Exploring the Interlink ITL Token: Tokenomics, Utilities, Benefits, and More

Interlink ITL is a fixed-supply token that enables verified human payments, governance access, and institutional alignment within a bot-resistant blockchain network.

UC Hope

January 27, 2026

Table of Contents

InterLink Token, known by its ticker ITL, is the core value and coordination asset within the Interlink ecosystem. It is designed to support verified human participation in digital systems at a time when automated bots and synthetic identities increasingly distort online activity. The project positions ITL as both a strategic reserve asset for institutions and a practical payment token for everyday peer-to-peer use among verified individuals.

This article examines what ITL is, its tokenomics, the utilities it provides, and the benefits it offers.

What is the ITL Token?

InterLink Token is the primary value token issued by Interlink Labs, a blockchain project launched in 2025 with a stated goal of building a global Human Network. The network is designed to verify that participants are real people rather than automated systems, using biometric verification as its core defense against bots. The ITL token sits at the center of this system.

Interlink operates on a dual-token structure. ITL functions alongside ITLG, the InterLink Genesis Token. ITLG serves as the operational utility token powering the network, including gas fees on the Interlink Layer 1 blockchain and participation in applications such as decentralized finance tools and mini apps. ITL, by contrast, is positioned as the strategic and economic anchor of the ecosystem.

ITL is described as a token of trust and institutional alignment. It is intended to be held primarily by venture capital firms, institutional players, ecosystem partners, and Human Nodes who commit to the long term direction of the network. By concentrating ownership among these groups, Interlink aims to signal stability and alignment with governance rather than short-term speculation.

At the same time, ITL is positioned as a human currency. It is designed for direct peer-to-peer payments between verified individuals without reliance on banks, governments, or payment intermediaries. A user with a smartphone and successful facial verification can earn, hold, and transfer ITL across borders. This approach targets populations that traditional financial systems often exclude.

Interlink reports more than five million verified users as of early 2026, indicating early traction for the Human Network concept. Token listings for ITL are planned for the first quarter of 2026, with the token currently not available on public exchanges.

ITL Tokenomics

Fixed Supply and Scarcity Model

ITL has a fixed total supply of 10 billion tokens. No additional issuance or inflation mechanism is defined. This fixed cap makes ITL the scarcer asset in the Interlink ecosystem, especially compared with ITLG, which has a total supply of 100 billion tokens.

The supply design supports ITL’s role as a long-term value and reserve asset.

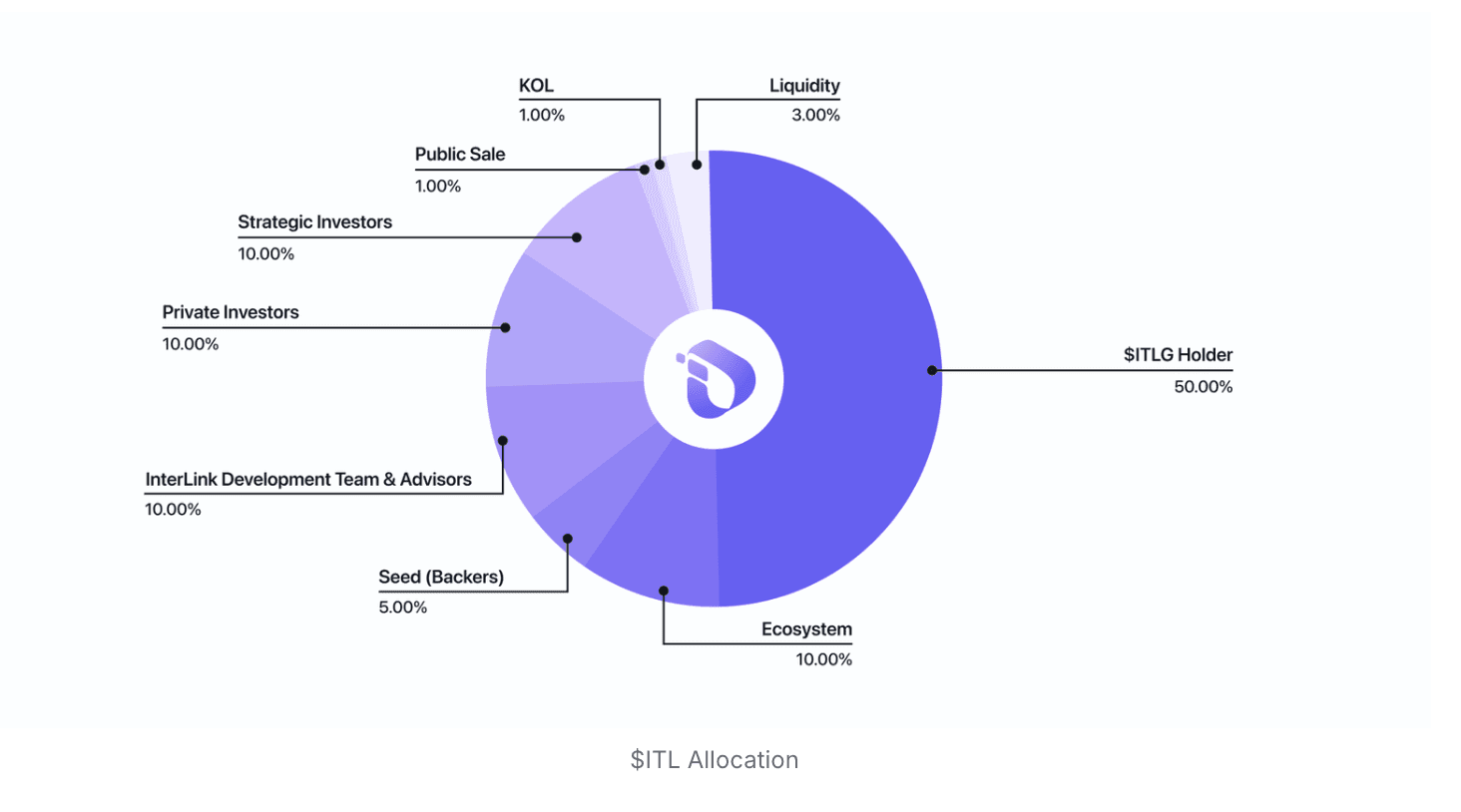

Allocation Structure

The total ITL supply is split evenly across two primary allocations.

Fifty percent of the supply is allocated to ITLG holders. These tokens are earned passively by holding or staking ITLG and do not require conversion or redemption. This creates a direct value bridge between the two tokens.

The remaining fifty percent is allocated to the Interlink Foundation. This allocation is reserved for strategic purposes, including ecosystem incentives, institutional partnerships, and long-term coordination across the network.

Derivation From ITLG

ITL is not minted independently through mining or emissions. Instead, it is derived from ITLG holding and staking. As demand for ITL increases, more ITLG must be locked to generate it.

This mechanism reduces circulating ITLG supply while increasing ITL distribution, reinforcing scarcity on both sides of the system. Value demand flows inward rather than leaking outward.

Economic Role Separation

Interlink uses a dual token economic model.

ITL functions as the strategic, governance, and reserve-aligned token. It is described as secure in structure and purpose.

ITLG functions as the operational utility token. It is used for gas fees, decentralized applications, and day-to-day network activity.

This separation is intended to improve regulatory clarity while keeping value accumulation focused on ITL.

Supply Pressure and Treasury Behavior

Because ITL has a fixed supply, deflationary pressure is introduced through locking, long-term holding, and foundation treasury accumulation.

The Interlink Foundation may acquire ITL through over-the-counter purchases rather than open-market sales, which are designed to support long-term stability rather than short-term liquidity extraction.

ITL Utilities

Access to the Human Layer

One of ITL’s primary utilities is staking for access to the Human Layer. Any partner, platform, or protocol that wants to interact with verified human users must stake ITL.

This creates a permission cost that protects the network from abuse while ensuring applications are built on verified participation rather than automated traffic.

Use cases include governance, rewards distribution, identity-based applications, and human-verified decision-making systems.

Institutional and Governance Utility

ITL is held by venture capital firms, institutional participants, ecosystem partners, and Human Nodes aligned with Interlink’s long-term direction.

Holding and staking ITL signals commitment to network governance, economic alignment, and strategic participation rather than short-term speculation.

ITL is also used by the Interlink Foundation as part of its coordination and reserve layer, aligning incentives across stakeholders.

Peer to Peer Human Payments

ITL functions as a human currency for direct peer-to-peer payments between verified individuals.

Transactions are permissionless and do not rely on banks, payment processors, or government-issued identity systems. Verification is handled through biometric authentication, enabling participation by users without formal financial infrastructure.

This utility targets populations that are traditionally excluded from global payment systems, including the unbanked.

Humanitarian and Public Sector Distribution

ITL enables direct value transfer to verified individuals for humanitarian and public interest use cases.

Organizations can distribute aid, grants, or subsidies without intermediaries, reducing delays and minimizing fraud. Funds reach the intended recipient directly and are tied to verified identity rather than documents or accounts.

AI Data Compensation

ITL supports direct compensation for verified human data used in artificial intelligence training.

- Users can contribute facial data, voice samples, or behavioral signals and receive ITL in return. This establishes an auditable, ethical compensation pathway for human-generated data.

- For organizations, this provides access to higher-quality datasets with reduced risk of synthetic or manipulated inputs.

Ecosystem Integration

ITL integrates across the broader Interlink ecosystem:

- It connects with decentralized finance tools under ITLX, including lending and staking.

- It works alongside ITLG on the Interlink Layer 1 blockchain, where ITLG is used for gas.

- It is compatible with the Interlink Visa Card, enabling real-world spending at merchants.

This integration ensures ITL utility extends beyond holding to active economic participation.

Benefits of ITL Token

For Institutions and Partners

- ITL provides institutions with exposure to a verified human network rather than anonymous or automated activity.

- Staking ITL grants access to real users with reduced bot risk, which is valuable for governance systems, data markets, and identity-dependent applications.

- The fixed supply and reserve-oriented design also make ITL suitable for long-term treasury holding.

For Developers and Platforms

- Developers gain predictable access to verified users by staking ITL. This reduces the need for external identity solutions and lowers fraud-related costs. Applications can be built with confidence that participation reflects real human input.

- The staking model also creates clear economic boundaries for access rather than open exploitation.

For Individuals and the Unbanked

- ITL allows individuals to earn, hold, and transfer value without requiring a bank account or government-issued identification.

- For unbanked users, this enables participation in global payments, digital labor, education programs, and aid distribution using only a smartphone and biometric verification.

For Network Stability

The dual token feedback loop strengthens overall network stability.

- Real-world ITL usage increases demand for ITLG locking.

- Reduced ITLG circulation supports price stability and network security.

Value is absorbed and retained rather than lost through high velocity circulation.

For Trust and Data Integrity

By tying participation to verified human identity, ITL reduces the influence of bots and synthetic actors.

This benefits systems that rely on trust, such as voting, reputation, governance, and AI training. Human verification becomes an economic feature rather than a compliance burden.

Risks and Considerations

Despite its structured design, ITL faces several risks that should be considered. The reliance on facial verification raises privacy and data protection concerns. While the project emphasizes privacy-focused implementation, regulatory standards vary by region and could affect adoption.

The token remains pre-launch, and delays in planned first-quarter 2026 exchange listings could impact confidence. Dual token systems can also confuse users if the education and interface design are unclear. Interlink’s ability to communicate the distinct roles of ITL and ITLG will be critical.

Competition is another factor. ITL operates in a crowded landscape of digital payment and settlement assets. Its differentiation depends on successful scaling of verification, merchant adoption, and institutional partnerships. Execution rather than concept will determine long-term relevance.

Conclusion

InterLink Token is positioned as a value and coordination asset built around verified human participation. Its fixed supply, derivation from ITLG, and staking-based access model reflect an emphasis on scarcity and long term alignment. By combining institutional holding structures with practical payment utilities, ITL aims to serve both governance and everyday use cases.

The project’s focus on unbanked populations, humanitarian distribution, and ethical data compensation highlights a clear set of priorities grounded in real-world needs. At the same time, its success will depend on execution, particularly in the scalability of verification, regulatory navigation, and adoption beyond early users.

As ITL approaches its planned public listings, it represents a distinct approach within digital assets, centered on trust, human identity, and structured economic design rather than speculative volume.

Sources

- Interlink Whitepaper: The ITL Token Explained

Read Next...

Frequently Asked Questions

What makes ITL different from other cryptocurrencies?

ITL requires verified human participation through biometric checks. This reduces bot activity and supports use cases that depend on real people rather than automated accounts.

How is ITL obtained?

ITL is derived from holding or staking ITLG and will also be distributed through institutional and ecosystem allocations once public listings begin.

Is ITL designed mainly for investment or for payments?

ITL serves both roles. It functions as a strategic reserve and governance asset while also enabling peer-to-peer payments among verified users.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens