KAS Review: Understanding Kaspa's Native Coin

A full deepdive into Kaspa's native KAS. Learn about its tokenomics, utility, and more.

Crypto Rich

March 18, 2025

Table of Contents

What Is Kaspa and Why Does it Need KAS?

Kaspa, launched in November 2021 with a fresh approach to cryptocurrency design. Its revolutionary blockDAG architecture enables parallel block processing, making it the fastest mineable cryptocurrency without sacrificing decentralization—a critical balance other projects struggle to achieve.

The project launched with unprecedented fairness: zero developer allocations, no pre-sales, and no founder reserves. Every KAS token enters circulation solely through mining, where network security is maintained through computational work.

As of March 2025, 25.88 billion KAS circulate in the market with each block yielding 61.73541265 KAS in rewards. This supports Kaspa's approximately $1.9 billion market capitalization and position as a leading proof-of-work cryptocurrency.

Token Supply and Distribution

Kaspa's total supply is capped at 28.7 billion KAS, distinguishing it from inflationary crypto and fiat currencies. This hard cap creates a deflationary economic model as adoption grows.

Several aspects make Kaspa's tokenomics distinctive:

- Zero pre-mine allocation

- No initial coin offering or pre-sales

- Absence of developer or founder allocations

- Equal mining opportunity for all participants

These principles establish Kaspa as one of the most equitably distributed cryptocurrencies in the market. Governance decisions remain entirely community-driven without centralized control.

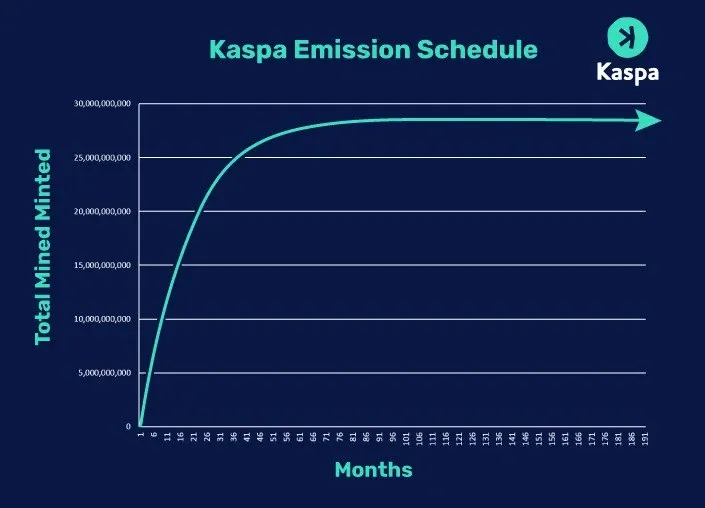

Emission Schedule and Halving Mechanism

The emission schedule follows a unique approach. When mining began in November 2021, the block reward was set at 500 KAS per second. Rather than implementing abrupt halving events like Bitcoin, Kaspa employs gradual monthly reductions. The reward halves annually through smooth monthly decrements.

Technically, this reduction follows a (1/2)^(1/12) multiplier applied monthly, creating a more predictable emission curve for miners. This month the reward has decreased to 61.73541265 KAS per second. According to the established emission schedule, the reward will continue declining to approximately 3.4375 KAS per second by May 2029, ultimately reaching just 0.0335 KAS per second by November 2037.

With over 90% of the maximum supply (25.88 billion of 28.7 billion KAS) already mined, the inflation rate has significantly decreased, potentially impacting market dynamics as new coin issuance slows substantially.

Mining and Block Speed

Kaspa's mining ecosystem has evolved significantly since its inception. Initially accessible via consumer CPU hardware, mining has progressed through several technological iterations:

- CPU mining - The initial phase allowing broad participation with standard computing hardware

- GPU mining - Transition to graphics processing units offering enhanced hashing capabilities

- FPGA mining - Implementation of field-programmable gate arrays for improved efficiency

- ASIC mining - Deployment of application-specific integrated circuits optimized for Kaspa

A notable milestone occurred in April 2023 when IceRiver introduced the first ASIC miners specifically designed for Kaspa. These specialized devices dramatically increased mining efficiency and network security.

Mining Algorithm and Energy Efficiency

Kaspa implements the kHeavyHash mining algorithm, engineered for optimal energy efficiency while maintaining robust network security. The algorithm design helps miners optimize operational costs through reduced electricity consumption.

The blockDAG architecture enables rapid block generation, which fundamentally alters mining dynamics compared to traditional blockchains. This accelerated block production reduces variance in mining rewards and diminishes the advantage of large mining pools over individual operators. The result is a more distributed mining landscape that promotes decentralization.

Today, the network hashrate is 1,200,163.4 TH/s, reflecting substantial computational resources dedicated to securing the network and validating transactions.

How KAS' Design Affects Its Value

Scarcity and Supply Dynamics

The fixed maximum supply of 28.7 billion KAS creates inherent scarcity. As adoption increases while supply growth diminishes, basic economic principles suggest potential appreciation in value due to supply-demand dynamics. Although 28.7 billion coins is not a small amount of coins compared to Bitcoin's 21 million.

The gradual emission reduction mechanism through smooth monthly decrements helps mitigate market volatility typically associated with abrupt halving events seen in other proof-of-work cryptocurrencies. This approach allows for more measured market adjustments rather than cyclical shock events.

Equitable Distribution and Market Stability

The absence of pre-allocated tokens to founding teams or venture capital creates a more equitable distribution model. Price discovery and valuation reflect genuine market demand rather than concentrated holder activities or strategic releases from early investors.

Kaspa's accessibility to individual miners through its blockDAG architecture supports broader distribution of tokens. This widespread ownership may contribute to more stable price action and resilience against market manipulation that can occur with concentrated token ownership.

Future Supply and Mining Economics

Looking forward, with approximately 90% of the maximum supply already in circulation, the remaining 2.82 billion KAS will be released at an increasingly slower rate over many years. This diminishing new supply could potentially intensify scarcity effects if demand maintains or grows.

As block rewards continue to decrease, the economics of mining will shift. Miners will increasingly rely on transaction fees rather than block rewards to sustain operations. This economic transition is a crucial phase in any proof-of-work cryptocurrency's lifecycle, potentially affecting overall network security if transaction volume and fees don't adequately compensate for diminished block rewards.

The ongoing evolution of mining hardware technology will continue to impact the mining ecosystem. The community governance mechanisms will face decisions about maintaining accessible participation while ensuring network security remains robust.

Summary: KAS Tokenomics

Kaspa distinguishes itself in the cryptocurrency ecosystem through its distinctive tokenomic framework:

- Maximum supply cap: 28.7 billion KAS

- Fair launch with zero pre-mine allocation

- Annual halving implemented through graduated monthly reductions

- Mining progression from CPU to ASIC technologies

- Energy-efficient kHeavyHash algorithm

- Rapid block times supporting decentralized mining participation

- Community-driven governance without centralized control

These fundamental design decisions have created an economic framework balancing transaction throughput, equitable distribution, and long-term sustainability. As of March 2025, with 25.88 billion KAS in circulation and ranked in the top 50 coins on Coinmarketcap, Kaspa has established itself as a significant player in the proof-of-work cryptocurrency space.

For investors, miners, and cryptocurrency enthusiasts, Kaspa offers a compelling case study in sustainable tokenomics designed for the long term. As other projects struggle with centralization and emission challenges, Kaspa's foundation of fairness, predictability, and technical innovation positions it uniquely in the market. Those looking for cryptocurrencies built on sound economic principles should consider how Kaspa's approach differs fundamentally from both traditional finance and other digital assets.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens