Bubblemaps: On-Chain Analytics Tool Deep Dive

Bubblemaps visualizes blockchain data through interactive bubble maps. Review covers features, BMT token, Intel Desk, and V2 platform updates.

Crypto Rich

October 11, 2022

Table of Contents

Last revision: October 2, 2025

Bubblemaps is an on-chain analytics platform that transforms blockchain data into visual bubble maps, making it easier to spot wallet clusters, token concentration, and suspicious activity. Founded in 2021 by Nicolas Vaiman, Arnaud Droz, and Léo Pons, the platform has exposed multiple high-profile scams and now receives over one million monthly visits.

The platform has become standard infrastructure for crypto due diligence. Major outlets, such as The Financial Times and The New York Times, have cited its investigations into token manipulation and insider trading.

How Does Bubblemaps Work?

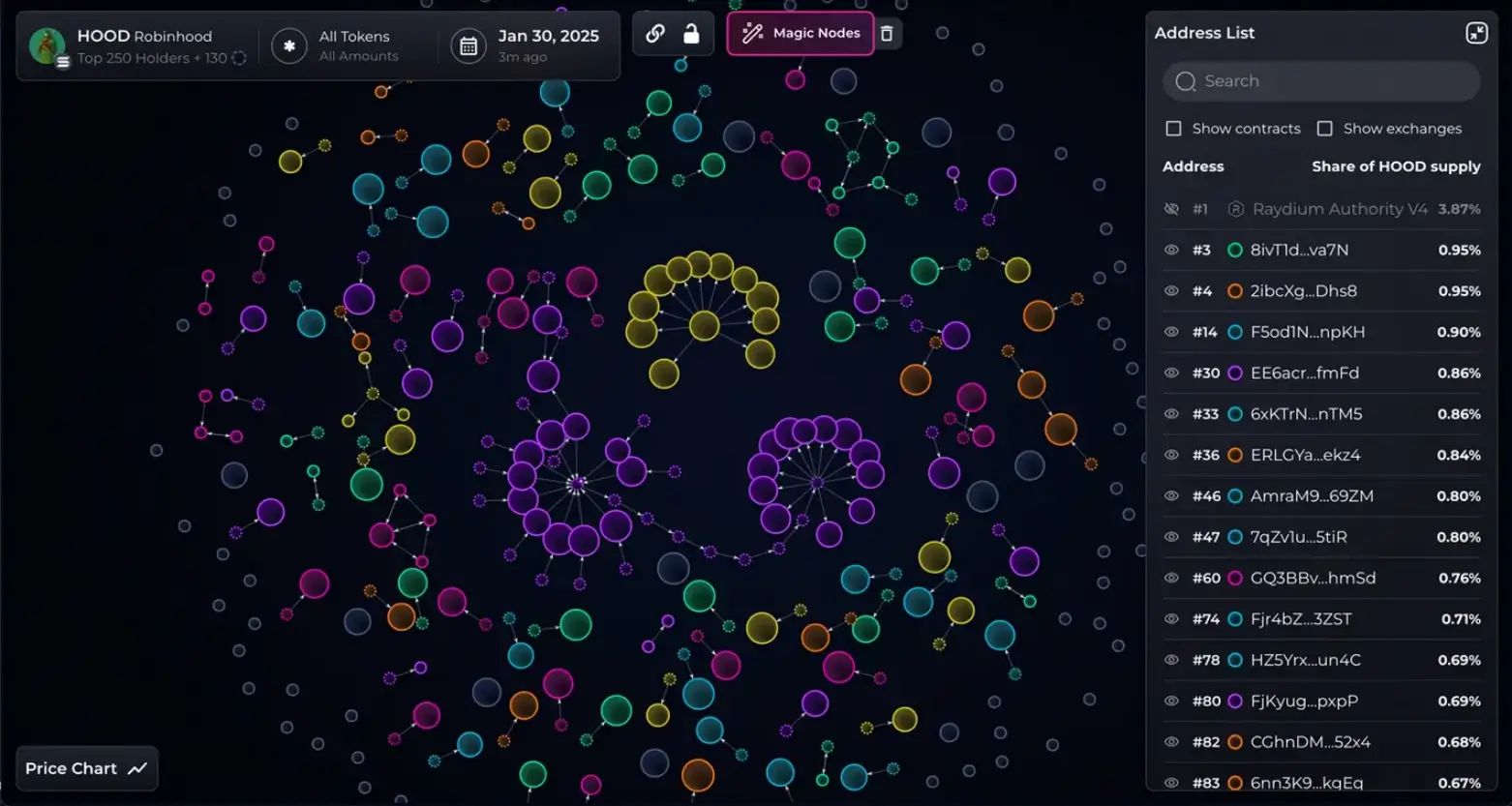

Bubblemaps converts wallet addresses and transaction data into visual representations. Each bubble represents a wallet holder, with size corresponding to the percentage of the total token supply that the wallet holds. Lines connecting bubbles show transfer history between addresses.

Search for any token by name or contract address, and Bubblemaps generates a visualization of the largest holders. Exchange wallets and smart contracts stay hidden by default to reduce clutter, though you can reveal them through the interface. Data refreshes every six hours—a balance between accuracy and computational efficiency.

As of October 2025, the platform supports ten blockchains:

Solana generates the highest investigation volume, driven by its explosive memecoin activity. The visualization works the same way across all supported chains.

What Are Magic Nodes and Time Travel Features?

Bubblemaps V2 introduced two powerful features that simplify on-chain investigation without requiring technical expertise.

Magic Nodes

Magic Nodes is Bubblemaps V2's automated wallet clustering system. One click reveals hidden connections between addresses by analyzing funding sources, transfer patterns, and historical holdings. What would traditionally take hours of manual blockchain forensics now happens instantly.

The feature proved its worth by detecting a Sybil attack on the Baby Shark token. A single entity controlled 300+ wallets that drained $10 million within minutes of launch—7% of the total supply.

Time Travel

Time Travel allows users to rewind token distribution from launch to the present, showing how holdings have changed over time. Spotting early insider accumulation or coordinated buying patterns becomes straightforward. You can adjust date ranges to focus on specific time periods.

Both features are now available in the free tier—a shift from V2's initial private beta, where they were restricted to paying users.

What Is the Intel Desk Platform?

Intel Desk is Bubblemaps' community investigation system that launched in early 2025. Users submit cases about suspicious wallets, potential scams, or questionable token launches. BMT token holders vote on which investigations the platform should prioritize.

Investigation Process

Here's how investigations work:

- Community members propose investigation targets

- BMT holders vote using their tokens

- Bubblemaps' core team leads approved investigations

- Contributors can assist with data gathering

- Results are published publicly

Bubblemaps allocated 30 million BMT tokens (3% of total supply) for distribution over one year through quarterly leaderboards. Contributors who identify scams or insider schemes earn rewards based on the impact of their investigation.

Binance partnered with Intel Desk, offering substantial BMT rewards for content creators and traders. Meanwhile, integration with trading platforms Axiom and MEVX brings investigation tools directly into active trading interfaces.

How Did Bubblemaps Evolve From Moonlight to BMT?

The project launched in April 2021 with the Moonlight token, which funded initial platform development. The visualization tool went live in September 2021. By 2022, the ecosystem had rebranded itself as Bubblemaps.

Moonlight used a hyper-deflationary model with a 7% transaction tax. Every transaction splitted the tax: 2% went to holders, 5% built liquidity pools. The total supply sat at one quadrillion tokens.

In March 2025, Bubblemaps launched BMT as a replacement token—a sharp departure from Moonlight's deflationary approach. BMT is an omnichain token deployed across Solana and BNB Chain using LayerZero's Omnichain Fungible Token (OFT) standard. This architecture allows the token to move seamlessly between chains through a burn-and-mint mechanism, maintaining a unified supply across both networks. The new token has a fixed supply of one billion units with no transaction taxes, aligning with the platform's evolving focus on governance rather than tokenomics gimmicks.

The BMT launch on March 11, 2025, generated controversy when Bubblemaps' own analytics showed 94% supply concentration in wallets connected to the deployer on Solana. The team explained that 86% of the tokens were allocated to the deployer wallet for gradual distribution to vesting contracts, with the whitepaper detailing the allocation schedules publicly. Initial circulating supply was evenly split between Solana and BNB Chain. Some users still questioned whether this contradicted the platform's mission of exposing concentrated control.

What Investigations Has Bubblemaps Completed?

Bubblemaps has exposed manipulation across multiple high-profile token launches. Here are the most significant cases:

Hawk Tuah Token

- Over 90% of HAWK supply controlled by one wallet cluster (team wallets plus connected addresses)

- Launched at $500 million market cap before collapsing to $60 million within 20 minutes

- Led to a lawsuit against token creators alleging securities violations

Uniswap Governance

- Venture capital firm a16z controlled 41.5 million UNI tokens (over 4% of supply)

- Concentration gave a16z effective veto power over governance proposals

- Contradicted Uniswap's claims of decentralized decision-making

Neiro Token

- Insiders captured 78% of the supply at launch

- Generated $4.5 million in profits while holding two-thirds of positions

- Coordinated accumulation happened before public marketing began

Daddy Token

- Insiders acquired 30% of the supply before Andrew Tate promoted the token

- Wallets held over $45 million in value at peak

- Marketing campaigns started after insider positions were established

LIBRA Token

- Marketed as a presidential memecoin with grassroots support

- Actually had 82% supply concentration in a single cluster

- Finding contradicted community narratives promoted during launch

These investigations haven't just caught individual scams—they've changed how institutional investors approach token launches. Major protocols now routinely check token distribution metrics that Bubblemaps pioneered.

What Are BMT Token Specifications and Utility?

$BMT launched on March 11, 2025, as an omnichain token with a total supply of one billion units across Solana and BNB Chain. Using LayerZero's Omnichain Fungible Token (OFT) standard, BMT can move seamlessly between chains through a burn-and-mint mechanism that maintains a unified supply. As of October 2025, the token trades with a circulating supply of approximately 450 million BMT.

Token utility includes:

- Governance voting on Intel Desk investigation priorities

- Premium analytics, including P&L computation and AI-powered cluster interpretation

- Omnichain functionality across Solana and BNB Chain via LayerZero

- Access to cross-chain analytics features

The whitepaper allocates 26.3% of the supply to ecosystem development, primarily Intel Desk investigation incentives. Additional allocations cover team vesting schedules, community rewards, liquidity provision, and strategic partnerships.

BMT trades on centralized exchanges including ByBit, Kraken, and Bitget. The token experienced significant price movement after launch before stabilizing at its current trading levels.

How Much Funding Has Bubblemaps Raised?

Bubblemaps secured approximately €3 million in seed funding in September 2023, led by INCE Capital. Participants included Stake Capital, Momentum 6, LBank Labs, and V3ntures. Notable angel investors included Nicolas Bacca (former CTO of Ledger), Dyma Budorin (CEO of Hacken), and Owen Simonin.

In 2024, the company raised an additional €3.5 million, bringing total funding to approximately €6.5 million. The investor roster expanded to include major backers: Consensys, Polygon, Avalanche, Aptos, Linea, and Fuel.

Platform statistics show over one million monthly visits. The team consists of the three co-founders plus eight members handling operations and development.

What's the Difference Between Free and Premium Access?

Bubblemaps offers both free and premium tiers to accommodate different user needs.

Free Tier

The free tier provides:

- Bubble map visualization for listed tokens across all supported chains

- Analysis of the largest holders with transfer history

- Magic Nodes functionality

- Time Travel historical analysis

- Data updates every six hours

Premium Access

Premium access includes:

- AI-powered wallet clustering and pattern interpretation

- P&L (profit and loss) computation

- Cross-chain analytics

- Bubble maps with top 1,000 holders (vs standard display)

- Intel Desk voting rights

Users holding 250 billion of (now-retired) Moonlight tokens received lifetime premium access under the legacy system. Those holding 50-200 billion Moonlight got tiered weekly credits. BMT holders now get access to premium features based on their token holdings.

No wallet connection required for basic free usage—just visit the website and search for tokens.

How Do Platform Integrations Work?

Bubblemaps appears embedded within multiple trading platforms and blockchain explorers. View a token on Etherscan, CoinGecko, or DEX Screener, and a Bubblemaps visualization can appear right in the interface.

Pump.fun lets users check token distribution before trading. Photon and BullX include bubble maps in their token analysis screens. DEX tools like DEX Screener and DEXTools integrate the visualizations directly. Trojan provides instant distribution checks before you execute trades.

OpenSea Pro shows NFT collection holder distributions and wallet relationships. This helps users spot whale accumulation or coordinated collection manipulation.

These integrations make bubble map analysis a standard step in token research rather than a separate workflow. You don't need to leave your trading platform to check distribution data.

What Are the Platform's Technical Limitations?

Supernodes—addresses with extremely high transaction volumes like exchange hot wallets—have limited functionality. You can't open full transfer tables for supernodes, and connections between two supernodes don't appear on maps. These restrictions prevent computational overload from processing millions of transactions.

Data updates occur every six hours for most tokens rather than in true real-time. Newly launched tokens may take longer to appear on their first map. The team cites computational efficiency as the reason for this trade-off.

The default visualization covers the largest holders. While this captures the vast majority of concentrated holdings for most tokens, smaller holders remain invisible. If you're investigating long-tail distribution, you'll need alternative tools.

Magic Nodes automation occasionally produces false positives when identifying wallet relationships. Legitimate transfers between unrelated parties can appear suspicious if their patterns match common indicators of manipulation.

How Does Bubblemaps Compare to Chainalysis?

Chainalysis focuses on institutional clients, law enforcement, and regulatory compliance. The firm was valued at $8.6 billion in 2022 and operates through traditional business models. IPO discussions have circulated in recent years.

Bubblemaps targets retail traders and DeFi participants with visual tools that don't require coding skills. The platform utilizes a community token model, facilitated by BMT, for governance and premium features.

Key differences:

Chainalysis offers transaction monitoring, sanctions screening, and investigative software to governments and enterprises. Pricing stays private with annual contracts.

Bubblemaps provides visual token distribution analysis, accessible to anyone with a free-tier account. Premium features require BMT token holdings.

Chainalysis investigations remain confidential for clients. Bubblemaps publishes findings publicly through Intel Desk and social media.

The platforms serve different markets with minimal overlap. Chainalysis handles regulatory compliance and law enforcement work. Bubblemaps helps traders avoid scams and evaluate token concentration before making an investment.

What Challenges Does the Platform Face?

Like any growing platform, Bubblemaps faces several ongoing challenges.

Token Launch Perception

The BMT launch, with a 94% supply concentration, created optics problems despite transparent vesting schedules. Some community members felt the launch contradicted the platform's mission, even though the team had published full allocation details in advance.

Centralization in Governance

Intel Desk introduces community voting, but the core team maintains control over investigation execution and platform development priorities. Complete decentralization remains an aspirational goal rather than an implemented reality.

Economic Sustainability

The bounty program allocates 3% of the supply over one year. Long-term sustainability depends on converting free users to premium subscribers or landing institutional contracts. Revenue model details beyond BMT token sales remain limited in public disclosures.

Competition from Emerging Tools

Multiple on-chain analytics platforms have been launched since 2023, many of which have received venture funding. Maintaining differentiation as the market matures requires continued innovation beyond visual bubble maps.

Market Volatility Impact

BMT price fluctuations affect governance participation and premium access costs for users. The token price movement from launch levels could impact the effectiveness of incentives over time.

What Does the Roadmap Include?

Near-term priorities focus on Intel Desk expansion with full bounty program activation across quarterly leaderboards. Blockchain support continues expanding—V2 launched in May 2025 with six chains and has since grown to ten by October 2025, with more Layer 2 networks planned.

AI capabilities are being developed for automated risk flagging and pattern recognition, eliminating the need for manual investigation triggering. The system would alert users to suspicious patterns as they emerge.

Institutional tools for enterprise-grade analytics are still under development. These would serve venture capital firms and protocols evaluating token launches or partnership opportunities.

The original 2022 roadmap mentioned potential staking vaults and exchange features. These haven't materialized yet—the focus has stayed on the core intelligence layer instead.

CEO Nicolas Vaiman stated during the V2 launch: "Solana proved that real-time transparency is no longer optional, it's expected. And with V2, we're scaling that experience across chains. Structured on-chain data is becoming the foundation of crypto's next financial layer."

What Should Users Watch For When Using Bubblemaps?

When analyzing tokens with Bubblemaps, certain patterns wave red flags. Here's what to look for:

Asymmetric distribution patterns

- Healthy tokenomics usually show relatively balanced bubble distributions

- Extreme asymmetry with one dominant cluster signals potential manipulation

- Concentration risk increases with severely uneven distribution

Hidden connections revealed by Magic Nodes

- Supposedly independent wallets showing coordination often indicate coordinated control

- Legitimate projects occasionally show some connections through early investor relationships

- Extensive undisclosed links raise serious red flags

Pre-launch accumulation visible through Time Travel

- Insider accumulation before public announcement often precedes rug pulls

- Early positioning creates asymmetric information advantages

- Watch for significant holdings established before marketing begins

Gradual concentration over time

- Token supply slowly moving from distributed holdings into fewer wallets

- Can indicate smart money exiting while insiders accumulate

- Suggests informed selling pressure from those in the know

Conclusion

Bubblemaps transforms blockchain data into visual bubble maps across ten blockchains. Magic Nodes identifies hidden wallet connections, while Time Travel reveals historical changes in distribution.

The BMT token launched in March 2025 to power governance voting through Intel Desk, where users propose and prioritize community investigations. High-profile cases include exposing manipulation in Hawk Tuah, Neiro, and LIBRA tokens, leading to lawsuits and regulatory discussions.

With €6.5 million in funding and over one million monthly visits, Bubblemaps has become standard infrastructure for token due diligence. The platform integrates directly into Etherscan, DEX Screener, and other widely used tools. Whether Intel Desk's community model can maintain its edge as competitors emerge will shape what comes next.

Visit bubblemaps.io to start analyzing tokens, or follow @bubblemaps on X for the latest investigations and updates.

Sources

Bubblemaps Wiki - "Official Documentation and Multichain Support".

Bubblemaps Blog - "Official Updates, Insights, and Investigations".

CryptoRank - “Funding rounds information".

CoinMarketCap - "Bubblemaps price today, BMT to USD live price, marketcap and chart".

Bitget News - "BubbleMaps Set to Launch BMT Token on March 11, 2025" (March 2025).

Binance Academy - "What Is Bubblemaps (BMT)?" (March 2025).

Read Next...

Frequently Asked Questions

What is Bubblemaps used for?

Bubblemaps visualizes token distribution across blockchain wallets using interactive bubble maps. Each bubble represents a wallet holder, with size showing their percentage of the total supply. It helps users identify concentrated ownership and suspicious transfer patterns before making an investment.

Is Bubblemaps free to use?

Yes, the free tier includes full bubble map visualization, Magic Nodes, Time Travel, and analysis of the largest holders across ten blockchains. Premium features, such as P&L computation, AI cluster interpretation, and Intel Desk voting, require BMT token holdings.

What is the BMT token for?

BMT enables governance voting on Intel Desk investigation priorities, unlocks premium analytics features, and facilitates omnichain transactions between Solana and BNB Chain via LayerZero. The token launched on March 11, 2025, with a one billion supply using the OFT standard for seamless cross-chain movement. Circulating supply is approximately 450 million tokens.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events