ICE Tokenomics Review: Worth The Hype?

The ICE token is at the heart of the Ice Open Network ecosystem. Discover its tokenomics, use cases, burn mechanism, and read our critical assessment.

UC Hope

March 4, 2025

Table of Contents

The cryptocurrency landscape witnessed a new entrant in early 2025 with the mainnet launch of Ice Blockchain, also known as Ice Open Network (ION). Founded in 2022, this layer-1 blockchain officially went live with its mainnet in late January 2025. Despite being a newcomer in an increasingly crowded market, Ice Blockchain has managed to build a substantial community base, claiming more than 40 million members.

At the heart of the Ice ecosystem lies the ICE token, which serves multiple functions within the network. As with any cryptocurrency project, understanding the tokenomics is crucial for potential community members and users. This article examines ICE's token utility, distribution, and deflationary model to determine whether the project lives up to its community-driven hype.

ICE Token Utility

The ICE token serves several key functions within the Ice Open Network ecosystem:

Transaction Fees

Similar to ETH on Ethereum or SOL on Solana, ICE functions as the primary gas token for the network. Users must spend ICE to conduct transactions on the Ice Blockchain, creating a baseline demand mechanism for the token.

Governance Rights

ICE token holders gain voting privileges on network proposals and decisions. According to the project's whitepaper, "ICE holders wield the power to shape the network's future," giving the community direct influence over development direction.

Network Security Through Staking

Like many proof-of-stake blockchains, ICE can be staked to secure the network. Stakers receive rewards for their participation, supposedly incentivizing long-term holding and network security.

Additional Ecosystem Functions

Beyond these primary uses, ICE is integrated into several network features:

- ION ID: A unique identifier system where transaction fees are redistributed to ICE stakers

- ION Connect: A revenue-sharing model distributing earnings among creators, consumers, nodes, and the Ice team

- ION Liberty: A node reward system for running network infrastructure

- ION Vault: A storage solution compensating nodes for securely storing user data

Token Distribution

ICE has a total supply of approximately 21.15 billion tokens. The initial distribution was structured as follows, according to the project’s whitepaper:

- Community Mining Allocation: 28%

- Mining Rewards Pool: 12%

- Team Pool: 25%

- DAO Pool: 15%

- Treasury Pool: 10%

- Ecosystem Growth and Innovation Pool: 10%

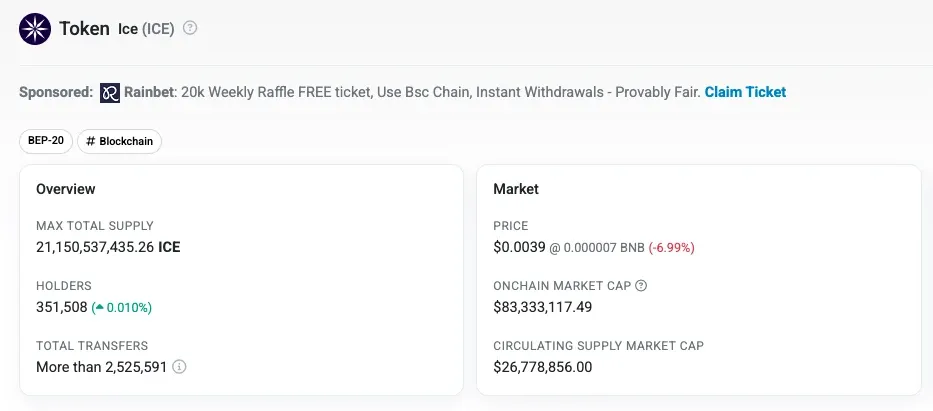

Despite Ice's mainnet launch enabling migration to its native chain, data from BscScan indicates that most ICE tokens remain on BNB Chain, where the token was originally hosted. On BNB Chain alone, ICE has over 350,000 holders, suggesting wide distribution among crypto users.

However, CoinGecko data shows only 6.8 billion of the total 21+ billion tokens are currently in circulation. This indicates significant future inflation potential as the remaining tokens enter the market.

Deflationary Mechanism: Effective or Wishful Thinking?

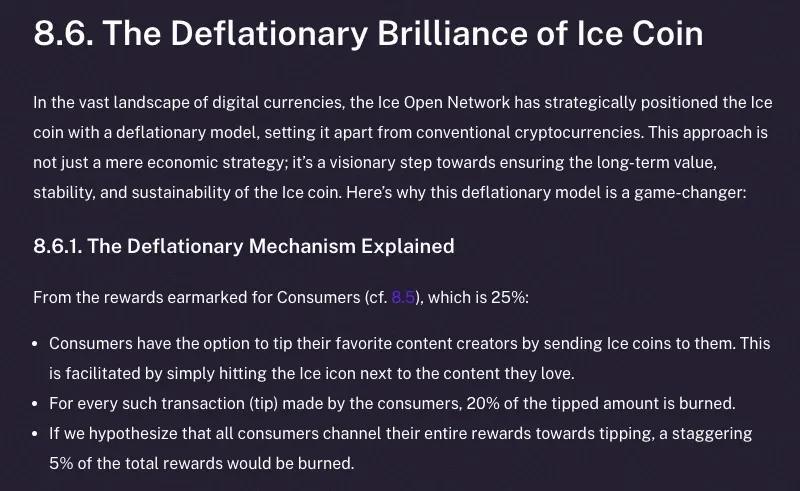

To counter inflation and create sustainable long-term value, Ice Blockchain implements a deflationary model through its content creator tipping system:

- Users can tip content creators with ICE tokens

- 20% of each tip is permanently burned

- This mechanism is meant to remove tokens from circulation over time

According to the project's whitepaper, if all users redirected their rewards to tips, "a staggering 5% of the total rewards" would be burned. However, this scenario seems highly improbable given typical investor behavior…

The Ice team believes this mechanism will encourage long-term holding rather than immediate selling, but its effectiveness depends entirely on user participation in the tipping ecosystem - something that is certainly not guaranteed.

Critical Assessment: Strengths and Weaknesses

Strengths

- Practical Utility: ICE has clear and necessary uses within the ION ecosystem

- Large Holder Base: With over 350,000 holders on BNB Chain alone, ICE appears more widely distributed than many competing tokens

- Integrated Ecosystem: The token is well-integrated across multiple network features

Weaknesses

- Highly Concentrated Team Allocation: The 25% allocation to the project team is substantial and could create selling pressure if team members liquidate holdings

- Inflation Concerns: With less than one-third of the total supply currently circulating, significant inflation is expected in the near to medium term

- Questionable Deflationary Mechanism: The burning system relies on user generosity rather than automatic or governance-driven mechanisms

- Network Adoption Uncertainty: ICE's value proposition depends heavily on widespread adoption of the Ice Open Network in a saturated L1 blockchain market

Market Performance

Since the network's mainnet launch on January 29, 2025, the ICE token has experienced a dramatic decline in value. Its market capitalization fell from over $85 million on January 28 to below $25 million just one month later, representing a loss of more than 70% of its value.

This significant price drop following mainnet launch may raise questions about investor confidence in the project's long-term viability and the effectiveness of its tokenomic design.

Conclusion: Proceed with Caution

While Ice Blockchain has developed a relatively thoughtful tokenomic structure with clear utility and governance mechanisms, several factors warrant caution from potential investors.

The token's value is intrinsically tied to the adoption and activity on the Ice Open Network itself. In an increasingly competitive layer-1 blockchain environment, driving significant user adoption represents a substantial challenge.

The combination of high team allocation, low circulating supply percentage, and questionable deflationary mechanisms creates additional uncertainty around ICE's long-term value proposition.

As with any cryptocurrency investment—particularly smaller cap tokens like ICE—thorough research is essential before engagement. The project may succeed in its ambitions, but current market trends and tokenomic analysis suggest community members should approach with appropriate skepticism rather than being swayed by community hype alone.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens