Ondo Finance's Surging TVL: Research into Growth Drivers and Data

Ondo Finance has experienced significant growth in the blockchain industry, accumulating over $1.6 billion in TVL across DeFi.

UC Hope

September 22, 2025

Table of Contents

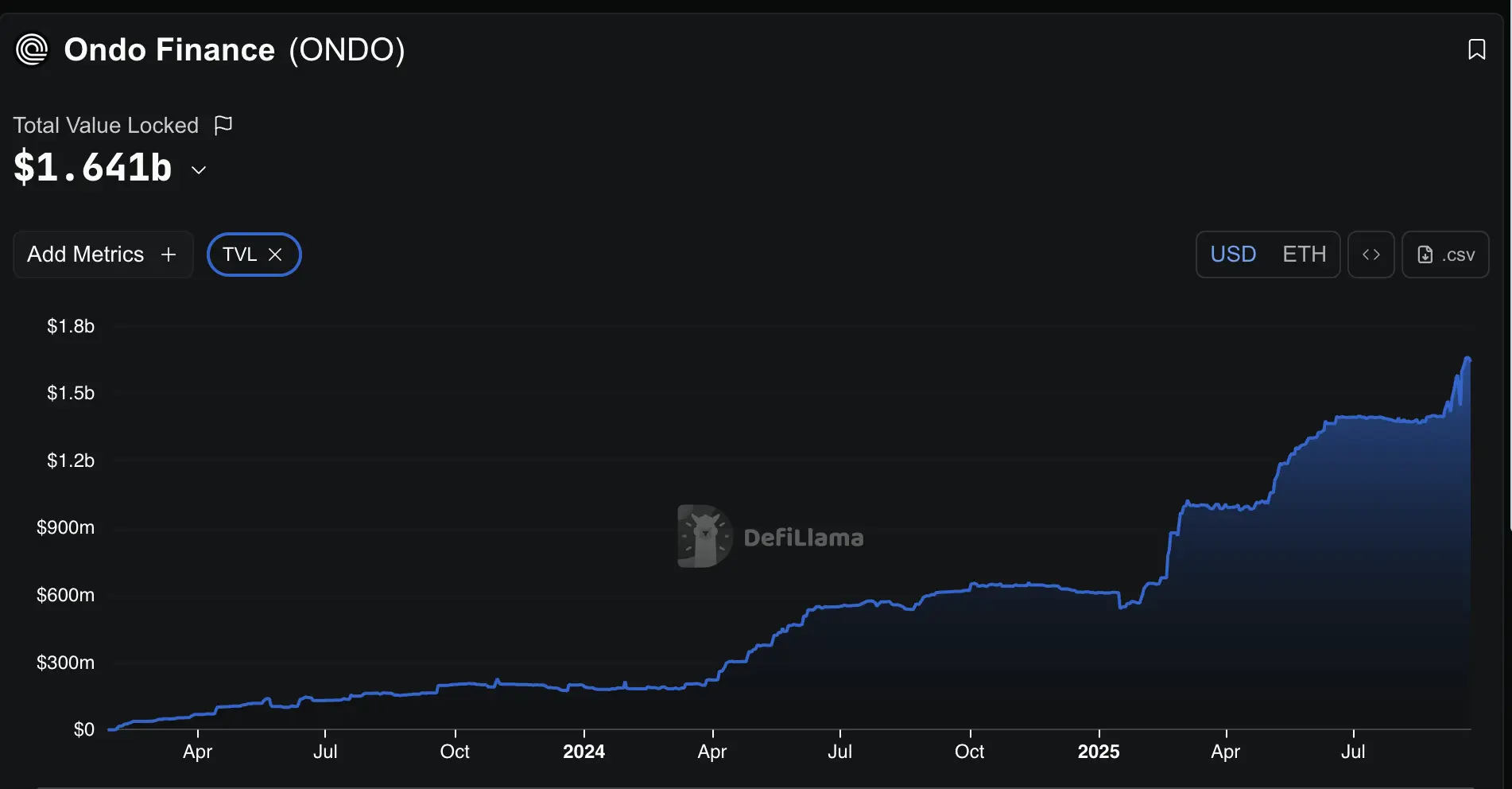

With its focus on tokenizing real-world assets, Ondo Finance has seen its Total Value Locked (TVL) surge significantly in recent months. The protocol's TVL, which measures the total assets deposited into its smart contracts, has grown through expansions across multiple chains and product launches, drawing from institutional interest in tokenized U.S. Treasuries and other assets.

Ondo Finance operates on several blockchains, with Ethereum holding the largest share of its TVL. DefiLlama data shows Ethereum accounts for $1.302 billion, followed by Solana at $241.94 million. Other chains include XRPL with $30.34 million, Mantle at $27.34 million, Sui with $16.93 million, Noble at $14.53 million, Arbitrum holding $5.28 million, Aptos at $1.94 million, and Stellar with $589,000.

This distribution highlights Ondo's multi-chain approach, which allows users to access its products on networks with varying transaction speeds and costs. For instance, Solana's architecture supports higher throughput, contributing to recent asset inflows. The protocol's main offerings, such as OUSG, a tokenized version of short-term U.S. Treasuries, and USDY, a yield-bearing stablecoin, form the core of this TVL. These products offer on-chain exposure to traditional yields, typically ranging from 4% to 5%, without requiring direct custody of the underlying assets.

Historical Trends in TVL Growth

Ondo Finance's TVL has followed an upward trajectory throughout 2025, starting from lower levels and crossing significant milestones. On January 17, 2025, the TVL stood at $548 million, marking the year's low point. By March 2025, it exceeded $1 billion, driven by increased adoption of tokenized U.S. Treasuries.

The protocol reached a new peak in June 2025 at $1.368 billion, amid heightened interest in real-world asset tokenization. As of September 2025, the TVL has settled at $1.641 billion, representing a compounded annual growth rate of over 200% for the year.

This growth aligns with the overall expansion of the decentralized finance sector, where lending protocols reached a peak TVL of $153 billion in the second quarter of 2025, driven by macroeconomic factors such as interest rate shifts. In the real-world assets category, tokenized products have increased 40% year-to-date to a total TVL of $11 billion, with Ondo ranking third at $1.656 billion.

What are the Factors Contributing to the TVL Increase?

Several key elements have contributed to Ondo Finance's TVL growth, including sector-wide trends and protocol-specific developments.

Expansion in Real-World Asset Tokenization

Ondo Finance specializes in tokenizing assets, such as U.S. Treasuries, enabling users to hold and trade them on blockchain networks. Industry forecasts indicate tokenized real-world asset TVL could reach $50 billion by the end of 2025, a 194% increase from current figures.

Ondo's OUSG product, for example, achieved a market capitalization of $629 million by May 2025, appealing to institutions seeking stable yields through blockchain.

Launch of Ondo Global Markets

The introduction of Ondo Global Markets, a platform for tokenized stocks and exchange-traded funds, added significant TVL. It accumulated over $100 million in its first week and contributed a $242 million overall increase, making Ondo the largest protocol in this subcategory.

Partnerships, such as one with Mastercard for non-U.S. stock trading and a $250 million investment from Pantera Capital, have bolstered this platform.

Blockchain Expansions and Integrations

Ondo has extended its presence to additional networks, enhancing accessibility. Integration with the Stellar Network unlocked $10 million in annual yields, leading to a 390% increase in active addresses from 935 to 4,559 within 24 hours. On the Sei Network, Ondo brought the first tokenized treasury bills, USDY.

Institutional and Regulatory Support

A White House report has noted Ondo's compliance in asset tokenization, while acquisitions like Strangelove and collaborations with Chainlink and BitGo have strengthened security and data feeds. Pro-crypto policies from the Trump administration are expected to facilitate the adoption of real-world assets further.

What Next for Ondo Finance?

Ondo's third-quarter 2025 roadmap includes broader access to Global Markets and a potential filing for an exchange-traded fund with 21Shares, which could drive TVL above $2 billion by the fourth quarter.

In summary, the platform provides tokenization of U.S. Treasuries and other assets across multiple blockchains, with current capabilities including yield generation through OUSG and USDY, cross-chain settlements via Ondo Chain, and tokenized stock trading on Global Markets. These features support its increasing TVL and position it within the real-world assets sector.

Sources:

- DefiLlama - Ondo Finance Protocol Page: https://defillama.com/protocol/ondo-finance

- Coindesk - Real World Asset Coverage: https://www.coindesk.com/markets/2025/03/21/real-world-assets-cross-usd10-billion-in-total-value-locked-defillama

- Coingeek - RWA Tokenization to hit $50B by 2025: https://coingeek.com/rwa-tokenization-to-hit-50-billion-in-2025-report/

Read Next...

Frequently Asked Questions

What is Ondo Finance's current TVL?

Ondo Finance's total value locked is $1.641 billion as of September 22, 2025, per DefiLlama data, primarily on Ethereum at $1.302 billion.

How has Ondo Finance's TVL grown in 2025?

Ondo Finance's TVL grew from $548 million in January 2025 to $1.641 billion in September, with milestones like crossing $1 billion in March and peaking at $1.368 billion in June.

What drives Ondo Finance's TVL surge?

Key drivers include real-world asset tokenization, the launch of Ondo Global Markets adding $242 million in TVL, and integrations with networks like Stellar and Sei.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens