Cathie Wood Invests in World's Largest Non-US $ETH DAT: Japan’s Quantum Solutions

Tokyo-based Quantum Solutions secures its position as the leading non-US Ethereum Digital Asset Treasury and has USD 180m in Additional Funds to Acquire More ETH

BSCN

October 24, 2025

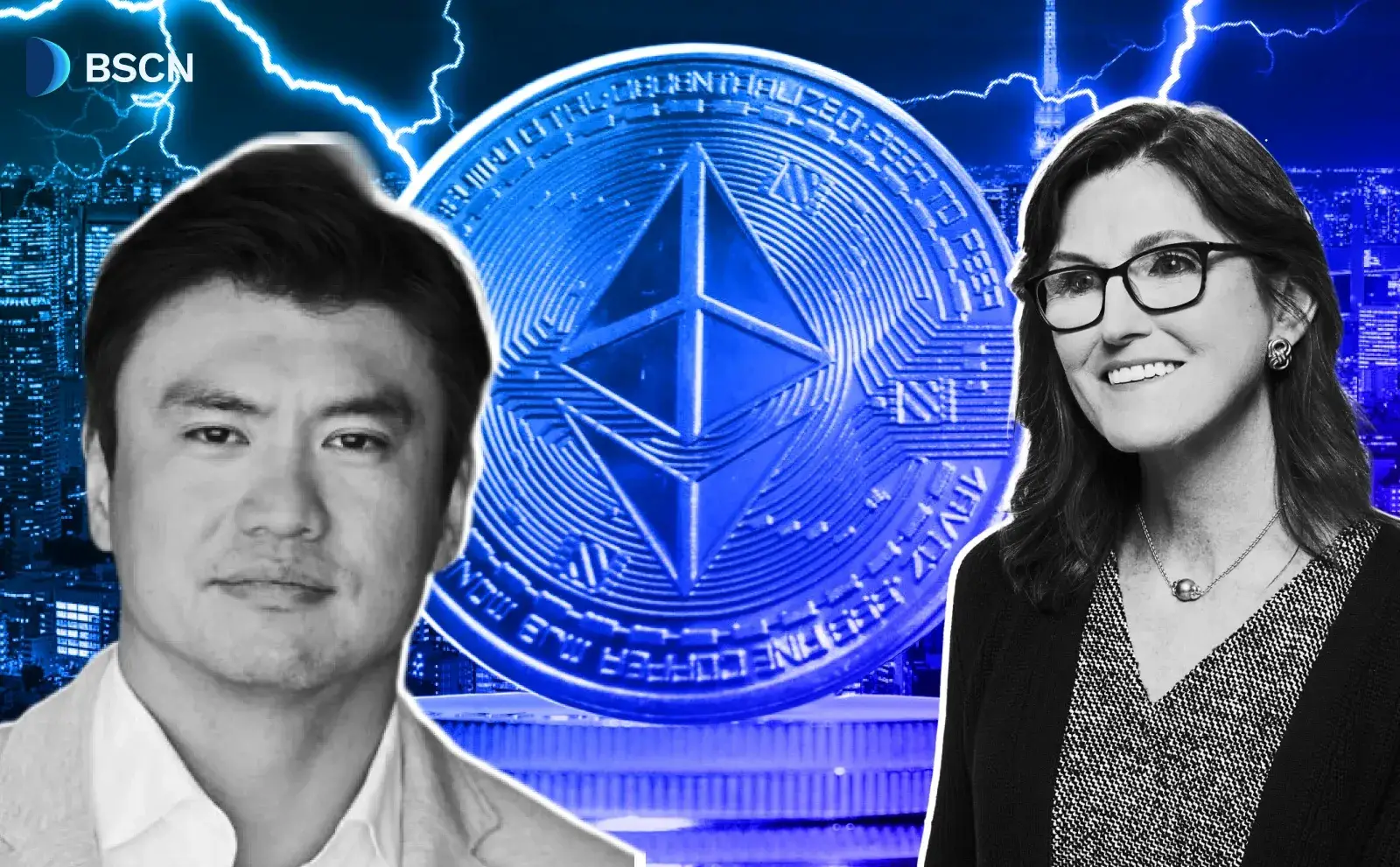

In a tweet on October 23, 2025, Cathie Wood (Founder, CEO, and CIO of ARK Invest) announced her support for Quantum Solutions, a Tokyo-based AI company listed on the Tokyo Stock Exchange. According to CoinGecko's leaderboards, Quantum Solutions recently became the largest non-US listed Ethereum Digital Asset Treasury (DAT) upon disclosing on October 22 that it had acquired an additional $8 million worth of ETH in just one day.

This move marks a recent hot streak of winning picks by Cathie Wood, whose support for Bitmine Immersion Technologies (BMNR) helped push the company to the very top of the ETH league tables. Like BMNR, Quantum Solutions touts big ambitions and has plenty of cash left in its warchest to acquire ETH following its $180 million raise in late September 2025.

Three months into the DAT revolution, we’re happy to support Japan’s first institutional-grade ETH DAT.

— Cathie Wood (@CathieDWood) October 23, 2025

Expanding access to innovation in global capital markets is key — thrilled to do this alongside @Quantum_SKK2338 and @FrancisBZhou. https://t.co/e6YlnJMHI4

The purchase aligns with Quantum Solutions' broader strategy to diversify its assets and leverage digital currencies for long-term value. While US-based firms dominate the Ethereum treasury landscape, this development marks a notable shift toward greater participation from APAC markets, where regulatory environments are evolving to accommodate such initiatives.

Recent data from Coingecko shows that the total ETH held in tracked treasuries exceeds 4.6 million tokens, valued at over $18 billion, representing about 10.6% of Ethereum's circulating supply. US companies lead the pack, with entities like BitMine Immersion and SharpLink holding millions of ETH each. However, non-US treasuries are gaining ground, particularly in Asia. Quantum Solutions' recent acquisition pushes its total to approximately 3,865 ETH, surpassing other non-US listed players and claiming the top spot outside the United States.

This leaderboard not only reflects asset allocation trends but also offers insights for investors. Companies building ETH treasuries often see benefits from price appreciation and ecosystem participation, such as earning staking rewards at rates typically between 3% and 5% annually, depending on network conditions.

Quantum Solutions' Background and Treasury Strategy

Founded in 1999 and publicly listed since 2002 under ticker 2338.T, Quantum Solutions specializes in AI infrastructure, mobile gaming, and IP monetization. Its expansion into digital assets began earlier in 2025, with initial Bitcoin treasury initiatives backed by Integrated Asset Management (Asia) Limited, best known for being the majority shareholder of Forbes.

In late September 2025, Quantum Solutions raised $180 million through a strategic share issuance to investors including Susquehanna International Group (via CVI Investments), ARK, and IAM. This capital was earmarked for building Japan's first major corporate ETH treasury, with ambitions to accumulate over 100,000 ETH. The firm views ETH as a core reserve asset due to its utility in smart contracts and decentralized applications, which align with its AI-driven business model. By integrating ETH holdings, Quantum Solutions aims to explore staking opportunities and potentially enhance returns without disrupting its primary operations.

This approach mirrors strategies adopted by other firms, where digital assets serve as a hedge and a source of passive income. For example, staking ETH involves locking tokens in the network to validate transactions, earning rewards in return. Quantum Solutions has indicated plans to engage in such activities, which could provide actionable yields for shareholders.

Details of the $8M Purchase

The latest acquisition, valued at $8 million, involved purchasing ETH at prevailing market rates, bringing Quantum Solutions' total holdings to a level that outranks other non-US entities on CoinGecko. Executed in the afternoon of October 22, 2025 (GMT+8), this transaction was part of a phased accumulation plan. The company cited favorable market conditions and confidence in Ethereum's long-term prospects as key factors.

Prior to this, Quantum Solutions had incrementally built its position, with a notable addition of over 3,800 ETH in recent months. The $8 million infusion not only bolsters the treasury's size but also demonstrates commitment to transparency, as the firm promptly updated its stakeholders via an official disclosure. For those analyzing similar purchases, it's worth noting that ETH acquisitions can be optimized by timing dips in the market—Ethereum's price has fluctuated between $3,500 and $4,500 in recent weeks—or using over-the-counter trades to minimize slippage.

This step positions Quantum Solutions ahead of peers like Def Consulting, emphasizing Japan's emerging role in crypto adoption. Regulatory support in Japan, including clear guidelines from the Financial Services Agency, has facilitated such moves, offering a model for other Asian firms considering treasury diversification.

Market Implications and Broader Context

Quantum Solutions' ascent to the top non-US spot could encourage more international companies to adopt ETH treasuries, especially as Ethereum's upgrades, like improved scalability through layer-2 solutions, enhance its appeal. This trend may lead to increased institutional demand for ETH, potentially stabilizing prices and fostering innovation in sectors like AI, where blockchain integration can secure data processing.

Overall, Quantum Solutions' initiative reflects a calculated integration of digital assets into traditional business frameworks, which may yield benefits as global adoption grows.

Read Next...

Disclaimer

Author

BSCN

BSCNBSCN's dedicated writing team brings over 41 years of combined experience in cryptocurrency research and analysis. Our writers hold diverse academic qualifications spanning Physics, Mathematics, and Philosophy from leading institutions including Oxford and Cambridge. While united by their passion for cryptocurrency and blockchain technology, the team's professional backgrounds are equally diverse, including former venture capital investors, startup founders, and active traders.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens