How Platforms Like Pump.fun and Axiom have Become Rug Machines, Making Millions off Chaos?

Pump.fun and Axiom generate revenue from meme coin launches, but most tokens fail. AI tools like AssetSwap aim to bring safer trading insights.

BSCN

July 11, 2025

Table of Contents

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCNews. The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. BSCNews assumes no responsibility for any investment decisions made based on the information provided in this article.

Thousands of new coins surge into the market each day but when focusing on the manic world of meme coins, one can see that volatility isn’t a side effect but rather a thriving business model. In fact, platforms like Pump.fun and Axiom have turned this meme coin chaos into a cash machine, extracting hefty fees from each frenzy and seemingly winning at scale.

To this point, during a week-long stretch in April 2025, Pump.fun raked in $12.2 million in revenue while Axiom closed with a cool $10.5 million. But behind these rapid launches and “get-rich-quick” hype, there’s a dark underbelly of rug pulls and broken dreams.

The numbers don't lie

Since 2024, the meme coin market has evolved into a high-speed carnival of speculation, with Solana-centric token launchpads making it trivial for anyone to mint a coin, leading to an explosion of new coins daily. At the peak of the frenzy in January, over 71,000 tokens were launched in a single day on Pump.fun.

Most of these offerings never amounted to anything, with Binance research indicating that roughly 97% of all newly launched memecoins end up failing or going to zero. But in true Ponzi-like fashion, nearly all of them see an initial pump as speculators rush in hoping to catch the next PEPE or SHIB.

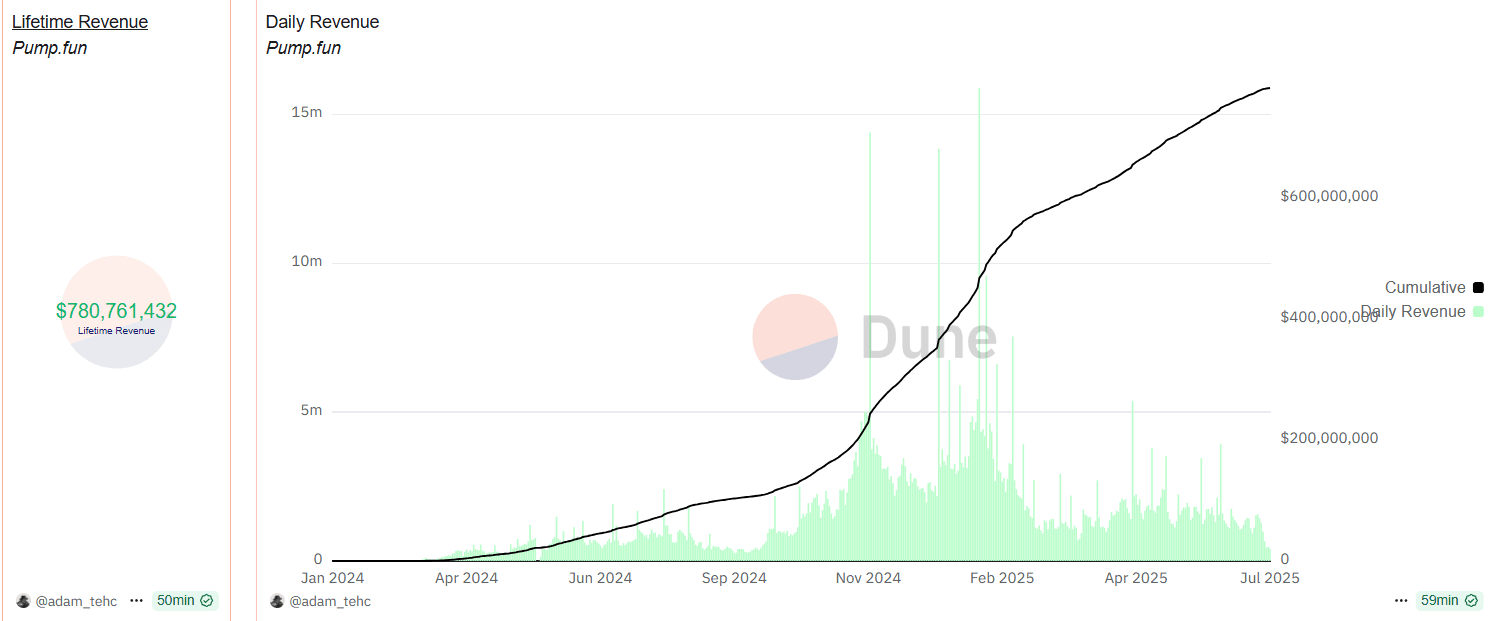

This “pump then dump” cycle has proven highly lucrative for the platforms facilitating it. Pump.fun, for example, takes a cut from every token launch on its bonding curve system (so much so that since launching in early 2024, it has amassed almost $780 million in fees).

Similarly, Axiom, launched in February 2025 as a trading bot platform, has quickly climbed Solana’s dominance charts by charging users about 0.75%–1% per trade. On July 7, 2025, Axiom’s daily fees even hit $1.75 million, ranking it among the top protocols globally by fee income.

Turning chaos into clarity

Amid this turbulence, AssetSwap.ai has emerged as a much-needed watchdog and co-pilot for traders. The platform leverages AI (GPT-4 level language models coupled with on-chain analytics) to decode patterns and spot red flags faster than any human could. The goal isn’t to stop people from chasing meme coins, but to help them do so with eyes wide open and parachutes at the ready.

One of AssetSwap’s standout features is an AI-driven risk scanner aptly named “AI-Pick,” which according to company CTO Yoann Defay is built “to do what no scanner or chart can: detect rugs before they become hashtags.”

To elaborate, the AI is trained to recognize subtle signals of a scam or impending rug pull, whether it’s a suspicious concentration of tokens in one wallet, a sudden liquidity withdrawal, or even social media sentiment that looks artificially amplified.

That said, AssetSwap’s AI doesn’t stop at warnings as it also actively guides users on navigating the meme coin minefield. Through a simple chat interface, a trader can ask, “Is this new coin likely to be a rug?” and get an analysis of the token’s contract code safety (e.g. whether the developer can mint unlimited tokens or has strange privileges), liquidity lock status, and even dev wallet history.

This level of due diligence, often skipped by eager degens in the past, is now as easy as asking a question. Not only that, for coins that are mooning but might crash, AssetSwap can advise on prudent stop-loss levels or when on-chain metrics suggest exiting. Essentially, it personalizes a risk strategy for each user’s portfolio and behavior, acting as a financial co-pilot that’s immune to hype.

What lies ahead?

For the first time, market chaos can seemingly be countered with clarity. And while Pump.fun and Axiom (alongside the rest of their ilk) will undoubtedly continue to mint money from the uninitiated, their golden age of unbridled chaos may be waning. As more traders enlist AI guidance, these scam machines must evolve or watch their easy profits dwindle.

The meme coin casino isn’t closing anytime soon, but thanks to AI watchdogs like AssetSwap, the house no longer always wins. And for the thousands of everyday traders who just want a fair chance in the madness, that is a very welcome change. Interesting times ahead!

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

BSCN

BSCNBSCN's dedicated writing team brings over 41 years of combined experience in cryptocurrency research and analysis. Our writers hold diverse academic qualifications spanning Physics, Mathematics, and Philosophy from leading institutions including Oxford and Cambridge. While united by their passion for cryptocurrency and blockchain technology, the team's professional backgrounds are equally diverse, including former venture capital investors, startup founders, and active traders.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens