Understanding Unich's UN Token and Its Tokenomics

A breakdown of Unich’s UN tokenomics, covering supply distribution, vesting schedules, and the role of UN in driving platform growth.

Miracle Nwokwu

October 3, 2025

Table of Contents

Unich operates as a decentralized over-the-counter (OTC) exchange, focusing on pre-market and pre-order trading across multiple blockchains like Solana, Ethereum, and Avalanche. The platform has built a user base exceeding 5.5 million, emphasizing secure, peer-to-peer transactions without traditional intermediaries. At its core lies the UN token, which serves as the native utility asset powering the ecosystem. As Unich navigates its pre-launch phase, the Initial DEX Offering (IDO) for UN tokens remains ongoing, having launched in July 2025 and continuing to attract participants seeking early access.

This explainer breaks down the token's structure, allocation, vesting mechanisms, and utilities. By examining these elements, readers can gain a clearer picture of how UN fits into Unich's broader vision for decentralized trading.

The Basics of the UN Token

The UN token runs on the Solana network, chosen for its high throughput and low transaction costs, which align with Unich's goal of efficient OTC operations. With a total supply capped at 1 billion tokens, UN carries the ticker symbol $UN. Project leaders have scheduled listings on top-tier centralized exchanges (CEX) and decentralized exchanges (DEX) for the third and fourth quarters of 2025, aiming to broaden accessibility once the token generation event (TGE) occurs.

Unich positions UN as more than just a transactional tool; it integrates deeply into platform functions, from fee reductions to governance. Recent partnerships, such as those with Gate Wallet and Bitget Wallet, have expanded wallet compatibility, allowing millions of users to interact with the ecosystem more seamlessly. Additionally, Unich's appearance on platforms like DappRadar and DappBay provides real-time tracking of token performance post-TGE, offering transparency for potential holders.

UN Token Allocation

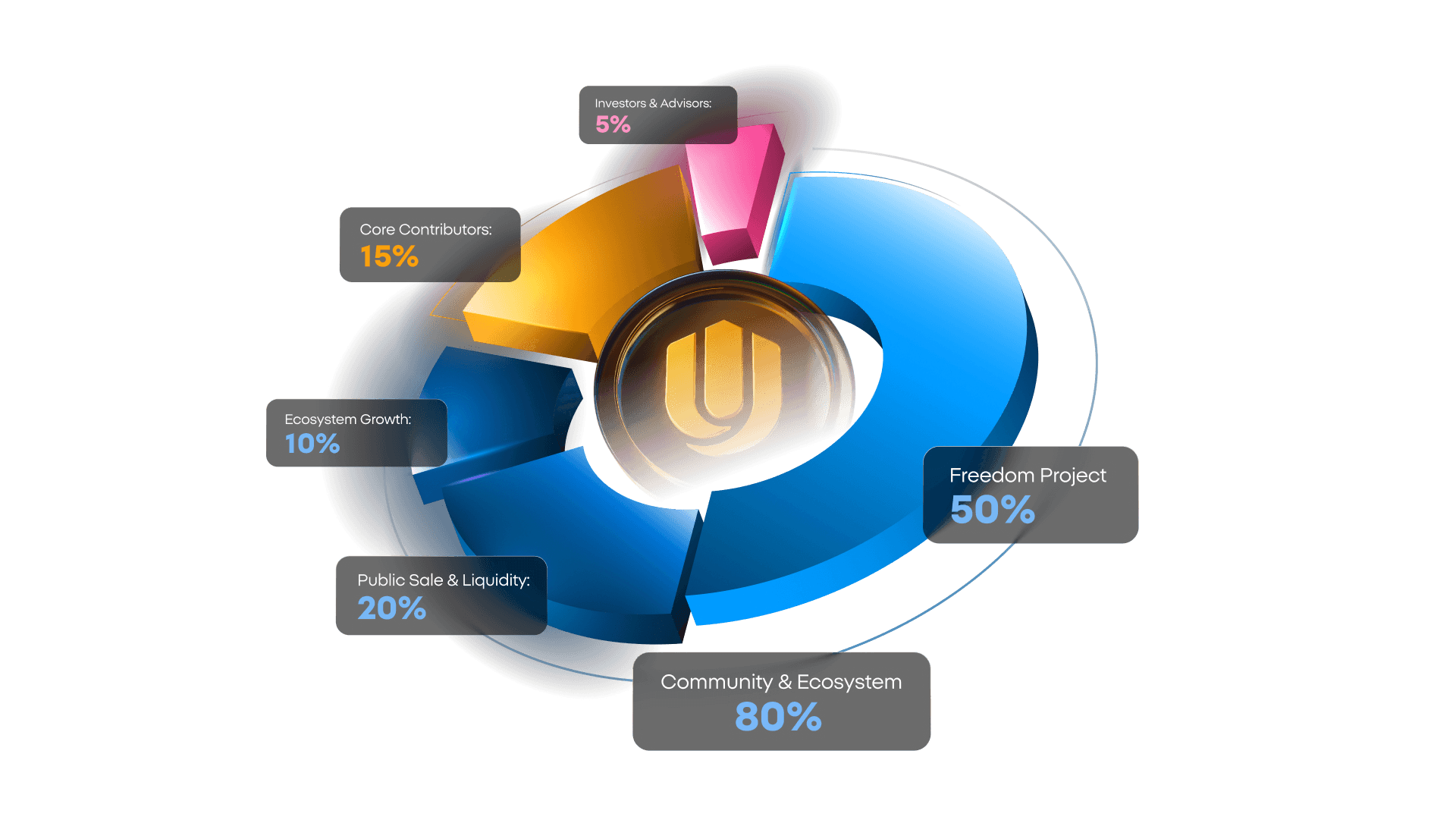

Unich's tokenomics allocate the 1 billion UN tokens across three main categories, with a strong emphasis on community and ecosystem growth. This distribution reflects a strategy to foster long-term engagement rather than short-term speculation.

The largest share—80%, or 800 million tokens—goes to the community and ecosystem. Within this, half (50% of total supply, or 500 million tokens) is reserved for the Freedom project, an upcoming initiative that will distribute Freedom Coins (formerly FD Points) through decentralized means. Participants must complete KYC verification to ensure rewards reach genuine contributors, and these coins will later be redeemable for UN tokens. Details on the redemption process and launch timeline are expected soon, as the project rolls out.

Another 20% of the total supply (200 million tokens) supports the IDO, liquidity provision, and other services. This portion aims to encourage widespread participation while bolstering market depth and funding platform enhancements. The remaining 10% (100 million tokens) funds ecosystem development, including research, product innovation, liquidity incentives, and strategic partnerships. For instance, recent collaborations with wallet providers demonstrate how these funds might be deployed to expand reach.

Core contributors receive 15% (150 million tokens), recognizing the founding team, developers, and key partners who drive the platform's technical backbone. Finally, 5% (50 million tokens) is set aside for investors and advisors, whose expertise and networks help in scaling operations. This smaller allocation to private parties underscores Unich's community-focused approach, where the majority of tokens circulate among users and supporters.

Vesting Schedules

To prevent rapid sell-offs and align interests over time, Unich implements vesting periods across allocations. For the community and ecosystem portion, the IDO segment unlocks 20% after three months, with the remaining 80% vesting linearly over the next four months. Ecosystem growth funds start with 10% unlocked immediately, followed by linear vesting over 36 months. The Freedom project's allocation begins only upon its official launch, adding a layer of conditional release.

Core contributors and investors/advisors both face a 12-month cliff, meaning no tokens unlock in the first year, after which they vest linearly over 36 months. This structure ties rewards to sustained contributions, reducing the risk of early dumps that could destabilize the token's value. Notably, the vesting for the Freedom allocation is separate from the general release schedule, allowing flexibility as the project matures.

These mechanisms draw from standard practices in blockchain projects, where gradual unlocks help maintain market confidence. By spreading distributions over years, Unich aims to support organic growth, as seen in its expanding partnerships and user base.

UN Token Utilities

UN's design integrates multiple use cases to create value for holders within the ecosystem. Holders can benefit from reduced trading and withdrawal fees, making frequent interactions more cost-effective on the platform. This ties directly to Unich's OTC model, where lower costs could attract high-volume traders.

Early access to new features and products represents another perk, giving UN holders a competitive edge in testing and adopting innovations before the general public. Staking offers yields of 20% to 30% annually, providing a passive income stream that encourages long-term holding.

A deflationary element comes through the "Burn to Boost" program, where 30% of Unich's quarterly profits fund buybacks and burns of UN tokens until the supply halves. This could potentially increase scarcity over time, assuming platform revenue grows—Unich has reported over $20 million in revenue within six months of its mainnet launch.

Governance rounds out the utilities, allowing UN holders to propose and vote on protocol changes. With 80% of tokens community-allocated, this empowers users to influence decisions, from feature updates to strategic directions.

The Current Pre-Launch Phase and IDO

Unich remains in its pre-launch stage, with the IDO serving as a key fundraising mechanism. Launched in July 2025, the IDO offers 100 million UN tokens at an initial price of $0.15, rising to $0.175 in subsequent rounds, targeting $15 million in total raises. Participants with Unich NFTs qualify for a 25% discount, while a referral program provides 11% rewards—split as 8% in stablecoins like USDT immediately and 3% in vested UN.

This phase precedes the TGE and exchange listings, allowing early supporters to acquire tokens before broader market availability. Unich's updates highlight ongoing efforts, such as integrations with major wallets, to prepare for full operations.

As Unich approaches its Q4 2025 listings, the tokenomics framework positions UN as a utility-driven asset in the OTC space. Ultimately, the token’s success will depend on Unich's ability to deliver on its trading ecosystem promises.

Sources:

Unich Tokenomics Documentation: https://docs.unich.com/welcome-to-unich/unich-tokenomics

- Comprehensive Analysis of UN Tokenomics: https://analysis.unich.com/unich-un-tokenomics-a-comprehensive-overview/

Read Next...

Frequently Asked Questions

What is the total supply of Unich’s UN token?

Unich’s UN token has a fixed total supply of 1 billion tokens, running on the Solana blockchain for low fees and high-speed transactions.

How are UN tokens allocated across the ecosystem?

Out of the 1 billion tokens, 80% go to the community and ecosystem, 15% to core contributors, and 5% to investors and advisors. This ensures most tokens remain with users and project supporters.

What vesting schedule does Unich use for UN tokens?

Unich applies vesting to prevent rapid sell-offs. Core contributors and investors face a 12-month cliff followed by 36-month linear vesting, while IDO allocations unlock gradually over several months.

What are the main utilities of the UN token?

The UN token supports fee reductions, staking with 20–30% APY, governance rights, early access to features, and the “Burn to Boost” deflationary buyback program.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens