Litecoin in 2025: A Year of Milestones for the Digital Silver

Litecoin crosses 300 million transactions in 2025 with record 2.7 PH/s hashrate, Telegram integration, and growing ETF prospects. Complete year analysis.

Crypto Rich

July 24, 2025

Table of Contents

Litecoin achieved a historic milestone in January 2025 by processing its 300 millionth transaction. The number cements its position as the most-used cryptocurrency for real-world payments outside of stablecoins. While Bitcoin maximalists debate store-of-value narratives and Ethereum developers chase scaling solutions, Litecoin quietly built something different: a payment network that actually works.

More than just a statistic, this milestone shows how the network evolved from Bitcoin's testing ground into a standalone payment powerhouse. Since launching in 2011, Litecoin has operated without interruption. The year 2025 brought multiple records—from achieving an all-time high hashrate of 2.7 petahashes per second to expanding into major platforms like Telegram Wallet.

What Makes Litecoin Different from Bitcoin?

Litecoin differs from Bitcoin primarily through faster transaction speeds, lower fees, and enhanced accessibility. Charlie Lee, a former Google engineer, created Litecoin in October 2011 to address Bitcoin's limitations. Built as a Bitcoin fork, it tackles speed and accessibility problems that made Bitcoin less practical for everyday use.

Blocks process every 2.5 minutes compared to Bitcoin's 10-minute intervals. This enables faster transaction confirmations. The Scrypt hashing algorithm was originally designed to democratize mining. Today, it has evolved into a robust proof-of-work network secured by specialized hardware. This consensus mechanism connects Litecoin to Bitcoin's security model while maintaining distinct characteristics for different use cases.

A fixed supply of 84 million coins—four times Bitcoin's 21 million—mirrors the historical relationship between silver and gold. This tokenomics design creates scarcity while allowing greater circulation for everyday transactions. Transaction fees typically cost under $0.01. Together, these fundamentals position Litecoin as practical digital money rather than purely a store of value.

Reliability stands as the network's greatest achievement. Since 2011, Litecoin has operated continuously without downtime or security breaches. Hundreds of millions of transactions have processed while maintaining perfect uptime. Financial institutions increasingly value this track record as they seek battle-tested blockchain infrastructure for mission-critical applications.

Litecoin's ecosystem extends beyond basic payments. Key components include:

- Mining pools that secure the network through distributed hashpower

- Wallet software that manages private keys and transaction signing

- Layer-two solutions like Lightning Network that enable instant micropayments

All these components create a comprehensive financial infrastructure that reaches far beyond simple peer-to-peer transfers.

How Secure is Litecoin's Network in 2025?

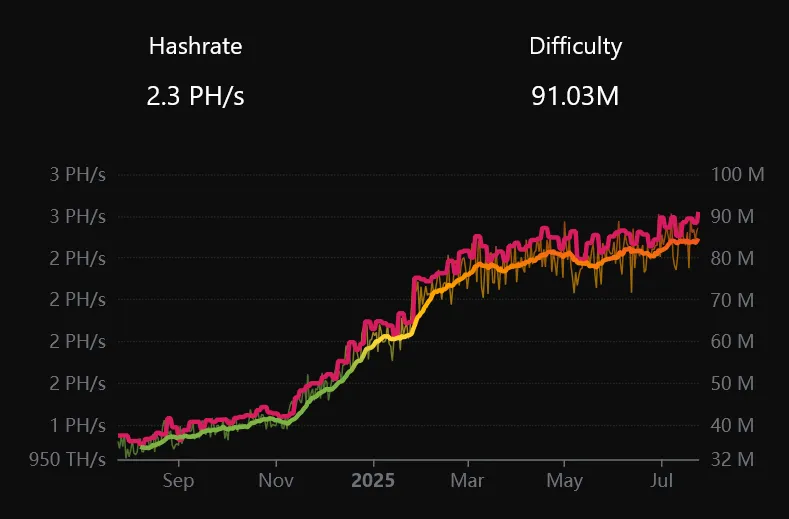

In March 2025, Litecoin's security metrics hit unprecedented levels as the network's hashrate climbed dramatically throughout the year. From approximately 1 petahash per second at the start of 2025, the hashrate has surged to 2.4 petahashes per second as of July 2025, representing a massive increase in computational power protecting the blockchain from attacks. This sustained growth reflects increasing miner confidence and demonstrates the network's evolution into enterprise-grade infrastructure.

The hashrate surge coincided with processing over 15 million transactions in the first quarter alone. Unlike many proof-of-work networks facing environmental criticism, Litecoin's Scrypt algorithm enables merge-mining with other cryptocurrencies. This maximizes security efficiency without proportional energy increases.

Security milestones carry significance beyond technical metrics. Regulators evaluating cryptocurrency ETF applications prioritize networks with proven security and decentralization. Litecoin's commodity status from the U.S. Commodity Futures Trading Commission strengthens its institutional adoption prospects when combined with this security record.

Mining Economics Support Growth

Mining economics also support long-term network health. The combination of transaction fees and block rewards creates sustainable incentives for miners, while the network's efficiency compared to Bitcoin mining makes it attractive for operators seeking profitable alternatives.

Major Platform Integrations Drive Adoption

Litecoin's expansion into mainstream platforms accelerated throughout 2025, with integrations removing friction barriers that previously limited cryptocurrency adoption.

Telegram Wallet Integration Expands Global Reach

March 24, 2025, marked a significant expansion. Litecoin integrated into Telegram's internal wallet system. This move gave millions of users across Asia and Europe seamless access to buy, sell, and transfer LTC directly within the messaging platform.

The integration tackles a key adoption barrier. It eliminates the need for separate wallet applications or complex setup processes. Users can now send Litecoin as easily as sharing a message. This opens new use cases for micro-transactions and peer-to-peer payments in regions where Telegram dominates social communication.

Early adoption metrics show increasing daily active users leveraging Litecoin for small-value transactions, particularly in markets where traditional banking infrastructure remains limited. The integration's success demonstrates how cryptocurrency adoption accelerates when friction barriers disappear.

Payment Platform Leadership

Litecoin maintains its dominant position among cryptocurrency payment processors with strong performance across major platforms:

- Top-ranked cryptocurrency for merchant payments on BitPay

- Third place ranking on CoinGate, surpassing many higher-market-cap competitors

- Steady growth in transaction volumes on Venmo and PayPal platforms

Traditional fintech platforms report building on the more than 201,000 transactions processed through one major provider in 2024. This momentum extends into 2025 as users discover Litecoin's Layer 1 blockchain advantages for remittances and cross-border transfers.

The widespread adoption of payments reflects Litecoin's practical advantages over alternatives. Faster confirmation times than Bitcoin, lower fees than Ethereum, and greater stability than most altcoins create an optimal combination for commerce applications.

Does Litecoin Offer Privacy Features?

Yes, Litecoin offers privacy features through Mimblewimble Extension Blocks (MWEB), which experienced explosive growth throughout 2025. By July 24, 2025, over 164,000 LTC were locked in MWEB addresses—a new record representing approximately $18.5 million in value at current prices of $113.04—demonstrating record adoption of Litecoin's optional privacy features.

MWEB enables confidential transactions that hide amounts and balances while preserving network auditability. Unlike privacy coins that obscure all transaction data, MWEB offers opt-in fungibility that maintains compliance with regulatory requirements while providing enhanced financial privacy.

Growing User Adoption

This privacy layer addresses a fundamental limitation of transparent blockchains. Traditional cryptocurrencies expose all transaction history, creating surveillance concerns that limit adoption for legitimate use cases. MWEB's growth indicates an increasing demand for financial privacy without compromising the benefits of blockchain transparency.

The feature's adoption also demonstrates Litecoin's role as a testing ground for Bitcoin improvements. MWEB's success could influence Bitcoin's future privacy implementations, continuing Litecoin's tradition of pioneering features later adopted by its predecessor.

Which Companies Are Adding Litecoin to Their Treasury?

The corporate treasury trend represents a significant shift in how businesses view Litecoin's dual nature as both store of value and payment medium.

Luxxfolio Holdings Pioneers LTC Treasury Strategy

In January 2025, Canadian firm Luxxfolio Holdings became the first publicly traded company to adopt Litecoin as a treasury asset. The company cited Litecoin's real-world utility and lower volatility compared to other altcoins as primary factors in their decision.

By July, Luxxfolio expanded their strategy, holding 20,084 LTC in treasury as of their July 17 update, valued at approximately $2.27 million at current prices of $113.04 per LTC. This approach positions LTC as both an inflation hedge and payment enabler, differentiating it from pure store-of-value strategies typically associated with Bitcoin treasury adoption.

The move reflects growing institutional recognition of Litecoin's hybrid characteristics. Unlike Bitcoin, which serves primarily as digital gold, Litecoin combines store-of-value properties with practical payment functionality, making it attractive for companies requiring both treasury management and operational payment capabilities.

MEI Pharma Leads U.S. Market

July brought a major milestone when U.S. biopharmaceutical firm MEI Pharma (Nasdaq: MEIP) announced a $100 million private placement dedicated to building a Litecoin treasury. The deal closed on July 22, 2025, making MEI Pharma the first Nasdaq-listed public company to adopt such a strategy. The announcement sparked a significant stock surge and contributed to LTC's price appreciation, with Litecoin trading at $113.04 as of July 24, 2025.

These early corporate adoptions establish precedent for other companies considering cryptocurrency treasury strategies. Litecoin's commodity regulatory status provides clearer compliance pathways than securities-classified cryptocurrencies, reducing legal uncertainties that prevent institutional adoption.

Litecoin ETFs Gain Approval

Three dedicated Litecoin ETF applications from Canary Capital, CoinShares US, and Grayscale have progressed significantly, with Canary Capital launching the first U.S. spot Litecoin ETF (LTCC) on October 28, 2025, following SEC approvals enabled by generic listing standards despite a government shutdown in October.

Grayscale's Litecoin Trust (LTCN) is now publicly traded as a fund, with a market price of $7.18 as of November 3, 2025, while CoinShares' application faced delays but aligns with the wave of altcoin ETF debuts in late October.

The SEC's July 2025 guidance on cryptocurrency ETF regulations, combined with mid-September approvals for broader exchange listing rules, facilitated these launches, contributing to Litecoin's price rebound above $100 amid growing institutional traction and corporate treasury adoptions.

Hashdex expanded its Nasdaq Crypto Index US ETF (NCIQ) in September 2025 to include additional assets like XRP, Solana, Stellar, and Cardano alongside Bitcoin and Ethereum, providing diversified exposure for investors, though Litecoin was not part of this update despite earlier proposals.

This basket approach continues to offer alternatives beyond Bitcoin and Ethereum, with potential future inclusions. Litecoin's regulatory advantages supported these ETF approvals. The Commodity Futures Trading Commission's commodity classification removes securities law complications that affect many other cryptocurrencies. This clear regulatory status, combined with its extensive operational history, addressed key concerns regulators typically raise about cryptocurrency ETF applications.

Discussions about a U.S. strategic cryptocurrency reserve, established via executive order in March 2025 as the Strategic Bitcoin Reserve and U.S. Digital Asset Stockpile, have considered Litecoin alongside Bitcoin, recognizing the historical gold-silver monetary relationship.

Litecoin Summit 2025 Showcases Community Strength

The fifth annual Litecoin Summit, held May 29-30 at Harrah's in Las Vegas, brought together industry leaders, developers, and community members for intensive discussions about Litecoin's future development.

Key presentations focused on MWEB adoption growth and upcoming interoperability projects like LitVM, a zero-knowledge omnichain initiative designed to enhance Litecoin's compatibility with Ethereum and other blockchain ecosystems. These technical developments address criticisms about Litecoin's innovation pace while maintaining its core reliability principles.

Technical Roadmap Highlights

The summit highlighted Litecoin's unique position as a testing ground for Bitcoin improvements. Historical examples include Segregated Witness (SegWit) and Lightning Network compatibility, both implemented on Litecoin before Bitcoin adoption. This relationship continues to provide value for both networks while establishing Litecoin's technical contributions to the broader cryptocurrency ecosystem.

Community engagement metrics show steady growth, with Litecoin's X following exceeding 1.2 million by July 2025. Developer activity continues to expand, with active GitHub repositories, and new wallet implementations adding MWEB support, while core protocol improvements maintain network efficiency.

Technical Achievements Define 2025 Performance

Beyond headline metrics, Litecoin's technical performance throughout 2025 demonstrates the network's maturation into enterprise-grade infrastructure.

Transaction Volume Breaks Records

The first ten weeks of 2025 saw Litecoin process 14 million transactions, establishing a pace that could shatter previous annual records. This volume reflects genuine utility rather than speculative trading, as transaction patterns indicate regular use for payments, remittances, and commerce applications. Amid July's corporate treasury announcements, LTC experienced significant price appreciation, reaching $113.04 on July 24, 2025.

Daily transaction counts consistently reach thousands, while 24-hour trading volumes frequently exceed billions in value. These metrics demonstrate sustained network activity that supports long-term value propositions beyond speculative price movements.

Zero Downtime Record Continues

Litecoin's flawless operational record has been maintained throughout 2025, ensuring continuous service throughout its entire existence. This reliability becomes increasingly valuable as financial institutions evaluate blockchain infrastructure for critical applications.

The achievement becomes more impressive considering the complex technical challenges blockchain networks face. Protocol upgrades, mining pool changes, and external attacks have disrupted many competitors, while Litecoin's conservative development approach has preserved operational continuity.

Can Litecoin Compete with Newer Cryptocurrencies?

Yes, Litecoin can compete effectively with newer blockchain platforms, though it faces ongoing criticism about innovation pace and competition from projects offering faster transaction speeds or more advanced features. Solana, Polygon, and other networks market superior technical specifications, questioning Litecoin's relevance in a rapidly evolving landscape.

However, Litecoin's defenders emphasize organic growth over venture capital-driven development. The absence of token dumping by early investors and paid promotional campaigns creates more sustainable adoption patterns. Charlie Lee's 2017 decision to sell his personal holdings, often mischaracterized as abandonment, was explicitly designed to avoid conflicts of interest while he continued promoting the project.

The network's proof-of-work consensus mechanism, while energy-intensive, provides security guarantees that newer consensus mechanisms have yet to prove over extended periods. For institutions prioritizing battle-tested infrastructure over cutting-edge features, Litecoin's conservative approach offers advantages.

Market positioning also benefits from realistic expectations. Unlike projects promising revolutionary changes or unlimited scalability, Litecoin focuses on incremental improvements to established functionality. This approach may appear less exciting but creates more predictable development outcomes.

Looking Forward: Second Half 2025 Prospects

The remainder of 2025 holds significant potential for Litecoin across multiple development areas.

Key Development Areas

Several major initiatives could reshape Litecoin's landscape:

- Pending ETF approvals that could dramatically expand institutional accessibility

- Continued MWEB adoption acceleration as users discover privacy benefits

- Technical developments like LitVM expanding its utility into decentralized finance applications

Traditional investors currently face significant barriers accessing cryptocurrency markets, and regulated investment products could unlock massive capital flows. The optional nature of privacy features allows compliance with varying international regulations while providing enhanced fungibility for users who require it.

Corporate treasury adoption remains in its early stages, with additional companies likely to evaluate Litecoin's risk-return profile. The combination of store-of-value properties and payment functionality offers unique advantages for businesses requiring both treasury management and operational payment solutions.

Conclusion

Litecoin's 2025 performance demonstrates that utility and reliability remain valuable in a market often dominated by speculation and hype. The network's 300 million transaction milestone, record hashrate achievements, and expanding institutional adoption reflect organic growth built on proven infrastructure rather than promotional campaigns.

As digital silver to Bitcoin's digital gold, Litecoin has found its niche serving practical payment needs while maintaining store-of-value characteristics. The network's conservative development approach delivers predictable improvements to established functionality rather than revolutionary promises.

For a cryptocurrency that has survived multiple bear markets, regulatory uncertainty, and technological competition, 2025 represents validation of a different approach to blockchain development—one that prioritizes utility over speculation and reliability over innovation theater.

Visit the official Litecoin website for more information and follow @litecoin on X to stay updated on the latest developments.

Sources:

- Litecoin Official Announcements and Monthly Updates (2025)

- Reuters US SEC's guidance is first step toward rules governing crypto ETFs

- U.S. Commodity Futures Trading Commission Regulatory Classifications and Updates

- Luxxfolio News - Litecoin holdings

- TheBlock News - Canary Capital Litecoin ETF

Read Next...

Frequently Asked Questions

What makes Litecoin different from other cryptocurrencies in 2025?

Litecoin combines flawless operational history with practical features like 2.5-minute block times and sub-penny transaction fees. Its optional privacy through MWEB and regulatory clarity as a commodity create unique advantages for both individual users and institutions.

How significant is Litecoin reaching 300 million transactions?

This milestone demonstrates genuine utility beyond speculative trading. The volume represents real-world usage for payments, remittances, and commerce, establishing Litecoin as the most-used cryptocurrency for practical applications outside of stablecoins.

What are Litecoin's prospects for ETF approval in 2025?

Three dedicated Litecoin ETFs await SEC approval with strong market confidence for approval by December. The network's commodity status and operational track record address key regulatory concerns that typically complicate cryptocurrency ETF applications.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events