Can Litecoin Win SEC Approval for a Spot ETF in 2025?

Litecoin ETF approval odds stand at 80% in 2025, but SEC delays and competing filings mean investors face months of regulatory uncertainty.

Soumen Datta

August 22, 2025

Table of Contents

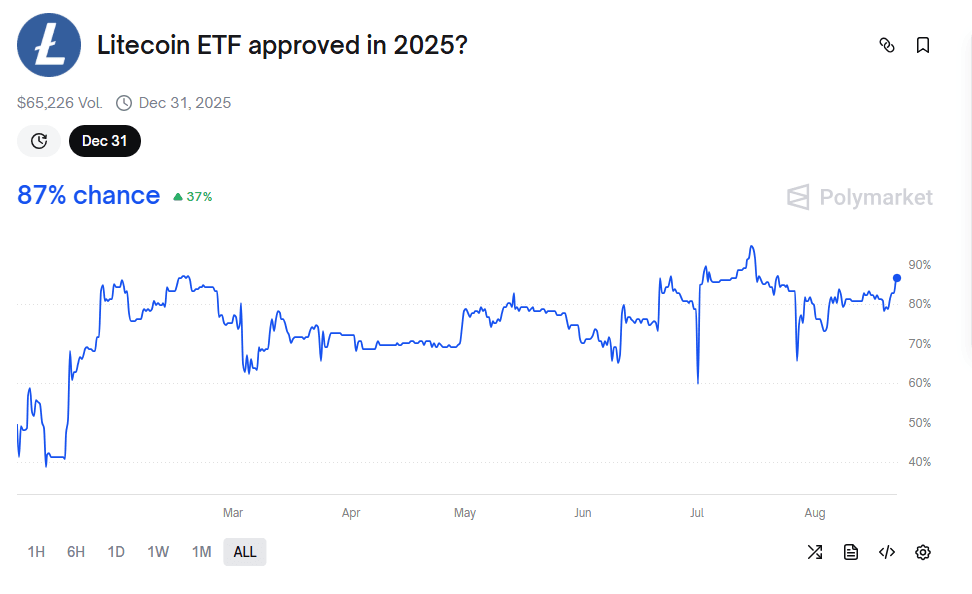

The probability of a Litecoin (LTC) spot ETF being approved in 2025 is currently estimated at 87%, according to prediction platform Polymarket. However, recent delays from the U.S. Securities and Exchange Commission (SEC) and competing applications from other crypto assets suggest that while approval is possible, it is not guaranteed.

Litecoin’s price action reflects this uncertainty. After climbing to a five-month high of $133, fueled by ETF rumors and corporate treasury investment, LTC has since pulled back. It trades at $155.60, down 5.8% in the past seven days, and 1.7% this month, giving the coin a market cap of $8.81 billion (CoinMarketCap).

Why a Litecoin ETF Matters

A spot exchange-traded fund (ETF) allows investors to gain exposure to the underlying asset—here, Litecoin—without directly holding or managing it. Spot ETFs differ from futures ETFs, as they track the actual market price of the asset.

Approval of a Litecoin ETF would carry several implications:

- Institutional access: Opens the door for traditional funds and retirement accounts to allocate capital to LTC.

- Liquidity growth: ETFs historically drive higher daily volumes, as seen with Bitcoin and Ethereum.

- Market legitimacy: SEC approval signals regulatory confidence in LTC’s maturity and resilience.

For now, investors are weighing whether Litecoin will become the third major cryptocurrency—after Bitcoin and Ethereum—to gain spot ETF approval in the U.S.

Current Status of Litecoin ETF Filings

Several investment managers have filed for a Litecoin ETF:

- Canary Capital: First to submit, filing with Nasdaq on January 15, 2025.

- Grayscale Investments: Filed shortly after, targeting NYSE Arca.

- CoinShares: Entered the race with a similar product, adding weight to institutional interest.

Despite these moves, the SEC has delayed decisions on all Litecoin ETF applications until October 2025, grouping them with reviews of XRP and Solana ETFs. The Commission cited the need for more public input and further evaluation of fraud prevention standards.

Earlier, public comments were open until May 26, 2025, with rebuttals accepted through June 9, 2025.

The SEC’s Cautious Stance

The SEC has taken a methodical approach to crypto ETFs. Approval for Bitcoin and Ethereum spot ETFs only came after multiple rejections and extensive legal battles.

Nate Geraci, president of The ETF Store, noted:

“The SEC is conducting careful reviews, but approvals remain possible if regulatory concerns are addressed by October 2025.”

Key concerns for the SEC include:

- Market manipulation risks in crypto spot markets.

- Investor protection standards and custody solutions.

- Surveillance-sharing agreements with regulated exchanges.

Until these issues are fully addressed, delays remain the SEC’s preferred approach.

Prediction Market Odds and Analyst Views

- Polymarket: 87% chance of LTC ETF approval in 2025.

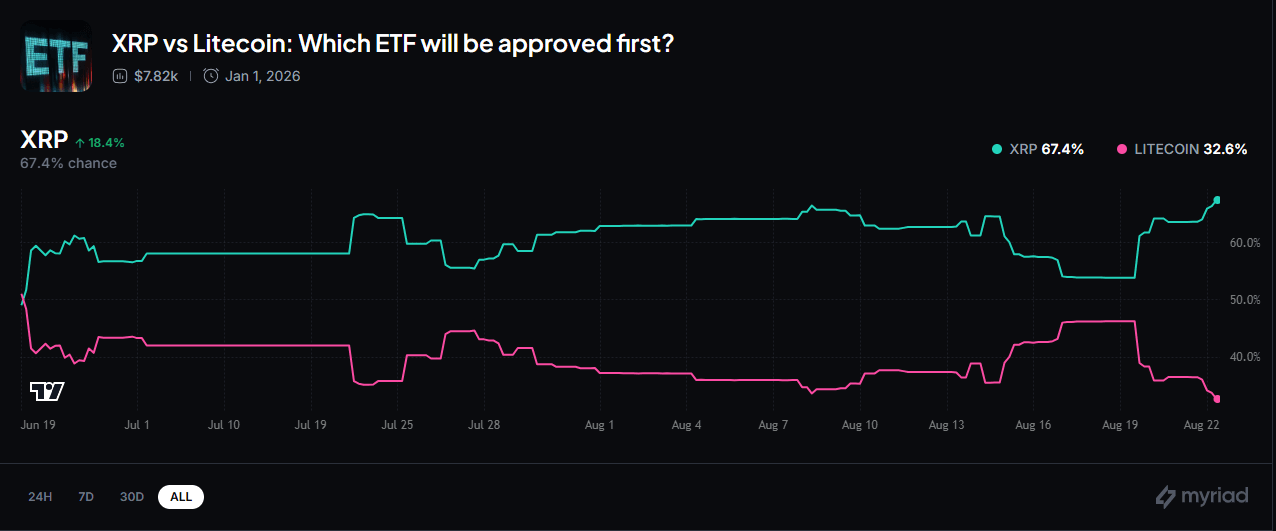

- Myriad: Nearly two-thirds of users predict an XRP ETF will be approved before Litecoin’s.

- Last February, Bloomberg ETF analysts, James Seyffart and Eric Balchunas, estimated a 90% chance that US regulators will approve a spot Litecoin ETF before year-end.

- Illia Otychenko (CEX.IO): Argues the main driver of recent LTC strength is corporate treasury investment, not ETF speculation.

Otychenko points to MEI Pharma’s $100 million treasury allocation into Litecoin as the real catalyst behind its price surge, noting that “90% ETF odds have been priced in since February.”

Market Adoption Signals

Beyond ETF speculation, Litecoin shows steady adoption as a payment currency:

- CoinGate data: Litecoin accounted for 14.5% of crypto payments processed in the past month.

- This places LTC second only to Bitcoin, ahead of USDC.

- Payment adoption highlights Litecoin’s long-standing reputation as a fast and low-fee network.

Such utility strengthens the case for an ETF by showing real-world use beyond speculative trading.

Short-Term Volatility, Long-Term Positioning

Regulatory delays have created sharp market swings. For example, analysts noted a recent price range of $84.65 to $89.51 as traders sold off amid disappointment at SEC postponements.

Still, institutional managers remain prepared:

- Grayscale, Bitwise, and CoinShares are continuing to build ETF infrastructure.

- Market precedent shows that once approvals come, inflows are rapid, as happened with Bitcoin and Ethereum ETFs.

- The October 2025 deadline is the key milestone for Litecoin, XRP, and Solana ETFs.

Competing Assets: XRP and Solana

Litecoin is not the only asset under review. The SEC is considering multiple altcoin ETF applications at the same time:

- XRP: Strong community and corporate support; prediction markets favor XRP’s approval first.

- Solana (SOL): Fast-growing ecosystem, but regulatory risks tied to past SEC lawsuits against tokens may weigh on decisions.

The fact that Litecoin, Solana, and XRP are being reviewed together suggests the SEC is evaluating altcoin ETFs as a category rather than in isolation.

Bloomberg ETF analysts estimate a 90% chance that US regulators will approve a spot Litecoin ETF before year-end.

Last February, analysts James Seyffart and Eric Balchunas believe Litecoin has stronger odds than other pending proposals, including spot ETFs for XRP, Solana, and Dogecoin, which they place at 65%, 70%, and 75% likelihood of approval in 2025.

What This Means for Litecoin Investors

For now, investors should expect:

- Ongoing volatility tied to regulatory headlines.

- No final decision before October 2025.

- Institutional inflows only once an ETF is approved, but firms are positioning early.

Even if approval does not arrive immediately, the SEC’s procedural moves show Litecoin remains in consideration—an important signal in itself.

Conclusion

The probability of a Litecoin spot ETF approval in 2025 sits near 85%, but SEC delays and competing filings for XRP and Solana mean nothing is guaranteed. Institutional interest is strong, with multiple asset managers applying for ETFs and companies like MEI Pharma committing treasury capital.

The final deadline of October 2025 will be decisive. Until then, Litecoin remains caught between growing adoption, corporate interest, and regulatory caution. Approval would likely bring inflows and legitimacy, but investors must prepare for a drawn-out process.

Resources:

Polymarket odds of a Litecoin LTC spot ETF getting approved: https://polymarket.com/event/litecoin-etf-approved-in-2025/litecoin-etf-approved-in-2025

Litecoin price action: https://coinmarketcap.com/currencies/litecoin/

Myriad’s odds of “XRP vs Litecoin: Which ETF will be approved first?”: https://myriad.markets/markets/xrp-vs-litecoin-which-etf-will-be-approved-first-9f8eab80-5487-4e81-85bb-cbced5cad595

Read Next...

Frequently Asked Questions

1. What are the chances of a Litecoin ETF approval in 2025?

According to Polymarket, the probability is about 80%, though the SEC has delayed final decisions until October 2025.

2. Who has filed for a Litecoin ETF?

Canary Capital, Grayscale Investments, and CoinShares have all submitted applications to list a Litecoin spot ETF in the U.S.

3. Why is the SEC delaying decisions on Litecoin and other ETFs?

The SEC is seeking more public input and further analysis of fraud prevention, investor protections, and surveillance-sharing before expanding approvals beyond Bitcoin and Ethereum.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens