What Is Dollar-Cost Averaging (DCA) in Crypto?

Dollar-cost averaging splits crypto investments into regular purchases to reduce timing risk. Learn how DCA works, when it outperforms lump sums, and modern tools.

Crypto Rich

March 10, 2021

Table of Contents

Last revision: November 20, 2025

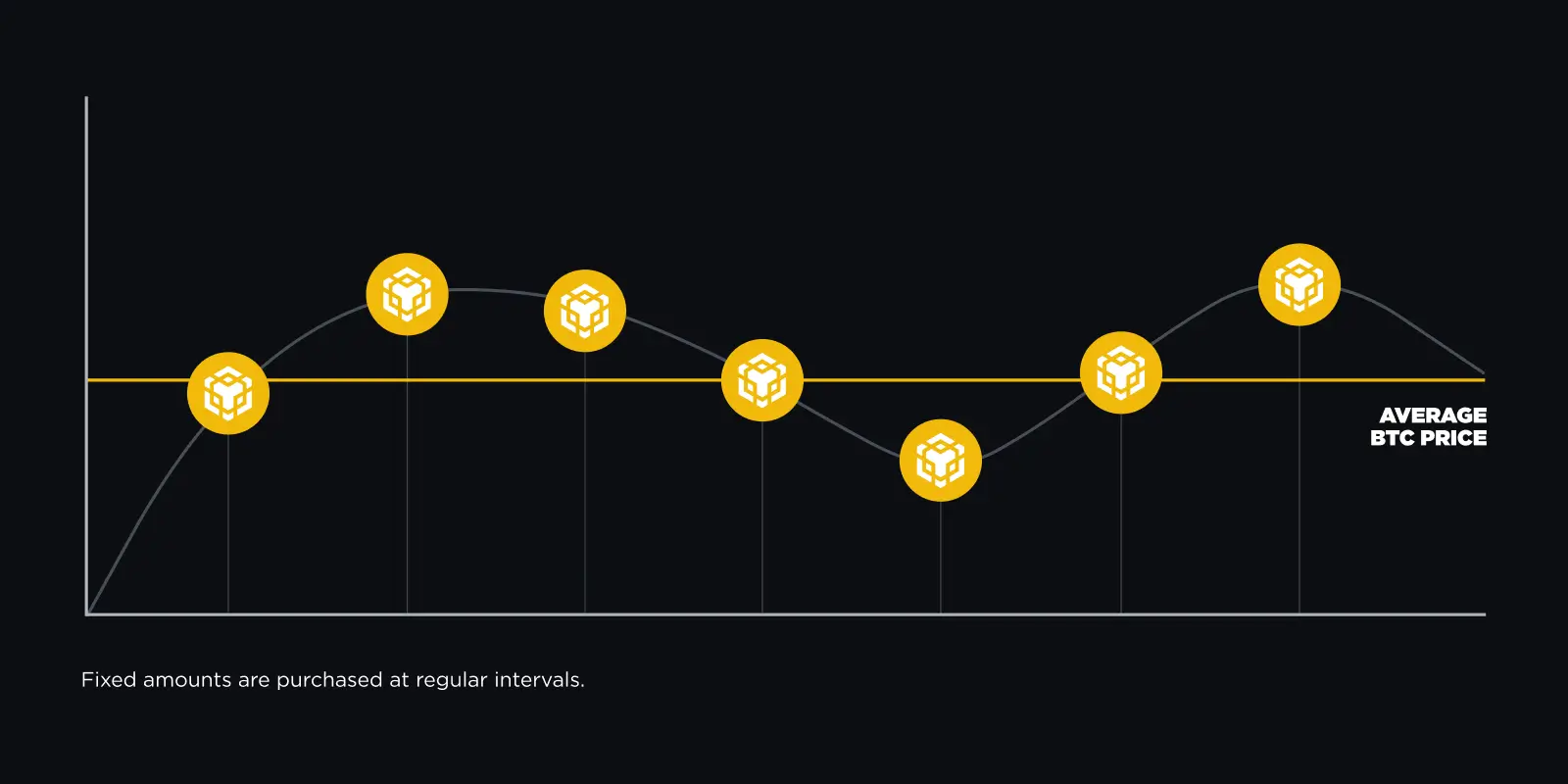

Dollar-cost averaging (DCA) is an investment strategy in which you split your total investment into smaller, equal purchases made at regular intervals, such as buying $100 of Bitcoin every week instead of $5,200 at once. This approach reduces the risk of investing a large sum right before a price drop.

The strategy gained popularity in traditional finance during the 1970s. It has since become standard among crypto investors who want market exposure without trying to time volatile price swings. Research from Vanguard shows that while lump sum investing outperforms DCA about two-thirds of the time in rising markets, DCA can lower average purchase prices during volatile periods and removes the hesitation that causes many investors to wait indefinitely for "perfect" entry points that never arrive.

DCA relates to several other investment approaches. Portfolio rebalancing adjusts asset allocations periodically. Value averaging adjusts investment amounts to hit value targets. Buy-and-hold strategies maintain long-term positions. Understanding how DCA fits within these broader frameworks helps investors build complete strategies rather than isolated tactics.

How Does Dollar-Cost Averaging Work?

DCA operates on a simple principle: invest a fixed dollar amount at consistent intervals regardless of price. This creates a mathematical outcome where you automatically buy more units when prices are low and fewer units when prices are high.

Here's a practical example. Say you commit to buying $100 of Ethereum every Monday for three months. You execute that purchase whether ETH trades at $1,800, $2,200, or $1,500. When ETH drops to $1,500, your $100 buys approximately 0.067 ETH. When the price rises to $2,200, the same $100 only buys about 0.045 ETH.

Over time, this creates an average cost per unit that typically falls between the highest and lowest prices during your investment period. The strategy requires no market analysis, no chart reading, and no attempts to predict short-term price movements.

Building an effective DCA plan involves several key decisions about investment amounts, timing, and duration.

Setting Up a DCA Strategy

Three core decisions shape any DCA plan: your total investment amount, purchase frequency, and time horizon.

Your total investment amount should be money you can afford to lock up long-term. Most financial advisors recommend investing only amounts you won't need for at least 12-24 months, given crypto's volatility.

Purchase frequency depends on your goals and transaction costs. For larger portfolios over $10,000, weekly purchases work well since transaction fees represent a small percentage. Monthly purchases often make more sense for smaller amounts to avoid fees eating into returns. Some investors simply align purchases with their paycheck schedule—buying crypto the same day they receive salary.

Time horizon matters significantly. Academic research from Ibbotson Associates found that DCA strategies perform better over 12+ month periods compared to 3-6 month windows. Shorter timeframes don't provide enough market cycles to benefit from the averaging effect.

When Does DCA Outperform Lump Sum Investing?

The comparison between DCA and lump sum investing (putting all money in at once) has clear patterns based on market conditions.

DCA Performance in Bear Markets

DCA typically outperforms during bear markets and high volatility periods. A 2022 analysis by crypto analyst Willy Woo examined Bitcoin price data from 2017-2021. He found that DCA strategies beat lump sum investments by 15-30% when initiated during market peaks.

During Bitcoin's 2021-2022 decline from $69,000 to $15,500, the difference became stark. Investors who DCA'd throughout the decline paid average prices of $32,000-38,000. Lump sum investors who bought at various points between $50,000-65,000 saw steeper losses.

Note that crypto market conditions evolve rapidly. While these historical patterns demonstrate DCA's value during volatility, investors should consider current market dynamics when planning their strategies.

Lump Sum Advantages in Bull Markets

Lump sum investing statistically performs better in bull markets. Vanguard's 2012 study analyzing 60 years of market data found that lump sum beat DCA approximately 66% of the time in traditional markets. The reason is straightforward: rising markets mean delayed purchases cost more. If Bitcoin rises from $40,000 to $55,000 over six months, spreading $6,000 across monthly purchases results in a higher average cost than buying $6,000 at $40,000.

What Are Modern DCA Tools for Crypto?

Sticking to a manual DCA schedule takes discipline and time. Fortunately, several platforms now automate the entire process, though features and fees vary widely. With the introduction of spot Bitcoin ETFs in 2024, investors can also apply DCA strategies through traditional brokerage accounts, though this article focuses on direct crypto purchases.

Exchange-Based DCA Options

Most major exchanges, including Coinbase and Kraken, offer built-in recurring buy features. Users can schedule automatic purchases daily, weekly, or monthly. Coinbase charges standard trading fees between 0.5-2% depending on volume. Coinbase Pro users pay lower fees ranging from 0.05-0.5%. Kraken's recurring buys use the same fee structure as regular trades, starting at 0.26% for purchases under $50,000.

Dedicated DCA Platforms

For Bitcoin-only investors, dedicated platforms like Swan Bitcoin and River Financial specialize in automated purchases. Swan charges a flat 1% fee on buys and sells as of 2025, with potential waivers for auto-withdrawals or the first $10,000, plus a small monthly holding fee on balances over $10,000 (often waived). River offered zero fees on recurring buys for the first 7 days in 2025, with fees as low as 0.30% for some DCA plans thereafter. Both support daily, weekly, and biweekly schedules. Fees change periodically, so check platform sites for current rates.

DeFi Protocol Alternatives

Decentralized finance protocols provide non-custodial alternatives. Platforms like Uniswap and PancakeSwap allow users to retain control of their funds while automating purchases using TWAMM (time-weighted average market maker) on Uniswap, or TWAP (Time-Weighted Average Price) on PancakeSwap. These require more technical setup, such as using hooks in Uniswap v4, and gas fees can vary significantly based on network congestion.

Understanding the total cost structure, including protocol and network fees, helps investors choose platforms that maximize returns over time.

Comparing DCA Platform Costs

Small fees compound quickly with frequent purchases. Consider a $50 weekly purchase with a 1% fee. Over a year, you'll pay $26 in fees on $2,600 invested. Drop that fee to 0.5%, and you pay only $13 annually—a $13 difference that compounds over time.

Looking at a multi-year timeframe makes the impact clearer. That same $50 weekly DCA with 1% fees costs $130 over five years on a $13,000 investment. At 0.5% fees, you pay only $65—saving $65 that stays invested and compounds.

Withdrawal Fees Matter Too

Network withdrawal fees matter too if you plan to move crypto to personal wallets. Some platforms include one free withdrawal per month. Others charge $15-25 for Bitcoin withdrawals and $5-15 for Ethereum withdrawals, regardless of the amount transferred.

Before committing to any platform, calculate your total annual costs: (purchase amount × frequency × fee percentage) + annual withdrawal costs = total annual expense.

How Do Taxes Affect DCA Strategies?

Each crypto purchase creates a separate tax lot with its own cost basis and holding period. Frequent DCA purchases increase this complexity but also create tax optimization opportunities.

US Tax Treatment

In the United States, selling crypto triggers capital gains taxes. The IRS allows investors to choose which tax lots to sell under the specific identification method. Say you DCA'd $100 weekly for a year and now want to sell $1,000 worth. You can specifically sell the lots with the highest cost basis to minimize your tax bill by reporting smaller gains.

Here's how this works in practice. Imagine you bought Bitcoin at $40,000, $30,000, and $50,000 across different DCA purchases. Bitcoin now trades at $45,000, and you need to sell $5,000 worth. By selecting the lots purchased at $50,000 (which are now at a loss) or $40,000 (smallest gain), you can reduce taxable gains by roughly 25% compared to selling the $30,000 lots.

Most crypto tax software, including CoinTracker, Koinly, and TokenTax, automatically tracks DCA purchases and calculates optimal selling strategies. These platforms connect to exchange APIs to import transaction history and generate tax reports showing gains, losses, and suggested optimization strategies.

In the US, short-term capital gains on assets held for less than 1 year are subject to ordinary income tax rates ranging from 10-37%. Long-term capital gains over one year receive preferential rates of 0-20%. DCA investors who hold positions for more than 12 months before selling can reduce tax liability by 10-20% compared to frequent traders.

International Tax Considerations

Tax treatment varies by country. The United Kingdom treats crypto as capital assets with an annual tax-free allowance of £3,000 as of 2024. Germany exempts crypto gains from taxation if held for more than 1 year. Australia taxes crypto gains as capital gains with a 50% discount for assets held over 12 months.

What Are the Limitations of DCA?

DCA doesn't eliminate market risk—it only spreads it across time. If an asset's price declines steadily over your investment period and doesn't recover, DCA still results in losses.

Opportunity cost represents another limitation. Money committed to DCA could potentially earn returns elsewhere. If you plan to DCA $10,000 over 10 months ($1,000 monthly), the $9,000 not yet invested in month one could sit in Treasury bills earning 4-5% annual yield. This forgone interest reduces DCA's effective returns.

DCA requires steady cash flow. Missing scheduled purchases breaks the strategy's rhythm and reduces its effectiveness. Investors who can't commit to regular purchases throughout the planned timeframe often abandon DCA mid-strategy, typically during market downturns when continuing would be most beneficial.

The strategy also doesn't address exit timing. While DCA handles entry systematically, investors still face the challenge of when to sell. Many DCA investors lack clear exit plans and hold through both profitable peaks and subsequent declines.

When Should You Use Reverse DCA?

Reverse DCA involves selling equal amounts at regular intervals instead of buying. This strategy helps investors gradually exit positions while reducing the risk of selling everything right before a price surge.

The approach mirrors entry DCA. Want to sell $12,000 worth of Bitcoin? You could sell $1,000 monthly for 12 months regardless of price. This creates an average selling price across that period rather than trying to time a single optimal exit.

For example, if Bitcoin trades at $50,000, $48,000, $52,000, and $55,000 across four months, selling $3,000 each month creates an average exit price of $51,250. If you had sold the entire $12,000 position in month one at $50,000, you would have missed the higher prices in months three and four. Conversely, if you sold everything in month two at $48,000, you would have locked in the worst price.

This works especially well in a few situations. Taking profits during bull markets. Rebalancing portfolios. Funding planned expenses. An investor who accumulated Bitcoin from $20,000 to $45,000 might use reverse DCA to systematically take profits if they believe markets have run up significantly.

The same psychological benefits of entry DCA apply to exits as well. Selling everything at once creates regret if prices rise afterward. Gradual selling at fixed intervals removes emotion from the decision-making process and provides multiple exit points at different price levels.

Tax considerations also favor reverse DCA for large positions. Selling $100,000 of crypto in a single year could push investors into higher tax brackets. Spreading that sale across two tax years using reverse DCA keeps income levels lower and reduces the effective tax rate.

How Does DCA Compare to Value Averaging?

Value averaging takes a more complex approach than standard DCA. Instead of investing fixed dollar amounts, it adjusts investment amounts to reach a target portfolio value at each interval.

The mechanics differ significantly. You set a target growth rate—say you want your portfolio to grow by $1,000 monthly. In month one, you invest $1,000. If your portfolio grows to $1,200 by month two (a $200 gain), you only invest $800 to reach your $2,000 target. If the portfolio drops to $900, you invest $1,100 to reach the target.

Research from Michael Edleson, who developed the strategy, shows value averaging can outperform standard DCA by 1-2% annually in volatile markets. The method forces investors to buy more during price dips and less during rallies—a more aggressive version of DCA's natural averaging.

However, value averaging requires significantly more capital flexibility. Unlike DCA's fixed $1,000 monthly commitment, value averaging might require $2,000 one month and $400 the next. Most investors find DCA's predictable cash requirements easier to maintain.

The complexity of value averaging also creates more taxable events and tracking requirements. Standard DCA involves one simple transaction per period. Value averaging requires calculations before each purchase and may involve selling during periods of strong gains, triggering tax obligations.

What Common Mistakes Do DCA Investors Make?

Historical data from Coinbase (2023) indicates that 60% of users who set up recurring buys disabled them within six months, typically after market corrections. These investors miss the accumulation phase where DCA generates its best results.

The most frequent DCA mistakes include:

- Stopping purchases during market downturns when lower prices offer the best accumulation opportunities

- Choosing unrealistic investment amounts that strain budgets and break the strategy's rhythm through missed payments

- Running DCA indefinitely without exit criteria rather than setting profit targets or time-based completion dates

- Ignoring fee impact on small purchases where costs can consume 10% or more of total investment annually

- Leaving accumulated crypto on exchanges instead of moving funds to hardware wallets quarterly

Is DCA Right for Your Investment Strategy?

Different investor profiles benefit from DCA in different ways. The strategy's systematic approach works well in some situations but proves suboptimal in others.

Ideal DCA Candidates

DCA works best for investors who:

- Have a regular income to support consistent purchases

- Want crypto exposure without market timing stress

- Plan to hold investments for 12+ months

- Accept average rather than optimal returns

- Can commit to purchases during market downturns

When to Consider Alternatives

DCA likely isn't optimal if you:

- Have a lump sum ready to invest in a confirmed early bull market

- Can handle the stress of all-or-nothing investment timing

- Possess advanced technical analysis skills with proven success

- Need liquidity in the short term

- Want to maximize returns rather than minimize risk

Crypto markets regularly see 30-50% drawdowns and 70-80% bear-market declines. DCA helps investors accumulate through full market cycles rather than only buying during euphoric peaks. Research from Dalbar Inc. shows the average investor underperforms market indices by 3-4% annually due to poor timing decisions. DCA's systematic approach helps close that gap.

Summary

Dollar-cost averaging provides systematic crypto exposure through regular fixed-dollar purchases regardless of price. Over time, the strategy creates average purchase prices that typically fall between market highs and lows.

Modern platforms make implementation straightforward. Exchange-based platforms charge fees of 0.05-2%. Dedicated services like Swan Bitcoin or River Financial charge fees ranging from 0.30-1%. DeFi protocols charge 0.1-0.3% protocol fees plus gas costs. Tax lot tracking through platforms like CoinTracker, Koinly, or TokenTax helps optimize capital gains obligations across multiple purchase dates.

The strategy performs best during bear markets and periods of high volatility. It underperforms lump sum investing in sustained bull markets. Success requires a commitment to continue purchasing during downturns, when accumulation benefits are strongest.

Sources

- Vanguard Research: "Dollar-cost averaging just means taking risk later" (2012).

- Willy Woo: Bitcoin Analysis and Commentary.

- Michael Edleson: "Value Averaging: The Safe and Easy Strategy for Higher Investment Returns".

- IRS Publication 544: Sales and Other Dispositions of Assets.

- UK HMRC: Cryptoassets Manual (2024 Update).

Read Next...

Frequently Asked Questions

How much money should I invest with DCA?

Only invest amounts you won't need for at least one to two years, given crypto's volatility. Most advisors suggest 5-10% of investable assets for crypto DCA. Start with amounts small enough to maintain through market downturns.

Does DCA work better than buying the dip?

DCA removes the need to identify dips correctly, which most investors fail at consistently. The systematic approach guarantees you'll buy some dips without trying to predict them, maintaining discipline through market cycles.

Can I DCA with any cryptocurrency?

Yes, though established assets like Bitcoin and Ethereum are better suited to long-term DCA strategies. Smaller altcoins face a higher risk of complete failure. Most automated DCA tools focus on the top 20 cryptocurrencies by market cap.

Should I DCA during a bull market?

Starting DCA during strong bull markets often results in higher average costs than lump-sum investing. However, if you can't commit a lump sum or want to reduce timing risk, DCA still provides systematic exposure even if mathematically suboptimal.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens