What Happened to Pi Network's $100M Venture Fund?

Pi Network's $100M Venture Fund invests in startups to enhance the utility of the Pi token, marking its first investment in OpenMind AGI's $20M AI robotics round.

UC Hope

August 14, 2025

Table of Contents

Pi Network's $100 million venture fund, established by the Pi Foundation, supports startups and businesses that can integrate the Pi token into practical applications, thereby expanding its utility beyond cryptocurrency mining. The fund was launched amid Pi Network's transition to its Open Network phase, where the project sought to shift from user acquisition to real-world adoption.

By allocating a percentage of the foundation's reserves in Pi tokens alongside U.S. dollars, the initiative aimed to foster innovation across various sectors, enabling portfolio companies to leverage Pi's global user base for transactions and growth. This move addressed criticisms of Pi's limited functionality after launch, positioning the token as a viable tool for embedded payments and ecosystem expansion, rather than relying solely on community mining efforts.

Speaking of investments, the protocol is yet to confirm any investment via the Venture Fund. However, recent updates have suggested that the Venture Fund is already functioning, despite no official announcement from the core team.

Why was Pi Network Ventures introduced?

The Pi Foundation, an ownerless organization responsible for the long-term development of the Pi ecosystem, introduced Pi Network Ventures on May 14, 2025. The fund totals $100 million, funded through a combination of Pi tokens and U.S. dollars. Specifically, the Pi tokens come from 10% of the foundation's reserves. This structure enables the fund to support investments in both cryptocurrencies and traditional fiat currencies.

The fund operates independently but aligns with Pi Network's goals. Pi Network, a mobile-based cryptocurrency project, has built a user base of tens of millions across more than 200 countries, including over 19 million users who have completed the Know Your Customer (KYC) verification process. Portfolio companies backed by the fund may gain access to this user base, potentially integrating Pi as a transactional layer in their operations.

Investment Focus and Application Process

Pi Network Ventures targets startups and businesses at various stages, from early-stage to Series B and beyond. The fund prioritizes high-quality projects that can drive innovation and increase the real-world utility of the Pi token. Key sectors include blockchain and Web3 utilities, generative AI and AI applications, FinTech, embedded payments, e-commerce platforms, marketplaces, social networks, and real-world consumer or enterprise applications.

Investments are not limited to cryptocurrency-related projects. Instead, the fund seeks opportunities where Pi can serve as a payment or transactional tool, enhancing its adoption outside the crypto space. The fund follows standard Silicon Valley venture capital practices for sourcing, vetting, and selecting investments. Entrepreneurs interested in funding can apply through a Google Form available on the official Pi Network site.

“Pi Network Ventures’ investment processes are intended to mirror the practices of traditional Silicon Valley venture capital firms with respect to sourcing, selection, vetting processes, and more, designed to identify and support high-impact and disruptive startups and businesses,” Pi Ventures' Mission reads.

Notably, the fund is not required to deploy the entire $100 million. Decisions on investments occur over time, based on the quality of applications received. This approach ensures that capital is allocated only to projects that meet the fund's criteria.

Pi Venture Fund: The Story so Far?

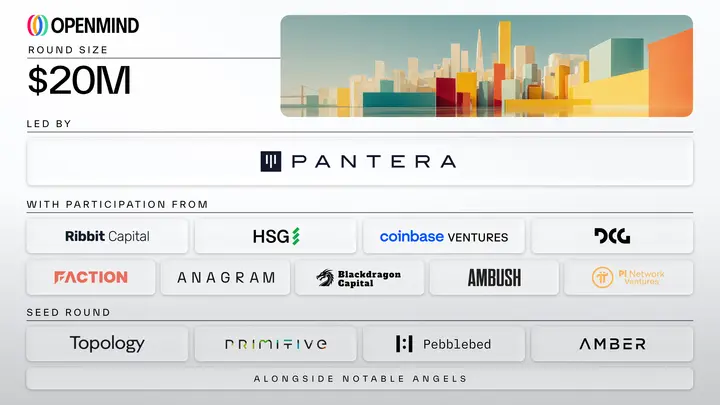

On August 5, 2025, several sources reported that Pi Venture Fund participated in a $20 million funding round for OpenMind AGI, a startup specializing in robotics and artificial intelligence infrastructure. The round, which was announced by the platform on August 4, was led by Pantera Capital, with additional investors including Coinbase Ventures, Ribbit Capital, and Sequoia China. The exact amount contributed by Pi Network Ventures has not been publicly specified.

OpenMind AGI develops technologies for humanoid robots. Its key products include OM1, a universal operating system designed for robots, and the FABRIC protocol, which builds trust, secures identity, and enables real-time cooperation among intelligent machines. This investment fits Pi Network's strategy to expand into AI and robotics ecosystems. Potential applications for the Pi token in these areas include self-driving cars, elder care, smart manufacturing, and logistics, where secure and efficient transactions are needed.

The involvement in OpenMind AGI marks the fund's entry into decentralized robotics infrastructure. By supporting such projects, Pi Network Ventures aims to position the Pi token for use in emerging technologies that require reliable, blockchain-based systems for identity and collaboration.

How the Community Reacted to the Investment

Within the Pi Network community, often referred to as Pioneers, the investment in OpenMind AGI has sparked mixed reactions. Some users have expressed concerns that this move diverts resources and attention from the core development of the Pi Network itself. Discussions on platforms like X and Reddit highlight worries that the fund's activities might delay progress on essential network features, such as Mainnet enhancements or broader token utility.

These concerns stem from the project's history. Pi Network, launched in 2019, has focused on mobile mining and building a large user base without energy-intensive proof-of-work mechanisms. Pioneers, who mine Pi through a mobile app, anticipate greater functionality and value from the token. The venture fund's external investments, while intended to boost ecosystem growth, have led some to question priorities.

While some pioneers were critical, the majority were excited by the protocol’s idea to invest in the AI firm. Despite these discussions, no official confirmation from the Pi Foundation about the investment has been issued as of August 14, 2025.

Final Thoughts

Although the participation in OpenMind AGI's $20 million funding round has not been announced through official Pi Network channels such as @PiCoreTeam posts or its blog, the fund maintains its activity. It continues to accept applications from entrepreneurs via a Google Form on the official site, evaluating submissions based on standard venture capital criteria to select high-quality projects.

The fund's capabilities encompass deploying capital, granting portfolio companies access to Pi's user base of tens of millions across over 200 countries, and targeting sectors like blockchain utilities, generative AI, FinTech, gaming, and e-commerce to support token integration and network growth.

In the meantime, users expect the Fund to shift its focus towards Pi ecosystem development. For now, BSCN will continue to monitor the innovation, as we expect further developments in the blockchain industry.

Sources

- Pi Network Official Blog - Launch Announcement: https://minepi.com/blog/pi-network-ventures

- Pioneers Question OpenMind AGI Funding: https://beincrypto.com/pi-core-team-investment-openmind/

- Pi Network X Account: https://x.com/PiCoreTeam

Read Next...

Frequently Asked Questions

What is Pi Network Ventures?

Pi Network Ventures is a $100 million fund launched by the Pi Foundation on May 14, 2025, to invest in startups and businesses that can enhance the utility of the Pi token across various sectors, including AI, FinTech, and e-commerce.

What was Pi Network Ventures' first investment?

According to various reports, the fund participated in a $20 million funding round for OpenMind AGI on August 5, 2025, with a focus on robotics infrastructure, including the OM1 operating system and the FABRIC protocol.

Are there any other investments by Pi Network Ventures?

As of August 14, 2025, no other investments have been publicly announced or reported by official or third-party sources.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens