Linea Tokenomics: Unraveling the Details

Linea has revealed its $LINEA tokenomics, allocating 85% to ecosystem growth while introducing dual-burn mechanics and no governance rights for holders.

Miracle Nwokwu

July 30, 2025

Table of Contents

Linea, the Ethereum Layer 2 (L2) solution developed by Consensys, on July 29, unveiled the tokenomics of its native token, $LINEA, putting an end to speculation about its potential launch. No specific date has been set for the token generation event (TGE), but the announcement sheds light on a structure that allocates 85% of the total token supply to the ecosystem, emphasizing community involvement.

This move reflects Linea’s aim to align with Ethereum’s foundational principles while introducing a unique economic model. Here’s a closer look at the details, offering readers a clear understanding of what this development entails.

The Purpose and Role of the $LINEA Token

Linea positions itself as an L2 designed to bolster Ethereum’s ecosystem, not just to scale it. The $LINEA token serves as an economic coordination tool rather than a governance or gas token. Unlike many projects, ETH remains the exclusive gas token on the network. This decision underscores a deliberate choice to avoid inflationary mechanics tied to native token usage for transactions. Instead, $LINEA will reward genuine network usage, support the development of aligned applications, and fund Ethereum’s long-term growth.

The token does not grant onchain governance rights, and the protocol will operate without a decentralized autonomous organization (DAO). This approach sets it apart from typical L2 token models, focusing instead on practical utility.

Token Supply and Allocation Breakdown

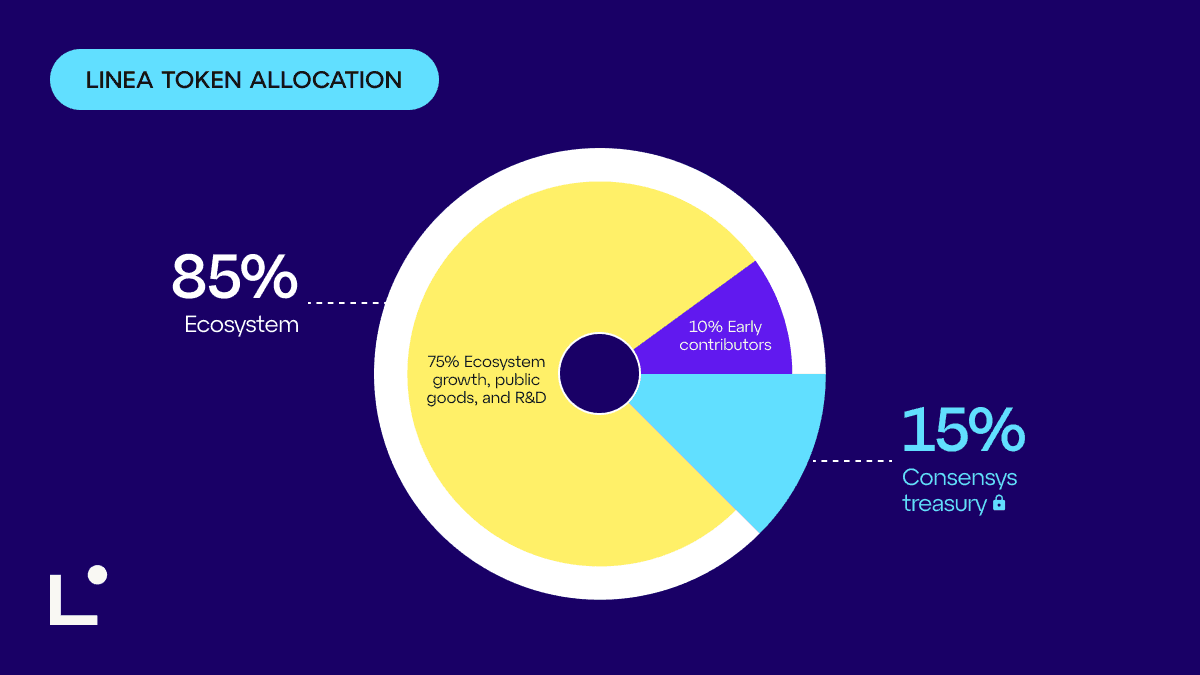

The total supply of $LINEA stands at 72,009,990,000 tokens, a figure 1,000 times the initial circulating supply of ETH at its genesis. This allocation mirrors Ethereum’s original distribution, signaling a commitment to long-term ecosystem alignment. The breakdown is as follows:

- Ecosystem Allocation (85%): The majority of the supply, 85%, is dedicated to the ecosystem. This includes 75% allocated to an Ecosystem Fund and 10% for early contributors. The Ecosystem Fund, managed by the Linea Consortium—a group comprising Ethereum-native entities like ENS Labs, Eigen Labs, SharpLink, Status, and Consensys—will support network growth. The fund operates in two phases: an initial 25% for ecosystem activation (covering liquidity, partnerships, and early builder support) and the remaining 50% distributed over 10 years to sustain development.

- Early Contributors (10%): This portion splits into 9% for users via an airdrop and 1% for strategic builders. Eligibility hinges on activity-based metrics, such as Linea Experience Points (LXP) and onchain participation. Full details, including an eligibility checker, will be released before the TGE.

- Consensys Treasury (15%): The remaining 15% goes to the Consensys treasury, locked for five years. These tokens cannot be transferred until the vesting period ends but may be used within the ecosystem, such as for liquidity or staking, to support protocol stability. This allocation reflects Consensys’s role as an early Ethereum contributor and its intent to remain a long-term stakeholder.

At the TGE, approximately 22% of the total supply—around 15.8 billion $LINEA tokens—will enter circulation. This includes airdrops, ecosystem activation programs, and liquidity provisions, with the rest remaining locked or vesting over time.

The Dual-Burn Mechanism: A Unique Economic Tie

One of Linea’s standout features is its dual-burn mechanism, which links network usage to the value of both ETH and $LINEA. All gas fees are paid in ETH. Of the net fees (after Layer 1 costs), 20% are burned, reducing ETH’s circulating supply and reinforcing its monetary value. The remaining 80% are used to buy and burn $LINEA tokens on the open market. This process creates a deflationary pressure on both assets, tying their economic health directly to network activity. The mechanism aims to align the interests of the L2 with Ethereum’s Layer 1, offering a novel approach to value accrual.

Governance Without Tokenholder Control

Linea opts for a governance model that eschews token-based voting. Instead, the Linea Consortium oversees strategic decisions, including token emissions, grants, and fund allocations. This group, composed of Ethereum stewards and legally structured as a U.S.-based non-stock corporation, seeks to ensure durability and adaptability. The full charter, detailing seat allocation, voting thresholds, and veto rights, will be published before the TGE. This structure avoids the complexities of DAO governance while maintaining a collaborative oversight framework.

Conclusion

The tokenomics reveal a design focused on reinforcing Ethereum’s ecosystem rather than introducing a speculative asset. By using ETH as gas and burning both ETH and $LINEA, Linea attempts to create a symbiotic relationship between the L2 and its parent network. The absence of insider allocations or pre-sales to employees and investors adds transparency to the distribution process. However, the lack of a confirmed TGE date leaves some uncertainty for participants awaiting airdrops or ecosystem involvement. Readers interested in tracking developments should keep an eye on Linea’s official blog and X channels.

As details emerge closer to the TGE, stakeholders will gain a clearer picture of its practical impact. For now, the unveiling provides a solid foundation for understanding Linea’s place within Ethereum’s scaling landscape.

Sources:

Read Next...

Frequently Asked Questions

What is the purpose of the $LINEA token?

The $LINEA token is designed as an economic coordination tool rather than a gas or governance token. It rewards network usage, funds ecosystem development, and supports Ethereum’s long-term growth without granting governance rights or replacing ETH for gas fees.

How is the $LINEA token supply allocated?

The total supply of 72,009,990,000 $LINEA tokens is distributed as follows: 85% to the ecosystem (75% for an Ecosystem Fund and 10% for early contributors) 15% to the Consensys treasury, locked for five years This design mirrors Ethereum’s original supply philosophy.

What is the dual-burn mechanism in Linea?

Linea employs a dual-burn model where 20% of net ETH gas fees are burned, and 80% are used to buy and burn $LINEA from the open market. This ties the value of both ETH and $LINEA to network activity and creates deflationary pressure on both assets.

Does $LINEA offer governance rights to holders?

No, $LINEA does not grant governance rights. Governance is handled by the Linea Consortium, a U.S.-registered non-stock corporation composed of Ethereum-native stakeholders. Tokenholders do not participate in protocol decision-making.

When is the $LINEA Token Generation Event (TGE)?

As of now, Linea has not announced a specific date for the $LINEA Token Generation Event. Details regarding eligibility for airdrops and participation will be shared closer to the TGE on Linea's official blog and X channels.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens