Why is Ethereum (ETH) Price Down Today? Market Analysis

Ethereum’s price falls below key support levels, driven by macroeconomic concerns, heavy liquidations, and bearish chart patterns. Read the full analysis.

Miracle Nwokwu

March 11, 2025

Table of Contents

Ethereum (ETH) is experiencing a significant downturn, with prices dropping to $1,755, a decline of over 11% within the last 24 hours, according to Coingecko. This drop aligns with broader market turbulence, and a combination of macroeconomic pressures, market liquidations, and technical bearish signals that are driving Ethereum’s decline.

Let’s break down the key factors contributing to this drop and analyze the ETH/USDT chart for deeper insights.

Macroeconomic Pressures and Market Sentiment

The crypto market is reeling from global economic uncertainty, primarily triggered by U.S. President Donald Trump’s recent imposition of tariffs—25% on goods from Mexico and Canada, and 10% on Chinese imports. These measures, enacted in early March 2025, have sparked fears of a global trade war, with retaliatory tariffs from affected nations raising concerns about inflation and sustained high interest rates. Historically, such "risk-off" environments have negatively impacted cryptocurrencies, as investors shy away from volatile assets like Ethereum. A similar pattern was observed during the March 2020 COVID-19 market crash, where ETH saw sharp declines amid global uncertainty.

Adding to the pressure, the crypto market has faced significant liquidations. Recent data indicates over $240 million worth of ETH positions wiped out within a 24-hour period, with $196.27 million accounting for long liquidations.

This forced selling from leveraged traders has accelerated Ethereum’s price drop, with open interest in ETH futures falling, reflecting reduced market participation.

Technical Analysis: Unpacking the ETH/USDT Chart

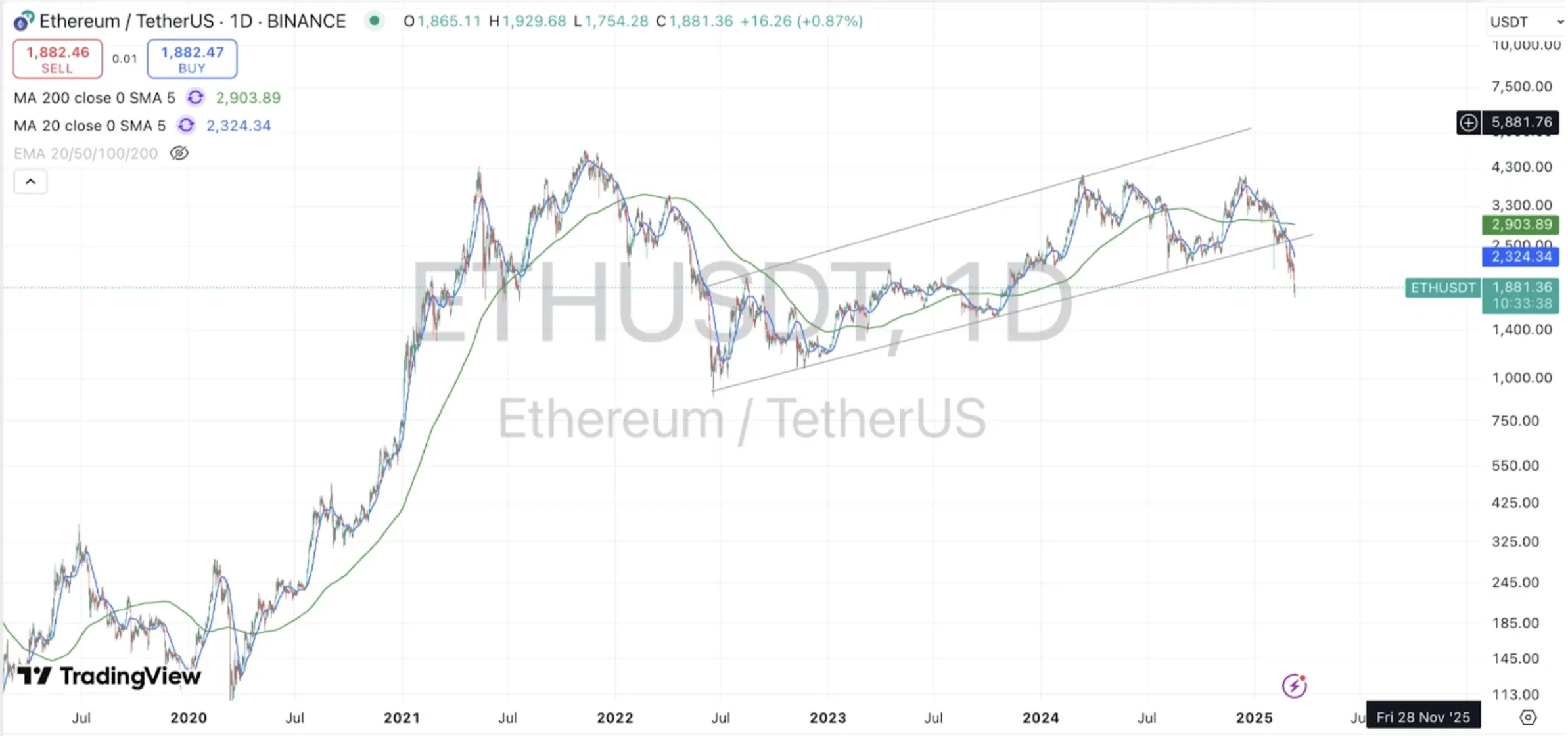

From a technical perspective, the chart above captures ETH’s long-term trend and recent decline. Key indicators and levels reveal a bearish outlook in the short term, with several critical points to watch.

Ethereum’s recovery began in 2023, with ETH climbing steadily to a recent high of approximately $3,900 in early 2025. However, the chart shows an ascending channel pattern forming since this peak, a bearish formation indicating weakening momentum. The price has since broken below the channel’s lower trendline, confirming the bearish bias, and is now trading at $1,881 (as of writing).

Moving averages (MAs) on the chart further support the bearish outlook, as the price currently sits well below the 200-day EMA (Exponential Moving Average) at $2,904 — now acting as a dynamic resistance level.

A further breakdown of the chart to a 4-hour time-frame reveals a descending channel, with the price already hitting the lower channel trendline. Historically, rebounds have taken place at such levels. A bounce from yesterday’s lows would ideally take it towards the $2000-2050 region, with further upside potentially targeting $2450.

A break above these levels would require a significant shift in market sentiment, potentially driven by a resolution to global trade tensions or renewed buying pressure.

The combined market cap of the entire crypto industry currently sits at $2.7 trillion, dropping by over 5.6% in the last 24 hours.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens