ChainOpera DeepDive: The Collaborative Intelligence of AI Agent Network Co-created and Co-owned by The Community

ChainOpera AI is a decentralized, community-owned platform that enables collaborative AI agents for DeFi, e-commerce, and blockchain-integrated applications, powered by verifiable intelligence.

UC Hope

October 31, 2025

Table of Contents

With the interest in Artificial Intelligence (AI) constantly growing in the blockchain industry, ChainOpera AI stands out as a platform that fosters collaborative intelligence via a network of AI agents and models, all co-created and co-owned by community participants. This structure empowers users, developers, and resource providers to build, launch, and interact with tailored AI agents, ensuring they retain full oversight of their personal data.

By merging AI with blockchain systems it enables practical uses in areas such as decentralized finance, real-world assets, payment processing, influencer engagements, and online commerce.

This article explores the protocol and its unique offerings, including its ecosystem, key features, and utilities in the blockchain ecosystem.

What is ChainOpera AI?

ChainOpera AI functions on the premise that artificial general intelligence will develop from a network of specialized models and agents rather than from isolated large language models. This network involves contributions from distributed institutions and individuals within a decentralized framework.

The platform's structure includes a full-stack AI infrastructure comprising a Super AI App, an AI-native blockchain, and decentralized elements for model training and inference. The system operates at the intersection of AI, cryptocurrency, and financial technology, aiming to enhance accessibility to decentralized finance by automating workflows and providing data insights.

ChainOpera's AI Protocol serves as a blockchain-based operating system that emphasizes trust, transparency, and collective ownership.

- Tokenomics in the platform use a dual-token model to handle service payments and support ecosystem sustainability.

- Service providers engage through staking mechanisms to ensure quality and accountability, with options for delegation to improve reliability.

- A global agent leaderboard tracks contributions based on traffic, engagement, and utility.

The platform plans to adopt a subnet-style architecture for scalable growth and implement a "Proof-of-AI" system for verifiable trust in activities such as compute usage, agent execution, and contribution validation.

ChainOpera has launched products including the AI Terminal App, the Agent Developer Platform, the Model and GPU Platform, and a blockchain TestNet.

The platform handles millions of daily prompts using distributed resources, incorporating anti-Sybil measures and rate limits to ensure operational sustainability. Potential future models may involve fees or staking for advanced features and governance participation.

ChainOpera Ecosystem Breakdown

The ChainOpera ecosystem connects various participants in a shared economic model. Users interact with AI agents, make payments per prompt using stablecoins, and earn rewards from data contributions.

Developers build agents, stake $COAI tokens, and receive earnings from user engagements. GPU providers, as part of the decentralized physical infrastructure network, contribute computational resources and get compensated based on AI demand.

Core components include:

- AI Terminal as a Super App,

- Agent Developer Platform for building tools

- Model and GPU Platform for infrastructure

- AI Protocol for blockchain operations

- $COAI token for transactions.

Partnerships with Render for GPU rendering, Mind Network for fully homomorphic encryption, DeepSeek for models, and others like Aethir, Theta, and Qualcomm bolster the ecosystem's technical foundation.

Economic flows involve usage-based rewards, stablecoin payments, data exchanges, and revenue distribution among stakeholders. This setup creates a loop in which user interactions drive agent performance, which, in turn, generates rewards for developers and providers.

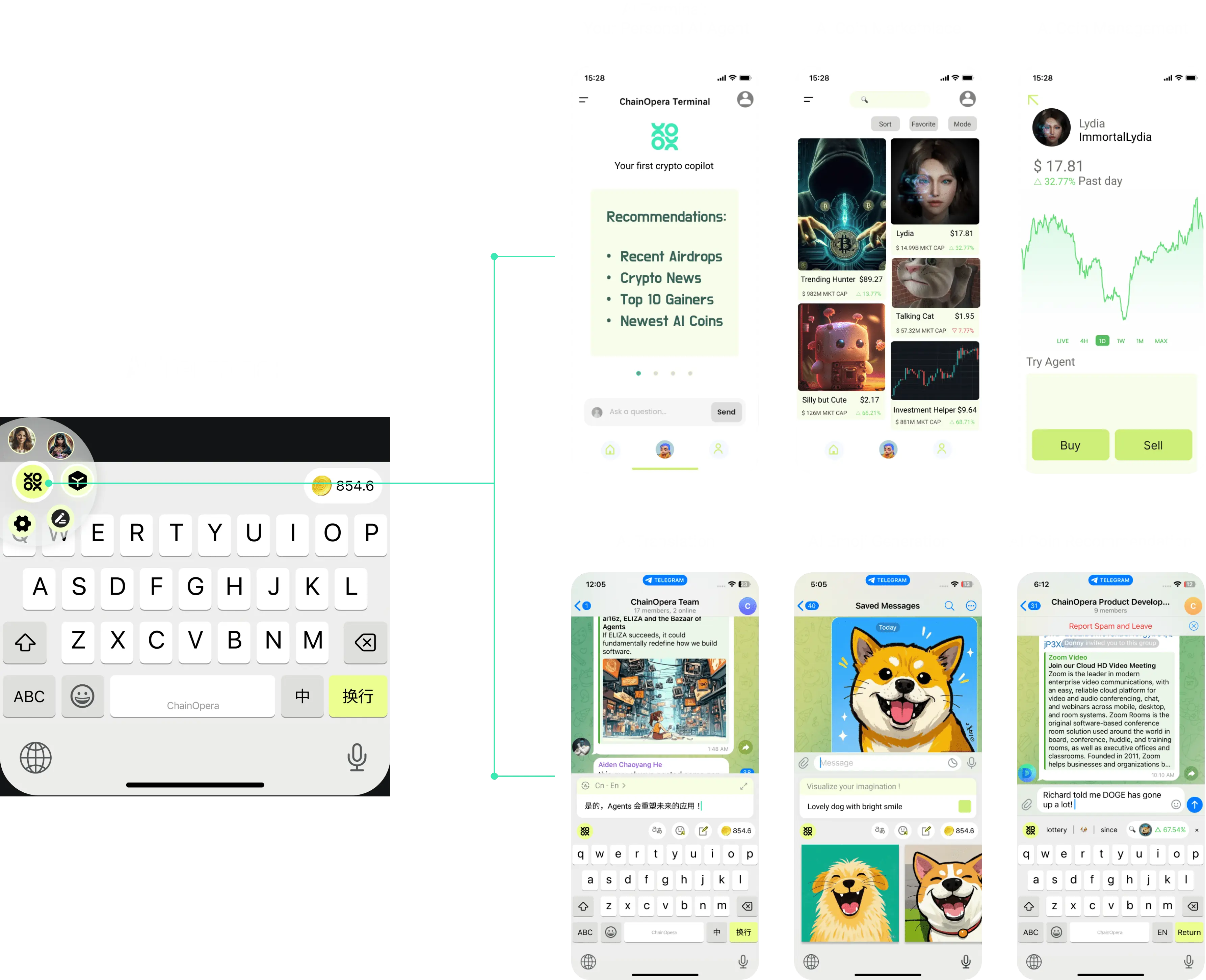

The Super App: AI Terminal App

The AI Terminal App serves as a unified interface for personalized, secure AI interactions. It combines elements of an AI social network, described as a blend of LinkedIn and Messenger for agents, where users deploy agents for specific workflows and retain data control.

Users can contribute to AI model improvements through interactions, gaining tailored experiences. As a daily tool, it manages schedules and connects across devices. The app supports real-time collaboration in finance, commerce, gaming, and other areas.

It hosts community-contributed models, such as those from DeepSeek, and accommodates millions of users. An iOS version is available, enhancing accessibility.

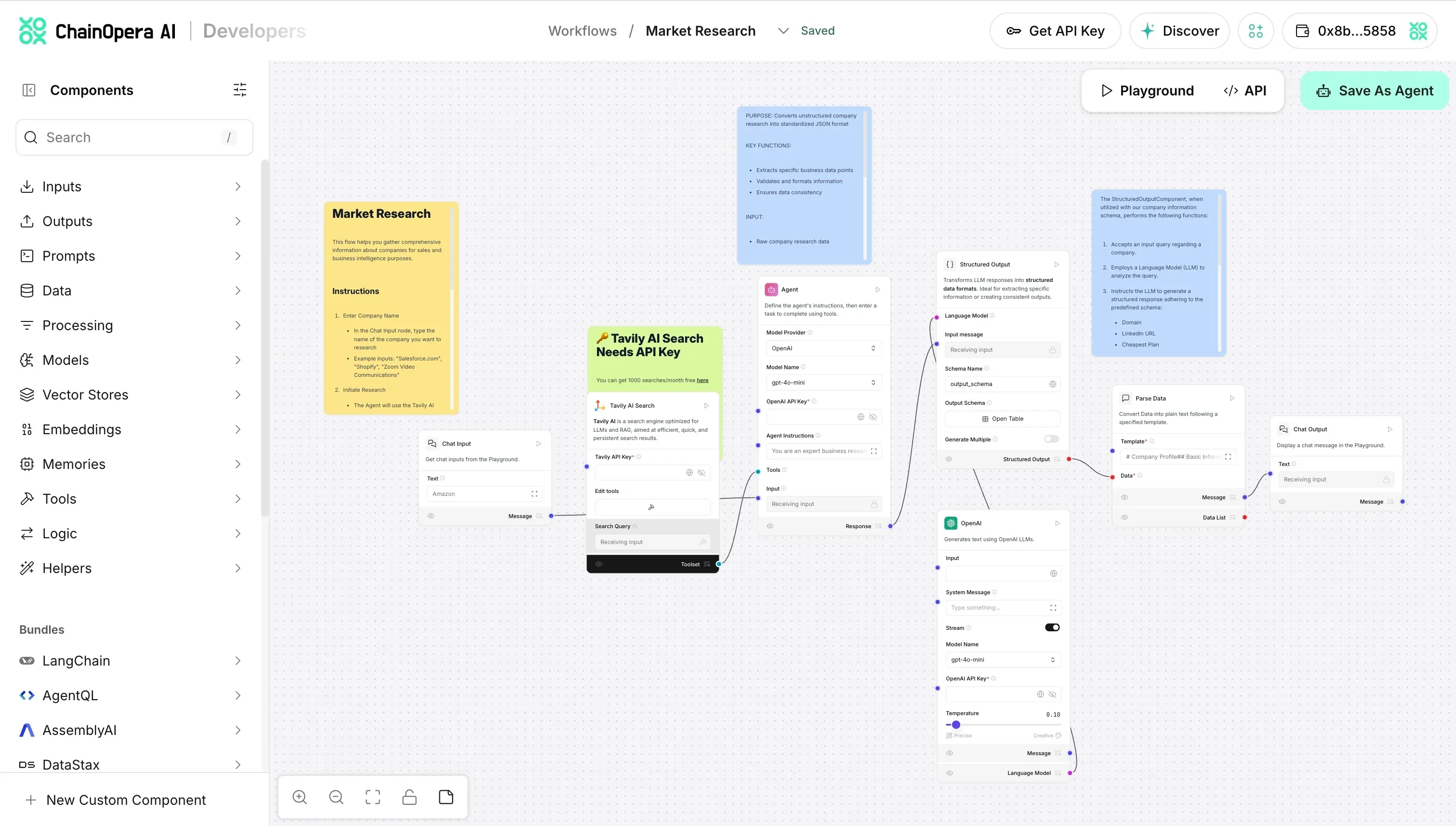

For Developers: The AI Agent Platform

The AI Agent Developer Platform provides tools for building, launching, and scaling AI agents in a decentralized environment. It caters to developers at all levels of expertise, using modular tools, open frameworks, and blockchain coordination.

The AgentOpera Multi-agent Framework integrates components such as an agent router for task routing, a multi-agent workflow planner for sequencing operations, and model APIs compatible with both open- and closed-source models. The Model Context Protocol supports tool integration, while retrieval-augmented generation and knowledge base features enhance data handling.

The A2A Protocol enables communication between agents, and AgentDevOps tools allow deployment and publication to an agent marketplace for discovery. Agents can be integrated into the Super AI App, including the AI Terminal and Agent Social Network, to deliver utility in finance, commerce, and beyond.

Software development kits are available for web and mobile applications, facilitating broader adoption.

The Model and GPU Platform Explained

ChainOpera's Model and GPU Platform supplies decentralized infrastructure for AI training and inference. It reduces dependence on centralized systems by integrating model APIs, distributed GPU compute, and a federated execution layer to support multi-agent operations.

The FedML open-source library underpins distributed training, model serving, and federated learning. FEDML Launch is a decentralized GPU scheduler for running AI jobs across geographically distributed clusters. A global CPU and GPU cluster is maintained by community members worldwide, enabling resource sharing.

As a decentralized physical infrastructure network layer, it coordinates the use of AI assets like GPUs, models, and data, ensuring fair recognition for contributors. The platform supports real-time scaling to handle high traffic volumes, with ongoing community calls to secure additional GPU contributions to meet demand.

The COAI Token

The $COAI token serves as the native utility token for the ChainOpera AI ecosystem. It functions as a medium for accessing services, rewarding contributions, and enabling participation in the decentralized AI network. The tokenomics design focuses on distribution and an unlock schedule that supports balanced growth.

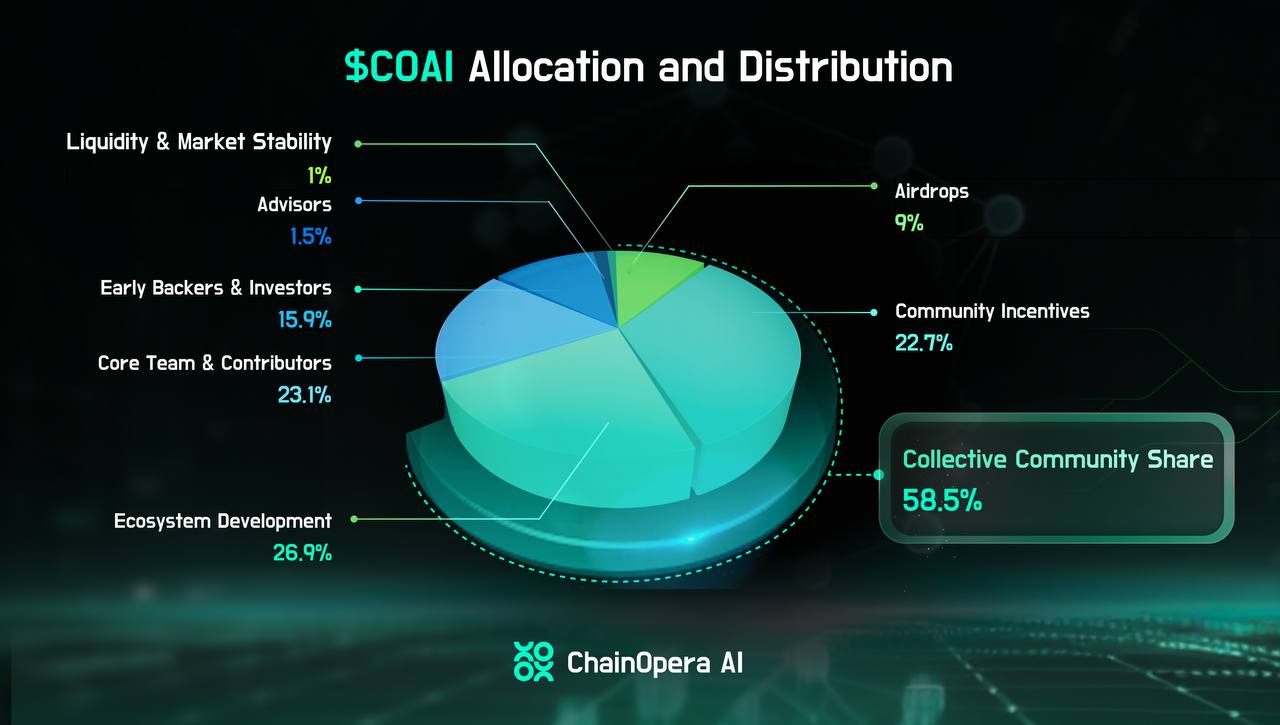

Allocation and Distribution Details

The distribution of $COAI aligns with ChainOpera's approach to shared ownership and creation. It avoids concentration of control by linking allocations to active participation, such as contributions in time, technology, or community efforts. This structure promotes collective building and transparent governance in the AI ecosystem.

A total of 58.5% of the supply goes to the collective community share. This portion aims to drive ecosystem expansion and sustained involvement through practical use.

- Ecosystem Development (26.9%): This covers support for developer and agent-builder programs, contributions from GPU, model, or data providers, hackathons, incubators, and technical initiatives. It also funds upgrades to the AI Terminal, Agent Social Network, and Developer Platform.

- Community Incentives (22.7%): These recognize AI creators for launching and refining agents, acknowledge compute or data providers, and include user engagement programs like feedback campaigns and onboarding. Community outreach efforts, such as ambassadors, meetups, and regional activities, are also supported.

- Early Distribution and Airdrops (9%): These target early contributors and community expansion via specific airdrop campaigns focused on meaningful involvement. Breakdown includes the ChainOpera Community Airdrop (first batch) at 1.5%, Binance Alpha Airdrop at 3%, and future airdrops at 4.5%.

The total supply of $COAI is capped at 1 billion tokens.

Liquidity and market stability account for 1% of the supply.

The core team and contributors receive 23.1% of the supply. This allocation is reserved for key builders and stewards, with vesting over a 1-year lock followed by linear monthly releases to align with long-term goals in decentralized intelligence.

Advisors receive 1.5%, allocated to those who offer strategic input and expertise. It follows the same vesting schedule: a 1-year lock, then monthly releases over time.

Early backers and investors hold 15.9%. This goes to partners who provided initial capital, networks, and collaborations to develop ChainOpera. They support the integration of AI and cryptocurrency for applications in decentralized finance, real-world asset tokenization, payments, and related areas.

Circulation and Unlock Schedule

The unlock schedule for $COAI balances immediate availability with extended commitments to foster ecosystem stability and contributor dedication.

At the Token Generation Event, 19.65% of the supply becomes available initially. This enables early access for developers, resource providers, and community members.

Breakdown at the event:

- Ecosystem Development: 5.45% for grants, hackathons, and partner seeding.

- Airdrops: 9% for recognizing early contributors.

- Community Incentives: 4.2% for users, developers, providers, and rewards.

- Liquidity and Market Stability: 1% for provision.

- Core Team, Backers, Investors, and Advisors: 0%, fully locked.

By the end of year one, circulation reaches about 25%. This gradual increase ties supply to actual adoption, usage, and service demand, allowing organic development without excess supply.

The core team, advisors, and early backers adhere to a 4-year vesting plan: a 1-year lockup with no releases, followed by linear monthly unlocks over 36 months at 1/36 per month. This setup encourages ongoing involvement.

Full unlocking occurs by the end of 48 months, with all tokens in circulation. The timeline aligns supply with demand across AI agents, compute, data, and participants.

Key Features of ChainOpera AI

ChainOpera includes several technical features designed for decentralization and collaboration.

Decentralized Ownership: ChainOpera enables community members to co-own and influence the AI ecosystem through a structure that distributes tokenized rewards for contributions, ensuring participants have a stake in the platform's development and operations.

Multi-Layer Stack: The platform's architecture includes application, agent, model, GPU, and AI chain layers, which together provide end-to-end decentralization by handling different aspects of AI processing and coordination in a distributed manner.

Privacy and Security Measures: To protect user information during processing, ChainOpera integrates fully homomorphic encryption for secure computations, federated learning for distributed model training without data sharing, and data dark pools for anonymized data handling.

Tokenomics: ChainOpera's tokenomics revolves around the $COAI token, used for payments, rewards, staking, and governance. Rewards are allocated based on usage metrics such as traffic and engagement, while staking mechanisms ensure service quality and accountability.

Global Agent Leaderboard: This feature recognizes high-impact contributions by ranking agents based on criteria such as utility and engagement, providing visibility and incentives for top performers within the ecosystem.

Model Integrations: The platform supports connections to both open-source and closed-source models, enabling developers to incorporate a wide range of AI resources into their agents and workflows.

Partnerships for Enhanced Capabilities: Collaborations with external entities improve specific functions, such as GPU rendering via Render Network, privacy protections through Mind Network, and model access with DeepSeek, expanding the platform's technical reach.

Resource Management Tools: Anti-Sybil mechanisms prevent identity manipulation, and rate limits control usage to maintain system stability, helping to manage resources effectively amid growing demand.

Community Surveys on Sustainability: ChainOpera conducts surveys to collect input from community members on practices related to long-term viability, incorporating feedback to refine operational and economic models.

Scalability Solutions: Through edge-cloud inference for faster local processing and distributed training for model development across networks, the platform handles high volumes of interactions without performance degradation.

Community-Driven Expansion: Elements such as calls for GPU contributions encourage members to contribute resources to the global cluster, supporting growth in computational capacity and fostering broader participation.

Use Cases and Utilities in ChainOpera

ChainOpera supports specific applications across sectors. In decentralized finance and cryptocurrency trading, AI agents automate complex workflows, deliver actionable insights, and help discover memecoins and execute token trades.

- For daily tasks, the platform provides automation for scheduling and management, serving as a companion across devices.

- The AI Agent Social Network enables real-time interactions in which agents communicate and collaborate with humans across finance, commerce, and gaming.

- Users can monetize their data by contributing to AI training datasets and earning rewards.

- Developers participate in a creator economy by building and monetizing domain-specific agents.

- GPU farming leverages decentralized rendering and computing to efficiently allocate resources.

- Agents can process on-chain events, ingesting real-time data for liquidity monitoring and smart trading decisions.

- The "type-to-earn" mechanism allows users to contribute to AI improvements through interactions and receive utility benefits in return.

These utilities extend to real-world assets, payment finance, key opinion leader engagements, and e-commerce, where agents simplify processes and enhance accessibility.

AI Capabilities Within ChainOpera

ChainOpera's AI capabilities center on collaborative intelligence, leveraging a network of specialized agents across different modalities to handle workflows.

Federated learning enables privacy-preserving model training on distributed datasets. Multi-modal support integrates models such as DeepSeek-R1 large language model and DeepSeek-Janus-Pro for text and multimodal processing.

The A2A Protocol facilitates agent-to-agent communication, allowing coordinated actions. Verifiable AI is achieved through the Proof-of-AI system, which validates compute, execution, and contributions. Scalability features handle millions of prompts daily through edge-cloud inference and distributed training.

Open-source integration relies on the FedML library for large-scale distributed training, model serving, and federated learning. The platform's multi-agent framework includes tools for routing, workflow planning, and knowledge base management.

Roadmap and Future Plans

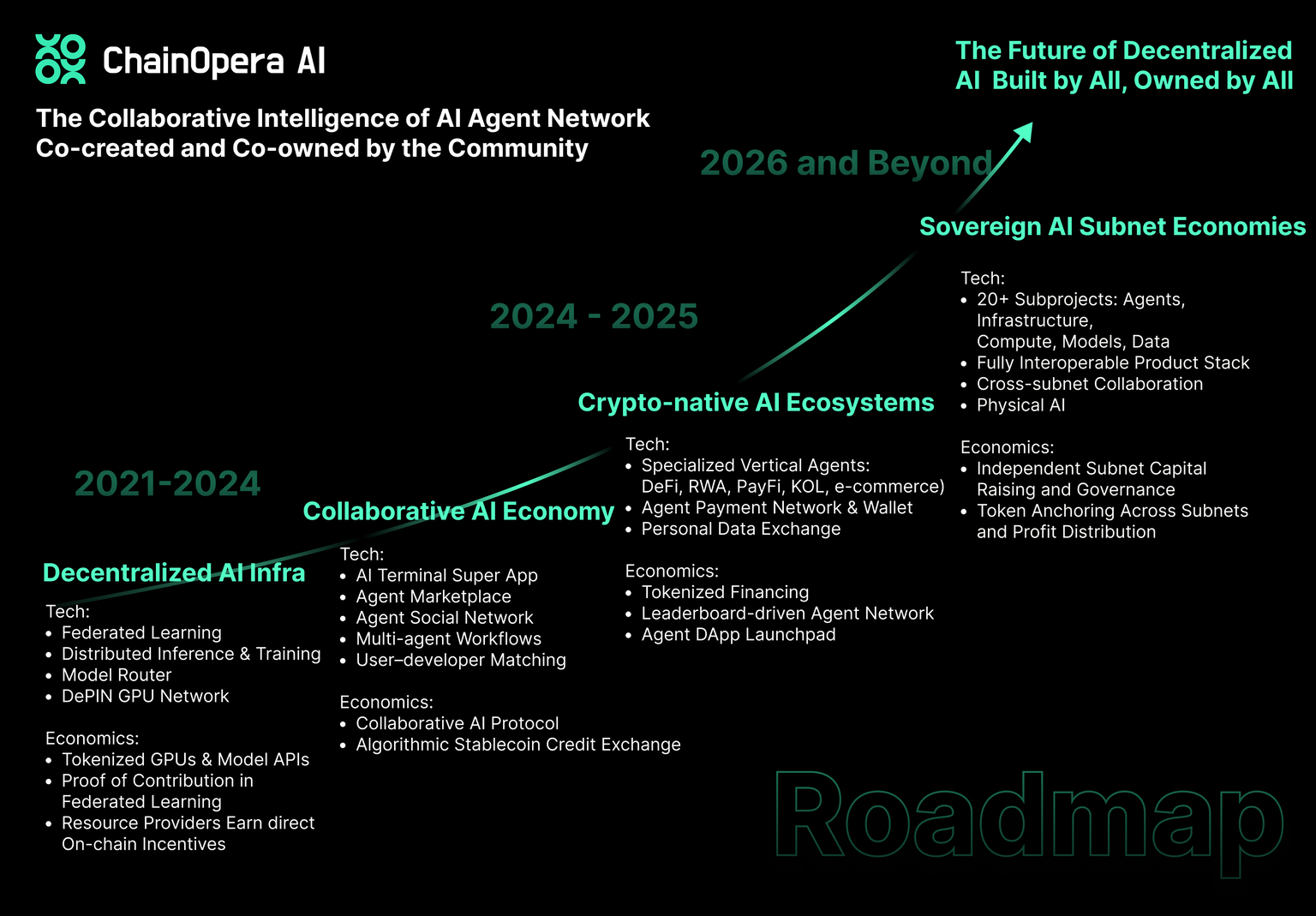

ChainOpera AI's roadmap outlines a multi-stage development path to establish a decentralized ecosystem for collaborative intelligence, integrating AI agents, models, and blockchain. The plan spans from foundational infrastructure in 2025 to advanced autonomous economies by 2026 and beyond.

It includes specific timelines, with some features marked as released and others scheduled for Q3 2025 and Q4 2025, along with long-term goals extending into Q1 2026 and beyond. The roadmap adapts based on community input, market conditions, and ecosystem changes, focusing on technical advancements and economic models to support applications in cryptocurrency and financial technology.

The roadmap is divided into four stages, each building on the previous one to decentralize AI resources, foster agent collaboration, apply the system to the crypto sector, and create self-governing subnets. Key milestones include platform launches, framework releases, and incentive systems tied to user and developer participation.

Stage 1: From Compute to Capital (2025 and Beyond)

This stage centers on decentralizing AI training and inference infrastructure, allowing community contributions of GPUs, data, and models. The goal is to create a market for these resources through technical tools and economic incentives.

Technical developments include;

- Building a decentralized physical infrastructure network for GPUs, a federated learning framework, and platforms for distributed inference and training.

A model router directs tasks based on industry, complexity, and user preferences to balance quality, efficiency, and cost.

Releases include the following:

- Decentralized Model and GPU Platform in Q1 2025 for distributed model deployment, inference, training, and job scheduling on decentralized compute.

- The Federated Learning open-source library launched in Q1 2025 for GPUs, smartphones, and IoT devices.

- Verifiable Inference Service, co-built with EigenLayer, is set for Q4 2025.

- Multi-modal AI for text, image, audio, and video, with advanced routing, begins in Q1 2026. On-chain incentives for models tie to usage and ratings from Q1 2026.

- Integration between GPU layers and user chats for job scheduling starts in Q3 2025, with performance-based incentives for providers, including staking, in Q4 2025.

- A global compute pool unifying personal and cloud GPUs with scheduling and incentives rolls out in Q1 2026.

- Community-driven decentralized large model training (beyond 100B parameters) starts in Q4 2025, with end-user deployment, compute and data contributions, and continuous online training in Q1 2026 and beyond.

Economic mechanisms involve providers earning usage-based incentives, which form the basis for decentralized AI operations. Proof of contribution in federated learning allows resource providers to earn on-chain incentives directly.

Stage 2: From Agentic Apps to a Collaborative AI Economy (2025 and Beyond)

This phase connects users, developers, and compute resources via an AI social network, where agents act as service endpoints. It emphasizes app launches, workflows, and matching systems to drive collaboration.

Product and technical milestones feature the AI Terminal Super App, AI Agent Marketplace, AI Agent Social Network, and multi-agent workflows.

- The AI Terminal App launched on iOS in Q1 2025 and web in Q2 2025.

- The Agent Marketplace, categorized by models, trading, and productivity, went live in Q2 2025. Agent Router, named Super Agent Coco, routes requests based on intent from Q2 2025.

- The AI Agent Social Network, which allows agents to be friends and to use group workflows, launched in Q2 2025.

- The Agent Developer Platform, with prompt, zero-code, API, and open-source modes, was released in Q2 2025, including Model APIs, Model Context Protocol for tools, retrieval-augmented generation, knowledge bases, AgentOpera framework, deployment, and marketplace publishing.

- Developer incentive economics and AgentOpera open-source library arrive in Q3 2025.

- Agent idea proposals and matching subsystems, with incentives, start in Q3 2025.

- Templates for trading strategies and key opinion leaders launch in Q3 2025, expanding to multi-modal in Q1 2026.

- Honor accounts with benefits like ad credits and support begin in Q3 2025.

- A credit system linking stakeholders launched in Q2 2025, with fair distribution via leaderboards in Q3 2025.

- Agent-to-agent payment networks with wallets and fee allocation begin in Q4 2025.

Economics uses the CoAI Protocol to align users, developers, and providers. A credit system and supply-demand matching handle transactions, with traders earning allocations for listing strategies as agents from Q3 2025.

Stage 3: From Collaborative AI to Crypto-Native AI Ecosystems (2025 and Beyond)

Here, the focus shifts to applying the ecosystem to crypto and fintech verticals like decentralized finance, real-world assets, payment finance, key opinion leaders, and e-commerce.

It involves specialized agents, federated training for fintech models, agent payments, and data exchanges.

- Technical progress includes incentivizing vertical agents and training large language models for fintech via federated learning.

- Ecosystem partnerships for real-world assets, on-chain exchanges, and decentralized finance run from Q3 to Q4 2025 and beyond.

- For retail traders, automated trading agents with workflows and triggers launch in Q3 2025, alongside strategy agents; AI trader twins for offline execution start in Q1 2026.

- For key opinion leaders, virtual agents for fan interactions and content creation tools arrive in Q3 2025, with proof-of-second-me protocol in Q4 2025.

- For AI users, use-to-earn incentives upgrade in Q3 2025, with multi-model scoring and data contributions in Q1 2026.

- The marketplace evolves to sell AI-generated assets in Q1 2026. AI social feeds and AI phones launch in Q1 2026, extending to physical AI like robotics.

Economic features include usage-driven allocations, leaderboards, and launchpads. Participation incentives cover workflows and annotations.

Stage 4: From Ecosystems to Autonomous AI Economies (2026 Q1 and Beyond)

The final stage establishes self-governing AI subnets that interconnect globally, offering infrastructure and tokenized exchanges.

- Technical elements involve multiple subprojects for agents, infrastructure, compute, models, and data, with interoperable stacks for subnet economies and collaborations.

- Subnetwork tokenomics modularize components into self-operating units with independent governance and mainnet token support for cross-subnet work.

- A creator community with developer hubs and homepages for building followers and sharing launches in Q1 2026.

- Future expansions include enhanced Proof-of-Intelligence protocols and physical AI applications.

Economics enable independent subnet capital raising, governance, token anchoring, and profit distribution, creating sustainable community-driven units with cross-subnet value exchange.

Conclusion

ChainOpera AI integrates decentralized AI agents, models, and blockchain to support collaborative workflows across finance and other sectors. Its ecosystem connects users, developers, and providers through tokenized rewards and verifiable processes, handling millions of interactions daily. The AI Terminal App, Agent Developer Platform, and Model and GPU Platform form the core infrastructure, backed by partnerships and community contributions. This setup demonstrates a practical approach to distributed AI, emphasizing data control and resource efficiency.

Researchers and developers may find value in exploring its open frameworks for building specialized agents, highlighting the platform's role in advancing decentralized intelligence systems.

Sources:

- Website: https://chainopera.ai/

- Whitepaper: https://paper.chainopera.ai/

- ChainOpera AI Roadmap: https://paper.chainopera.ai/roadmap-and-research/chainopera-ai-roadmap

- ChainOpera AI Ecosystem: https://medium.com/@chainopera/the-worlds-first-truly-decentralized-chatgpt-right-at-your-fingertips-community-hosted-deepseek-24f97264a16f

Read Next...

Frequently Asked Questions

What is ChainOpera AI's main focus?

ChainOpera AI focuses on creating a decentralized network of AI agents and models for collaborative intelligence, integrating with blockchain for applications in decentralized finance and e-commerce.

How does ChainOpera ensure data privacy?

ChainOpera uses fully homomorphic encryption, federated learning, and data dark pools to protect user data during AI processing and interactions.

What are the key components of ChainOpera's ecosystem?

Key components include the AI Terminal App for user interactions, the Agent Developer Platform for building agents, and the Model and GPU Platform for decentralized compute resources.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens