Are Decentralized Token Folios (DTFs) the Next Index Revolution? [Report]

A detailed look at Decentralized Token Folios and how they bring transparent, programmable, index-based diversification to a growing and more mature digital asset market.

Miracle Nwokwu

November 28, 2025

Table of Contents

Decentralized Token Folios, or DTFs, have emerged as a structured approach to investing in digital assets. These products bundle multiple cryptocurrencies into a single token, allowing investors to gain exposure to broad market segments or specific themes without handling each asset individually. As digital asset markets expand, DTFs provide a mechanism that mirrors traditional index funds but operates entirely on blockchain networks.

This development comes at a time when the cryptocurrency ecosystem has matured, with total market capitalization exceeding $4 trillion and encompassing sectors such as decentralized finance, artificial intelligence, and tokenized real-world assets. Investors, both institutional and retail, now seek ways to diversify holdings efficiently, and DTFs address this by offering transparency and accessibility through smart contracts.

The concept builds on decades of financial innovation, where tools like mutual funds and exchange-traded funds simplified portfolio management. In the digital realm, DTFs extend this logic by enabling 24/7 trading, instant redemptions, and integration with other onchain protocols.

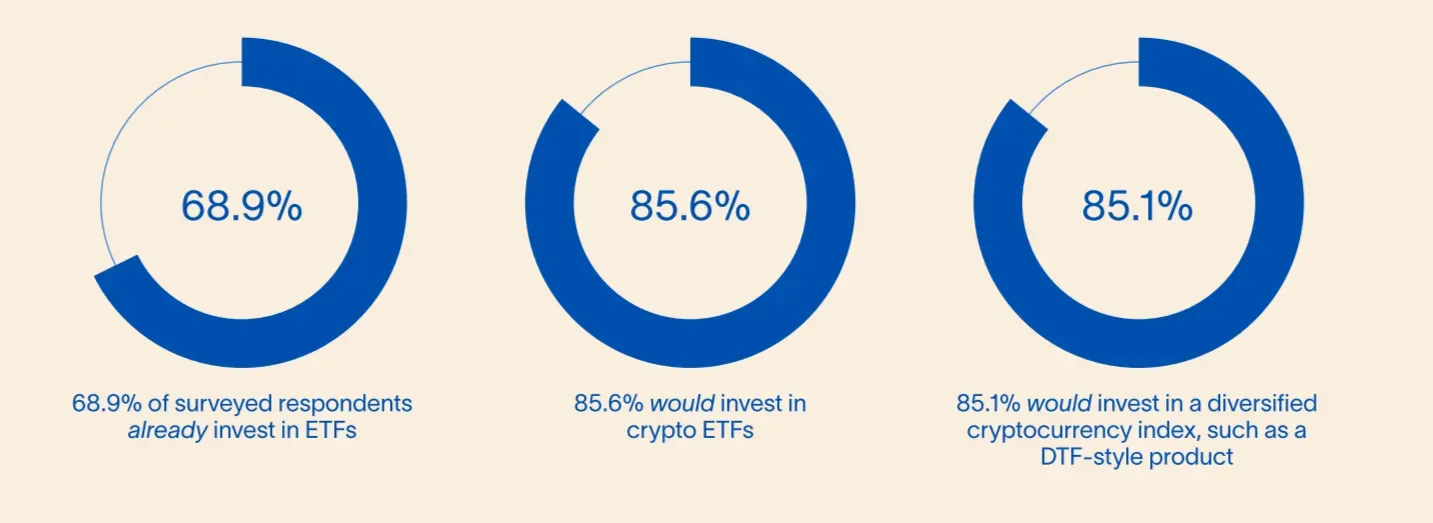

A survey conducted by Reserve and Centiment revealed that 85.1% would consider investing in a decentralized index product if available, indicating substantial interest. This report examines DTFs in detail, exploring their mechanics, the role of supporting infrastructure, notable implementations, and potential implications for future investing.

The Evolution of Index Investing

Index investing began transforming financial markets in the 1970s with the introduction of mutual funds that tracked broad benchmarks like the S&P 500. Vanguard's 1976 launch of its first index fund, which initially raised only $11 million against a $150 million target, faced criticism for being too passive. Yet it paved the way for widespread adoption, as investors recognized the benefits of low-cost diversification.

By the 1990s, exchange-traded funds (ETFs) advanced this further; the SPDR S&P 500 ETF, launched in 1993, now averages $29.3 billion in daily trading volume and stands as one of the most liquid securities globally.

Digital assets followed a similar path. Early crypto investments focused on single tokens like Bitcoin, but as the market diversified, demand grew for bundled products. Crypto ETFs marked a key milestone, with spot Bitcoin ETFs approved in 2024 and Ethereum versions soon after.

These products attracted billions in inflows, exemplified by BlackRock's IBIT ETF, which surpassed $100 billion in assets under management since its October 2025 launch. They offer simplified access, regulatory oversight, and easy integration into traditional portfolios. However, limitations persist.

Most crypto ETFs provide exposure to individual assets rather than diversified baskets, and regulatory hurdles delay multi-asset versions. Centralized custody and restricted trading hours also constrain their utility in a global, always-on market.

DTFs represent the next step, adapting index principles to blockchain environments. They maintain diversification and simplicity while adding features like real-time transparency and programmability. This shift aligns with the cryptocurrency market's growth, where the number of tokens has surged from around 500,000 in 2021 to approximately 18 million in 2025, driven by advancements in development tools and sector expansion.

What Are Decentralized Token Folios?

At their core, DTFs function as onchain portfolios that aggregate up to 100 or more digital assets into a single ERC-20 token. Users can mint new tokens by depositing the underlying assets or redeem them for the components at a 1:1 ratio, all handled permissionlessly via smart contracts. This eliminates the need for centralized custodians and enables continuous operation. Governance occurs through decentralized mechanisms, where token holders vote on parameters like rebalancing frequency or fee structures.

DTFs support various types, including index-based ones that track market-cap-weighted benchmarks and yield-bearing versions that incorporate income-generating assets. For instance, creators can design folios focused on themes such as decentralized finance protocols, infrastructure tokens, or real-world asset tokenizations.

The protocol allows for customizable incentives, enabling teams to allocate fees, raise capital, or provide liquidity rewards. Compared to ETFs, DTFs offer superior flexibility: real-time holdings verification on the blockchain versus quarterly reports, and composability with other DeFi tools for strategies like lending or hedging.

Practical applications include thematic investing. A DTF might bundle tokens from emerging sectors, allowing investors to position portfolios around trends without selecting individual projects. This approach reduces complexity in a market where new tokens appear daily, often exceeding 50,000. By automating rebalancing—typically monthly—DTFs ensure alignments with market shifts, capturing rotations across narratives like privacy-focused assets or community-driven tokens.

Reserve's Infrastructure for DTFs

Reserve Protocol serves as the foundational platform for DTF creation and management. Launched in February 2025, its Index Protocol enables anyone to build, launch, and govern these products using open-source contracts.

The system supports efficient rebalancing, onchain governance, and autonomous operations, all while maintaining 1:1 asset backing. Reserve's audited infrastructure reduces friction, allowing direct minting and redemption on networks like BNB Chain or Ethereum.

This setup democratizes index creation, much like how Vanguard simplified mutual funds. Institutions can design custom folios, while retail users access pre-built ones through decentralized applications. Staking governance tokens earns portions of minting and total value locked fees, incentivizing participation without intermediaries. Reserve's focus on transparency and programmability positions DTFs as tools for broader financial inclusion, particularly as more assets tokenize.

Key Partnerships and Launches

Since its debut, Reserve has collaborated with established index providers to enhance DTF credibility. Partners include Bloomberg Indices for the Galaxy Crypto Index, CoinDesk Indices for the DeFi Select Index, and MarketVector for the Token Terminal Fundamental Index. Additional collaborators like Virtuals Protocol, MEV Capital, and Altcoinist.com contributed to the initial rollout of 12 DTFs in February 2025.

These partnerships integrate trusted methodologies into onchain products. For example, the Bloomberg Galaxy DeFi Index benchmarks rebalance monthly in USD, providing exposure to decentralized finance with defined fees.

Such integrations bridge traditional finance and blockchain, offering institutional-grade options like the Large Cap Index DTF launched with CF Benchmarks in September 2025. Europe's first onchain index, VLONE, developed by Venionaire Capital and Compass Financial Technologies, further demonstrates regulatory compliance under BMR standards.

The CoinMarketCap CMC20 Index

A prominent example is the CMC20 token, recently launched through a partnership between CoinMarketCap and Reserve. This DTF tracks the top 20 cryptocurrencies by market capitalization, excluding stablecoins, wrapped tokens, and restricted assets like Monero.

It spans six sectors: Layer-1 blockchains (over 82%, including Bitcoin, Ethereum, Solana), payments networks (about 7%, such as XRP and TRON), centralized exchange tokens (around 5%, like BNB), infrastructure (Chainlink), DeFi (Hyperliquid's HYPE), and privacy/community (Zcash, Dogecoin, Shiba Inu).

CMC20 rebalances monthly to reflect market changes, ensuring it captures evolving trends automatically. Deployed on BNB Chain by Lista DAO, it supports trading on platforms like PancakeSwap, Bitget, and MEXC, with bridging via Celer Network. CMC20 has since surged to an all-time high of $210, before retracing to its current price of $193. Governed by Reserve's RSR token, it exemplifies how DTFs provide benchmark exposure similar to the S&P 500 but in a decentralized format.

Market Adoption and Growth

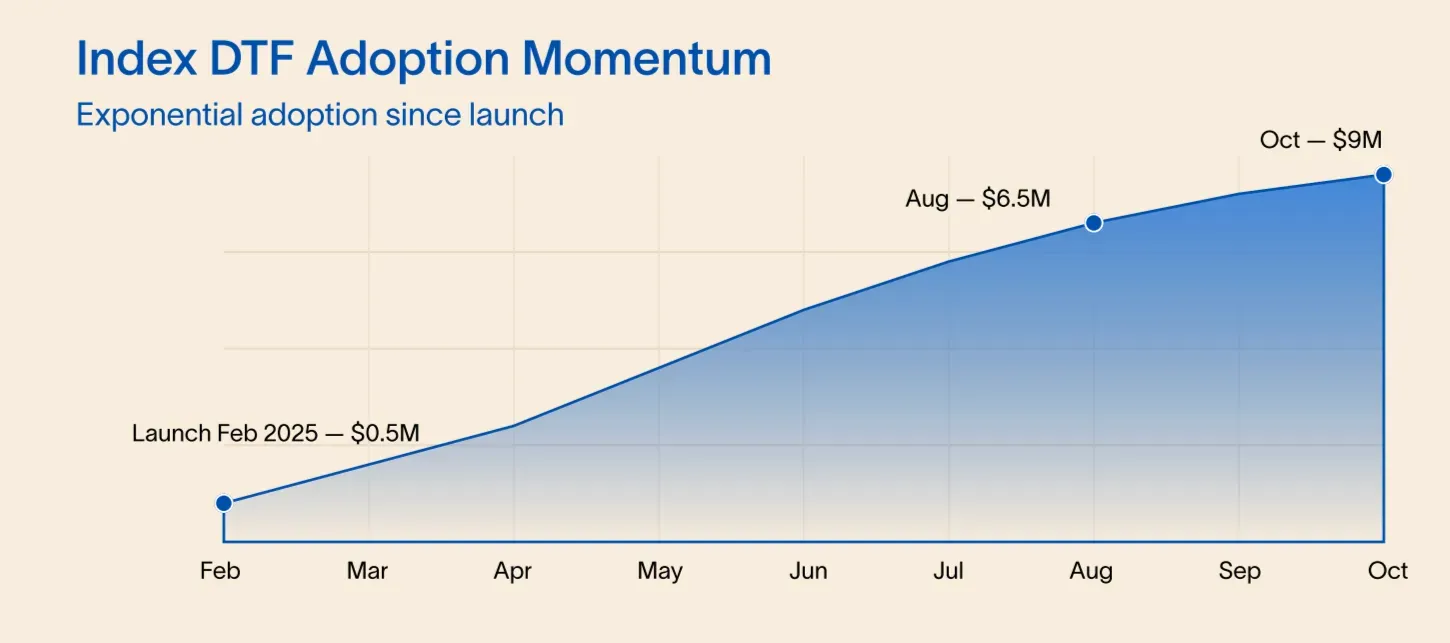

DTFs have shown steady progress since February 2025. Total market capitalization for index DTFs reached over $9 million by October 2025, with an average 30% month-over-month growth, per Reserve’s report. This trajectory reflects increasing demand for onchain diversification. Sector allocations in these products typically include Layer-1/Layer-2 (20%), DeFi (24%), real-world assets (22%), infrastructure (18%), tools (8%), and thematics (8%).

Adoption extends to practical use cases, such as collateral in lending markets or components in yield strategies. The permissionless nature encourages innovation, with creators launching folios tailored to specific narratives. As evidenced by survey data, 68.9% of respondents already hold traditional ETFs, and 85.6% express interest in crypto versions, suggesting DTFs could attract similar inflows.

Convergence in Market Dynamics

Analysis of market drivers highlights cryptocurrency's maturation. Using correlation-based effective rank—a measure of independent factors influencing prices—the top 500 digital assets now exhibit 20 to 25 distinct drivers, comparable to the S&P 500's range. Early crypto markets had fewer than 10, largely tied to Bitcoin, but sectors like DeFi and infrastructure have introduced diversity since 2020.

This convergence underscores the value of diversified products. Just as the S&P 500 captures multifaceted equity dynamics, DTFs enable similar breadth in digital assets, making them suitable for capturing cross-sector movements.

Future Prospects

As tokenization of real-world assets accelerates, DTFs could integrate traditional securities with cryptocurrencies, expanding portfolio options. Reserve's platform facilitates this by supporting hybrid folios. With rebalances like the CF Digital Asset Index Family set for December 2025, ongoing refinements will enhance accuracy. Institutions may increasingly use DTFs for efficient allocation, while retail investors benefit from reduced entry barriers.

Challenges remain in regulatory alignment, but early compliant launches like VLONE suggest pathways forward. Overall, DTFs position themselves as versatile tools for modern investing.

Conclusion

Decentralized Token Folios extend the principles of index investing into blockchain ecosystems, offering diversified exposure with enhanced features. Through platforms like Reserve and partnerships with index providers, they provide actionable ways for investors to engage with digital markets. As adoption grows, DTFs may indeed represent a significant advancement in how portfolios are constructed and managed.

Sources:

- Reserve Vanguard Report: Historical overview of index investing and diversification principles.

- State Street Global Advisors (SSGA): Industry insights on the future of crypto and blockchain evolution.

- Vanguard Corporate History: Background on the origins and milestones of index fund development.

- ETF.com: Spot Bitcoin ETFs Review: Analysis of early performance and market impact of Bitcoin ETFs.

- Yahoo Finance: BlackRock IBIT AUM Update: Coverage of IBIT’s growth beyond $100B in assets under management.

GlobeNewswire: Reserve Ecosystem Partnerships: Details on Reserve’s Index Protocol launch and collaborations with Bloomberg, CoinDesk, and MarketVector.

Read Next...

Frequently Asked Questions

How do DTFs differ from traditional ETFs?

Unlike ETFs, which often involve centralized custody and limited trading hours, DTFs operate permissionlessly on blockchain, offer instant redemptions, programmable governance, and composability with DeFi protocols.

What role does Reserve Protocol play in DTFs?

Reserve Protocol, launched in February 2025, provides open-source infrastructure for creating, managing, and governing DTFs, supporting rebalancing, governance, and partnerships with index providers like Bloomberg and CoinDesk.

What is the CMC20 Index?

CMC20 is a DTF tracking the top 20 cryptocurrencies by market cap (excluding stablecoins and wrapped tokens), rebalancing monthly across sectors like Layer-1, DeFi, and infrastructure, deployed on BNB Chain.

What are the future prospects of DTFs?

DTFs could integrate tokenized real-world assets, expand hybrid portfolios, and attract institutional adoption, though regulatory challenges persist, positioning them as tools for broader financial inclusion.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens