Taker Protocol: A Deep Dive into Bitcoin’s Incentive Layer

With EVM compatibility and LSD-focused DeFi tools, Taker Protocol aims to connect Bitcoin users to broader on-chain opportunities and yield products.

Miracle Nwokwu

June 27, 2025

Table of Contents

Taker Protocol has quickly risen to become a notable player in the Bitcoin ecosystem. Launched as the first and largest Bitcoin incentive protocol, it aims to broaden access to Bitcoin gains for fractional holders. Unlike traditional Layer 2 solutions or purely financial platforms, Taker positions itself as a Bitcoin Incentive Layer. Its goal is to encourage adoption, holding, and utilization of Bitcoin and its derivatives, potentially expanding the community by a factor of 100.

This article explores Taker’s origins, features, milestones, and future plans, offering readers a detailed look at its role in the evolving Bitcoin landscape.

Origins and Milestones

Taker’s journey began with its testnet launch in October 2024, a critical step to test its infrastructure before the mainnet went live on January 2, 2025. This mainnet launch marked a significant milestone, introducing lite-mining and an open incentive network. According to the project, the launch saw impressive achievements: over 7 million on-chain addresses, 230 million transactions processed, and more than 80,000 BTC holders integrated on-chain.

The project also reported distributing 25,000 $UXUY tokens and $2,000 worth of $TAKER tokens through its #Airdrop2049 campaign, alongside hosting an AMA with UXLINK on June 23. These milestones highlight Taker’s early success in building a robust user base and operational capacity.

The UXLINK Partnership

A notable development this year is Taker’s collaboration with UXLINK, announced in mid-June 2025. This partnership seeks to integrate UXLINK’s 40 million users into Taker’s Bitcoin incentive layer. The alliance focuses on enhancing user engagement and exploring new token utilities, creating value for both communities. UXLINK, a Web3 social platform, brings its vast user network, while Taker contributes its expertise as a BTC community builder. The collaboration includes ecosystem integration, joint use case development, and mutual growth initiatives. UXLINK’s commitment to support Taker post its Series A funding round ensures long-term stability. Together, they aim to build a powerful engine for BTC yield and adoption, leveraging their combined strengths.

Core Features and Technical Foundation

Taker’s design caters specifically to retail Bitcoin holders, offering tools to maximize yields. Its EVM-compatible Taker Chain supports existing decentralized applications (dApps) and integrates seamlessly with Bitcoin derivatives like Liquid Staking Derivatives (LSDs) and Liquidity Restaking Tokens (LRTs). This compatibility broadens its appeal to developers and users alike. The platform’s economic flywheel drives user traffic, creating a self-sustaining growth loop that benefits the ecosystem.

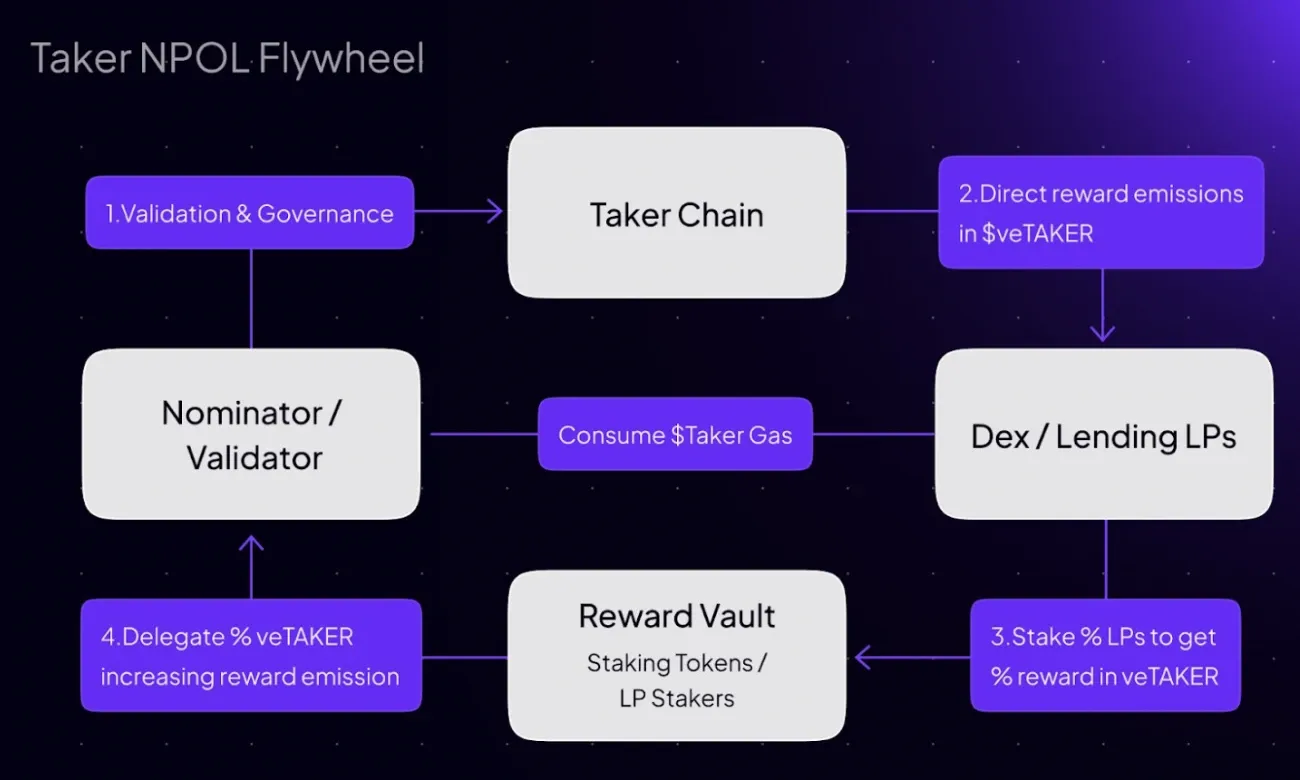

At the technical level, Taker Chain introduces Nominated Proof of Liquidity (NPoL), a consensus mechanism blending Nominated Proof of Stake (NPoS) with liquidity incentives. NPoS allows token holders to nominate validators, while the POL layer rewards liquidity contributions, enhancing security and scalability. A dual finality mechanism—Probabilistic Finality via BABE and Provable Finality via GRANDPA—ensures continuous block production and irreversible consensus. The chain’s high transaction-per-second capacity and fast finality further support its performance. Security is reinforced through audits by Scalebit, a firm with a track record in the Bitcoin space, and the use of the Substrate framework by Parity Technologies.

Network and Token Details

The native token, $TAKER, has a total supply of 1 billion. It serves as the gas token on Taker Chain, powering transactions and interactions. The chain supports a native Automated Market Maker (AMM) DEX, similar to Uniswap V3, and integrates lending protocols for Bitcoin LSDs and LRTs. These features position $TAKER as a central component of the ecosystem’s DeFi offerings. Users can explore network activity via the Blockscout explorer at explorer.taker.xyz, providing transparency into transactions and smart contracts.

Key Products Driving the Taker Ecosytem

Taker’s product suite is designed to convert users and retain them within the ecosystem.

Taker Sowing acts as a user acquisition engine, already attracting over 5 million participants. It uses a zero-barrier task system, where users complete on-chain and off-chain activities to earn Taker Diamonds. These diamonds grant access to future $TAKER airdrops and Laser Medal NFTs, symbolizing loyalty. The system educates users on Bitcoin yields through guided missions, bridging them into DeFi products.

Lite-Mining offers a lightweight mining option, where users earn Taker Points (TP) via simple on-chain tasks without staking. This lowers entry barriers, appealing to both Web2 and Web3 users. Accumulated TP can unlock ecosystem benefits, with future NFT-gated tasks planned to deepen user engagement.

Taker Swap is a DEX focused on BTC LSD assets, featuring low slippage and liquidity aggregation. It integrates with Taker Lend, allowing users to deposit swapped assets into lending pools for yields. An intelligent routing engine optimizes swap paths, making it user-friendly for beginners and advanced traders.

Taker Lend enables borrowing stablecoins against Bitcoin LSD collateral, such as wBTC or SolvBTC. It offers flexible interest rates and a risk control system with liquidation mechanisms. Users can unlock liquidity, leverage positions, or optimize yields through DeFi strategies, making it a vital part of the BTC DeFi infrastructure.

Cross-Chain Capabilities

Taker Chain enhances interoperability through partnerships with Meson and Free.tech. Meson, a leading cross-chain platform, facilitates asset bridging for BTCB, cbBTC, and wBTC, supporting integrations with projects like Stakestone and MerlinBTC. Free.tech, built on Meson, focuses on Bitcoin ecosystem bridges, enabling seamless asset and message transfers across blockchains. This infrastructure supports diverse use cases, from DeFi to cross-chain applications.

Roadmap and Strategic Vision

Taker’s 2025 roadmap outlines a phased approach to growth. Q1 saw the launch of Lite-Mining and Taker Swap development. Q2 introduced Sowing and began Taker Lend development, alongside community campaigns and the Taker Laser Cat NFT sale. Q3 plans the $TAKER token listing, airdrop, and full deployment of Lend and Swap with liquidity mining rewards. Q4 targets ecosystem partnerships, DeFi integrations, and programs for ETF and Real World Asset (RWA) users, bridging traditional finance with on-chain incentives.

The strategic vision targets over 500 million crypto users globally, with a product funnel from Sowing to Lend/Swap, retained through NFTs and tasks. Taker estimates a $50 billion total value locked (TVL) potential, positioning it as a scalable Bitcoin growth engine. Unlike typical DeFi protocols, it focuses on converting attention into on-chain engagement, unifying traffic, incentives, and usability.

What This Means for Users and the Market

For retail Bitcoin holders, Taker offers accessible entry points through Sowing and Lite-Mining, with opportunities to earn yields via Lend and Swap. Developers benefit from EVM compatibility and cross-chain tools, enabling innovative dApps. The UXLINK partnership could amplify reach, though its success depends on execution and market conditions. Investors should monitor token listing impacts and partnership outcomes, as these will shape Taker’s market position.

Taker’s approach diverges from traditional Bitcoin scaling solutions, prioritizing user growth over pure transaction efficiency. Its reliance on task-based incentives and community building sets it apart, but challenges like competition and regulatory scrutiny remain. The project’s progress suggests potential, yet its long-term impact hinges on delivering on its ambitious roadmap.

This deep dive reveals Taker Protocol as a multifaceted initiative with a clear focus on expanding Bitcoin’s user base. Its technical innovations, product diversity, and strategic partnerships provide a foundation to watch closely in the coming months.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens