What Is Crypto Vesting? Token Release Explained

Crypto vesting locks tokens for gradual release to team members and investors. Learn how vesting schedules work and impact token prices.

Crypto Rich

June 10, 2022

Table of Contents

Last revision: October 20, 2025

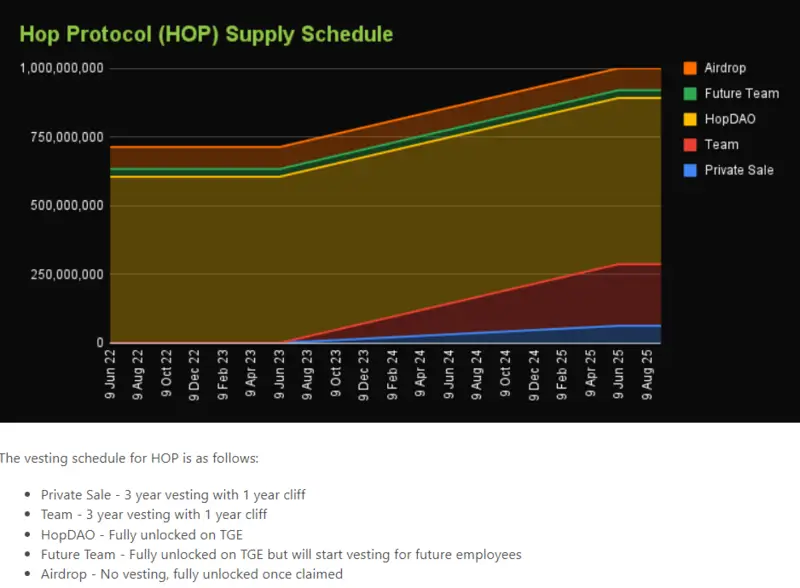

Crypto vesting locks tokens and releases them gradually over time to stakeholders like team members, advisors, and early investors. Without it, insiders could dump their entire allocation at launch, creating sharp price drops that harm regular investors.

How Does Crypto Vesting Work?

The mechanics are straightforward. Vesting schedules control when and how tokens unlock. The process involves two key components: the cliff period and the vesting period.

The cliff is an initial lockup where no tokens can be accessed. Once it ends, tokens unlock either all at once or gradually during the vesting period. A common structure includes a 6-month cliff followed by 18 months of linear vesting, meaning tokens unlock in equal amounts over that timeframe.

Projects typically vest tokens for several stakeholder groups:

- Team members and founders receive vested allocations as compensation

- Early-stage investors who participated in seed or private rounds wait through lockup periods before accessing tokens

- Advisors and partners receive vested tokens for ongoing contributions

- Development funds may follow vesting schedules to demonstrate responsible treasury management

The technical implementation uses smart contracts that automatically enforce vesting terms. These contracts hold tokens and release them according to predefined schedules without requiring manual intervention.

What Are the Different Types of Vesting Schedules?

Projects structure vesting in several ways depending on their tokenomics and stakeholder agreements. Each approach has distinct characteristics.

Linear Vesting

With linear vesting, tokens release in equal increments over the vesting period. If someone has 12,000 tokens vesting linearly over 12 months after a cliff, they receive 1,000 tokens monthly. This approach creates predictable unlock timing that markets can anticipate.

Graded Vesting

Graded schedules release larger portions initially with decreasing amounts over time, or vice versa. Some projects frontload tokens to reward loyalty, while others backload releases to maintain long-term alignment.

Milestone-Based Vesting

Instead of time-based unlocks, milestone-based vesting ties releases to specific achievements. Development teams might unlock tokens after completing technical milestones like mainnet launches or reaching user adoption targets. This structure directly connects compensation to performance.

Hybrid Schedules

Hybrid schedules combine multiple approaches. A project might use a 12-month cliff, then release 25% of tokens immediately, followed by linear vesting of the remaining 75% over 24 months.

Why Do Crypto Projects Use Vesting?

Vesting addresses several practical concerns in crypto project launches and operations.

Price Stability

Price stability improves when token supply enters circulation gradually rather than all at once. Large token unlocks create selling pressure that can overwhelm demand, causing price declines. Vesting spreads this pressure over time, allowing markets to absorb new supply without dramatic volatility.

Team Commitment and Credibility

Team commitment becomes more credible with vesting schedules. When founders and developers have multi-year vesting, they demonstrate confidence in long-term success rather than seeking quick profits. Investors view lengthy team vesting as a positive signal about project dedication.

Fair Distribution

Fair distribution ensures early investors don't have excessive advantages over public participants. Private sale investors typically purchase tokens at steep discounts. Vesting prevents them from immediately dumping these discounted tokens on public buyers, which would create unfair market dynamics.

Regulatory Considerations

Regulatory considerations also factor into vesting decisions. Some jurisdictions scrutinize token sales for securities law compliance. Vesting schedules can help demonstrate that tokens serve utility purposes rather than purely investment functions.

How Does Vesting Impact Token Price?

Understanding vesting schedules helps investors assess price risks and opportunities. The timing and size of unlocks directly affect market dynamics.

Unlock Events and Selling Pressure

Unlock events often trigger selling as recipients realize profits or diversify holdings. Markets typically price in known unlocks ahead of time, but execution can still cause temporary dips. The magnitude depends on unlock size relative to circulating supply and current market conditions.

Supply Dynamics and Dilution

Comparing circulating supply to total supply shows how much dilution lies ahead. Projects with low circulating supply compared to total supply face more significant dilution as vesting progresses. A token with 100 million in circulation but 1 billion total supply will experience substantial percentage increases in circulating supply as vesting continues.

Early Investor Cost Basis

Early investor cost basis matters significantly. Seed investors might have paid 90% less than current market prices. Even after substantial price declines from peak values, these investors remain profitable, giving them an incentive to sell during unlock events.

Schedule Modifications

Projects sometimes adjust vesting schedules through governance votes or team decisions. Extensions or modifications typically require transparency and community input, but changes do occur. Some projects have extended team vesting to demonstrate continued commitment during market downturns.

What Should Investors Look for in Vesting Schedules?

Several factors indicate whether a project has structured vesting responsibly.

Team Vesting Duration

Team vesting duration is a key indicator of project commitment. Industry standard suggests minimum 3-4 year vesting for founders and core team members, with at least a 6-month cliff. Shorter schedules may signal insufficient long-term commitment.

Total Vested Percentage

Total vested percentage shows how much supply remains locked. Projects allocating 40-60% of the total supply to insiders should raise questions about fair distribution. Lower percentages generally indicate more community-focused tokenomics.

Unlock Calendar Transparency

Unlock calendar transparency matters. Reputable projects publish detailed vesting schedules showing exact unlock dates and amounts. This information should be easily accessible in documentation or on the project website. Vague or hidden vesting terms suggest problems.

Cliff Alignment

Cliff alignment across stakeholder groups indicates fairness. When team members have longer cliffs than private investors, it shows priority placed on long-term building over early profit-taking.

Token tracker platforms provide unlock data for many projects. These tools show upcoming vests and historical unlock performance, helping investors time positions around major events.

How Can Investors Track Token Unlocks?

Several methods exist for monitoring vesting schedules and upcoming unlock events.

Project Documentation

Project documentation remains the primary source. Whitepapers, tokenomics papers, and official websites should detail vesting structures. This information establishes the baseline schedule, though some projects update terms over time.

Blockchain Explorers

Blockchain explorers show vesting contract activity for transparent projects. By examining smart contracts holding vested tokens, technical users can verify claimed schedules match on-chain reality. This verification prevents projects from misrepresenting their vesting terms.

Third-Party Analytics Platforms

Third-party analytics platforms aggregate unlock data across multiple projects. These services track vesting schedules, calculate circulating supply changes, and send alerts about upcoming major unlocks. Some platforms focus specifically on token unlock tracking.

Community Resources

Community resources like project Discord servers and governance forums often discuss upcoming unlocks. Engaged community members track schedules and share analysis about potential price impacts.

The technical implementation of vesting contracts varies by blockchain. Ethereum-based projects typically use time-locked contracts with specific release functions. Other chains employ similar mechanisms adapted to their technical architectures.

What Are Common Vesting Schedule Structures?

Different stakeholder groups typically receive distinct vesting terms based on their project contributions and risk profiles.

Team and Founder Allocations

Founder and core team allocations usually carry the longest vesting periods. Standard structures include 4-year total vesting with a 1-year cliff, followed by monthly or quarterly unlocks. This extended timeline ensures team members remain motivated throughout critical development phases.

Early Investor Terms

Seed investors often receive 2-3 year vesting with 6-12 month cliffs. These early participants took a significant risk by investing before product validation, but shorter vesting than team members reflects their financial rather than operational contribution. Private sale participants typically get 1-2 year vesting with 3-6 month cliffs. These investors purchased tokens at discounts but provided capital closer to launch, justifying shorter lockups than seed rounds.

Public Participants and Advisors

Public sale buyers generally receive immediate or very short vesting terms. Since public participants pay full price without discounts, projects often provide immediate liquidity or minimal lockup periods. Advisor and partnership allocations vary widely based on the scope of contributions. Strategic advisors providing ongoing guidance might have 2-3 year vesting, while one-time consultants receive shorter schedules or immediate tokens.

What Risks Do Vesting Schedules Present?

While vesting protects against certain risks, it creates others that investors should understand.

Technical and Security Risks

Contract vulnerabilities represent technical risks. Vesting contracts must be thoroughly audited because bugs could allow premature token access or lock funds permanently. Several projects have experienced vesting contract exploits that disrupted tokenomics. Transparency failures also allow projects to hide vesting details. Without clear documentation and on-chain verification, teams could potentially access tokens outside stated schedules.

Governance and Market Risks

Schedule changes pose governance risks. Projects sometimes extend or modify vesting through community votes or unilateral decisions. Extensions generally benefit token holders by reducing selling pressure, but process transparency matters significantly. Large concentrated unlocks create price pressure risks. When major portions vest simultaneously rather than gradually, markets may struggle to absorb selling. Projects with many stakeholders receiving similar vesting terms face aligned unlock timing.

Regulatory Uncertainty

Regulatory classification uncertainty affects vesting structures. Changing securities regulations might impact how vesting terms should be structured or disclosed. Projects operating in legal gray areas face particular uncertainty as compliance requirements evolve.

How Has Crypto Vesting Evolved?

Vesting practices have matured substantially as the industry has developed standards and learned from past mistakes.

Early Problems and Learning

Early projects often featured minimal or no vesting, leading to dramatic pump-and-dump patterns where insiders profited while public buyers suffered losses. These experiences taught the industry about alignment importance. Smart contract capabilities expanded vesting possibilities. Modern vesting contracts support complex conditions, partial unlocks, and milestone-based releases that weren't technically feasible in early blockchain implementations.

Industry Standards and Expectations

Investor expectations shifted toward demanding transparent, reasonable vesting terms. Projects without clear vesting schedules now face skepticism from experienced crypto participants who recognize red flags. Community governance has become more involved in vesting decisions. Mature projects sometimes vote on vesting modifications, giving token holders direct input on tokenomics adjustments.

Technical Challenges

Multi-chain implementations require adapted approaches. As projects deploy across multiple blockchains, coordinating vesting across chains presents technical challenges. Cross-chain vesting solutions are still developing as projects work to maintain consistent tokenomics across different network environments.

Conclusion

Crypto vesting locks tokens for gradual release to team members, investors, and other stakeholders over defined timeframes. The mechanism uses cliffs and unlock periods to prevent mass selling after project launches. Investors should examine total vested percentages, unlock schedules, and team vesting duration when evaluating projects. Transparent vesting indicates responsible tokenomics design, while opaque or short schedules create investment risks. Understanding circulating versus total supply helps assess future dilution from upcoming unlocks.

Sources

- Ethereum Foundation: Token Vesting Contract Documentation.

- CoinMarketCap: Circulating Supply vs Total Supply Methodology.

- CoinGecko: Token Unlock Tracking Data.

- DeFi Safety: Smart Contract Audit Standards for Vesting Mechanisms.

Read Next...

Frequently Asked Questions

What is the cliff period in crypto vesting?

The cliff period is an initial lockup where no tokens can be accessed. After the cliff ends (commonly 6-12 months), tokens begin unlocking according to the vesting schedule. It ensures minimum commitment before any tokens become available.

Can vesting schedules be changed after launch?

Yes, though changes typically require governance votes or community approval in established projects. Teams sometimes extend vesting to show continued commitment, but modifications should be transparent and justified. Unilateral changes without explanation raise concerns.

Where can I find token unlock schedules?

Check project whitepapers, tokenomics documentation, and official websites first. Third-party platforms like Token Unlocks, Messari, and CryptoRank aggregate vesting data. Blockchain explorers let technical users verify on-chain vesting contracts directly.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens