Inside The PancakeSwap Ecosystem: Key Developments in September 2025

PancakeSwap's September 2025 updates are centered on token burns, integration for multichain capabilities, feature updates, and community engagement.

UC Hope

October 10, 2025

Table of Contents

Leading Decentralized Exchange (DEX) on the BNB Chain, PancakeSwap, detailed several ecosystem advancements in its September 2025 report, covering token supply management, community initiatives, multichain expansions, trading feature upgrades, and prediction market enhancements.

These steps reflect ongoing efforts to strengthen the platform's tokenomics, user base, and interoperability within the broader decentralized finance landscape, with measurable effects on metrics like token burns, trading volume, and blockchain integrations. This article explores the protocol’s key updates from the past month, based on its report on X.

Ongoing CAKE Token Supply Reductions

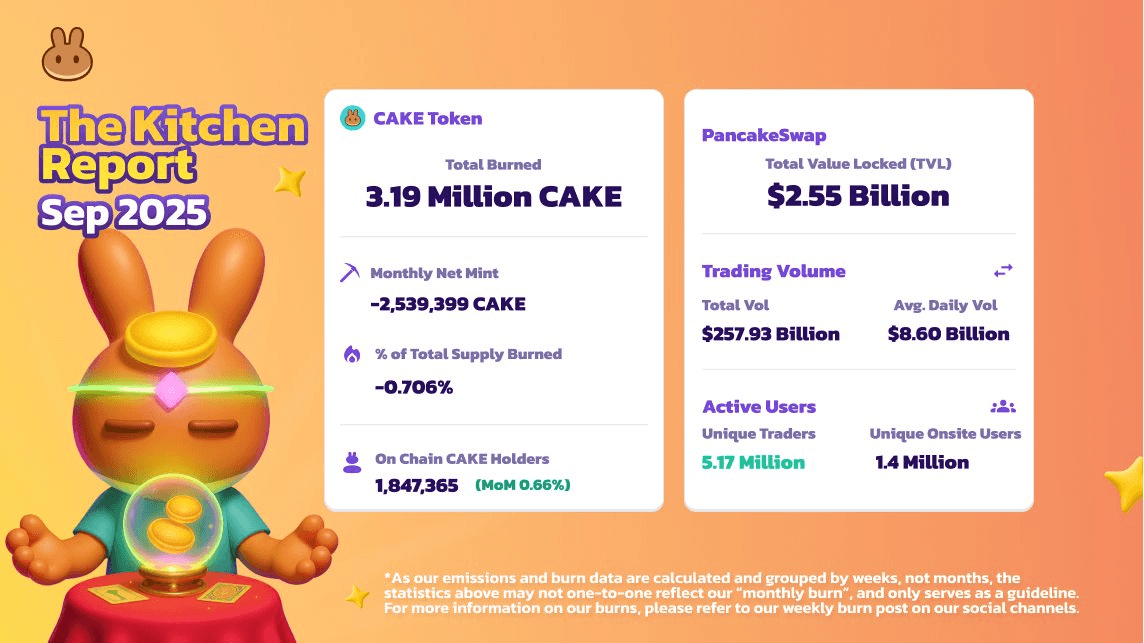

Within the PancakeSwap ecosystem, the CAKE token serves as both the governance and utility asset, with its supply dynamics remaining a focal point in September 2025. The month recorded the 25th straight period of net supply decrease, with burns totaling 3.19 million CAKE tokens against emissions, representing a total supply of 0.706%.

Major contributors to these burns included fees from swaps and perpetual trading, which accounted for more than 2.8 million CAKE removed from circulation. Prediction market fees added another 220,595 CAKE to the total. These mechanisms tie directly into the platform's tokenomics, where transaction-based fees fund permanent token removals.

“So far, over 28,798,488 CAKE has been permanently burned, reinforcing our commitment to sustainable tokenomics and responsible emissions. This consistent deflation shows the strength of our ecosystem and long-term vision,” PancakeSwap Blog read.

The pursuit of "ultrasound CAKE" underpins these efforts, a model where burns outpace new emissions to create deflationary pressure. This approach, inspired by Ethereum's post-2022 merge changes under EIP-1559, was formalized in PancakeSwap's ecosystem through CAKE Tokenomics v2.5 in April 2023. That update introduced real yield distributions alongside burns to support long-term token value.

Real-time tracking is available via the Burn Dashboard, which logs weekly emissions and burns, though monthly summaries provide the primary reference point. Variations may occur due to on-chain transaction timing, but the consistent reductions highlight PancakeSwap's commitment to controlled tokenomics as a core ecosystem feature.

Community Building and the Flippin’5 Tour

Community engagement forms a key pillar of the PancakeSwap ecosystem, and September 2025 saw heightened activity through the Flippin’5 Tour, dubbed Cooked Onchain. Launched in August 2025 to mark the platform's fifth anniversary, the tour hosted three meetups in Hanoi, Jakarta, and Delhi, drawing hundreds of participants from the global user base.

Events included on-site pancake preparation, distribution of exclusive anniversary merchandise, and interactive contests like pancake decoration with various toppings and designs. These activities extended beyond entertainment, enabling in-person discussions on DeFi strategies and fostering connections among users who typically interact online.

Since its inception in September 2020, PancakeSwap has grown to serve 143 million users and handle $2.5 trillion in cumulative trading volume. September 2025 metrics showed 5.17 million unique traders, 1.4 million unique on-site visitors, and 1,847,365 on-chain CAKE holders, a 0.66% rise from August. Total value locked stood at $2.55 billion, with trading volume reaching $257.93 billion and average daily volume at $8.60 billion.

These figures illustrate how community events integrate with operational growth, reinforcing user retention and participation in governance and staking within the ecosystem.

Multichain Expansion With Solana Integration

Interoperability across blockchains is central to PancakeSwap's ecosystem strategy, and September 2025 brought Solana's addition to cross-chain swaps. This raised the supported networks to seven: BNB Chain, Arbitrum, Base, Ethereum, zkSync, Linea, and Solana.

Powered by the Relay Protocol, the integration facilitates asset transfers between Solana and EVM-compatible chains in under a minute, with transparent fees shown prior to confirmation. Users perform these swaps in one transaction on the PancakeSwap interface, eliminating the need for separate bridging tools.

For context, Relay has handled over 55 million transactions for more than 5 million users, proving its reliability in bridging non-EVM environments like Solana, which gained traction in 2025 for its high transaction throughput. An X Space session with Relay representatives detailed the technical setup, including how the protocol manages cross-chain messaging and settlement.

Overall, the development is expected to enhance liquidity flow and user accessibility, aligning with PancakeSwap's multichain focus to reduce fragmentation in DeFi ecosystems.

Introduction of Fee-Earning Limit Orders

Trading tools within the PancakeSwap ecosystem advanced in September 2025 with the rollout of fee-earning limit orders. Users can now set precise execution prices and receive 0.1% fees on completed trades, akin to liquidity provision rewards, delivered automatically to their wallets.

Built on the Infinity architecture, this on-chain feature operates without intermediaries, bots, or extra costs. It combines centralized exchange-style control with decentralized security, enabling trades to execute when market conditions align with user-defined parameters.

The launch correlated with a 28.55% CAKE price surge to $3.46, its 2025 peak. Concurrently, ORBS-powered limit and TWAP orders were phased out on September 29, 2025, with migration recommended to the new system. This upgrade refines trading efficiency by integrating fee mechanics that incentivize participation and bolster ecosystem liquidity.

Prediction Markets Extend to BTC and ETH

PancakeSwap's prediction markets, a gamified element of its ecosystem, expanded in September 2025 to cover Bitcoin (BTC) and Ethereum (ETH) on the BNB Chain, joining the existing BNB market. Rounds occur every five minutes, using Chainlink oracles for price verification.

Participants predict directional moves, contributing to scalable prize pools. A 3% fee on winnings feeds into CAKE burns, directly supporting tokenomics. Instant results and reward claims follow each round, with an interface optimized for quick navigation.

The timing aligned with Bitcoin's September 2025 fluctuations, fueled by ETF inflows and halving cycle effects. Post-launch, CAKE appreciated 6% amid increased user activity.

An accompanying $2,500 campaign, running through October 2025, rewards top BTC and ETH predictors, encouraging sustained engagement.

Conclusion

September 2025 developments in the PancakeSwap ecosystem centered on refining CAKE tokenomics through burns, strengthening community ties via international meetups, broadening multichain access with Solana integration, enhancing trading via fee-earning limit orders, and diversifying prediction markets to include BTC and ETH.

These initiatives supported key metrics, including $2.55 billion in TVL and a growing holder base, while integrating features that promote deflation and interoperability. Such elements underline the platform's operational framework in DeFi, providing users with tools for trading, governance, and cross-chain interactions that emphasize sustainability and functionality.

Sources:

- PancakeSwap Official X Post: https://x.com/PancakeSwap/status/1976199738459554112

- PancakeSwap Burn Dashboard: https://pancakeswap.finance/burn-dashboard

- Relay Protocol Technical Discussion: https://x.com/PancakeSwap/status/1971204975641694434

- Monthly Recap Blog: https://blog.pancakeswap.finance/articles/kitchen-report-september-2025

Read Next...

Frequently Asked Questions

What role do CAKE burns play in PancakeSwap's ecosystem?

CAKE burns reduce token supply by removing tokens from circulation through fees from swaps, perpetuals, and predictions, supporting a deflationary model that has eliminated over 28 million CAKE since implementation.

How does Solana's integration affect PancakeSwap users?

Solana's addition to cross-chain swaps allows asset transfers across seven blockchains in under a minute using Relay Protocol, improving speed and reducing costs for multichain operations.

What benefits do fee-earning limit orders offer in PancakeSwap?

These orders enable users to earn 0.1% fees on filled trades at set prices, executed on-chain without additional tools, combining precision trading with passive rewards.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens