Solana Surges in Q1 with Massive Gains in Revenue DEX Volume

The surge was largely driven by meme coins like TRUMP and MELANIA, which boosted app revenue by 20%.

Soumen Datta

May 19, 2025

Table of Contents

A Red-Hot Start to 2025

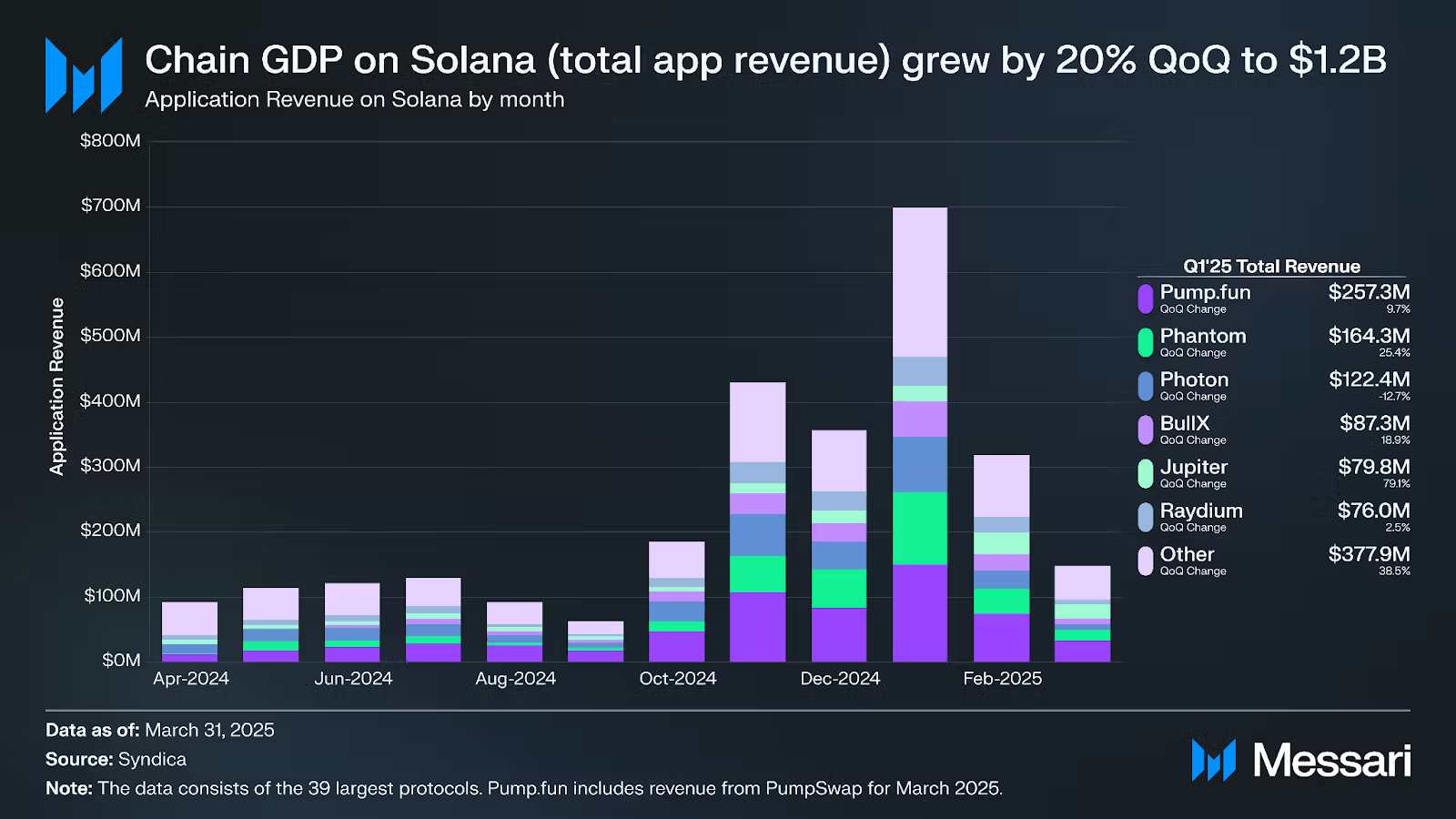

Solana stormed into the first quarter of 2025 with an economic surge few expected. The chain’s GDP—measured as total application-generated revenue—hit $1.2 billion, according to Messari’s Q1 “State of Solana” report. That marks a 20% increase quarter-on-quarter, up from $970 million in Q4 2024.

But the real story lies in January, which alone contributed $699 million—more than half of the quarter’s total. The primary force behind this revenue explosion? Meme coins.

Tokens like TRUMP and MELANIA lit a speculative fire under the Solana ecosystem.

Memecoin Mania and DEX Dominance

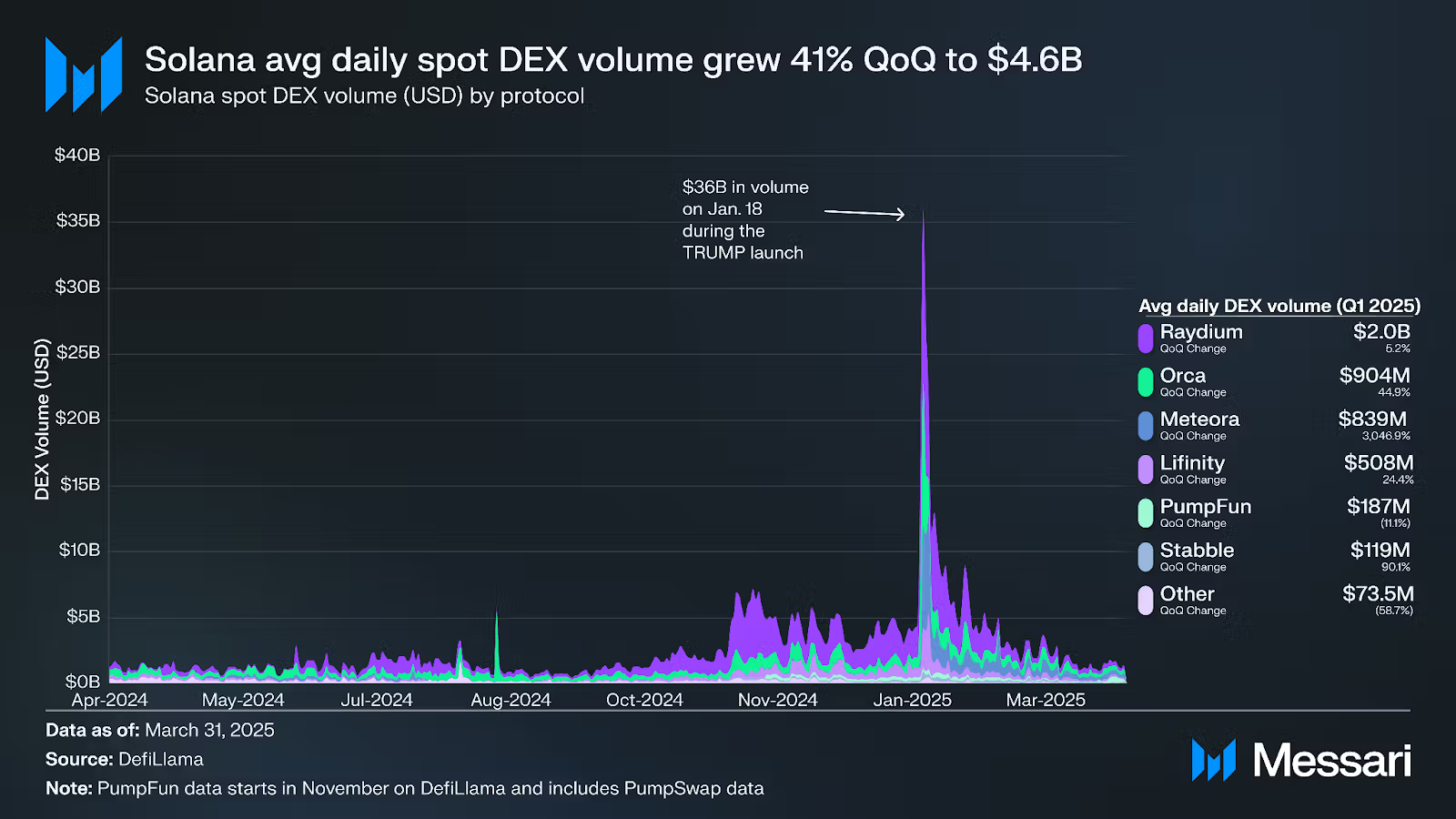

The surge in revenue came largely from trading platforms, especially decentralized exchanges. Solana's DEX volumes in January alone jumped 153%, reaching $8.3 billion. Average daily spot trading volumes across Q1 grew 41% quarter-on-quarter to $4.6 billion.

Raydium took the top spot among DEXs by quarterly trading volume, commanding 31% of all spot volume. Jupiter, once the king, dropped to second with a 24% share. Still, Jupiter retained dominance in perpetuals, ending Q1 with an average of $1 billion in daily perp trading and a commanding 79.2% market share.

The rise in memecoin trading was the key. The November 2024 U.S. elections and the January launch of the TRUMP token sparked a fresh wave of user speculation. This wasn’t limited to one exchange—Meteora, for instance, saw an eye-popping 3047% growth in quarterly DEX volume to $839 million, propelled by TRUMP, MELANIA, and LIBRA tokens.

Pump.fun, Jupiter, and Phantom Drive Revenue Spike

The three largest revenue-generating apps were:

- Pump.fun at $257 million

- Phantom at $164 million

- Jupiter at $80 million

Together, they accounted for over 40% of Solana’s Chain GDP in Q1. Pump.fun, in particular, saw immense volume in speculative trading, later launching PumpSwap in March to support advanced memecoin trades. By the end of March, Pump.fun and PumpSwap averaged $279 million in daily volume.

Revenue Efficiency: Solana’s App RCR Hits 142.8%

Beyond raw numbers, Solana showed signs of a maturing economy. Its Application Revenue Capture Ratio (RCR) rose to 142.8%, up from 117.6% in Q4 2024.

This means that for every $100 spent on validator fees or MEV tips, apps on Solana generated $142.80 in revenue. It’s an impressive figure in blockchain economics and shows a high degree of monetization efficiency.

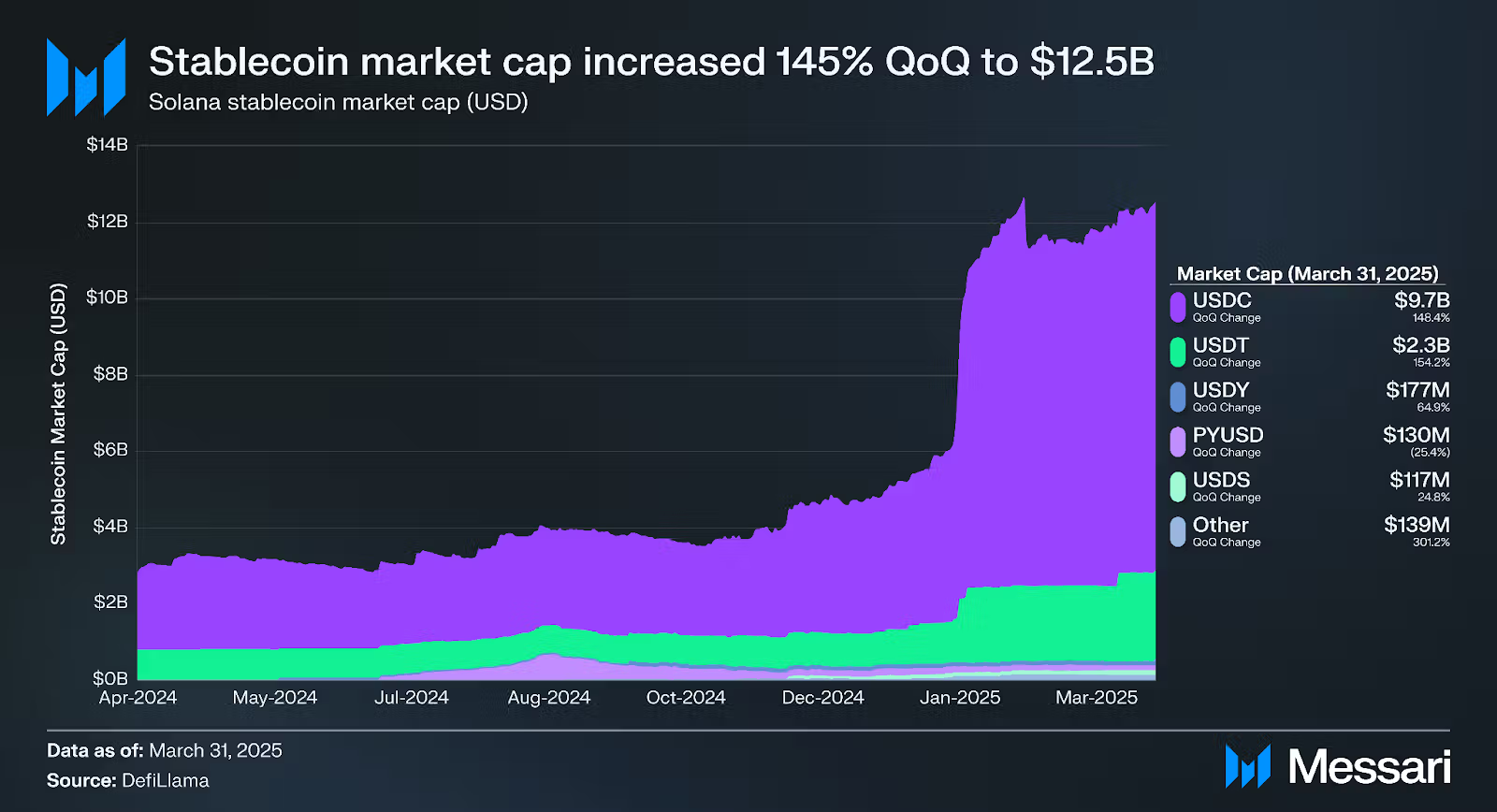

Stablecoin Liquidity Soars 145% QoQ

Stablecoins are a core part of blockchain liquidity, and Solana’s pool grew fast. Total stablecoin market cap on the chain rose 145% QoQ to $12.5 billion.

- USDC grew 148.4% to $9.7 billion

- USDT jumped 154.2% to $2.3 billion

- USDY (Ondo) climbed 65% to $177 million

Much of this came after the launch of the TRUMP token in January, which drew in large volumes of USDC liquidity. As trading activity accelerated, stablecoins became the preferred pairing currency across DEXs.

Even PayPal’s PYUSD, one of the few to decline, ended the quarter with $130 million in circulation on Solana.

DeFi TVL Tells Two Different Stories

Solana's Total Value Locked (TVL) in USD terms dropped 64% QoQ to $6.6 billion. But in SOL terms, TVL actually increased 18% to 53 million SOL.

This mixed signal reflects the price fluctuations of SOL itself, but also suggests that the core user activity and protocol engagement remained strong, even as dollar-denominated valuations dipped.

Kamino led in TVL with $1.6 billion and a 24% market share, despite a 13% QoQ drop. The protocol introduced Kamino Swap in December—an intent-based DEX with zero slippage and fees. That product innovation has kept Kamino at the front of the DeFi pack on Solana.

Trailing behind were:

- Jupiter Perps, with $1.4 billion in TVL (down 18% QoQ)

- Raydium, with $1.1 billion in TVL (down 46% QoQ)

Perpetuals Markets Expand, Jupiter Leads the Way

The perpetual futures market on Solana gained significant ground, with Jupiter averaging $1 billion in daily perp volume. It saw a 14% increase from the previous quarter, securing nearly 80% of the perp market share.

Other notable players:

- Drift at $138.2 million daily (down 17.3%)

- GMX, a new entrant, at $58.4 million daily after launching on Feb. 18

- Raydium Perps, launched on Jan. 9, saw $17 million daily volume

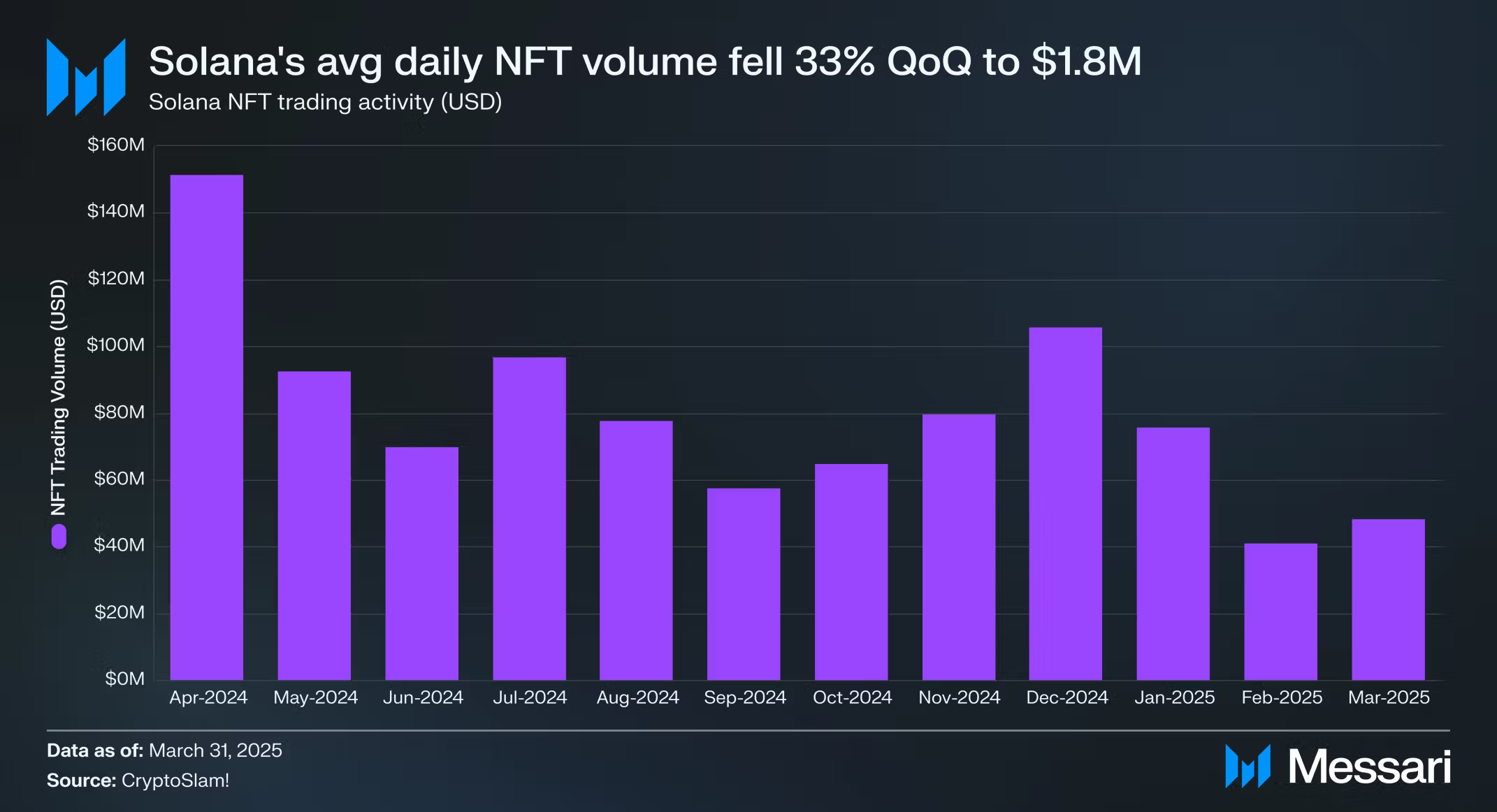

NFT Market Sees a Pullback

NFT trading on Solana slowed down in Q1, with average daily volume dropping 33% to $1.8 million. Magic Eden, Solana’s largest NFT marketplace, saw a 27% decrease in volume.

Despite the decline, Solana’s NFT ecosystem remains strong on creator royalties and continues to be an active hub for digital art.

Gaming and Web3 Integration Expand

Gaming projects on Solana also showed positive signs. Star Atlas invested in Shaga, a decentralized cloud gaming platform, expanding access to lower-end devices. Other projects like Lowlife Forms made waves by entering the top three most wishlisted games on the Epic Games Store.

The Solana Foundation’s Accelerate conference in New York, scheduled for May 2025, aims to bring developers and product teams together. The event will focus on scaling and shipping applications, reflecting the community’s commitment to building sustainable Web3 solutions.

Looking Ahead: Accelerate Conference Set for May

The Solana Foundation isn’t slowing down. In May, it will host the Accelerate Conference in New York City. The event will feature two tracks:

- Scale or Die, focused on developers

- Ship or Die, tailored to product and app teams

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens