Project Review: IO.NET and The IO Token

Explore IO.NET's decentralized AI computing platform, backed by $30M Series A funding. Learn about IO token utility, GPU infrastructure, and its role in the evolving AI-blockchain ecosystem.

Jon Wang

February 3, 2025

Table of Contents

The intersection of artificial intelligence and blockchain technology has emerged as a defining narrative in the current cryptocurrency bull market. Among the various projects combining these revolutionary technologies, IO.NET stands out as a prominent force. This comprehensive review explores IO.NET's infrastructure, IO tokenomics, and its potential as a long-term investment opportunity.

What is IO.NET and How Does it Work?

IO.NET, launched in 2024 but founded in 2022 by Ahmad Shadid, represents a groundbreaking approach to decentralized computing. Now led by CEO Tory Green, the platform operates as a decentralized computing network that aggregates GPU resources from various sources, effectively creating a decentralized physical infrastructure network (DePIN).

The platform addresses several critical challenges in traditional AI development:

- Limited Hardware Availability: Traditional cloud services often have weeks-long waiting periods

- Restricted Hardware Options: Users face limited choices regarding GPU specifications and locations

- Prohibitive Costs: Traditional AI computing resources can cost hundreds of thousands of dollars monthly

Core Components

IO.NET's ecosystem revolves around two primary components:

IO Worker

This interface enables GPU owners to contribute their computing power to the network. Through a user-friendly web application, providers can easily monetize their idle GPU resources and earn IO tokens as rewards.

IO Cloud

Built on the Ray framework—the same technology powering OpenAI's GPT-3 and GPT-4 training—IO Cloud provides users access to distributed computing resources. The platform features self-healing, fully meshed GPU systems that ensure high availability and fault tolerance, making it ideal for Python-based machine learning workloads.

Venture Capital Backing and Investment Rounds

IO.NET has attracted significant attention from prominent investors in the blockchain space. In March 2024, the project completed a $30 million Series A funding round led by Hack VC, with participation from:

Notable angel investors included Solana founder Anatoly Yakovenko and Aptos founders Mo Shaikh and Avery Ching. This follows an earlier $10 million seed round, demonstrating strong institutional confidence in the project.

Understanding the IO Token

The IO token serves as the primary utility token within the IO.NET ecosystem, built on the Solana blockchain. With a current market capitalization of approximately $245 million and a fully diluted valuation of $1.45 billion, the token plays several crucial roles:

Token Utility

- Payment for GPU computing services

- Rewards for computing power providers

- Staking opportunities for network security

- Reduced fees compared to USDC payments (0% vs 2%)

Tokenomics Overview

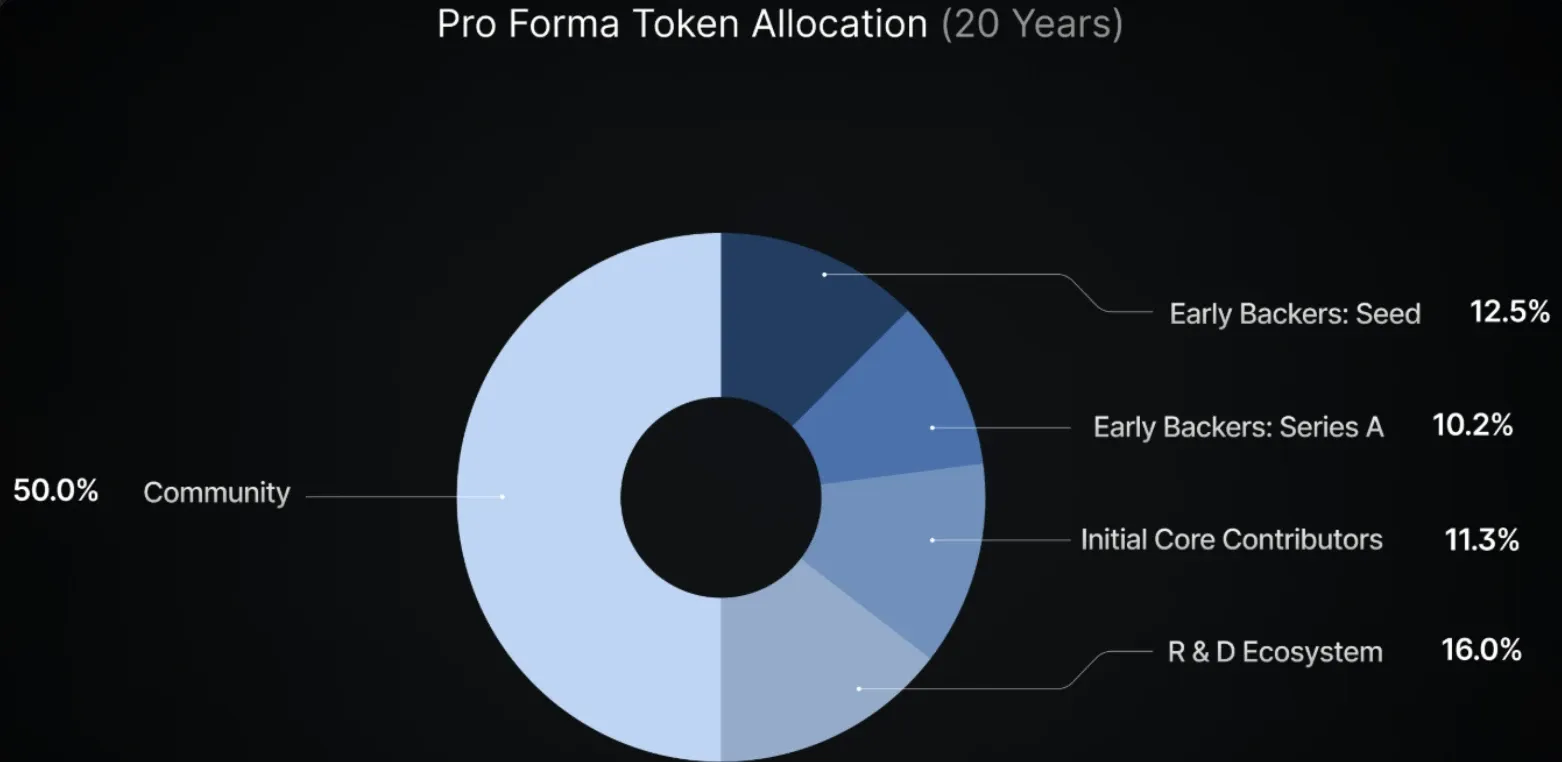

The IO token features a maximum supply cap of 800 million tokens, with the following distribution:

- Seed Investors: 12.5%

- Series A Investors: 10.2%

- Core Contributors: 11.3%

- Research & Development: 16%

- Ecosystem and Community: 50%

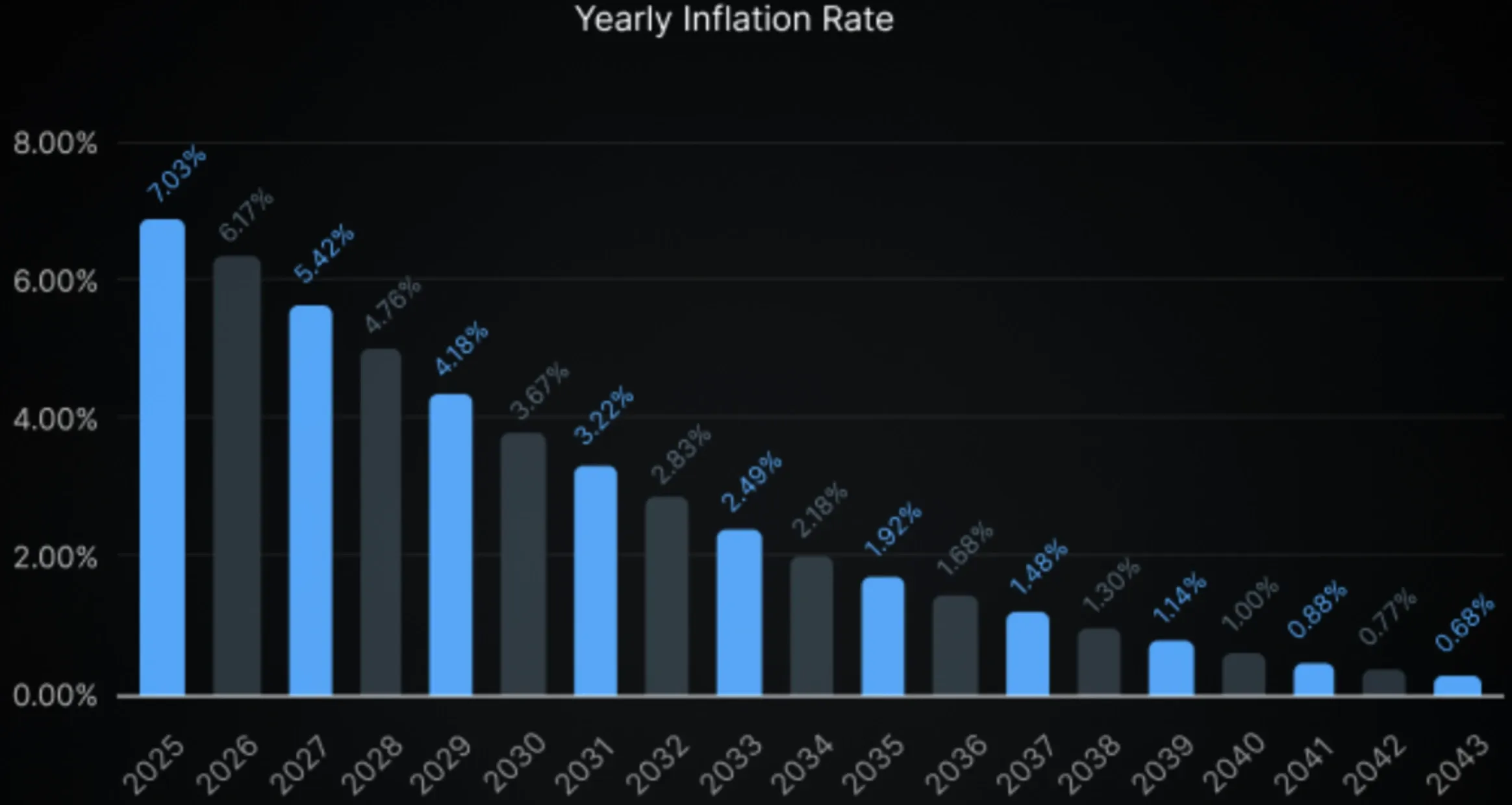

Token distribution follows a disinflationary model over 20 years, with rewards distributed hourly to suppliers and stakers. A deflationary mechanism uses network revenues to purchase and burn IO tokens, creating additional value for holders.

Recent Developments and Partnerships

IO.NET has demonstrated significant progress in 2024, achieving several key milestones, according to its official report:

- Generated $18.4 million in annual network earnings

- Improved platform reliability to over 99% cluster stability

- Reduced cluster creation time to under 1.5 minutes

- Secured partnerships with:

- Leonardo.ai and KREA for image generation

- Zerebro in the AI agent sector

- Creator.Bid on Coinbase's Base network

The platform has also shown strong community engagement, with 46 million social media impressions in October 2024 alone. The IO.NET partnership train continues, however, recently announcing collaboration with the likes of Alpha Network and Nexus.

Long-term Prospects: Opportunities and Risks

Positive Factors

- Strategic positioning in high-growth sectors (AI, DePIN, and Solana ecosystem)

- Strong institutional backing and financial resources

- Established market presence with growth potential

- Robust community support

- Sustainable tokenomics with both deflationary and long-term distribution mechanisms

- Continuous partnership and network development

Risk Considerations

- Potential market overvaluation in the Crypto AI sector

- Significant insider token allocations from VC funding

- Intense competition in the decentralized AI computing space

- Dependence on sustained product adoption

- Inherent cryptocurrency market volatility

Final Assessment

IO.NET presents a compelling value proposition in the emerging decentralized AI computing sector. The project's strong institutional backing, technical infrastructure, and strategic positioning in high-growth markets suggest potential for long-term success. However, investors should carefully consider the associated risks, including market volatility and competition within the sector.

As with any cryptocurrency investment, thorough due diligence is essential, and investors should only commit capital they can afford to lose. While IO.NET shows promise, its ultimate success will depend on maintaining sustainable growth and achieving widespread adoption of its decentralized computing solutions.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Jon Wang

Jon WangJon studied Philosophy at the University of Cambridge and has been researching cryptocurrency full-time since 2019. He started his career managing channels and creating content for Coin Bureau, before transitioning to investment research for venture capital funds, specializing in early-stage crypto investments. Jon has served on the committee for the Blockchain Society at the University of Cambridge and has studied nearly all areas of the blockchain industry, from early stage investments and altcoins, through to the macroeconomic factors influencing the sector.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens