Elixir Tokenomics and Airdrop Distribution: What We Know

Elixir has launched the ELX airdrop eligibility checker and revealed the official tokenomics, making waves in the crypto space.OK

Soumen Datta

March 6, 2025

Table of Contents

Elixir, an emerging network designed to integrate traditional financial institutions with decentralized finance (DeFi), announces to launch its ELX token along with the highly anticipated airdrop. With significant backing and a strong focus on community involvement, the project aims to redefine the DeFi landscape.

The $ELX eligibility checker is live

— Elixir (@elixir) March 5, 2025

Users, community members, and select DeFi power users can now view their allocation:https://t.co/EZ0A1ev0Fn pic.twitter.com/66NwUk8I1C

Here’s an in-depth look at the tokenomics, airdrop distribution, and what participants can expect moving forward.

What is Elixir and ELX Token?

Elixir is a purpose-built blockchain network designed to bring institutional liquidity to DeFi. Through deUSD, a synthetic dollar, Elixir connects traditional financial institutions like BlackRock, Hamilton Lane, and Apollo to the DeFi ecosystem. The network is secured by over 30,000 global validators and promises high-throughput infrastructure for future applications.

The native utility token of the Elixir ecosystem, ELX, is designed to power governance, network validation, and secure consensus. The token allows holders to participate in shaping the future of the network, further solidifying its community-driven approach.

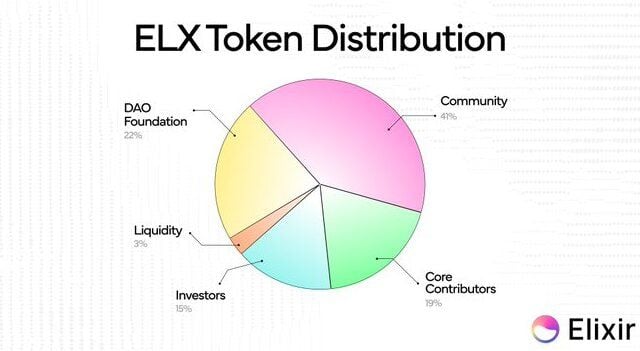

Tokenomics Breakdown

The Elixir tokenomics revolves around a carefully crafted distribution plan that ensures the project remains secure and sustainable. The total supply of ELX tokens has been allocated across different segments to incentivize various participants and foster growth.

Community Allocation (41%)

A substantial 41% of the ELX supply has been dedicated to the community, marking the importance of decentralized governance and network growth. This allocation includes:

- Season 1 Airdrop (8%): A portion of the tokens is distributed through an initial airdrop to early adopters and community members.

- Future Airdrops and LP Incentives (21%): To maintain community engagement and support liquidity providers, a significant share is allocated for future airdrops and incentives.

- Public Network Security Rewards (12%): ELX holders can participate in network staking, earning rewards for securing the network. These tokens are reserved for delegators and stakers.

Importantly, locked tokens cannot participate in staking, limiting the immediate impact of early allocations on the market.

DAO Foundation Allocation (22%)

The DAO foundation allocation accounts for 22% of the total token supply. These tokens are dedicated to supporting ecological donations, future ecosystem development, and rewards for projects contributing to the Elixir ecosystem.

Liquidity Allocation (3%)

To ensure sufficient liquidity on both centralized (CEX) and decentralized (DEX) exchanges, 3% of the total supply is reserved for market makers and liquidity providers.

Early Investor Allocation (15%)

The early investor allocation comprises 15% of the total ELX supply. These investors have provided crucial financial backing during the network’s development phase, spanning over three years.

Core Contributor Allocation (19%)

To incentivize the teams behind Elixir's development and future hires, 19% of the token supply has been allocated to core contributors. These tokens will be distributed to individuals who have played a role in shaping the Elixir ecosystem.

Airdrop Distribution and Eligibility

Elixir has created a unique approach to airdrop distribution, with over 40% of the total ELX supply allocated for the community. The first round of the airdrop has already been distributed, with tokens primarily going to Apothecary potion holders—early supporters of the Elixir ecosystem. The breakdown of the airdrop includes:

- Apothecary Potion Holders: 7% of the total supply has been distributed to Apothecary potion holders, a key group in Elixir’s early stages.

- Community Contributors: A portion (0.4%) was allocated to community members who contributed to the project, including those in special groups like Cult OGs, private cult members, and Discord role holders.

- Validators: Early testnet users who connected their validator to the Apothecary were rewarded with 0.25% of the token supply.

- DeFi Stablecoin Power Users: Another 0.25% went to users with significant interaction with stablecoins in DeFi.

Special boosts were applied to specific community groups, with Dewhales and Turtle Club members receiving a 20% boost to their allocation, while other community members received a 10% referral boost.

Importantly, Elixir took a snapshot of Total Value Locked (TVL) in the protocol on February 28th, granting a 30% boost to users who had funds in the protocol on that date. To ensure a fair distribution, a hard cutoff was applied, with a minimum of 37.5 ELX required to receive an allocation.

How to Check Your Airdrop Eligibility

To check your eligibility for the ELX airdrop, visit the Elixir eligibility checker and connect your EVM wallet. If you qualify, you will be able to claim your tokens directly once the distribution is live.

Airdrop recipients are automatically delegated to an Elixir Foundation validator. However, users can withdraw their tokens at any time or manage their delegation through the platform. After the initial three-month network stability phase, users can redelegate their tokens to other validators. A special "OG" status will be granted to those who remain delegated during the stability phase, earning higher staking rewards.

The Network Stability Phase and Rewards

Elixir’s network stability phase lasts for three months, during which time users who remain delegated will earn additional rewards. These rewards are designed to encourage long-term participation and network stability. By the end of the stability phase, users who remained delegated will have doubled their initial airdrop allocation.

- Reward Mechanism: Rewards are distributed in real-time during the stability phase, and users can withdraw their delegated ELX tokens at any time, keeping the emissions earned so far.

- No Cooldown for Airdrop Recipients: Unlike typical staking, airdrop recipients are exempt from the usual 7-day withdrawal cooldown period.

Once the stability phase concludes, these users will be granted accelerated staking rewards, boosting their validator staking rate under the “OG” program.

Future Outlook: Elixir and deUSD

One of the most exciting aspects of Elixir’s network is its focus on deUSD, a fully collateralized, yield-bearing synthetic dollar. This innovation allows traditional financial institutions to engage with DeFi without changing their asset exposure. With major institutions like BlackRock, Hamilton Lane, and Apollo backing the project, deUSD serves as a gateway for Real-World Assets (RWAs) to flow into the crypto economy.

Per reports, Elixir’s high-throughput infrastructure also supports liquidity for decentralized exchanges (DEXs), giving it a promising future in the DeFi space. The network’s modular structure enables seamless integration with centralized finance (CeFi) and decentralized finance (DeFi), increasing its adaptability across the crypto ecosystem.

The Role of ELX in Governance

ELX is not just a utility token; it is also the governance token of the Elixir network. Token holders will have the power to propose and vote on key decisions affecting the ecosystem. From shaping the future direction of the project to deciding on fees and governance structures, ELX holders will have significant influence over the network’s evolution.

Post-mainnet, Elixir plans to transition to full decentralization, with community-led governance running the ecosystem. Validators, stakers, and other participants will help guide the future of the Elixir network.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens