Canary Capital Sets Stage for Injective Staking ETF

While this trust doesn’t guarantee an ETF will go live, it marks a significant move toward that direction. Canary will need to file Form S-1 and Form 19b-4 with the SEC to proceed.

Soumen Datta

June 10, 2025

Table of Contents

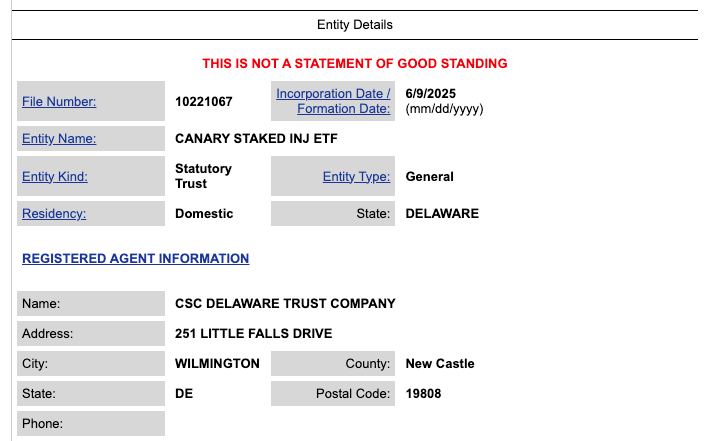

Canary Capital officially registered a trust in Delaware under the name “Canary Staked INJ ETF,” hinting at plans to launch a U.S.-listed exchange-traded fund tied to Injective's native token, INJ. This trust formation marks the initial step in what could become the first INJ staking ETF in the United States.

Filing a Delaware trust is a standard first move in the ETF creation process. It does not guarantee the product will make it to market, but it often precedes more formal applications to the U.S. Securities and Exchange Commission (SEC). Canary’s trust mirrors the early-stage filings of several other crypto ETFs that later saw full launches or approvals.

Exposure to INJ and Staking Rewards in One Package

The planned ETF aims to do more than just track the spot price of Injective. Canary Capital is looking to offer a dual-purpose investment vehicle—one that reflects INJ’s market price and also earns staking rewards. This model is similar to what has been attempted with Solana-based ETFs and a recently launched Injective exchange-traded product in Europe by 21Shares.

Staking allows token holders to support blockchain operations like transaction validation in return for additional tokens. In the context of an ETF, this means investors would not only get exposure to INJ’s price movements but also benefit from staking yields without having to handle the technical aspects of staking on their own.

SEC Filings Still Pending but Expected

The trust formation is just the beginning. To move forward, Canary Capital must file a Form S-1 registration statement with the SEC. This form outlines the ETF’s structure, underlying assets, and investment objectives. Approval from the SEC is essential before the product can be listed on any U.S. exchange.

In addition to the S-1, Canary will also need to submit a Form 19b-4 via the exchange where it intends to list the ETF. As of now, neither of these filings appears on the SEC’s public database, indicating that the process is still in its early phase.

A Broader Push Into Crypto ETFs

This is not Canary’s first foray into crypto ETFs. In April, Canary filed for a TRX staking ETF, applying the same approach of generating on-chain rewards while tracking a token’s spot price.

Most notably, the firm filed for a U.S. ETF tracking the spot price of Sui (SUI)—a first in the American market. Canary’s ambition reflects a broader strategy to capture new flows from crypto-curious investors who prefer traditional investment vehicles.

Beyond Injective and TRX, Canary is also seeking to bring ETFs for Solana (SOL), Litecoin (LTC), XRP, Hedera (HBAR), and Axelar (AXL) to the U.S. market.

Why Injective?

Injective is a blockchain designed for finance-focused decentralized applications, offering features like decentralized derivatives, prediction markets, and on-chain order books. Its native token, INJ, is used for staking, governance, and fee payments. With more institutional attention shifting toward DeFi infrastructure, INJ presents a unique asset for a staking-based ETF product.

The decision to wrap staking rewards into a regulated financial product may resonate with investors who want passive income opportunities without navigating crypto wallets or validator nodes.

ETFs that integrate staking also test the SEC’s willingness to approve yield-bearing crypto products. While the agency has been historically cautious, recent developments suggest more openness to innovation that aligns with investor protection standards.

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens