Avalanche Joins The ETF Race: What We Know

Avalanche has been making strides in tokenization and financial services, with JPMorgan and Mastercard actively exploring its potential.

Soumen Datta

March 12, 2025

Table of Contents

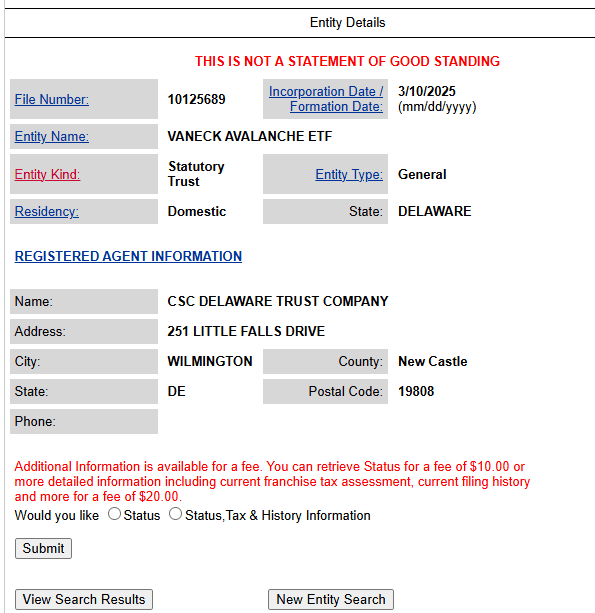

Investment firm, VanEck, filed for an Avalanche ETF with the U.S. Securities and Exchange Commission (SEC). This filing, made under the reference number 10125689, signals the firm's growing confidence in Avalanche's potential.

The filing was made in Delaware, where VanEck has previously registered other crypto ETFs. This marks the fourth standalone crypto asset ETF registration by the firm, following its filings for Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) ETFs.

The Avalanche Advantage: Why VanEck is Betting on AVAX

Avalanche, launched in 2020 by Emin Gün Sirer’s Ava Labs, is a multichain smart contract platform designed to rival Ethereum. Its goal is to offer a more scalable and efficient alternative to Ethereum’s infrastructure, which has often been criticized for its high transaction fees and slower processing speeds.

The Avalanche network is gaining traction, thanks to its ability to process thousands of transactions per second, a critical factor for scalability. It’s also one of the most flexible blockchain platforms available, allowing developers to create custom blockchains tailored to their specific needs.

At the heart of Avalanche’s ecosystem is its native token, AVAX. Though AVAX is no longer among the top 10 cryptocurrencies by market capitalization, it remains one of the top 20 assets, with a market cap of $7.1 billion. The token reached its peak market value in 2021 when it climbed into the top 10, and despite a 55% drop in price year-to-date (as of 2025), it has continued to show potential for long-term growth.

Avalanche’s Growing Institutional Adoption

The growing interest in Avalanche, especially from institutional players, is another reason why VanEck is pursuing this ETF. The Avalanche network has established partnerships with major financial institutions such as JPMorgan and Mastercard. These partnerships focus on advancing tokenization, portfolio management, and other financial services that leverage Avalanche’s blockchain.

JPMorgan, for instance, has been working to integrate its Onyx platform with a permissioned Avalanche Evergreen Subnet. These subnets are customizable blockchains designed for institutional use, offering features such as EVM compatibility, network privacy, and customizable gas structures. These subnets provide the necessary flexibility and privacy for large-scale financial applications, making them highly attractive to traditional financial players

VanEck’s Expanding Crypto ETF Lineup

VanEck’s filing for an Avalanche ETF follows its decision earlier this year to file for a Solana ETF. This comes after a change in regulatory sentiment under the new SEC leadership, led by Donald Trump’s appointee. The shift has allowed asset managers like VanEck to take bolder steps in filing for ETFs that offer direct exposure to cryptocurrencies like Bitcoin, Ether, and now Avalanche.

VanEck is well-known in the crypto ETF market, having been one of the first firms to file for a futures-based Bitcoin ETF in 2017. This experience has given the firm an edge as it continues to diversify its portfolio with more crypto-focused products. For example, after launching the Bitcoin ETF and Ethereum ETF, the firm extended its offerings to include Solana, and now, Avalanche.

The Importance of VanEck’s Avalanche ETF Filing

The registration of an Avalanche ETF is significant not only because it marks another entry for VanEck into the competitive crypto ETF market but also because it opens the door for broader institutional adoption of Avalanche. If approved, this ETF could help institutional investors gain exposure to AVAX without having to directly purchase or manage the tokens themselves.

It also provides a pathway for individuals who are interested in AVAX but may be hesitant to engage with cryptocurrency exchanges or wallets. ETFs have become an attractive option for traditional investors looking to gain exposure to the crypto market while mitigating the complexities and risks associated with direct crypto holdings.

In addition to VanEck, rival firms like Grayscale are also taking steps to register crypto-focused ETFs. For example, Grayscale recently filed with the SEC to convert its multi-coin fund, which includes AVAX among other assets, into an ETF. This move could further fuel competition among ETF providers and accelerate the growth of the crypto ETF sector.

For Avalanche, the potential ETF could provide a much-needed boost to the asset, especially as the market has faced challenges in 2025. The cryptocurrency market is experiencing a significant downturn, with major assets like Bitcoin and Ether down 17% and 55% year-to-date, respectively.

Challenges and Risks Ahead

However, there are still challenges that need to be addressed before the Avalanche ETF can become a reality. Regulatory scrutiny from the SEC remains a significant hurdle. Although the SEC has become more favorable toward crypto-related filings under the current administration, approval is never guaranteed. The SEC has yet to approve a spot Solana ETF, despite multiple filings from major firms, and the process for other assets may take time.

Another challenge for Avalanche, and for crypto ETFs in general, is the volatile nature of the market. With Avalanche’s price down by more than half this year, potential investors may be wary of committing to a product tied to an asset that can experience such sharp declines.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events