Brazil Leads Latin America's Crypto Surge in 2025

Brazil $318.8B crypto volume from 2024-2025, ranking 5th globally. Analysis of regulations, adoption rates, and institutional growth in LATAM's crypto leader.

Crypto Rich

December 1, 2025

Table of Contents

Brazil isn't just participating in the crypto economy. It's leading Latin America's charge.

The country saw $318.8 billion in cryptocurrency transactions between July 2024 and June 2025, nearly one-third of regional activity and a 109.9% jump from the previous year. Globally, Brazil now ranks 5th in Chainalysis' 2025 Crypto Adoption Index, up from 10th place just twelve months earlier.

But the numbers only hint at what's happening on the ground. In São Paulo coffee shops, workers split bills using dollar-pegged stablecoins. In rural villages, farmers receive international payments through crypto wallets linked to Pix, Brazil's instant payment system. At Blockchain Rio 2025, thousands gathered to discuss not whether crypto will reshape Brazilian finance, but how fast.

What sets Brazil apart is the overlap: grassroots adoption, regulatory clarity, and institutional money all arriving at once. Few emerging markets have built a crypto infrastructure that serves both Wall Street funds and unbanked populations simultaneously.

Why Are Brazilians Adopting Crypto?

Brazilians aren't buying crypto to get rich. They're buying it to protect what they have.

The Real has been volatile for years, pushing citizens toward dollar-denominated assets. Neighboring Argentina's even steeper inflation has pushed the entire region toward dollar alternatives, but Brazil's larger economy and better infrastructure made it the natural hub.

Stablecoins now account for 90% of crypto transactions in the country. People use them to hedge against currency swings, send money abroad, and pay for everyday purchases.

Ownership estimates range from 12% to 21% of the population, or around 32 million people. Men aged 18-49 lead at 25% adoption. Women over 50 make up 9%, above the global average of 6.8% for that demographic.

With 88% internet penetration, most Brazilians can access crypto as easily as mobile banking. But the real story isn't in the cities.

Rural Adoption Outpaces Urban Centers

São Paulo, the financial capital, shows just 8.7% crypto adoption. Rural areas run higher. Farmers use stablecoins to receive export payments, pay suppliers, and store value outside the shaky Real.

Pix makes this possible. The Central Bank launched the instant payment system in 2020, and crypto platforms quickly connected to it. Moving between crypto and traditional currency now takes seconds, not days.

The conversations on social media reflect this practical bent. Brazilian users swap tips on dollar savings strategies and debate tax rules. Speculation takes a back seat to utility.

What Regulations Govern Brazil's Crypto Market?

Brazil started building its crypto legal framework in 2022 and hasn't stopped since. The result is one of Latin America's most detailed regulatory structures.

Law 14,478/2022, the Virtual Assets Law, laid the foundation. It defined cryptocurrencies as assets, placed them under Central Bank oversight, and set baseline requirements for exchanges and service providers.

Law 14,754/2023 went further, extending securities regulation to virtual assets. Tokenized securities and investment products now have clearer guidelines.

November 2025 Reforms Tighten Requirements

In November 2025, the Central Bank raised the bar. New rules taking effect in February 2026 include:

- R$10.8 million to R$37.2 million in capital requirements, depending on activity

- Stablecoin reserve verification requirements

- Stricter anti-money laundering standards

- Consumer protection mandates for retail platforms

The resolutions also classify stablecoin trades as foreign exchange operations, potentially triggering IOF taxes. Rates remain under discussion. This could favor established players like Mercado Bitcoin while raising barriers for smaller exchanges.

DeCripto, the new transaction reporting system, was formalized through IN 2.291/2025 in November 2025. Mandatory monthly reporting begins July 2026, aligning Brazil with the OECD's Crypto-Asset Reporting Framework (CARF).

Not everyone is happy. Privacy advocates on social media call peer-to-peer technology a "defense for freedom" and warn that surveillance undermines crypto's core purpose. Industry players argue the opposite: clear rules bring institutional money and legitimacy.

Pro-Crypto Political Momentum

Politicians are paying attention. Deputy Jorge Seif has proposed Bitcoin reserves for the national treasury. Other lawmakers want to eliminate capital gains taxes on certain crypto transactions.

Brazil's rules are stricter than some countries, but that's the point. Institutions need legal certainty before writing checks.

Which Companies Lead Brazil's Crypto Ecosystem?

Homegrown platforms and global giants compete for the Brazilian market. The result benefits users and pushes innovation.

Mercado Bitcoin Dominates Locally

Mercado Bitcoin is Latin America's largest crypto platform. Its 4.2 million users can access over 650 digital assets. The exchange also leads Brazil in Real-World Asset tokenization and ranks 5th globally in that category.

Corporate clients are growing fast. Small and medium businesses now hold 10-15% of assets on the platform, using it for treasury management and cross-border payments.

Global Institutions Enter the Market

International players see opportunity. BlackRock's Bitcoin ETF, IBIT, has drawn significant institutional interest, and the Brazilian-listed version, IBIT39, pulls capital from across Latin America.

Traditional banks want in too. Itau BBA, the investment arm of Brazil's largest bank, led a $210 million financing round for OranjeBTC, the region's first dedicated Bitcoin financial company. Backers include the Winklevoss twins, Blockstream CEO Adam Back, and Mexican billionaire Ricardo Salinas.

Tokenized Assets Growing Fast

Brazil's tokenized asset market is estimated at over $4 billion, though figures vary depending on how broadly RWAs are defined. Bonds, receivables, and real estate all trade as tokens.

Embedded finance is reshaping how people access crypto worldwide. The concept is simple: banks and fintechs integrate crypto directly into their existing apps, so customers can buy, hold, and spend digital assets without switching platforms. Deutsche Bank and De Nederlandsche Bank have both published research on the trend. In Brazil, Nubank, Itau, and Mercado Pago already offer this integration. The sector reached $14.16 billion locally in 2025, and global projections run into the trillions by 2030.

Brazil captures 62% of Latin American crypto (social)media traffic. People here aren't just using crypto. They're talking about it.

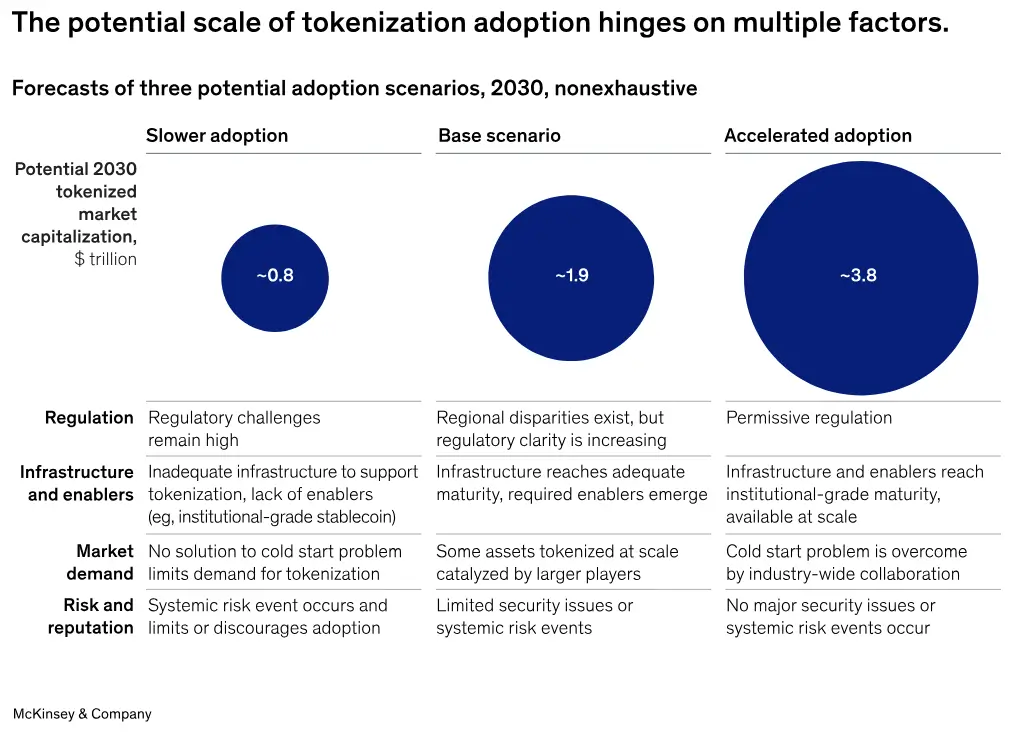

Tokenization Growth Projections

Global tokenization could hit $2 trillion to $16 trillion by 2030. That's a wide range, but even the low end represents massive growth. Brazil's regulatory head start positions it to grab a meaningful share.

Some forecasts even project up to $30 trillion in tokenized assets globally by 2030, with Brazil as Latin America's primary hub.

What Events Shape Brazil's Crypto Community?

Conferences have become proving grounds for Brazil's crypto ambitions.

Blockchain Rio 2025 Sets Regional Records

Blockchain Rio 2025 ran August 6-7 in Rio de Janeiro. The event drew startups, established institutions, and regulators for two days of panels and dealmaking.

Sessions covered:

- Stablecoin regulation and reserves

- Real-world asset tokenization

- Ethereum scaling for Brazilian use cases

- Compliance strategies for exchanges

The event drew developers and entrepreneurs from across Latin America.

São Paulo Emerges as Web3 Hub

BlockConfBR took over São Paulo in November 2025. Despite the city's lower retail adoption, it's becoming a magnet for blockchain startups and technical talent. The conference reinforced São Paulo's position as Brazil's Web3 capital.

What Does the Future Hold for Brazil's Crypto Market?

The pieces are in place for continued growth. Central bank projects, international partnerships, and political momentum all point in the same direction.

DREX CBDC Faces Setbacks

Brazil's central bank digital currency, DREX, has hit roadblocks. The pilot faced technical issues through 2025, with reports in November suggesting the platform was shut down in favor of stablecoin integration. A full rollout remains uncertain.

Bitcoin Reserve Proposals Gain Traction

Sovereign Bitcoin reserves remain a live debate. Other countries are having the same conversation, giving Brazilian lawmakers precedent to cite. Adoption would signal a fundamental shift in how the government views digital assets.

Risks persist. Scams, user education gaps, and volatility still demand attention. Regulators everywhere face the same balancing act: encourage innovation without abandoning consumer protection.

Conclusion

Brazil built Latin America's most developed crypto ecosystem through steady infrastructure work, not hype. Regulation from 2022 through November 2025 provides the legal foundation. DeCripto adds enforcement teeth.

The ecosystem now spans both ends of the market. Rural communities hedge currency risk with stablecoins. BlackRock products trade on Brazilian exchanges. Mercado Bitcoin connects millions to hundreds of assets while banks like Itau BBA fund Bitcoin ventures.

Blockchain Rio annually links these communities. The BRICS partnerships extend Brazil's reach beyond the region. Tokenization positions the country for the next phase of digital asset growth.

Sources

- Chainalysis 2025 Global Crypto Adoption Index - Methodology and country rankings

- Central Bank of Brazil - Regulatory resolutions

- Mercado Bitcoin - Platform statistics and RWA tokenization data

- Blockchain Rio - Event coverage and session archives

- TRM Labs - Latin America crypto transaction analysis

- Forbes Brasil - DeCripto regulation and reporting requirements

- McKinsey - “From ripples to waves: The transformational power of tokenizing assets”

Read Next...

Frequently Asked Questions

What percentage of Brazilians own cryptocurrency?

Estimates range from 12% to 21%, roughly 32 million people. Younger men lead adoption, but women over 50 outpace global averages for their demographic.

What laws regulate crypto in Brazil?

The Virtual Assets Law (14,478/2022) placed crypto under Central Bank oversight. November 2025 rules require R$10.8-37.2 million in capital for exchanges, effective February 2026.

Which is Brazil's largest crypto exchange?

Mercado Bitcoin, with 4.2 million users and 650+ assets. It also leads Latin America in tokenizing real-world assets.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events