Fraction AI Unveils Stable-Up, Bringing Stablecoins into the Agentic Economy

Fraction AI's Stable-Up lets users deposit stablecoins for AI-optimized DeFi yields via no-code agents.

UC Hope

November 24, 2025

Table of Contents

With stablecoins moving trillions in the blockchain industry, Fraction AI launched Stable-Up, integrating the reliable payment method into its ecosystem of autonomous agents. This new feature, accessible through the platform's dApp, allows users to deposit stablecoins like USDC into vaults where AI agents manage allocations across Decentralized Finance (DeFi) protocols to optimize yields based on specified risk profiles.

Built on the Base Layer 2 network, Stable-Up extends Fraction AI's mainnet operations by applying agent-based strategies to stablecoin management.

What is Stable-Up?

Stable-Up marks Fraction AI's focus on stablecoin integration within the agentic framework. Users deposit stablecoins into vaults, and AI agents then allocate those assets across various DeFi protocols to optimize yield. The feature operates on Base's infrastructure, which supports efficient, low-latency executions.

This launch aligns with the expanding stablecoin market, which is projected to manage trillions in on-chain capital. Stable-Up builds on Fraction AI's existing ecosystem, following its mainnet deployment.

In Stable-Up, users create custom AI agents through simple prompts or select from pre-built options. No programming is needed as agents are set with verifiable goals, such as maximizing yields or minimizing risks. These agents adapt using RLAF, analyzing performance data to dynamically adjust strategies.

Agents handle stablecoin activities by identifying opportunities, responding to market changes, and evolving based on feedback. Strategies are tailored to user-defined risk profiles, involving allocations to lending platforms, Decentralized Exchanges (DEXs), or meta-assets that combine stablecoins for added resilience.

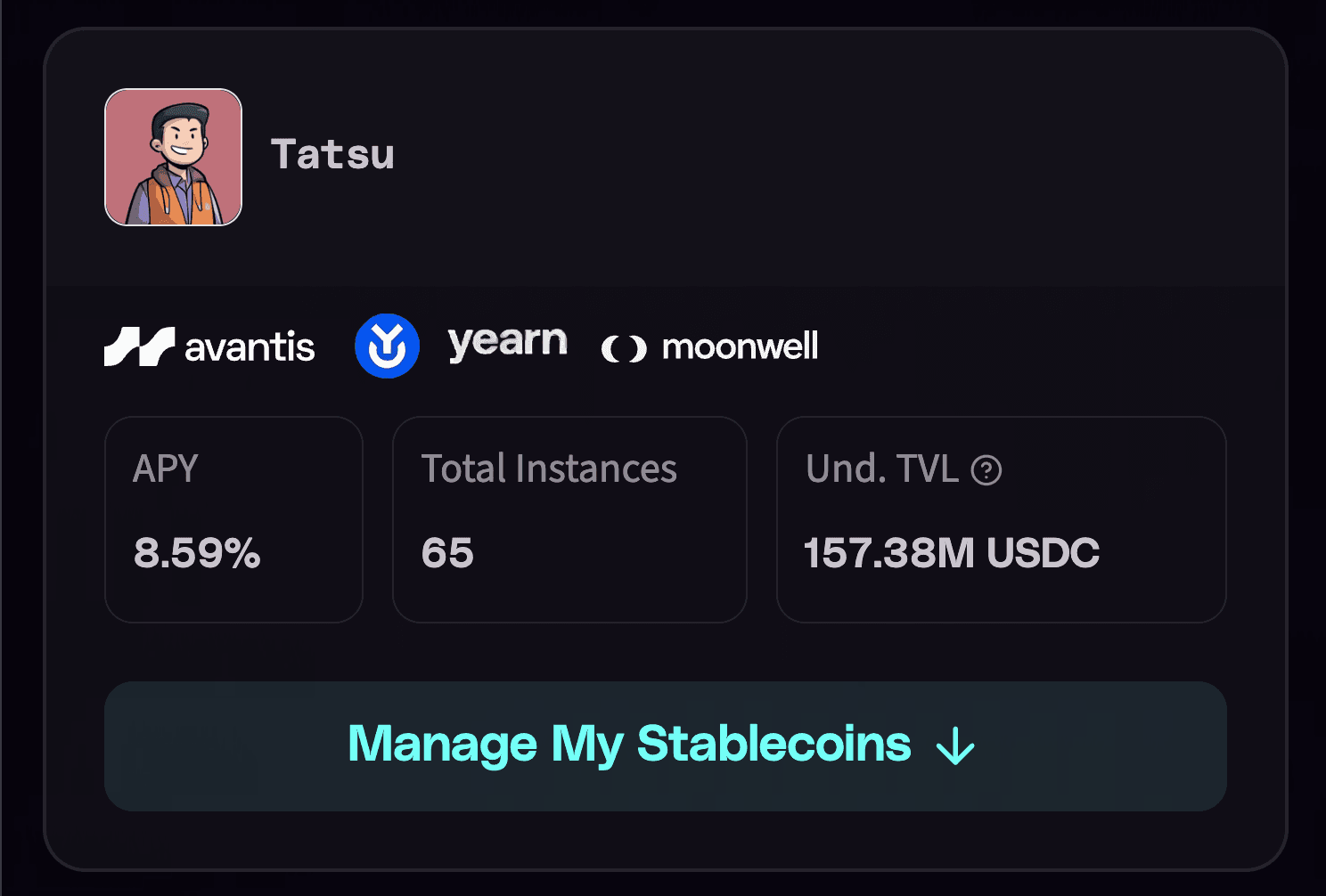

Integrations with DeFi Protocols

Stable-Up connects with protocols including Moonwell, Silo Finance, Morpho, Yearn.fi, Euler Finance, and Avantis, with additional integrations in development. This setup enables agents to coordinate asset movements and yield optimization across these platforms on the Base network.

Stable Up’s agents are now integrated with the top tier vaults on @MoonwellDeFi, @SiloFinance, @Morpho, @yearnfi, @eulerfinance and @avantisfi. Our Agents watch markets around the clock, track yield shifts, manage risk in real-time and learn from past performance to refine their… pic.twitter.com/0CcsKw4NtZ

— Fraction AI (@FractionAI_xyz) November 22, 2025

What are Stable-Up Key Features?

Participants in Stable-Up can earn yields with reported annual percentage yields (APYs) with the potential for over 20% through agent-optimized strategies. Users also accumulate Fractals points for activities, which may qualify them for future airdrops of the $FRAC token, which is still in pre-TGE.

The dApp interface supports low-barrier entry, enabling users to start with small deposits, monitor agents, and track metrics. Tokenomics for $FRAC remain pre-launch, with rewards currently distributed as points tied to platform activity.

Here is a detailed breakdown of Stable-Up’s Key Features:

Earning Yields through Participation in Stable-Up

Participants on the Stable-Up platform can generate yields on their investments or activities. Specifically, the system offers annual percentage yields (APYs) ranging from 5% to 10%, providing a reliable baseline return for users. However, yields can exceed 10% when leveraging agent-optimized strategies. These strategies likely involve automated or AI-driven agents that optimize asset allocation, risk management, or other financial maneuvers within the platform's ecosystem.

This tiered yield structure appeals to both conservative users seeking steady returns and more aggressive participants aiming for higher rewards, making Stable-Up a versatile option in the decentralized finance (DeFi) space. By participating actively, users can capitalize on these yields, which are designed to incentivize long-term involvement and platform growth.

Accumulation of Fractals Points and Future Airdrops

In addition to direct yields, users on the Stable-Up platform accumulate Fractals points for various activities, such as deposits, interactions, and other engagements. These points serve as a loyalty or rewards mechanism, tracking user contributions and potentially qualifying them for future $FRAC token airdrops. The airdrops are tied to the token generation event (TGE), aligning with the platform's roadmap for launching its native cryptocurrency.

This points system adds a gamified layer to the user experience, encouraging consistent participation while building anticipation for the token's release. As of now, these points represent a pre-token value accrual, positioning early adopters for potential benefits once $FRAC becomes fully operational and tradable.

User-Friendly dApp Interface for Low-Barrier Entry

The decentralized application (dApp) interface of Stable-Up is designed to lower entry barriers, making it accessible even for newcomers to the crypto space. Users can begin with small deposits, reducing the financial risk and allowing experimentation without significant commitment. The interface includes tools for monitoring agents in real time, tracking key performance metrics such as yields, point accumulation, and competition results, and providing intuitive dashboards for oversight.

This emphasis on usability ensures that both novice and experienced users can navigate the platform effectively, fostering inclusivity and driving adoption by simplifying complex DeFi interactions into straightforward, actionable steps.

Future Developments

Fraction AI plans to introduce DAO governance alongside additional protocol integrations and the launch of the $FRAC token. These steps aim to enhance community involvement and expand the platform's capabilities.

In summary, Fraction AI's Stable-Up integrates stablecoins with AI agents on the Base network, enabling no-code strategy creation and management for yield optimization across DeFi protocols. It offers rewards through APYs, points, and competitions, supported by a user base exceeding 320,000.

This development underscores the platform's focus on accessible AI tools in DeFi, providing a structured approach for stablecoin holders to engage with automated systems. For those interested, exploring the dApp offers a direct way to assess its functions, highlighting the value of such integrations in decentralized environments.

Sources

Fraction AI X: Stable-UP Announcement

Website: Stable-Up dApp

Read Next...

Frequently Asked Questions

What is Stable-Up in Fraction AI?

Stable-Up is a feature launched by Fraction AI on November 21, 2025, allowing users to deposit stablecoins into vaults managed by AI agents for yield optimization across DeFi protocols on the Base network.

How do AI agents work in Stable-Up?

Users create agents using natural-language prompts, setting goals such as yield maximization. Agents adapt via Reinforcement Learning from AI Feedback (RLAF), dynamically allocating assets based on risk profiles and market data

What rewards can users earn in Stable-Up?

Rewards include reasonable APYs and Fractals points for potential $FRAC airdrops.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens