AVAX

Grayscale Files to Convert Digital Large Cap Fund into Mixed Crypto ETF

Grayscale files to convert crypto fund into ETF

BSCN

October 15, 2024

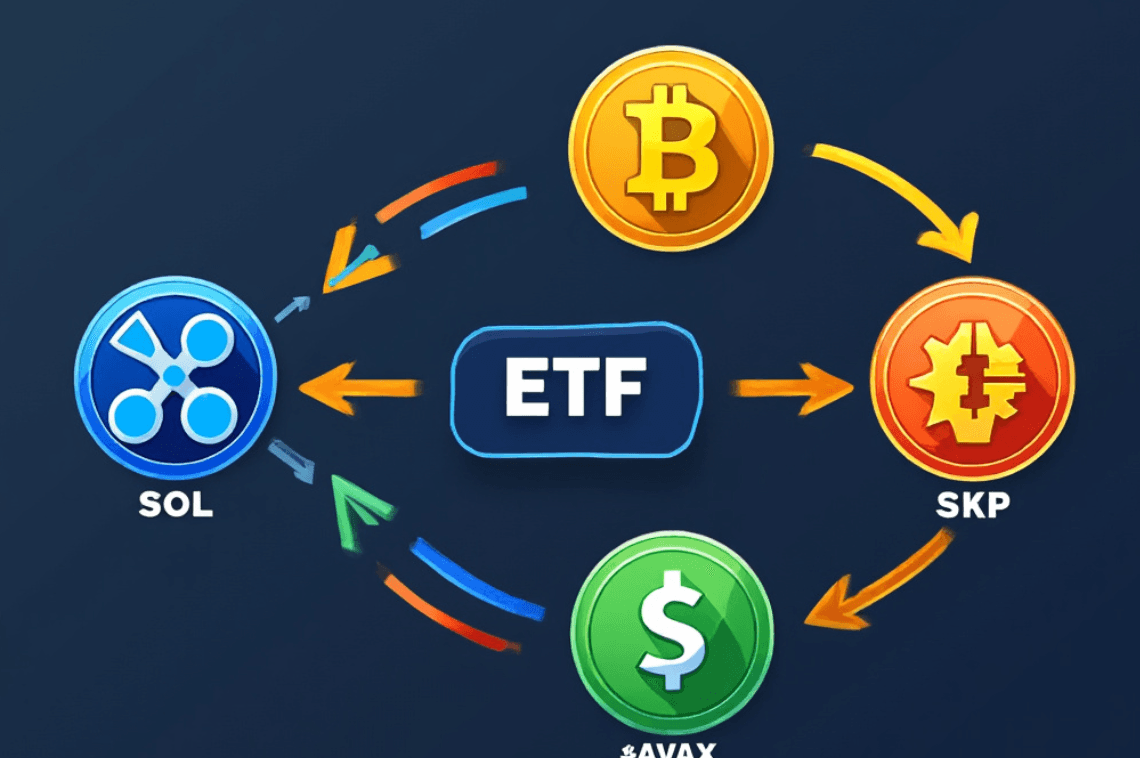

Grayscale Investments, a leading crypto asset management firm, has filed a request with the U.S. Securities and Exchange Commission (SEC) to convert its Digital Large Cap Fund, which includes major cryptocurrencies like Bitcoin, Ethereum, Solana, XRP, and Avalanche, into an exchange-traded fund (ETF). Currently trading over-the-counter with $524 million in assets under management (AUM), the fund’s composition is dominated by Bitcoin (nearly 75%) and Ethereum (around 19%), with Solana, XRP, and AVAX making up the remainder.

This move follows Grayscale’s previous successful conversions of both Bitcoin and Ethereum funds into ETFs. Grayscale’s Bitcoin ETF, launched in January, boasts an AUM of $14 billion, underscoring the growing demand for regulated crypto investment products. As Grayscale continues to push forward with its ETF offerings, the firm also recently launched products providing exposure to XRP and AAVE, highlighting its ambition to offer diversified, regulated crypto investment options.

Grayscale’s CEO, Peter Mintzberg, emphasized the importance of offering transparent and regulated access to crypto through familiar product structures. This is part of the company's broader strategy, particularly after its court victory over the SEC, to convert its flagship Bitcoin Trust into a spot ETF. The recent filings also place Grayscale in competition with other asset managers like Bitwise and Canary Capital, who are seeking approval for their own XRP ETFs. While Grayscale awaits the SEC's decision on its filings, its Ethereum Trust—currently the largest ether investment product globally with nearly $5 billion in AUM—may soon be converted into a spot Ethereum ETF as well.

Grayscale’s efforts, if successful, would further solidify its position as a market leader in offering investors access to a wide range of crypto assets through regulated and familiar investment vehicles. With competition heating up, the approval of more spot crypto ETFs, especially for XRP and Ethereum, could significantly shape the U.S. crypto investment landscape in the coming months.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Latest News

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens