Why 2026 Could Be Litecoin’s Breakout Year: Key Network Growth and Transaction Milestones Signal Massive Adoption Surge

Litecoin’s network activity surged in 2025, with higher transaction volumes, active addresses, and new integrations shaping its adoption outlook for 2026.

Miracle Nwokwu

January 14, 2026

Table of Contents

Litecoin, one of the longest-running cryptocurrencies, processed over 70 million transactions in 2025 alone, accounting for nearly a quarter of its total since launch and pushing the lifetime count past 370 million. This surge, documented by the Litecoin Foundation, highlights growing real-world use for payments and transfers.

As 2026 unfolds, these milestones, combined with new technological integrations and institutional interest, suggest Litecoin may finally see broader adoption. The network's hashrate hit a record 3.8 petahashes per second last year, reflecting stronger security and miner participation, while daily active users averaged 250,000. Yet questions remain about whether this momentum can translate to sustained value amid ongoing market dynamics.

Network Expansion and Usage Records

The Litecoin blockchain demonstrated robust activity throughout 2025, with transaction volumes often exceeding $20 billion daily in peaks. Data from sources like Coinwarz and Lunar Digital Assets show that the network handled more than 60 million new transactions in the year, a sharp increase from prior periods.

This growth stemmed from practical applications, such as cross-border payments and merchant integrations. For instance, Litecoin ranked among the top choices on platforms like BitPay and CoinGate, where it facilitated real transfers rather than speculative trades. Hashrate, a measure of mining power, climbed 99% from its 2024 high, reaching 3.8 PH/s in December, which bolstered defenses against potential attacks.

Daily active addresses also expanded, averaging over 250,000, as users turned to Litecoin for its 2.5-minute block times—four times faster than Bitcoin's—and fees often under $0.01. Corporate adoption added fuel; companies like Luxxfolio Holdings accumulated over 20,000 LTC, while MEI Pharma allocated $100 million to a Litecoin treasury.

These moves highlight Litecoin's appeal as a stable asset for balance sheets. In Europe, Germany's DZ Bank, the country's second-largest, just launched its "meinKrypto" platform, including Litecoin alongside Bitcoin, Ethereum, and Cardano under new MiCAR regulations.

Upcoming Innovations Set for 2026

Looking ahead, 2026 holds key developments that could amplify Litecoin's utility. The Litecoin Foundation's Mimblewimble Extension Blocks (MWEB) privacy feature, which allows optional confidential transactions, saw over 164,000 LTC locked in 2025, enhancing fungibility without altering the core protocol.

More transformative is LitVM, an EVM-compatible Layer-2 solution built on Litecoin. Using Polygon's Chain Development Kit and BitcoinOS technology, it aims to introduce smart contracts, DeFi, and real-world asset tokenization. Testnet launches in Q1 2026, with mainnet activation expected later, potentially unlocking Litecoin's $6 billion market cap for programmable applications.

The Litecoin Summit in Amsterdam, scheduled for June 22-23, will kick off Dutch Blockchain Week and focus on these advancements. Speakers and panels are set to discuss integration with Ethereum and Bitcoin ecosystems, fostering cross-chain liquidity. Such events could attract developers and institutions, building on 2025's momentum where Litecoin's on-chain volume grew from $8 billion to over $22 billion daily averages.

Addressing Historical Hurdles

Litecoin has not been without setbacks in recent years. Critics have pointed to a lack of groundbreaking updates compared to rivals like Solana or Cardano, which offer built-in smart contract capabilities. Scalability remains a concern; while faster than Bitcoin, high-traffic periods can still elevate fees slightly.

Price volatility has drawn scrutiny too—Litecoin traded near parity with Bitcoin at launch but has since lost ground, down 99% relative to BTC over time. Some attribute this to merged mining with Dogecoin diluting focus or founder Charlie Lee's 2017 sale near all-time highs, which sparked debates about commitment.

Regulatory uncertainties have loomed, with delays in U.S. ETF approvals affecting inflows; the Canary Litecoin ETF saw zero net additions for five days in late 2025, lagging behind XRP and Solana funds. Competition from stablecoins and newer blockchains has challenged Litecoin's payment niche, as they provide similar speed with added stability.

Despite these issues, Litecoin's 100% uptime since 2011 and fair launch—no pre-mined coins—have maintained its reputation for reliability. Recent efforts, like MWEB and LitVM, directly tackle criticisms by adding privacy and programmability without compromising decentralization.

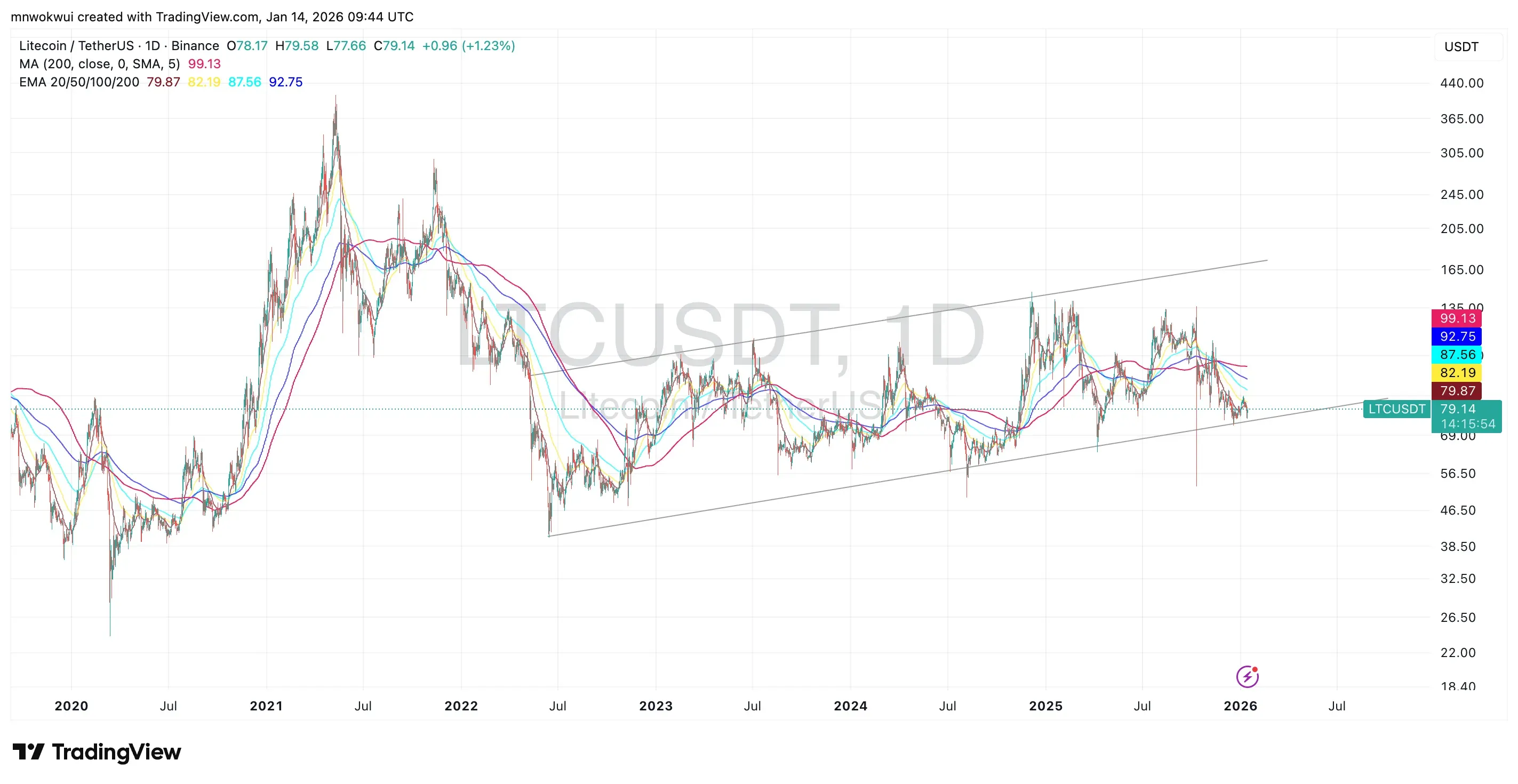

LTC Price Outlook Amid Channel Patterns

Litecoin's price has stabilized since the 2022 bear market, forming higher lows within an ascending channel. From a low near $50 in October 2025, it has stabilized to around $78 in early 2026, showing resilience.

If the broader bull market persists—fueled by Bitcoin's cycle—analysts project Litecoin could test $120-$140 by mid-2026, based on Fibonacci extensions from the channel. Optimistic forecasts reach $150-$220 if a supercycle emerges, driven by ETF approvals and DeFi integration, representing 80-180% gains.

However, downside risks exist; a break below $75 could target $60, per historical supports. Long-term holders, who make up 72% of addresses, remain profitable at current levels, supporting stability.

Litecoin's path in 2026 hinges on converting network strength into ecosystem growth. With proven transaction volumes, institutional nods, and LitVM's rollout, the cryptocurrency stands poised for expansion. While past critiques linger, these elements provide a foundation for renewed relevance in a maturing market. Investors watching the channel's upper bounds may find opportunities as milestones unfold.

Sources:

- Litecoin Foundation on X: Network activity and transaction milestone announcements.

- Litecoin Website: Privacy feature updates including MWEB.

- GlobeNewswire: LitVM unveiling and Litecoin Summit details (2025).

- BitPay: Decrypted report on merchant integrations and payments (2025).

- Litecoin Website: Litecoin spot ETF approval news.

- CoinGate: Seven years of Litecoin consumer payments data (2018-2025).

Read Next...

Frequently Asked Questions

How many transactions did Litecoin process in 2025?

Litecoin processed over 70 million transactions in 2025, pushing its lifetime total past 370 million, according to the Litecoin Foundation.

What drove Litecoin’s network growth in 2025?

Growth was fueled by real-world payment use, merchant integrations via BitPay and CoinGate, rising hashrate, and increased institutional participation.

What is LitVM and why does it matter for Litecoin?

LitVM is an EVM-compatible Layer-2 solution that brings smart contracts, DeFi, and tokenization to Litecoin, with a testnet planned for Q1 2026.

What role does privacy play in Litecoin’s roadmap?

Litecoin’s Mimblewimble Extension Blocks (MWEB) enable optional confidential transactions, improving fungibility without changing the core protocol.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events