DeepNode AI Review: How a Decentralized Network Turns AI Into an Open Market

A detailed review of DeepNode AI and the DN token, covering architecture, roles, tokenomics, incentives, and how the decentralized AI network works.

Soumen Datta

January 12, 2026

Table of Contents

DeepNode AI is a decentralized AI infrastructure that allows developers, validators, compute providers, and users to build, evaluate, and monetize AI models through an open, blockchain-coordinated network. The DN token is the settlement and incentive layer that powers every action on the platform, from model execution to validation and governance.

This review explains how DeepNode works, what problems it targets, how its architecture is structured, and how DN tokenomics are designed to support long-term network operation.

What Problem Does DeepNode AI Aim To Solve?

Modern AI development is highly centralized. A small group of large technology companies controls most AI models, compute infrastructure, and distribution channels. This structure creates several issues for developers and users alike.

First, value concentration is extreme. Developers often build models for centralized platforms but do not share in long-term revenue. Compute providers are paid fixed rates. Users pay recurring fees without insight into how models are evaluated or governed.

Second, visibility often matters more than utility. In many centralized AI platforms, models succeed due to marketing budgets, partnerships, or platform promotion rather than measured accuracy or usefulness.

Third, contributors lack transparent incentives. Validators, evaluators, and data contributors usually receive one-time payments, even if their work creates long-term value.

Finally, AI systems are siloed. Most platforms focus on narrow tasks like language models or image generation. Cross-domain intelligence remains difficult due to closed architectures and incompatible incentives.

DeepNode addresses these issues by treating intelligence as an open market rather than a closed product.

How Does DeepNode AI Work In Practice?

DeepNode operates as a peer-to-peer AI network. Models, validators, and compute nodes coordinate on-chain, while AI execution happens off-chain.

Instead of trading raw compute, the network trades intelligence. Developers submit AI models to specific domains, such as finance, research, or manufacturing. These models are executed by independent node operators and evaluated by validators.

Key operational elements include:

- Proof-of-Work Relevance (PoWR): Rewards are based on correctness and usefulness, not raw computation.

- Continuous Evaluation: Models are ranked over time. Poor performance reduces influence, while consistent accuracy increases visibility.

- On-Chain Coordination: Registration, reputation, validation results, and rewards are recorded on-chain for transparency.

This structure allows AI models to evolve continuously rather than being trained once and deployed indefinitely.

What Is The Architecture Behind DeepNode AI?

DeepNode is built as a hybrid system with on-chain coordination and off-chain execution. It launches on Base, an Ethereum Layer-2 network, to balance security with lower transaction costs.

The core architectural layers include:

- Model Marketplace: A decentralized registry where AI models are uploaded, validated, and monetized.

- Execution Layer: Distributed compute nodes that run AI inference tasks.

- Validation Layer: Validators assess outputs and assign trust scores.

- Reputation Layer: Tracks historical accuracy, reliability, and performance.

- Governance Layer: Manages protocol upgrades and policy changes.

- Domain Layer: Enables specialized subnets for industry-specific AI use cases.

Tasks are processed redundantly using a “one model, two nodes” rule to reduce errors and manipulation.

Who Participates In The DeepNode Network?

DeepNode defines clear, modular roles. Participants can specialize or combine roles, but conflicts of interest are restricted by design.

Main roles include:

- Model Creators: Upload and maintain AI models and earn DN per inference.

- Miners: Provide compute power and execute AI tasks.

- Validators: Verify outputs, assign trust scores, and protect network integrity.

- Stakers: Delegate DN to miners or validators and share in rewards.

- Backers: Bond DN to promising models in exchange for revenue share.

- Consumers: Use AI models via the marketplace or API.

- Domain Architects (later phase): Design and manage domain-specific AI subnets.

Validators cannot validate models they created or financially support, reducing bias.

What Is DN Token And How Is It Used?

DN is the native token of DeepNode. Every AI task, reward, and governance action settles in DN.

Core DN use cases include:

- Paying for AI inference tasks

- Rewarding miners, validators, and model creators

- Staking and delegation

- Model bonding and backer participation

- Governance voting

- Domain-level incentive configuration

DN is not a memecoin. Its role is strictly functional, tied to measurable network activity.

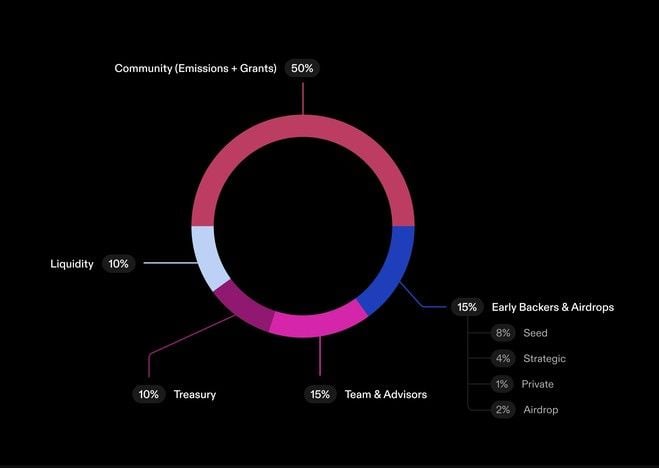

How Does DeepNode Tokenomics Work?

DN tokenomics are designed to align emissions with real usage, not fixed inflation.

Token distribution includes:

- Emissions and Grants: 50%

- Team and Advisors: 15%

- Treasury: 10%

- Liquidity: 10%

- Seed: 8%

- Strategic: 4%

- Private: 1%

- Airdrop: 2%

Vesting schedules range from immediate unlocks for airdrops to multi-year cliffs for team allocations.

Revenue flows through a routing module and is distributed across:

- Model owners

- Infrastructure and payment processors

- Buyback and burn at 1%

- Emission reinforcement based on usage

This structure avoids rigid reward splits that often create excess sell pressure in early-stage networks.

DN is now available for trading at exchanges like Gate, Bitget, MEXC, KuCoin and Binance Wallet.

Why Does DeepNode Avoid Fixed Emission Models?

Many compute networks use fixed emission splits between miners and stakers. This often leads to sustained sell pressure that exceeds real demand.

DeepNode avoids this by:

- Adjusting emissions at the domain level

- Rewarding miners based on verified work

- Allocating staking rewards only when needed

- Scaling rewards with actual usage

This approach aims to keep emissions proportional to value creation rather than protocol assumptions.

What Is The Role Of Liquid Staking With stDN?

DeepNode introduces a liquid staking token called stDN.

Users stake DN and receive stDN at a one-to-one ratio at launch. Over time, stDN increases in value as rewards accumulate rather than increasing in quantity.

Key characteristics include:

- Staked assets remain liquid

- Rewards accrue to token value

- Validators and stakers receive 95% of staking rewards

- A small portion goes to the foundation and token burn

- Withdrawal fees are burned to reduce supply

This design supports network security while allowing users to remain flexible.

Conclusion

DeepNode combines decentralized incentives with measurable AI performance. Its architecture prioritizes transparency, reputation, and continuous evaluation. DN tokenomics focus on usage-driven rewards rather than fixed inflation.

The platform does not promise guaranteed outcomes. It provides infrastructure where AI models, compute, and validation compete openly based on results.

Resources

DeepNode AI website: General Information

DeepNode AI on X: Announcements (January 2026)

DeepNode AI docs: About DeepNode AI

DeepNode’s DN token overview: About DN token

Read Next...

Frequently Asked Questions

What Is DeepNode AI In Simple Terms?

DeepNode AI is a decentralized network where AI models are built, run, and evaluated by independent participants using blockchain coordination.

What Is DN Token Used For?

DN is used to pay for AI tasks, reward contributors, stake for security, support models, and participate in governance.

How Is DeepNode Different From Centralized AI Platforms?

DeepNode uses open competition, transparent validation, and performance-based incentives instead of centralized control and opaque decision-making.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens