Sei Network Leads the Pack in Active Wallets: The King of EVM?

Sei Network boasts impressive metrics, positioning it as a leading protocol amongst EVM-compatible blockchains.

UC Hope

September 15, 2025

Table of Contents

As of mid-September 2025, the Sei Network has taken the top spot among EVM-compatible blockchains in terms of unique active wallets, with approximately 763,000 daily active wallets over the past 24 hours and an average of 900,000 over the past 30 days, according to several analytics platforms, including Artemis and Defillama.

This impressive showing positions Sei ahead of rivals like Polygon and Avalanche in user engagement, raising questions about whether it has become the dominant player in the EVM space.

Sei is the leading EVM chain by active wallets across multiple timeframes.

— Sei (@SeiNetwork) September 13, 2025

Bolstered by infrastructure like Chainlink, Circle, MetaMask, and more, Sei is emerging as the home for global onchain finance.

Markets Move Faster on Sei. ($/acc) pic.twitter.com/RovZWGKmvH

The network's focus on high-speed trading and DeFi applications, combined with recent integrations, has driven this growth, with daily active addresses climbing from around 250,000 at the start of the year to more than 700,000 by August.

Sei's Path to EVM Dominance in 2025

Sei Network operates as a Layer 1 blockchain designed for trading and Decentralized Finance. In May 2025, it completed a full transition to an EVM-only architecture, which streamlined compatibility with Ethereum-based tools and smart contracts. This change included the Giga upgrade, enabling up to 200,000 transactions per second in processing capacity.

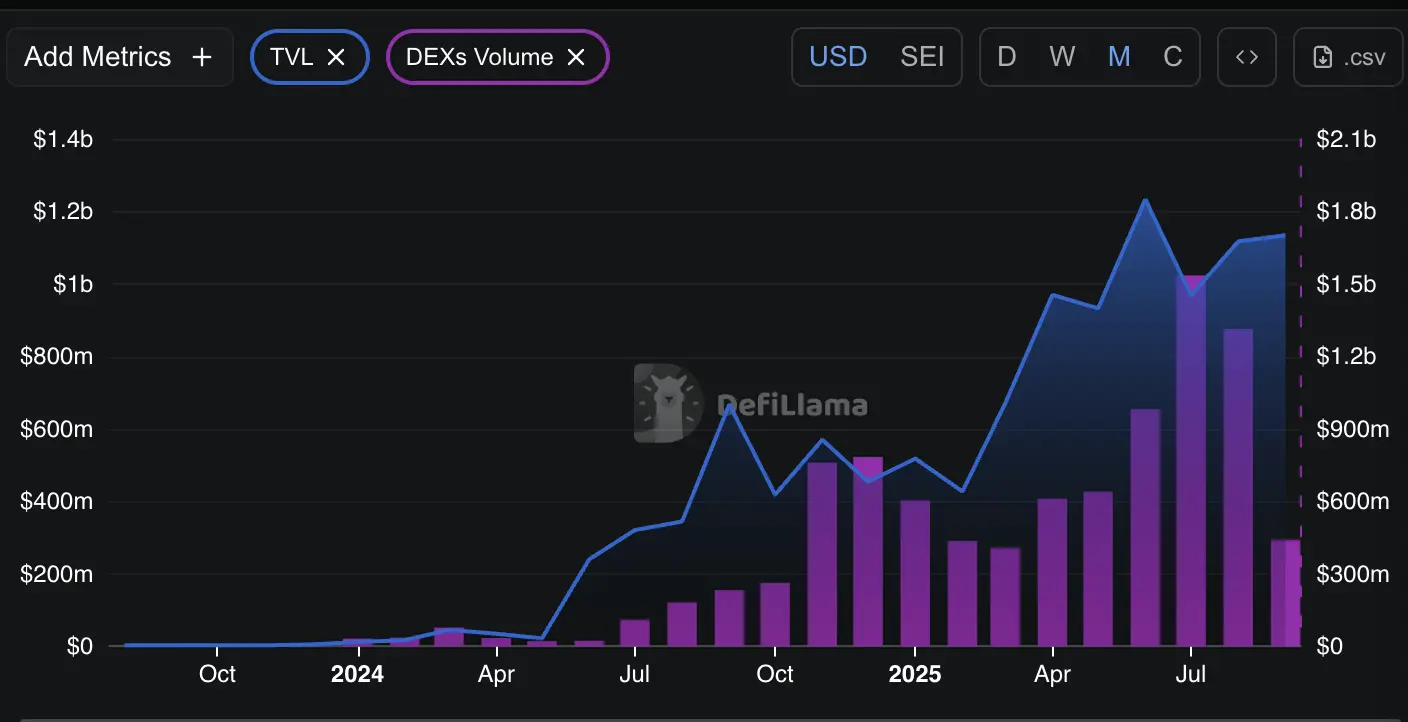

In July and August, the ecosystem surpassed $1 billion in monthly decentralized exchange volume, alongside a significant increase in total value locked compared to the previous year. Currently, the blockchain is on track to surpass $500M in DEX volume, indicating that it is primed to match the feat achieved in the previous two months.

The network's emphasis on sub-second finality has supported this expansion. Additionally, partnerships with established protocols have further solidified its role in onchain finance. Most importantly, daily active addresses reflect broader adoption, particularly in gaming and DeFi sectors, where Sei now hosts over 43 games and multiple lending platforms.

Breaking Down Unique Active Wallets Leadership

June 2025 Milestone in Daily Unique Active Wallets: According to Artemis data from June 2025, Sei Network reached an all-time high of 500,000 daily unique active wallets. This peak resulted from a 27 percent monthly increase in overall activity, reflecting growing user engagement across the platform's trading and DeFi features.

August 2025 Growth in Total Wallets and Gaming dApps: By August 2025, Sei experienced a 76 percent month-over-month increase in total wallets, reaching 8.3 million. Within this, 14 gaming decentralized applications on the network each had more than 100,000 unique active wallets, highlighting the sector's contribution to broader adoption.

Q2 2025 Industry Context and Sei's Performance: During the second quarter of 2025, the blockchain gaming industry had an average of 24.3 million unique active wallets overall. Sei's share in this space expanded by 51 percent in transaction volume and 73 percent in decentralized application volume. This period also saw Sei surpass 1 million daily unique active wallets for the first time, marking a notable escalation in its user base.

Comparisons with Other EVM Chains: According to metrics from mid-2025, Sei outperformed several EVM-compatible chains in terms of unique active wallets. Polygon recorded approximately 1.8 million over seven days and 5.2 million over 30 days, while Avalanche managed 1.2 million and 4.1 million, respectively. BNB Chain approached Sei's figures with 2 million over seven days and 6.5 million over 30 days, but Fantom lagged at 0.9 million and 2.8 million.

Nansen Report Insights on Growth Drivers: According to Nansen's first-half 2025 report, Sei's 180 percent growth in daily active wallets stems from its parallelized EVM design. This architecture processes high-frequency operations more efficiently than standard Ethereum setups, enabling smoother handling of concurrent transactions.

May 2025 Gaming Sector Highlights: In May 2025 alone, Sei's gaming sector attracted 403,650 daily unique active wallets. This figure outpaced Aptos, despite the latter's 22 percent growth rate, due to Sei's specialized features, such as intent-driven execution, which streamlines user interactions in trading-focused environments.

Impact of the EVM-Only Architecture Proposal: The May 2025 proposal for an EVM-only architecture, referred to as SIP, lowered barriers for migrations from Ethereum ecosystems. This adjustment has directly supported the upward trends in Sei's wallet metrics by facilitating easier integration of existing tools and contracts.

Broader EVM Adoption Trends and Sei's Position: As EVM adoption continues to expand, with performance enhancements reaching up to 50 times faster than certain alternatives, Sei's reported metrics demonstrate its ability to secure a substantial portion of onchain activity, particularly in high-throughput applications.

Key Developments in 2025 Contributing to Its Growth in the Blockchain Industry

Chainlink Data Streams Goes Live on September 10

On September 10, 2025, Chainlink Data Streams became available on Sei, delivering oracle data in under one second for decentralized finance and real-world asset tokenization. This service provides feeds for over 300 assets, including U.S. government economic indicators from the U.S. Department of Commerce. It supports applications like high-frequency trading and intent-based protocols, such as HaikuTrade.

The integration uses Chainlink's infrastructure to ensure low-latency updates, aligning with Sei's 400-millisecond settlement times. Official announcements from both Sei and Chainlink highlighted their role in enabling multi-chain strategies.

Native USDC and CCTP V2 Deployment in July

Circle activated native USDC and Cross-Chain Transfer Protocol version 2 on Sei on July 24, 2025. This allows instant USDC transfers across chains via a burn-and-mint mechanism, eliminating traditional bridges and minimizing slippage. Settlement times match Sei's sub-second capabilities, supporting the network's $1 billion-plus monthly decentralized exchange volume.

Initial partners included TakaraLend and FolksFinance for swaps and bridges, with Stargate adding CCTP V2 compatibility by July 28 for transfers involving Ethereum and Solana. The setup enables zero-bridge handling of stablecoins and real-world assets, reaching over 162 million users through telco integrations, such as Axiata's app. Following its launch, USDC activity led to a significant increase in the number of unique active wallets for gaming and DeFi hybrids, such as MetaArena.

MetaMask Adds Sei Support in August

MetaMask incorporated Sei on August 6, 2025, granting access to its decentralized applications and tokens for over 100 million users. The integration encompasses swaps, bridges, fiat on-ramps, and discovery through the Sei Ecosystem Hub, eliminating the need for manual RPC configurations.

A dedicated hub in the MetaMask Portfolio app focuses on Sei's gaming offerings, which rank first on DappRadar. An X Spaces event on August 13 discussed the addition, noting support for a total of 11 networks. This has eased cross-chain Web3 interactions, boosting Sei's daily active wallets toward 700,000 by late August.

Infrastructure Builds for Onchain Finance

Sei's expansions target onchain finance amid EVM growth. The May 2025 EVM pivot and Giga upgrade provide 200,000 transactions per second, emphasizing speed for financial applications. The total value locked aims for $600 million by the fourth quarter, supported by requests for proposals, such as Monaco's PitPass, for builder incentives.

New decentralized applications include Quizmatch on Axiata and Eldrem, an augmented reality role-playing game. DeSci version 2 proposals address on-chain science funding. Nansen's first-half report identifies Sei for financial use cases, with 180 percent daily active wallet growth. Real-world asset and tokenization efforts, backed by Chainlink and Circle, form a hub for global onchain finance.

The network's architecture simplifies Ethereum migrations, positioning it for high-frequency trading.

Conclusion

In summary, the data from mid-2025 underscores Sei's position as a leading EVM-compatible blockchain, with unique active wallet metrics surpassing those of Polygon, Avalanche, BNB Chain, and Fantom.

Its parallelized EVM architecture, supporting up to 200,000 transactions per second and sub-second finality, has driven a 180 percent increase in daily active wallets year-over-year, fueled by integrations such as Chainlink Data Streams for low-latency oracles, native USDC via Circle's CCTP V2 for efficient cross-chain transfers, and MetaMask support for seamless user access.

These developments, alongside a rise in total value locked and over $1 billion in monthly DEX volume, demonstrate Sei's capacity to handle high-frequency trading and DeFi operations effectively within the growing EVM ecosystem.

Sources:

- DappRadar Q2 2025 Blockchain Gaming Report: https://dappradar.com/blog/state-of-blockchain-gaming-in-q2-2025

- Nansen H1 2025 Onchain Analysis: https://research.nansen.ai/articles/sei-half-year-report-h1-2025

- Sei Network Official Blog: https://blog.sei.io/

- Artemis Analytics: https://app.artemisanalytics.com/asset/sei?from=assets

Read Next...

Frequently Asked Questions

What metrics show Sei Network leading EVM chains in user activity?

DappRadar reports 2.5 million unique active wallets over seven days and 7.8 million over 30 days for Sei in mid-September 2025, surpassing Polygon and Avalanche.

When did Chainlink Data Streams launch on Sei?

The integration occurred on September 10, 2025, providing sub-second oracle feeds for over 300 assets in DeFi and tokenization.

How does native USDC on Sei improve cross-chain transfers?

Launched on July 24, 2025, it utilizes Circle's CCTP V2 for instant burn-and-mint USDC transactions, thereby reducing slippage and aligning with Sei's 400-millisecond finality.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens