What is MYX Finance: Exploring the Perpetual DEX Powered by MPM Trading Engine

MYX Finance is a decentralized perpetual exchange using MPM for zero-slippage USDC-margined futures trading with up to 50x leverage on EVM chains.

UC Hope

November 28, 2025

Table of Contents

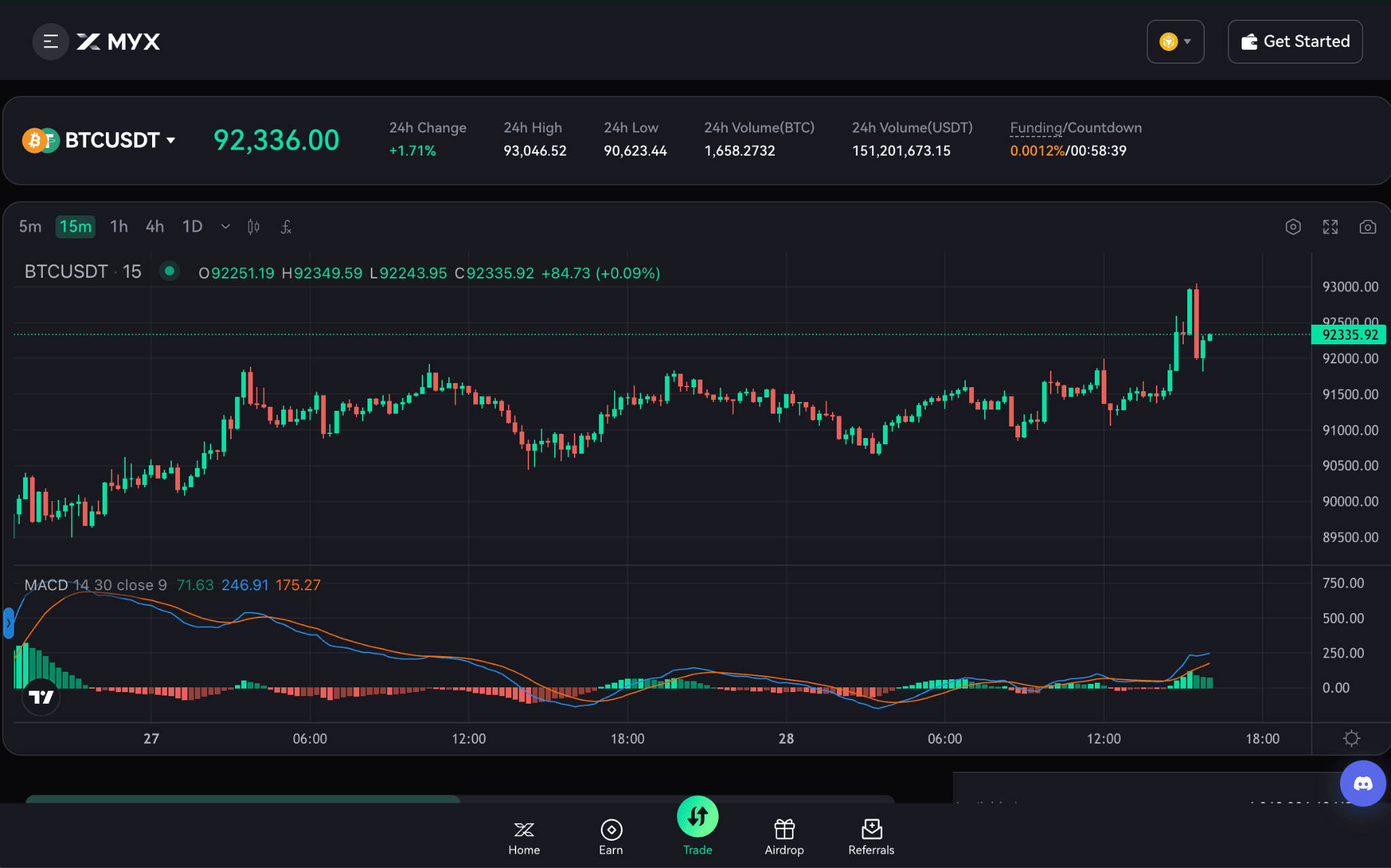

Perpetual decentralized exchanges continue to expand within the blockchain industry, according to market analytics published in 2025, and on-chain derivatives have attracted traders who prefer transparent execution. MYX Finance is one of the protocols supporting this shift. It offers a perpetual trading environment that uses the Matching Pool Mechanism to pair long and short positions at the index price. This system seeks to reduce slippage and improve capital efficiency for active traders.

In reviewing the platform, several features stand out in practice. The trading portal provides a clear layout for monitoring positions and adjusting leverage, and test interactions with the interface confirm that trades execute without repeated wallet confirmations. These traits improve usability for participants who place frequent orders.

This article explains how the protocol operates and draws on protocol documentation, observable on-chain behavior, and user-reported experiences to provide a balanced view of its capabilities and limitations.

What is MYX Protocol?

The MYX Protocol is the smart contract framework that enables perpetual trading within the MYX ecosystem. Users deposit USDC as collateral to open long or short positions across supported pairs, and the contracts remain active as long as margin requirements are maintained. According to the protocol documentation, these operations occur entirely on-chain and are open to public review, supporting transparency for traders who want verifiable execution.

The protocol provides cross-chain functionality that allows collateral to be deposited on one EVM network and used for trading on another. This is achieved through margin bridging, which is handled by the keeper network. In practice, this design reduces the need to move assets when trading across networks manually. Users should remain aware that cross-chain activity introduces the same security considerations that affect other bridge-enabled systems.

MYX includes portals for trading, staking, and earning. The trading portal displays positions and funding rates, while the earning portal offers ways to supply liquidity to matching pools. The staking portal lets holders support keeper nodes and receive a share of protocol revenues. These components create a unified environment in which trading activity influences the network's utility and value.

The protocol has attracted backing from investors, including Sequoia, Consensys, and Hack VC, which have supported its development and expansion. Since its mainnet launch, MYX has processed increasing volumes, with daily trading activity contributing to its Total Value Locked (TVL), which stands at $23.39 million as of the latest data from DefiLlama.

What is the MYX Keeper Network?

The MYX Keeper Network functions as a permissionless execution layer, comprising community-elected nodes that process trades and maintain network integrity. Each epoch, lasting one week, selects 21 active keepers from candidates who stake at least 300,000 $MYX.

Keepers perform tasks such as monitoring new orders, uploading index prices, triggering executions, recording history, and assigning referral tiers. These duties ensure that orders are not lost or delayed, and that prices remain verifiable. In return, keepers receive gas rebates, trading fee shares, and $MYX buy-backs.

Election occurs via weekly snapshots, ranking candidates by total stake, including delegations. Delegators stake non-custodially to candidates, sharing rewards without running nodes. Stake caps prevent dominance by large holders and promote rotation.

Slashing mechanisms enforce accountability. Misbehavior, such as submitting incorrect prices, triggers on-chain proofs and DAO votes, with penalties that can burn up to 100% of stakes. Whistleblowers receive 10% of the slashed amounts.

Compared to other DEXs, the keeper network avoids single points of failure. For example, some order books rely on a single cranker, risking censorship, while rollup sequencers may introduce MEV risks. MYX's model distributes execution across 21 nodes, enhancing resilience.

How does the Matching Pool Mechanism work?

The Matching Pool Mechanism serves as the core trading engine of MYX Finance. It aggregates open long and short orders and attempts to pair them at the current index price. If a counterparty is available, the trade executes at the oracle-derived price, reducing price impact compared with automated market-making models. If no match is available, the order remains in the pool until an opposing order appears.

The mechanism aims to improve capital efficiency and reduce liquidity fragmentation. Users who tested the system during periods of moderate volatility reported that execution felt immediate, although speed can vary during shifts in pool balance or keeper activity. Because execution relies on oracle prices, traders should consider that delays in price feeds can affect the timing of liquidations.

This approach differs from centralized limit order books, which queue orders, and from RFQ models, which depend on market makers. The pool structure supports permissionless listings and allows the protocol to add new assets, including newly launched tokens, without centralized approval.

MPM enables capital efficiency of up to 125x, allowing traders to control larger positions with less collateral than on standard DEXs. For instance, with 50x leverage on a perpetual contract, a user depositing $1,000 in USDC could manage a $50,000 position. The mechanism also supports permissionless listings, allowing any EVM-compatible token to be added as a trading pair without approval from a central authority. This has led to the inclusion of niche assets, such as memecoins, which can be listed and traded shortly after their launch.

The efficiency of MPM stems from its integration with the keeper network, which handles order processing and price feeds. Oracles, including those from Chainlink, supply verifiable price data to prevent manipulation. In practice, this means liquidations occur at publicly auditable prices, reducing the risk of unfair settlements.

Components of the MYX Ecosystem

The MYX ecosystem encompasses a range of interconnected elements that support trading, governance, and liquidity provision. Central to this is the native token, $MYX, which facilitates staking, voting, and reward distribution. The ecosystem operates across multiple chains, promoting liquidity flow between them.

Partnerships play a significant role in the ecosystem. One such partnership is its integration with Alchemy Pay, which provides fiat on-ramps and enables users to purchase USDC with credit cards directly. Similarly, AEON Pay extends the $MYX utility to real-world payments at over 20 million merchants. Other collaborations include TermiX AI for natural language-based trading commands, Rhea Finance for liquidity abstraction, and Pieverse for on-chain invoice generation.

The ecosystem also includes community-driven initiatives, such as airdrops and bounty programs. Airdrops distribute tokens to active users or participants in specific campaigns, like those involving Turtle or Rhea NFTs. Bounty programs reward researchers and auditors for identifying issues in the protocol's code, with payments for critical findings.

Governance within the ecosystem occurs through a DAO structure, where $MYX holders propose and vote on changes, such as adjusting stake caps or adding new chains. This decentralized approach ensures that protocol upgrades reflect community input rather than top-down decisions.

Key Features of MYX Finance

MYX Finance offers several features that cater to traders, stakers, and liquidity providers:

Trading Features on MYX Finance

MYX Finance provides trading options centered on USDC-margined perpetual futures contracts. Users can leverage up to 50x, meaning they can amplify their positions relative to the collateral they have deposited. Positions settle based on index prices sourced from oracles, ensuring that valuations reflect real-time market data. Funding rates apply at regular intervals, typically every eight hours, to maintain a balance between long and short positions by transferring payments from one side to the other depending on market conditions.

This trading setup occurs on the platform's trade portal, where users monitor open interest, adjust positions, and execute orders. The system supports a variety of assets, including cryptocurrencies and memecoins, through permissionless listings that do not require central approval. Settlements and liquidations use verifiable oracle data to prevent disputes, with automatic deleveraging mechanisms in place for extreme market events.

Earning and Staking Mechanisms

Users on MYX Finance can generate yields through the earn and staking portals. The earn portal allows participants to supply liquidity to matching pools or engage in buy-back programs. In these programs, a share of the platform's trading fees, such as the 0.0003 average taker fee after a 3% net protocol deduction, is used to buy $MYX tokens on-chain. These tokens are then redistributed to liquidity providers and stakers, creating a revenue-sharing model.

Staking involves locking $MYX tokens to back keeper nodes in the network. Stakers earn portions of trading fees, execution rebates, and penalties from slashed stakes. Yields accumulate from multiple sources, including a 60% payout ratio on protocol revenues, and can compare to those of mid-tier proof-of-stake blockchains. Delegation options let users stake without running nodes themselves, maintaining non-custodial control over their tokens.

Airdrops and Referral Systems for User Engagement

Airdrops on MYX Finance distribute tokens to encourage participation, often tied to specific campaigns or milestones. For example, recent airdrops have included rewards for holders of Turtle or Rhea NFTs, with claims processed through the platform's interfaces. These distributions aim to reward early adopters and active users, with allocations drawn from the 11.7% of the total token supply designated for airdrops and bounties.

The referral program offers tiered incentives to boost user growth. Participants receive fee discounts and rebates based on their referral activity, with VIP levels determining reduced trading costs, such as lower maker or taker fees. Keepers ensure these tiers apply consistently across chains, verifying and assigning benefits during order processing. Referrals can include rebates on trading volumes, honored in $MYX or USDC, to incentivize network expansion.

Cross-Chain Bridge Functionality

Bridge features on the platform facilitate transfers of collateral across supported networks, including BNB Chain, Linea, and Arbitrum. This allows users to deposit USDC on one chain and use it for trading on another, with keepers handling the underlying margin deltas. The process minimizes friction by automating bridges, ensuring liquidity flows to the most active markets without silos.

Such functionality supports unified positions, where a trader might hedge across multiple chains from a single interface. Integration with protocols like Rhea Finance further abstracts liquidity, efficiently routing assets. This cross-chain capability reduces the need for manual transfers, though users should note potential risks, such as bridge exploits common in DeFi.

Seamless Key for Simplified Trading

The Seamless Key feature streamlines the trading process by removing the need for repeated wallet interactions. Users create an EVM-compatible key encrypted with a password, stored locally on their device. This key enables gas-free and signing-free transactions, with operational costs deducted in USDC based on the previous week's average gas prices.

The setup involves authorizing the key through a master wallet, often integrated with Particle Network for easy onboarding via social logins, email, or phone. The key functions as a delegated trader, supporting browser-based access without crypto wallet extensions. It remains non-custodial, as no assets are held in the key itself. Additionally, funds stay in the master wallet, which can be hardware-secured. Security measures include unique order nonces and time-limited transaction validity to prevent unauthorized use.

API Integrations for Automated Trading

One of its most significant features is API support to accommodate automated and programmatic trading strategies. Developers and professional traders can connect bots or algorithms to execute orders, monitor positions, and manage risk in real-time. The APIs provide endpoints for trade placement, price queries, and account data, compatible with standard EVM tools.

This integration suits high-frequency or quantitative setups, where strategies might involve arbitrage across chains or automated hedging. The Seamless Key can double as an API key, allowing trusted third-party systems to operate on behalf of users while maintaining control through revocation options in the master wallet. Documentation for API usage is available in the protocol's Gitbook, aiding implementation for custom applications.

$MYX Tokenomics

The $MYX token has a total supply of 1 billion, with a circulating supply of 221.1 million as of November 28, 2025.

Token Allocation Breakdown

Allocation breaks down as follows:

- 40% for ecosystem incentives, divided into two pools of 13.18% and 26.82%.

- 11.7% for airdrops and bounties.

- 17.5% for private sale investors.

- 20% for team, advisors, and contractors.

- 3% for Binance wallet future airdrops.

- 1.8% for treasury.

- 2% for public distribution.

- 4% for liquidity provisioning.

Token Utilities

Utilities include staking for keeper participation, governance voting, and earning yields from fees, buy-backs, and penalties.

What are the Recent Updates and Integrations?

The protocol has developed several integrations to expand its utility. For example, the Chainlink Data Streams integration introduced sub-second data updates that enhance price accuracy during volatile periods. According to MYX's communication channels, this upgrade improves execution precision and supports permissionless asset listings.

Additional collaborations, such as TermiX AI for natural language trading commands and Alchemy Pay for fiat on-ramps, focus on accessibility rather than core trading mechanics. These partnerships vary in scope, so users may want to evaluate their practical relevance to their own trading needs. Below is the detailed breakdown of the recent updates:

Chainlink Data Standard Integration: On October 27, 2025, MYX Finance announced its upgrade to the Chainlink data standard, incorporating Chainlink Data Streams and DataLink. This provides sub-second, low-latency market data for perpetual markets across EVM chains, improving liquidation accuracy and supporting permissionless listings with institutional-grade precision. The integration ensures verifiable oracle prices, reducing the risk of manipulation in trade executions and settlements.

TermiX AI Partnership: Announced on October 14, 2025, this strategic alliance introduces AI-powered features for decentralized trading. Users can execute on-chain operations using natural language commands, creating a more intuitive interface. This partnership aligns with MYX's goal of combining intelligence and decentralization, potentially defining future Web3 interactions.

AEON Pay Collaboration: MYX partnered with AEON Community to enable real-world payments using $MYX. Through AEON Pay, the token can be spent at over 20 million merchants globally for shopping, dining, and daily transactions. The feature is live on Telegram and major wallets, bridging Web3 with traditional commerce.

Alchemy Pay On-Ramp: The protocol’s native $MYX token became available on Alchemy Pay's on-ramp service, supporting purchases in over 50 fiat currencies via cards, bank transfers, and other methods. This enhances global accessibility and simplifies entry for new users into the MYX ecosystem.

Rhea Finance Partnership: This collaboration, highlighted in September 2025 activities, improves liquidity routing through chain-abstracted solutions. It enables efficient asset movement across networks, supporting unified trading experiences on MYX.

Pieverse Booster Campaign: On October 31, 2025, MYX joined Pieverse's Booster Campaign as part of the Timestamping Alliance. Users can issue on-chain invoices and receipts using $MYX, with Binance Wallet payments qualifying for rewards. This demonstrates token utility and offers Pieverse Points for future airdrops.

New Asset Listings

MYX Finance continues to expand its trading options with permissionless listings, adding new perpetual contracts to broaden market access. These additions respond to community demand and emerging token launches.

- $LINEA Perpetual: Listed on September 15, 2025, following Linea Build's token generation event (TGE). The LINEA/USDT pair offers up to 50x leverage, with trading starting at 14:00 UTC. This enables users to trade the asset shortly after its launch.

- $RHEA Perpetual: Added on September 12, 2025, after Rhea Finance's strong performance on Binance Alpha. The RHEA/USDT pair supports up to 50x leverage, commencing at 10:00 UTC, providing exposure to chain-abstracted liquidity solutions.

- $WLFI Perpetual: Introduced on September 5, 2025, for World Liberty Financial. The WLFI/USDT contract offers up to 50x leverage and began trading at 13:00 UTC, catering to interest in new financial protocols.

These listings leverage MYX's MPM for zero-slippage trading, allowing rapid inclusion of niche assets like memecoins post-launch.

Technical and Operational Updates

MYX has addressed technical aspects, including network operations, mobile usability, and upcoming upgrades, to improve reliability and user experience.

- Keeper Network Elections: Keeper elections for new epochs persist, with weekly rotations selecting 21 nodes based on staked $MYX. This ensures decentralized execution, with stakers earning yields of over 100% annually from fees and penalties.

- DAO Proposals and Dividends: DAO activities include proposals for dividend distributions and compensating members via revenue shares. Over 1.5 million $MYX tokens are staked in the keeper system, supporting governance and liquidation participation.

- V2 Upgrade Plans: In response to community queries on September 9, 2025, MYX clarified that the current open-source code is V1, with V2 scheduled for release after the audit. This upgrade will expand the codebase, flexibility, stability, and asset support.

Awards and Market Recognitions

MYX has received accolades that validate its performance in the DeFi space.

- BNB Chain Awards: On September 8, 2025, MYX won first place in the Volume Powerhouse category at the BNB Chain Annual Awards, recognizing its $95 billion cumulative trading volume. This followed over 600,000 votes and highlights its role among builders like Superp and PancakeSwap.

- Binance Alpha Top Performer: Binance Wallet ranked $MYX as the #1 best-performing token from Alpha airdrops and TGEs, underscoring its market gains and community strength.

- Kraken Listing: Confirmed on October 13, 2025, $MYX's listing on Kraken expands global liquidity and accessibility on a significant exchange.

Risks and Considerations

Although MYX Finance offers several strengths, users should consider the following risks before engaging with the protocol.

Leverage and Liquidation Risk

Perpetual contracts involve significant volatility. High leverage can amplify gains but also increases the chance of rapid liquidation. Users should evaluate their own risk tolerance before opening prominent positions.

Oracle and Price Feed Delays

Trades and liquidations rely on Oracle data. Any delay in price updates can affect the timing and accuracy of settlements. This is a risk that applies to many DeFi protocols that use external data sources.

Cross-Chain Security Considerations

Collateral bridging across EVM chains creates additional exposure. Bridge exploits remain a known risk within decentralized finance. Users who trade across chains should understand the security assumptions of the bridging layer.

Keeper Network Reliability

The keeper network processes orders and uploads price data. Although the network includes slashing and rotation mechanisms, the possibility of temporary disruptions or coordination failures cannot be fully eliminated.

Smart Contract Vulnerabilities

All on-chain systems carry smart contract risk. Users benefit from reviewing audit information when available and should allocate capital only to investments they are prepared to lose.

Conclusion

MYX Finance offers a structured approach to on-chain perpetual trading through its Matching Pool Mechanism, Keeper Network, and cross-chain margin system. These elements create an environment that aims to provide transparent execution and accessible leverage for traders who prefer decentralization. The protocol also continues to expand its ecosystem through partnerships, integrations, and permissionless asset listings, which suggests an effort to support a broader range of trading strategies and user profiles.

Users should recognize that these strengths operate alongside common risks in decentralized derivatives markets. Leverage, oracle latency, cross-chain activity, and smart contract exposure all require careful consideration. A clear understanding of these factors can help traders evaluate whether MYX suits their objectives and risk tolerance.

For individuals seeking on-chain exposure with publicly auditable transactions and a focus on capital efficiency, MYX Finance offers a platform that merits further exploration. The value it provides ultimately depends on how users balance its technical capabilities with the operational and market risks that accompany all forms of decentralized trading.

Sources

- DefiLlama: MYX Finance Information, TVL, Perps Volume, and key statistics

- Gitbook: MYX Protocol overview

- Coinmarketcap: $MYX Token insights

- Medium Article: The MYX Keeper Network Explained

- X Posts: Recent Partnerships and Integrations

- Medium Article: MYX Finance Integrates the Chainlink Data Standard

Read Next...

Frequently Asked Questions

What is the Matching Pool Mechanism in MYX Finance?

The Matching Pool Mechanism (MPM) in MYX Finance pools and matches long and short orders in real-time to eliminate slippage, using oracle-provided prices for executions and supporting leverage up to 50x on USDC-margined perpetuals.

How does the MYX Keeper Network function?

The MYX Keeper Network elects 21 nodes weekly based on staked $ MYX. Keepers handle order processing, price uploads, and executions, earning fees and buybacks while facing slashing for misbehavior to ensure fair trading.

What are the tokenomics of $MYX?

$MYX has a total supply of 1 billion, with 221.1 million circulating, allocated across ecosystem incentives (40%), private sales (17.5%), team (20%), and others. It unlocks gradually and provides utility through staking, governance, and yields from protocol revenues.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events