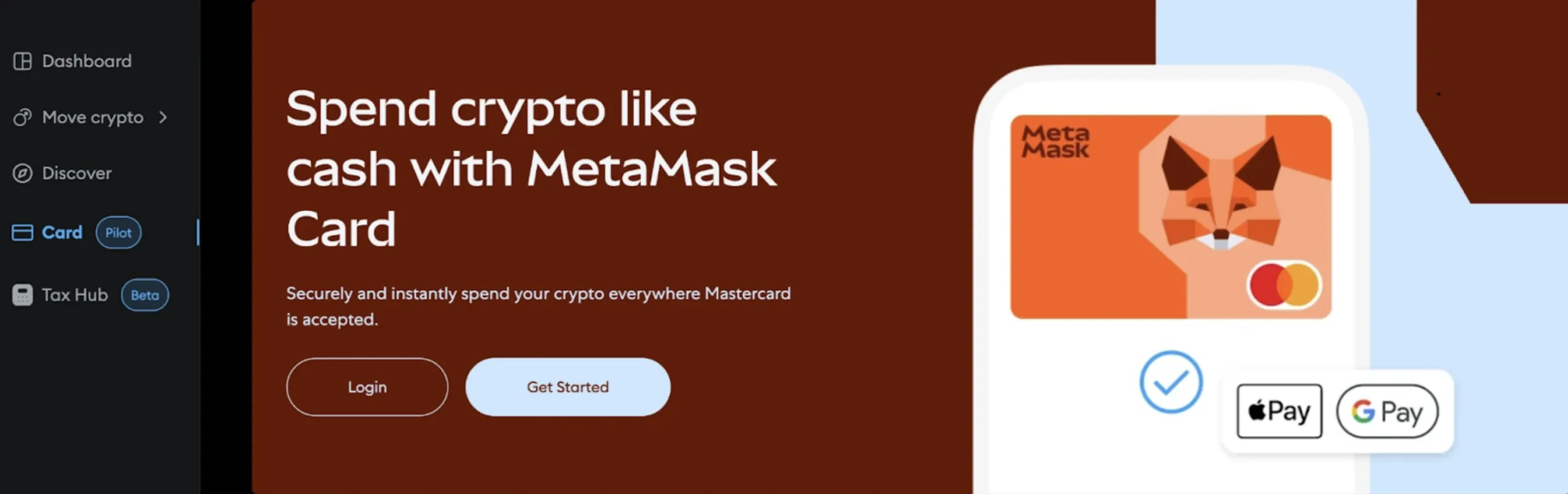

MetaMask Card: What Is It and How Does It Work?

The MetaMask Card lets users spend crypto directly from their wallet anywhere Mastercard is accepted. Learn how it works and its key features.

Soumen Datta

March 24, 2025

Table of Contents

Cryptocurrency has taken another step toward everyday usability by introducing crypto debit cards. MetaMask, a leading self-custodial wallet, has introduced the MetaMask Card. This new debit card allows users to spend crypto directly from their wallet anywhere Mastercard is accepted. Designed as part of MetaMask’s mission to improve the Web3 experience, the card bridges blockchain technology with the convenience of traditional financial systems. But how does it work, and what do you need to know? Here's a breakdown.

A New Way to Use Crypto in Daily Life

The MetaMask Card is a debit card created in collaboration with Mastercard and Baanx. It allows users to spend their cryptocurrency directly without converting it to fiat currency through centralized exchanges. Linked to your MetaMask wallet, the card connects to the Mastercard network, which operates in over 210 countries and territories. Whether you're paying for groceries, dining out, or shopping online, this card provides a seamless way to use crypto without waiting for bank transfers or dealing with intermediaries.

Currently in a pilot phase, the card is available in the U.S. (excluding New York and Vermont) and in regions like the UK, EU, Brazil, Mexico, Switzerland, and Colombia, with plans for broader rollouts.

How It Works

The MetaMask Card simplifies crypto spending while maintaining user control over funds. Here’s how the process unfolds:

1. Pass KYC and Link Your Wallet

To start, users must register and complete a Know Your Customer (KYC) verification process. This ensures regulatory compliance and identity verification. Once KYC is approved, you’ll receive a virtual version of the card, ready for use. Go ahead and link the card to a designated MetaMask wallet address. For added security, connecting the card to a dedicated hardware wallet is recommended.

2. Fund Your Wallet on Linea

The card currently uses the Linea network, a layer-2 Ethereum scaling solution designed for faster and cheaper transactions. Users in the U.S. can fund the card with USDC, while other regions also support USDT and wETH. Funding the card requires bridging crypto to the Linea network using the MetaMask Portfolio bridge tool. For instance, you can exchange ETH on Ethereum for USDC on Linea in just a few clicks. To make onboarding even smoother, MetaMask provides $1.00 worth of ETH to cover initial fees on Linea.

3. Set a Spending Limit

The MetaMask Card includes a spending cap feature, which gives users control over how much of their wallet balance the card can access at any time. The spending cap acts as an on-chain approval granted to Baanx, the payment processor. You can set a specific amount, such as $500, or choose unlimited access. Once the cap is reached, the card will stop authorizing transactions unless the limit is raised, which requires paying a small gas fee.

4. Pay Anywhere Mastercard Is Accepted

After setup, the MetaMask Card functions like any other debit card. It is available as a sleek metal card and can also be added to digital wallets like Apple Wallet for contactless payments. Each transaction incurs a minimal gas fee on the Linea network, often less than a cent. Users also earn 1% cashback on eligible purchases, adding an extra incentive to use the card regularly.

Why It’s Important

The MetaMask Card tackles one of crypto’s biggest challenges: ease of use in real-world applications. Traditionally, spending crypto required off-ramping through centralized exchanges, incurring fees and delays. Now, users can skip that process and pay directly with their digital assets.

This innovation aligns with MetaMask’s push to make Web3 more accessible. By partnering with Mastercard, the card offers a practical tool that integrates cryptocurrency into daily routines. Baanx’s Chief Commercial Officer, Simon Jones, described the card as “a step toward non-custodial neobanking”. It’s a significant move to bring cryptocurrency closer to mainstream adoption.

Keeping Your Funds Safe

Although the MetaMask Card is designed to be simple, it’s still part of the Web3 ecosystem, and security remains critical. Here are some key safety tips for users:

- Use a Dedicated Wallet: Link the card to a separate wallet, preferably one stored on a hardware device, to minimize risk.

- Enable Two-Factor Authentication (2FA): Add another layer of security by enabling 2FA on the card’s management platform.

- Avoid Phishing Attempts: Bookmark official MetaMask pages and be cautious with links to prevent falling victim to scams.

- Monitor Spending Limits: Regularly review and adjust your spending cap to ensure your funds are protected.

MetaMask emphasizes that users retain full control over their wallet keys, ensuring true self-custody even when using the card.

How to Get the MetaMask Card

To apply for the card, visit MetaMask’s official website and sign up, or join the waitlist if it’s currently unavailable in your region. Since the process involves KYC verification, be prepared with identity documents for approval.

The MetaMask Card is primarily available as a virtual card during the pilot phase. However, MetaMask has introduced a Metal Card, a premium physical card option. To get this physical card, users must join a waitlist and order it separately when it becomes available. The card is still in the pre-launch phase, with limited availability expected soon for eligible users who have completed KYC and already have the virtual card.

What’s Next for the MetaMask Card?

The MetaMask Card is currently in its early stages, but future plans include support for additional blockchains and more cryptocurrency options beyond USDC, USDT, and wETH. MetaMask’s roadmap also highlights improvements to Web3 usability, such as native Bitcoin and Solana support, enhanced user interfaces, and advanced features like gas abstraction for more flexible payment options.

With a near-perfect transaction success rate achieved through Smart Transactions, MetaMask is doubling down on its commitment to making decentralized tools both reliable and user-friendly.

Final Thoughts

The MetaMask Card is a step toward integrating cryptocurrency into everyday life. By combining the security of self-custody with Mastercard’s global reach, it eliminates many barriers that have kept crypto from being practical for daily transactions.

Crypto debit cards have the potential to become an essential tool for crypto users around the world. Whether you’re a seasoned enthusiast or just starting out, the MetaMask Card opens up new possibilities for spending digital assets effortlessly.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens