Why Bitcoin Dual-Staking Is the Future — And the Key to Scaling Across Chains

Discover b14g's dual-staking model and why it matters for the future of BTC.

BSCN

May 1, 2025

Table of Contents

In crypto, security is everything.

We’ve seen it happen over and over again: a blockchain protocol is only as strong as the assets backing it. That’s why more and more projects are turning to established networks like Ethereum and Bitcoin, borrowing their economic security rather than trying to build it from scratch.

Platforms like EigenLayer and Babylon have proven this model works — securing $10 billion and $5 billion respectively.

But beneath those big numbers is a challenge no one talks about — one that could quietly undermine the protocols relying on them.

Here’s why dual-staking matters — and how it could be the key to scaling Bitcoin staking across chains.

The Hidden Problem With (Re)Staking Today

The idea behind restaking is simple: protocols use large, trusted assets like ETH or BTC to secure smaller or newer networks. EigenLayer on Ethereum and Babylon on Bitcoin follow this model, allowing protocols to “borrow” security from ETH or BTC stakers.

On the surface, it’s a practical solution. Protocols can tap into existing capital, avoid building a validator network from scratch, and gain economic security quickly.

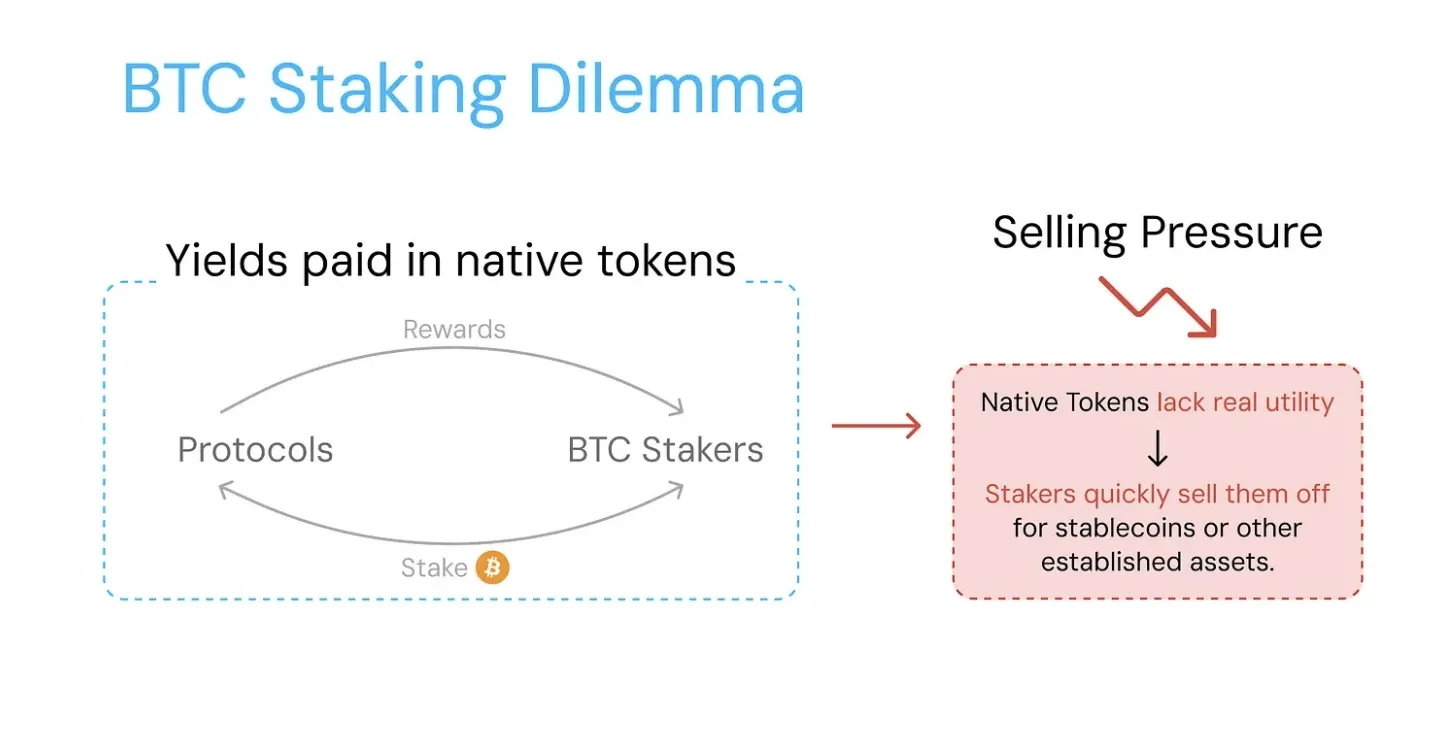

But this model comes with a trade-off: protocols must pay ETH or BTC stakers using their own native token.

While this might work initially, over time it creates a dangerous cycle. Every token printed to pay stakers ends up on the market. That creates constant selling pressure. As more tokens hit exchanges, the price declines.

In effect, protocols secure themselves in the short term by borrowing against their token’s future value. This approach risks undermining the token’s role and sustainability over time.

Bitcoin Dual-Staking: A Different Approach

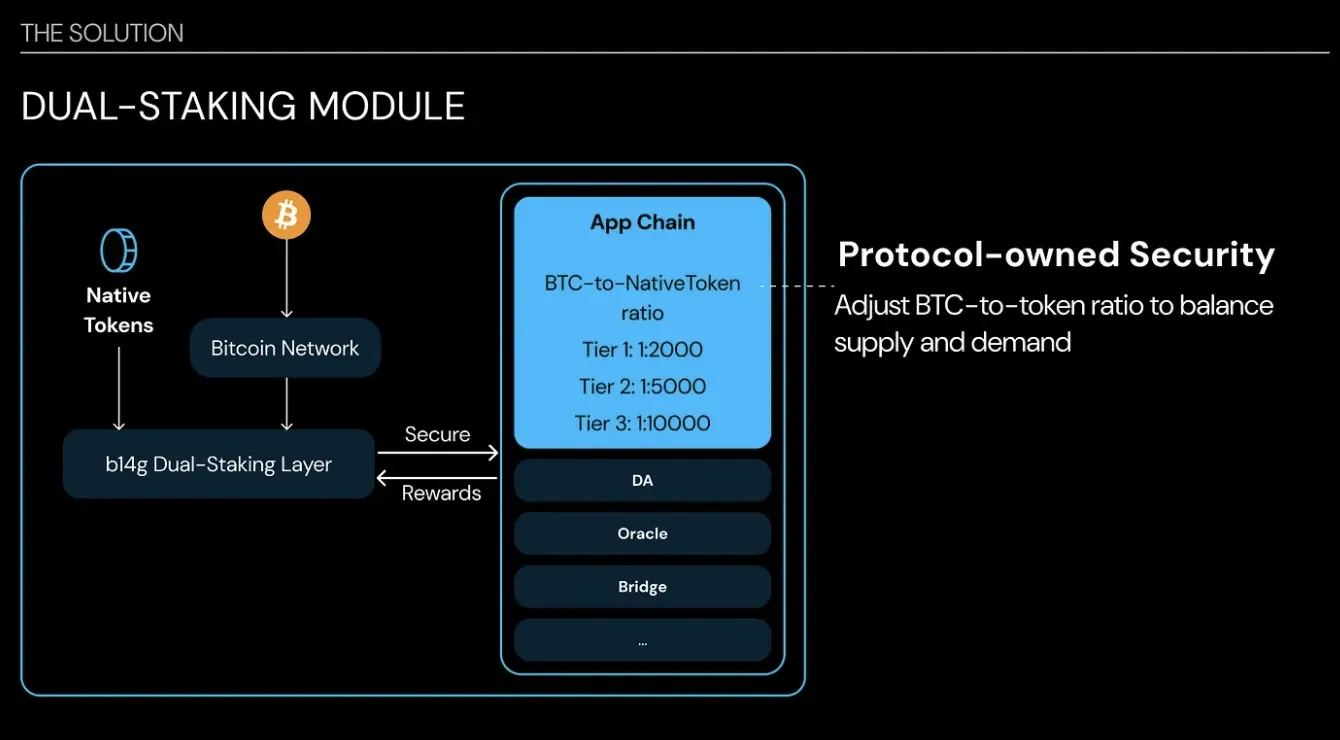

Dual-staking offers an alternative by requiring users to stake both BTC and the protocol’s native token together to secure the network. This small shift changes the incentive structure in meaningful ways.

First, the native token becomes a necessary part of network security, not just an incentive or speculative asset. If users want to participate in staking, they need to hold and stake the token. This creates a form of demand tied directly to the network’s functioning.

Second, fewer tokens are emitted or circulating because tokens are locked for staking rather than continually distributed as rewards. This reduces sell pressure and aligns the token’s role with the network’s security model.

This approach has parallels in other ecosystems. EigenLayer uses ETH and EIGEN tokens; Babylon plans to use BTC and BABY tokens; CoreDAO combines BTC and CORE tokens. These models show that dual-staking is already being implemented in practice.

What’s unique about b14g’s approach is its focus on building dual-staking as a modular layer — something protocols can integrate without having to design it from scratch.

Why Bitcoin Dual-Staking Scales Better

Scaling any staking system comes down to one thing: trust.

With b14g’s dual-staking model, there’s no bridging, no wrapping, no slashing of BTC. Your Bitcoin is time-locked non-custodially in your own wallet.

This matters because Bitcoin holders, especially large ones, prioritize one thing above all: don’t risk my Bitcoin. By removing the biggest fear, you unlock broader participation. And more participation drives scale.

At the same time, protocols benefit from a b14g’s flexible, modular framework. Want to adjust the BTC-to-token ratio? You can. Want to set custom yield tiers? You can. Want to align staking incentives with your protocol’s unique goals? You can. It’s flexible by design, meaning any chain, protocols can plug in.

Final Thoughts: The Road Ahead

Today, only 0.29% of Bitcoin is staked. For comparison, over 28% of Ethereum is staked. If Bitcoin staking adoption even approaches Ethereum’s levels, we’re looking at a $500 billion opportunity waiting to be unlocked.

Dual-staking is the key to tapping into that opportunity — safely and sustainably. It keeps BTC non-custodial and secure. It gives native tokens a meaningful, lasting role. It offers a scalable path for protocols to leverage Bitcoin’s security without sacrificing their token’s value.

For builders, it’s a chance to integrate proven security without inflating away their token’s worth. For BTC holders, it’s a way to earn yield without giving up custody or taking unnecessary risks.

It’s a win-win. The future of Bitcoin staking isn’t just staking. It’s dual-staking. And it’s coming to a chain near you.

To stay up to date with b14g's latest updates and announcements, visit the project's official blog and website.

Read Next...

Disclaimer

This press release was provided by a third party and does not necessarily represent the views of BSCN. BSCN will not be held responsible for the information contained within this press release, nor for any losses or damages incurred by decisions made based on the information within this press release. If you would like to contact us, please send an email to [email protected].

Author

BSCN

BSCNBSCN's dedicated writing team brings over 41 years of combined experience in cryptocurrency research and analysis. Our writers hold diverse academic qualifications spanning Physics, Mathematics, and Philosophy from leading institutions including Oxford and Cambridge. While united by their passion for cryptocurrency and blockchain technology, the team's professional backgrounds are equally diverse, including former venture capital investors, startup founders, and active traders.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens