Perpetual Trading on Decentralized Exchanges: No KYC, Full Custody of Your Funds

Discover the growth of perpetual DEXs, their advantages, and their role in DeFi. Learn about gasless trading, leverage, and full fund custody.

BSCN

January 24, 2025

Table of Contents

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCNews. The information provided in this article is for educational and informational purposes only and should not be construed as investment advice. BSCNews assumes no responsibility for any investment decisions made based on the information provided in this article.

We recently looked carefully at the CoinGecko 2024 Industry Report and found the numbers to be very impressive. Perpetual DEXs are growing at an astonishingly fast pace and this has greatly surprised many people. This large growth has a clear cause: a meaningful number of people use perpetual decentralized exchanges, even though a large portion do not completely comprehend perpetual trading in decentralized finance or its importance.

In this article, we'll explore perpetual trading, explain its key benefits, and explore its important role within the DeFi ecosystem. We'll also examine the current state of perpetual DEXs and how they're shaping up in today's market.

So, let’s dive in!

What is Perpetual Trading?

Perpetual trading uses perpetual futures contracts, also known as perpetual trading, to let traders trade, such as Bitcoin or Ethereum, without owning the asset.

Their difference from regular futures contracts is that these contracts do not have an expiration date; therefore, one can hold a specific number of them indefinitely.

Cryptocurrency perpetual trading's popularity has increased considerably because it offers large flexibility and frequently exhibits higher liquidity, thus easing faster trade execution. In addition, leverage is permitted, enabling the multiplication of potential profits; however, a commensurate increase in risks is also experienced.

Perpetual trading offers people a method to trade on at least some price movements without the inconvenience of acquiring or divesting themselves of the underlying asset.

What Benefits Does Perpetual Trading Bring to the Table

Perpetual trading offers important advantages, and its popularity has been increasing lately.

The absence of an expiration date is considered one of the most important advantages of perpetual swaps. Traders can maintain their positions for any length of time without the concern of rolling over or closing their contracts at a predetermined time.

Perpetual trading employs a funding rate mechanism to adjust the futures price with the actual price of at least one underlying asset. The funding rate is paid by one party in the trade to the other party; the magnitude of this payment is determined by the large price differential between the two sides, thus guaranteeing a perpetually balanced market.

Perpetual futures contracts enable traders to use leverage, thus permitting them to manage considerably larger positions with a substantially reduced initial capital investment. Increased leverage can substantially increase profits by a large amount; however, it is important to remember that leverage can also increase losses by a meaningful degree, therefore, careful risk management is necessary.

A minimum margin balance is required to be maintained by traders for the purpose of keeping their positions active in risk management. A balance that falls considerably below this level will trigger an automatic liquidation of the position to substantially reduce additional losses.

How The True Trade Platform is Revolutionizing Perpetual Trading in Decentralized Finance

Perpetual trading in decentralized finance (DeFi) refers to the use of perpetual futures contracts within blockchain-based platforms. These contracts enable traders to speculate on the price movements of various assets without actually owning them.

Perpetual trading has quickly become one of the most popular tools in DeFi, especially on decentralized exchanges (DEXs) that support derivatives. And it's no surprise—when you combine the benefits of both, the result is a space that's full of potential and excitement.

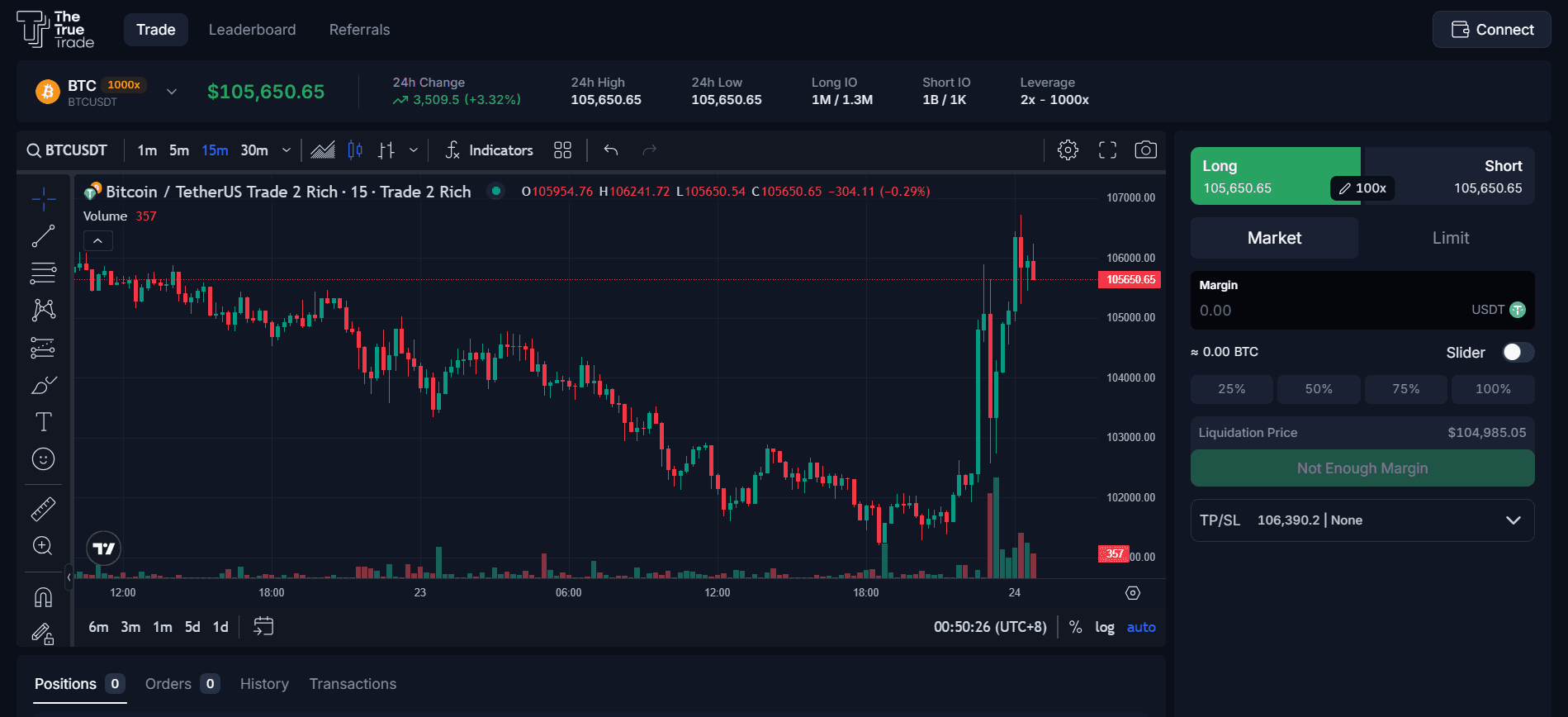

To give you a clearer picture, let's take The True Trade as an example. It's a decentralized exchange built on the BNB Chain, specifically designed for perpetual trading.

The True Trade is a great demonstration of how perpetual contracts and DeFi come together to deliver something remarkable. It offers a trading experience that's both simple and powerful, making it perfect for beginners while also meeting the needs of advanced traders.

One of its standout features is gasless trading. Users don't have to worry about transaction fees or gas costs, which makes it a cost-efficient solution for on-chain trading. On top of that, the platform allows quick and private onboarding without any KYC requirements, so users can start trading almost instantly.

Further, the platform also offers high leverage, going up to 1001x, allowing traders to take advantage of market movements with amplified positions. It also features minimal fees, ensuring higher profitability for traders, along with deep liquidity to support smooth and high-volume trades.

The platform adds even more flexibility by offering up or down trading, which lets users predict short-term price movements for assets like Bitcoin, Ethereum, and Solana. And, of course, all of this comes with the added peace of mind that you retain full custody of your funds throughout the entire trading process.

Collaborations with industry leaders like Chainlink, TradingView, and BNB Chain are powering The True Trade’s innovation and scalability, ensuring a top-tier trading experience.

So, the combination of perpetual contracts and DeFi features makes The True Trade an excellent example of what's possible in this space. And if you don't believe it, let's look at the current state of perpetual DEXs.

The Current State of Perpetual DEXs

Related to the current state of perpetual DEXs, the year 2024 shows just how far these platforms have come. While decentralized trading has always had its perks, like more user control and better security, this year, we're seeing explosive growth that's catching everyone's attention.

Looking at data from CoinGecko's 2024 Industry Report, the numbers are hard to ignore. Trading volume on the top 10 perpetual DEXs hit a massive $1.5 trillion, more than doubled in 2023 ($647.6 billion). This marks a huge 138% increase from the previous year, with Q4 alone accounting for nearly $500 billion. This shows a huge shift towards decentralized trading as these platforms offer better transparency and more user control.

And the growth isn't just in volume—open interest, which is another key metric, also skyrocketed. By the end of December, it hit an all-time high of $6.7 billion, closing the year at $4.8 billion. That's a 333% jump since January, with over 100% of that growth happening in just the last quarter of the year. This clearly shows that more and more traders are flocking to perpetual DEXs as they look for decentralized alternatives to centralized exchanges.

If you wonder, "Why is this happening?" the best answer is because perpetual DEXs offer something that traditional platforms don't. They give users full control of their funds, eliminating the risks of hacks or platform mismanagement that can come with centralized exchanges. Plus, with perpetual contracts—where traders can speculate without worrying about a contract's expiration—these platforms are perfectly suited for the fast-moving, 24/7 nature of crypto markets.

Conclusion

So, as the DeFi space grows, it's clear that perpetual DEXs are here to stay. They're setting new standards for security, user control, and liquidity while offering a more transparent way to trade.

The massive growth in both trading volume and open interest shows that decentralized perpetual trading isn't just a trend; it's quickly becoming the future of crypto trading.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

BSCN

BSCNBSCN's dedicated writing team brings over 41 years of combined experience in cryptocurrency research and analysis. Our writers hold diverse academic qualifications spanning Physics, Mathematics, and Philosophy from leading institutions including Oxford and Cambridge. While united by their passion for cryptocurrency and blockchain technology, the team's professional backgrounds are equally diverse, including former venture capital investors, startup founders, and active traders.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens