk up tokens they own or are paid to advertise. They might promise huge returns or use buzzwords to attract attention. In some cases, this leads to "pump-and-dump" schemes, where prices skyrocket briefly before crashing.

Signs of Shilling

- Unrealistic promises about price gains.

- Lack of transparency about financial ties to the token.

- Over-the-top enthusiasm about unknown or low-value projects.

How to Avoid Falling for Shilling

Always research projects independently. Genuine supporters usually provide balanced information and disclose their interests. Be cautious if someone pushes multiple tokens or gives vague details.

4. Token Generation Event (TGE)

What Is a Token Generation Event?

A Token Generation Event (TGE) is the process of creating and distributing tokens for a crypto project. It’s similar to an Initial Coin Offering (ICO) but is often used as a way to avoid regulatory scrutiny.

Why Do TGEs Happen?

Many companies use TGEs to raise funds for their projects. Unlike ICOs, TGEs are typically positioned as events for creating utility tokens rather than securities, potentially reducing tax and legal risks.

What Should You Know?

If you’re considering investing in a token during a TGE, research the project thoroughly. Understand the token’s purpose, the team’s background, and how funds will be used.

5. Throughput

What Does Throughput Mean?

Throughput measures how many transactions a blockchain can process in a set period, often expressed as transactions per second (TPS). It reflects a network's speed and efficiency.

Why Does It Matter?

A fast blockchain with higher throughput can handle more transactions, making it better suited for large-scale use. For example, Bitcoin’s throughput is lower than some newer networks like Solana, but it prioritizes security and decentralization.

Factors That Impact Throughput

- Consensus Mechanism: Proof-of-Stake (PoS) networks are typically faster than Proof-of-Work (PoW) systems.

- Traffic: High demand can slow down transactions.

- Complexity: More complex transactions, like those involving smart contracts, take longer to process.

Improving Throughput

Developers use techniques like sidechains, rollups, and block size adjustments to increase throughput without compromising network security.

6. Loan-to-Value (LTV)

What Is Loan-to-Value?

LTV is a ratio that measures the size of a loan compared to the value of the collateral provided. In crypto, borrowers must deposit digital assets as collateral to secure loans.

How It’s Used in Crypto Lending

For example, if you borrow $5,000 and provide $10,000 worth of Bitcoin as collateral, your LTV is 50%. If Bitcoin’s price drops, your collateral’s value falls, and your LTV rises. To avoid liquidation, you’d need to add more collateral.

Benefits of LTV

- For lenders: It reduces risk since loans are backed by assets.

- For borrowers: Lower LTV ratios often mean lower interest rates.

Risks to Watch

High LTV ratios can lead to liquidation during market downturns. Borrowers should monitor their collateral regularly to avoid losing it.

7. FOMO (Fear of Missing Out)

What Is FOMO?

FOMO refers to the fear that you’ll miss a profitable opportunity, causing you to make impulsive trading decisions. In crypto, this often happens when traders see a coin soaring in value and rush to buy without proper research.

How FOMO Affects Trading

FOMO can lead to risky behavior, like buying at the peak of a price surge or selling during a crash. For example, when Bitcoin drops sharply, some traders panic-sell, only to regret it when prices recover.

How to Control FOMO

- Stick to a clear trading strategy.

- Avoid making decisions based on emotions or social media hype.

- Research projects thoroughly before investing.

Remember, crypto is volatile, and not every opportunity is worth chasing.

Understanding these terms will help you navigate the crypto space with more confidence. While the market might seem overwhelming at times, staying informed and cautious can make a big difference in your success. Take your time to learn, and always think critically before making decisions.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens