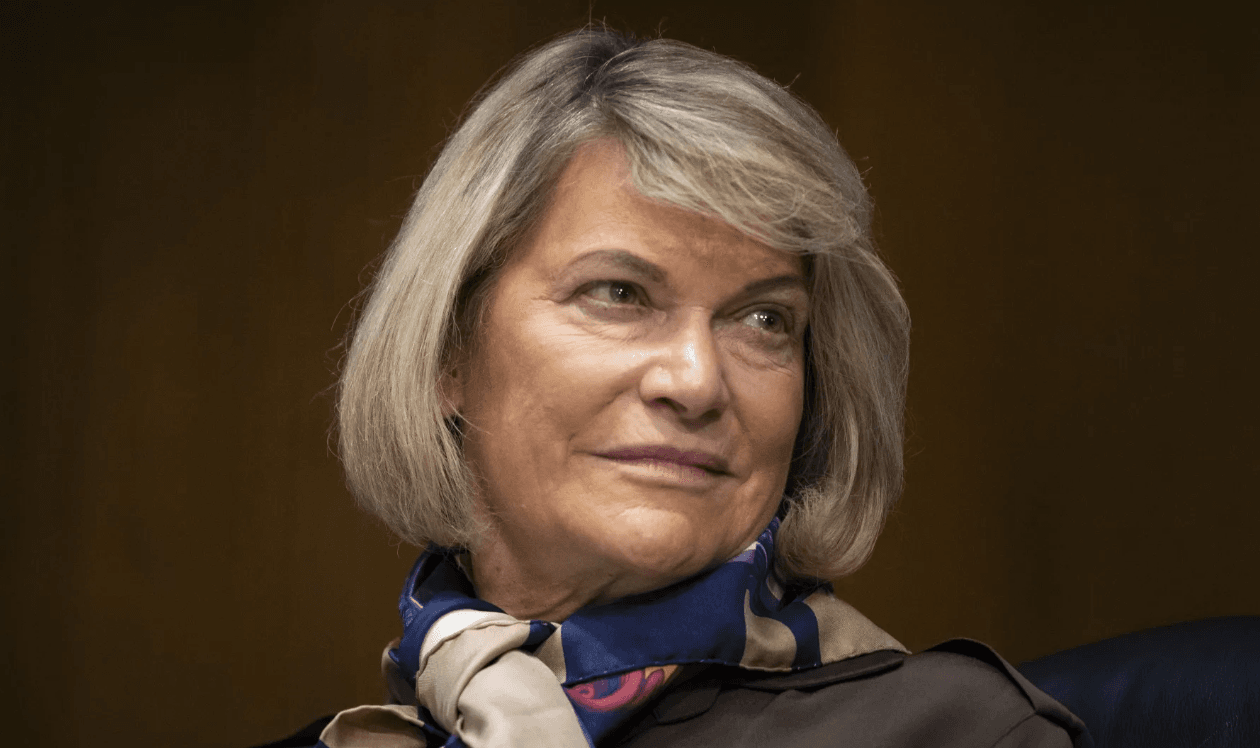

Senator Cynthia Lummis Named Chair of Senate Banking Subcommittee on Digital Assets

Lummis’ role will focus on crafting bipartisan legislation to regulate digital assets, such as Bitcoin, and establish a strategic Bitcoin reserve.

Soumen Datta

January 24, 2025

Table of Contents

U.S. Senator Cynthia Lummis from Wyoming has been appointed as the first-ever chair of the Senate Banking Subcommittee on Digital Assets. This historic appointment comes as the country looks to shape its digital asset regulations, with Lummis at the forefront of this crucial shift.

As a staunch advocate for digital currencies like Bitcoin, Lummis is expected to influence the future of blockchain technology and cryptocurrency in the U.S.

A Growing Role in Digital Asset Legislation

Lummis, a known supporter of digital assets, released a statement expressing her commitment to advancing legislation that secures the financial future of the country. She emphasized the importance of creating a comprehensive legal framework for digital assets, which will include market structure, stablecoins, and the establishment of a strategic Bitcoin reserve.

Lummis stated:

“Digital assets are the future, and if the United States wants to remain a global leader in financial innovation, Congress needs to urgently pass bipartisan legislation establishing a comprehensive legal framework for digital assets and that strengthens the U.S. dollar with a strategic bitcoin reserve."

Senator Tim Scott (R-SC), Chair of the Senate Banking Committee, expressed confidence that, under Lummis' guidance, the subcommittee would spearhead efforts to develop a balanced regulatory framework that encourages innovation within the U.S. rather than abroad.

The Senate Banking Subcommittee on Digital Assets

The Senate Banking Subcommittee on Digital Assets has two major priorities for the 119th Congress:

Passing Bipartisan Digital Asset Legislation: The subcommittee will focus on crafting laws that promote responsible innovation within the digital asset space. These laws will also address consumer protections, market structure, and the creation of a strategic Bitcoin reserve.

Oversight of Federal Regulators: Ensuring that federal financial regulators follow the law will be another core focus. This includes preventing initiatives like "Operation Chokepoint 2.0," which some lawmakers believe could harm the crypto industry through overregulation.

These two areas will be key in determining how digital assets are integrated into the broader financial system in the U.S. Under Lummis' leadership, the subcommittee will work to establish a fair regulatory environment that supports growth while protecting consumers.

Bipartisan Support and Industry Optimism

The subcommittee includes senators from both sides of the aisle, including Republicans like Thom Tillis (R-N.C.) and Bill Hagerty (R-Tenn.), and Democrats like Ruben Gallego (D-Ariz.) and Mark Warner (D-Va.). Ruben Gallego will serve as the ranking member of the subcommittee,.

Industry leaders have expressed optimism about the subcommittee's potential. Dennis Porter, CEO of the Satoshi Action Fund, called Lummis' appointment "a huge step forward" for advancing legislation, particularly the proposed Strategic Bitcoin Reserve. This initiative, supported by Lummis, would ensure that the U.S. holds a reserve of Bitcoin to strengthen the U.S. dollar.

The Path Ahead for Digital Asset Legislation

With the subcommittee now in place, the U.S. is expected to take significant steps toward creating a legal framework for digital assets. This comes after the House of Representatives made significant strides last year in advancing digital asset legislation, while the Senate had been slower to act.

However, with Lummis at the helm, there is hope that the Senate will now take up crucial bills to regulate cryptocurrencies and blockchain technology effectively. Lummis has already authored several digital asset bills in previous sessions, and her leadership is expected to bring more legislative action to the forefront.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens