What Are Automated Market Makers (AMMs)?

Learn how automated market makers work on DEXes, liquidity pools, impermanent loss risks, and top AMM protocols like Uniswap

Crypto Rich

January 19, 2021

Table of Contents

This article was last revised on September 11, 2025

Automated market makers (AMMs) are smart contract protocols that enable cryptocurrency trading through liquidity pools, instead of traditional order books. Rather than finding counterparty traders, these algorithms automatically price assets using mathematical formulas. Users can swap tokens directly against pooled liquidity.

Since Uniswap popularized the constant product formula in 2018, AMMs have become the backbone of decentralized finance. Major protocols now collectively hold billions in total value locked across blockchain networks. DeFi's overall TVL recently surpassed $150 billion, while Uniswap alone has processed trillions in cumulative trading volume.

Why Do Decentralized Exchanges Need AMMs?

Early decentralized exchanges tried to copy order book models on-chain. The approach failed badly. Each order placement and cancellation costs expensive gas fees, while thin liquidity made trading prohibitively expensive for users.

The solution came when developers realized algorithmic pricing could replace human market makers entirely. Instead of matching individual orders, AMMs let users trade against smart contract-controlled liquidity pools. This eliminates the need for counterparty discovery while maintaining decentralized operations.

AMMs also opened market-making to everyone. Traditional market making demands sophisticated infrastructure and substantial capital, but AMMs removed these barriers, enabling permissionless innovation in DeFi.

How Do Liquidity Pools Work?

Liquidity pools are smart contracts containing reserves of two tokens (usually two, but some protocols support more) that enable automated trading. Users pool their funds together, creating a shared reserve that anyone can trade against.

The Basic Process

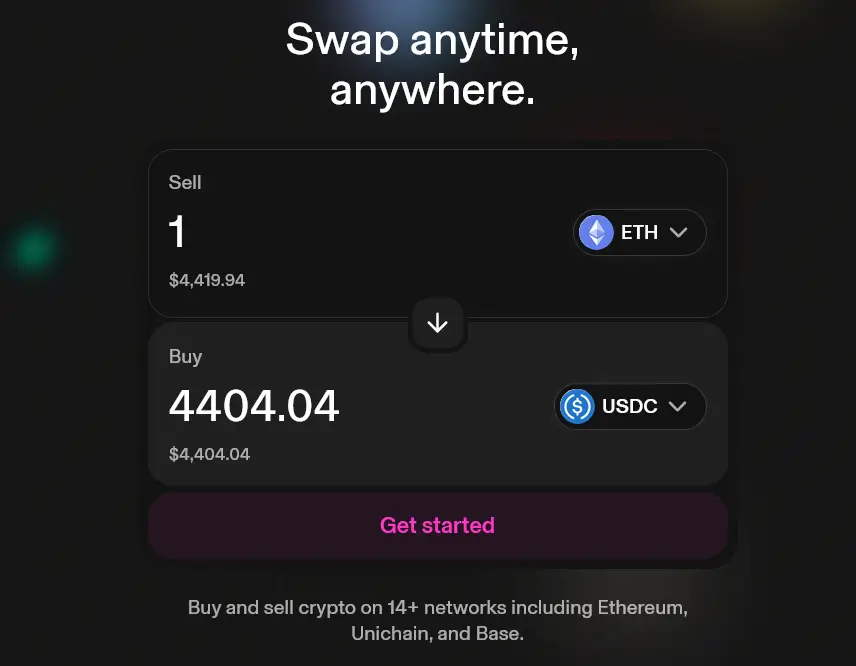

Here's how it works: Users deposit equal values of paired assets—like 50% ETH and 50% USDC—to become liquidity providers. The pool holds these tokens and uses them for swaps when other users want to trade.

Say someone wants to trade ETH for USDC. They send ETH to the pool and receive USDC back. The trade changes the token ratio in the pool, which automatically adjusts prices for the next trader. Popular tokens become more expensive, while less demanded ones become cheaper.

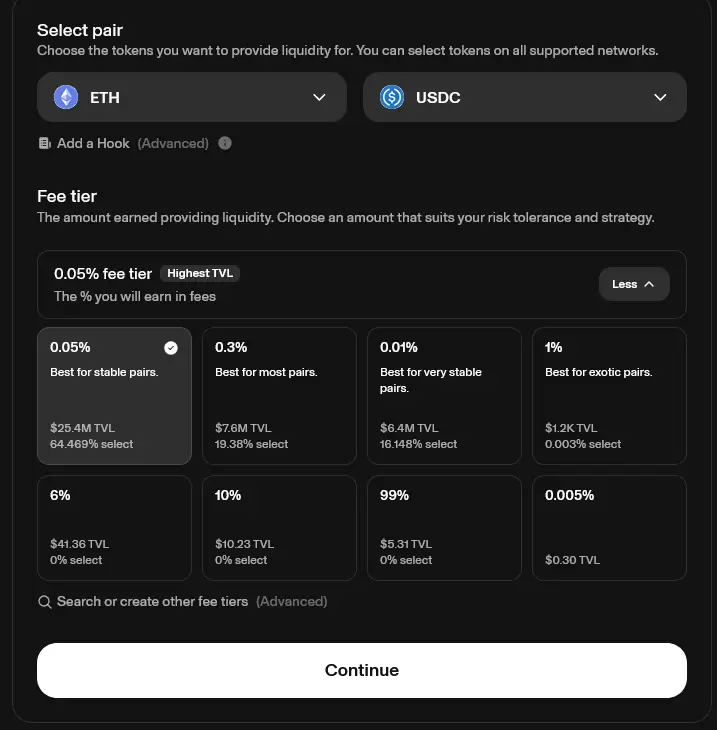

How Providers Earn Money

Liquidity providers earn fees from each trade based on their share of the pool. Many protocols add governance token rewards and automated compounding through yield farms.

Adding Liquidity Step-by-Step

The process for adding liquidity follows these basic steps:

- Select a token pair or create a new one

- Approve smart contract access to your tokens

- Deposit equal values of both assets

- Receive liquidity provider tokens representing your share

- Stake these tokens to earn trading fees and rewards

How Do AMMs Calculate Token Prices?

Most AMMs use the constant product formula that Uniswap made famous: x × y = k. This math automatically determines prices based on supply and demand, eliminating the need for human involvement.

Here's the breakdown: x and y represent the quantities of two tokens in a pool, while k stays constant. When users trade one token for another, the product of both quantities must remain the same.

Let's use a real example. A pool contains 100 ETH and 200,000 USDC, giving us a constant product of 20,000,000. If someone buys 10 ETH from the pool, they need to add enough USDC to keep the same product. The math works out to 90 ETH remaining in the pool, requiring approximately 222,222 USDC, which sets the effective price.

This creates automatic price discovery. More people buying ETH pushes its price up exponentially because of the constant product constraint. Arbitrageurs step in when AMM prices deviate from external markets, helping maintain accuracy.

Alternative AMM models use different approaches:

- Curve Finance uses stable swap formulas for stablecoins with minimal slippage

- Balancer allows pools with multiple tokens and custom weightings

- Emerging models include function oracles and hybrid approaches for specialized trading

What Risks Do Liquidity Providers Face?

Impermanent loss represents the primary risk for AMM liquidity providers, in addition to the usual dangers associated with smart contracts. It happens when token prices shift relative to each other after you deposit funds into a pool.

The "impermanent" part means it only becomes permanent when you withdraw your tokens. If prices return to their original ratio, the loss disappears. However, significant price swings often result in permanent losses, as providers typically need to exit positions at some point.

Here's a concrete example: You deposit 1 ETH and 2,000 USDC when ETH trades at $2,000. ETH's price doubles to $4,000. Arbitrageurs rebalance the pool to match market prices until it holds about 0.707 ETH and 2,828 USDC. Your total value becomes $5,656, but simply holding would have given you $6,000. That's a 6% impermanent loss.

Several factors affect how bad impermanent loss gets:

- Price volatility between paired tokens increases potential losses.

- Asset correlation reduces risk exposure.

- Time duration affects whether prices might revert.

- Trading fees can partially offset losses, though they rarely cover major price movements.

Modern AMM protocols fight impermanent loss in several ways. Concentrated liquidity lets providers set price ranges, reducing exposure to wild swings. Some platforms offer protection through diversification strategies, stable pairs, or insurance funds. Dynamic fees that adjust for volatility also help compensate providers during risky periods.

What Are the Main Benefits of Using AMMs?

AMMs provide several advantages over traditional exchange models, particularly for decentralized trading environments. These benefits have driven widespread adoption across multiple blockchain networks.

Key advantages include:

- Permissionless Access: Anyone can create trading pairs or provide liquidity without central approval, enabling trading of assets that centralized exchanges often avoid.

- 24/7 Availability: Smart contracts operate continuously without human intervention, unlike traditional markets that depend on operators who may exit during volatility.

- Full Transparency: All operations occur on public blockchains where users can verify pool balances, fees, and mechanics without trusting intermediaries

- Low Entry Barriers: Retail users can participate with modest amounts rather than requiring millions in capital and sophisticated infrastructure.

- Protocol Integration: Seamless compatibility with other DeFi protocols for lending, yield farming, and price oracles.

What Are the Main Limitations of AMMs?

Despite their advantages, AMMs face several limitations that affect user experience and adoption. Understanding these constraints helps explain ongoing development efforts across the ecosystem.

Technical Limitations

Capital Inefficiency: Traditional AMMs require liquidity across all possible price ranges, even though most trading occurs within narrow bands. Much of the deposited capital earns minimal fees while sitting unused.

Price Impact: The constant product formula creates exponential price changes as trade sizes increase. Large purchases or sales can move prices significantly, making AMMs less suitable for institutional-sized transactions.

Economic Challenges

Transaction Costs: Gas fees on Ethereum mainnet can make small trades economically unviable, though many AMMs now operate on cheaper layer-2 networks like Arbitrum, Optimism, and Base. Each swap requires blockchain transaction fees that sometimes exceed the value being traded on higher-cost networks.

Liquidity Fragmentation: Multiple AMMs split trading volume across different pools for the same assets. This division reduces effective liquidity and can create price discrepancies between platforms.

MEV Exploitation: Sophisticated actors profit at regular users' expense through front-running and sandwich attacks. The good news? Some protocols have implemented protections against these tactics.

How Have AMMs Improved Over Time?

The AMM space continues to evolve with major upgrades that address existing issues and introduce new features.

Recent big developments include:

- Advanced Hook Systems: Uniswap V4 enables developers to add custom features, such as limit orders and price tracking. Its singleton pools cut gas costs by up to 95%

- Cross-Chain Integration: Protocols now unify liquidity across chains like Solana, Ethereum, and Sui without bridging headaches

- MEV Protection: New models like CoW AMM capture sneaky arbitrage profits and give them back to liquidity providers

- Smart Fee Adjustments: Fees now change based on market chaos, paying providers more during volatile times

- Multi-Chain Expansion: Major AMMs have spread to multiple other chains, including Solana and Base, boosting volume across their ecosystems

- Emerging Innovations: Integration with perpetual futures trading and early experimentation with AI-driven liquidity optimization are expanding AMM capabilities into new markets

Which AMM Protocols Lead the Market?

The AMM ecosystem includes several dominant protocols, each optimized for different use cases and user requirements.

Top platforms include:

- Uniswap: The biggest AMM by volume and liquidity. Processes massive daily trading across Ethereum and layer-2 networks while leading the concentrated liquidity revolution

- PancakeSwap: Rules BNB Chain and beyond with over $2 billion TVL and integrated yield farming. Recently expanded to Solana and Base with smart position management

- Curve Finance: The stablecoin specialist with ultra-low slippage for correlated assets like USDC/USDT

- Balancer: Enables flexible pools with multiple assets and custom ratios, perfect for index-style investing with reduced impermanent loss

Conclusion

AMMs have transformed decentralized trading into essential financial infrastructure. These protocols enable permissionless asset exchange through algorithmic pricing and community-provided liquidity rather than traditional order books.

While challenges like impermanent loss persist, ongoing improvements in cross-chain functionality and MEV protection continue expanding AMM capabilities. For newcomers, established protocols like Uniswap or PancakeSwap offer proven systems to start learning the mechanics.

Sources:

- DeFiLlama - AMM protocol analytics and TVL data

- Uniswap Docs - Protocol documentation and specifications

- CoinGecko - Trading volume and market data

- PancakeSwap Docs - Liquidity pool information

- Curve Finance - User resources documentation

- Balancer - Technical documentation

Read Next...

Frequently Asked Questions

What is an automated market maker in simple terms?

An automated market maker is a computer program that automatically sets prices for cryptocurrency trades using mathematical formulas. Instead of matching buyers and sellers like traditional exchanges, AMMs let you trade directly against pools of tokens held in smart contracts.

How do AMMs make money?

AMMs generate revenue through trading fees charged on each swap, typically 0.25-0.3% of the transaction value. These fees are distributed to liquidity providers who deposit tokens into the pools that enable trading.

What is the difference between AMMs and centralized exchanges?

AMMs operate through smart contracts without central control, while centralized exchanges are managed by companies that custody user funds. AMMs offer permissionless access and transparency but may have higher fees and price impact for large trades compared to centralized platforms.

Can you lose money providing liquidity to AMMs?

Yes, liquidity providers can face impermanent loss when token prices change relative to each other. You might end up with fewer tokens than if you had simply held them separately, though trading fees and protection mechanisms can sometimes offset these losses.

Which AMM is best for beginners?

Uniswap and PancakeSwap are user-friendly options with extensive documentation and community support. Start with small amounts to understand the mechanics before committing significant capital to any liquidity pools

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens