BNB's Surge in 2025: Yield, Adoption, and Performance Metrics

BNB’s 2025 metrics highlight network strength through user growth, stablecoin expansion, and integration across finance, gaming, and real-world assets.

Miracle Nwokwu

October 31, 2025

Table of Contents

BNB, the native token of BNB Chain, has shown notable progress throughout 2025, driven by consistent network activity and expanding utility. Daily active addresses on the chain peaked at 3.4 million on October 13, reflecting a 300 percent increase in user growth compared to the previous year.

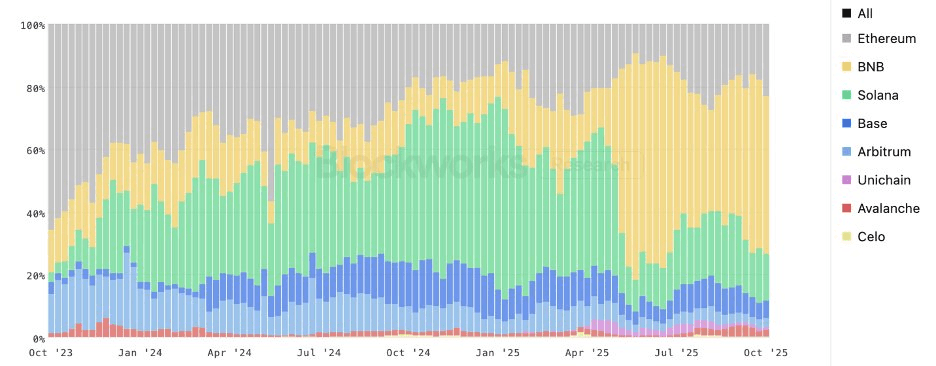

DEX trading volumes reached approximately $19 billion per day, capturing around 61 percent of the market share among major chains, while active stablecoin wallet addresses hit roughly 20 million, underscoring broad adoption across DeFi, AI, memes, real-world assets, and consumer applications.

These figures highlight BNB's role in providing users with exposure to diverse Web3 sectors, including historical native holding yields of 15 to 20 percent, which stem from its integration across asset issuance and distribution layers. As the year progressed, BNB's deflationary mechanisms burned over 64 million tokens, equivalent to more than $72 billion at October prices, further solidifying its economic structure. This combination of metrics sets the stage for examining BNB's developments more closely.

BNB's Growth Trajectory in 2025

BNB Chain's expansion in 2025 built on a multi-layered roadmap aimed at enhancing throughput and functionality. The network targeted over 20,000 transactions per second with block finality under 150 milliseconds, incorporating native zero-knowledge privacy modules for secure settlements.

Mid-year initiatives, such as the Binance Alpha program, sparked a surge in DEX activity, with volumes temporarily exceeding 70 percent of total on-chain spot trading. Looking ahead to 2026, upgrades promised near-instant confirmations, Nasdaq-level capacity, and upgradable virtual machines for parallel execution, alongside privacy features and simplified user controls. These enhancements positioned BNB Chain as a modular stack for asset issuance, discovery, and settlement, with BNB serving as the central utility token.

Stablecoins and payments formed another pillar of growth, as BNB Chain ranked among the top networks for transaction volume and user engagement in these areas. Integrations with tokenized treasuries from partners like Ondo Finance and Franklin Templeton, along with Circle's USDC deployment and cross-chain bridging, deepened liquidity. Exchange-linked real-world asset pilots, including Kraken's xStocks and tokenized funds, extended BNB's utility into mainstream scenarios.

The chain hosted thousands of projects across DeFi, gaming, social tokens, and NFTs, where BNB acted as the primary unit for participation. This tied demand to ecosystem expansion, blending CeFi and DeFi elements to support long-term value aligned with usage rather than cycles.

A significant shift occurred in U.S. market access, previously limited but now evolving through regulatory developments. Pipelines for BNB digital asset trusts (DATs) and ETFs, alongside listings on platforms like Robinhood and Coinbase, enabled fiat-based exposure for participants. The full pardon of Binance founder CZ removed potential barriers, signaling opportunities for developer onboarding and enterprise integrations in payments, custody, and infrastructure. This positioned North America as a potential growth engine, accelerating institutional adoption in an underserved region.

Product diversification further broadened investor access to BNB's narrative. Regional DATs, such as the NASDAQ-listed BNB Network Company, offered amplified returns, while ETFs in approval processes provided intraday liquidity mirroring token performance. Yield funds, like Hash Global's, catered to mandates restricting direct token holdings but allowing BNB-linked investments.

With KYC/AML compliance, independent audits, and standardized disclosures, these instruments reduced frictions and expanded the user base across liquidity and yield preferences. Recent examples included CMB International's $3.8 billion money market fund tokenized on BNB Chain via CMBMINT and CMBIMINT, integrating with protocols like Venus for collateralized lending.

Historical Performance and Cycle Resilience

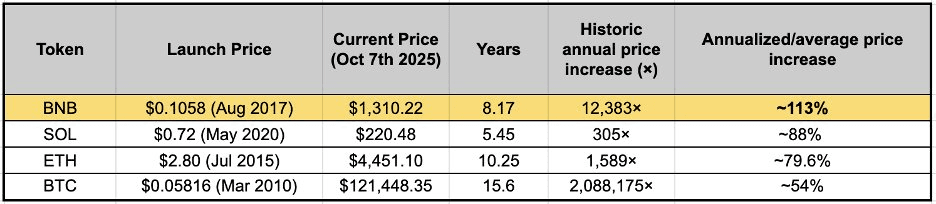

BNB demonstrated resilience across market cycles, outperforming peers among Layer-1 tokens eligible for DATs. From 2017 to October 2025, it achieved an annualized price increase of up to 113 percent, surpassing ETH, BTC, and SOL in structured gains. This decoupling from broader market beta allowed BNB to retain strength during downturns in 2018 and 2022, reclaiming highs through utility and supply discipline. The consistency stemmed from on-chain economic activity, platform integrations, and deflationary burns, making it suitable for long-term structured products that generate fees or yields.

BNB as a Strategic Portfolio Asset

Beyond crypto natives, BNB appealed to newcomers by improving risk-adjusted returns in diversified portfolios. Simulations showed that allocating 2 to 5 percent to BNB raised Sharpe ratios from 0.95 to 1.25 in equity-bond-commodity mixes, capturing Web3 exposure while enhancing diversification. Its independence from crypto beta, driven by dual CeFi-DeFi engines, reflected real usage and growth rather than macro liquidity.

Current conditions offered asset managers a chance to integrate BNB as an alternative, especially with institutional holdings like Applied DNA's $27 million in BNB and CEA Industries' 480,000 tokens for treasury strategies.

Balancing the Crypto Asset Trilemma

BNB addressed the crypto asset trilemma—economic throughput, security, and liquidity—through its Proof-of-Staked-Authority consensus and multi-venue access. It channeled user activity via transactions and deployments while maintaining robust validation and low-friction exchanges.

Unlike networks trading one dimension for another, BNB sustained balance, transforming holdings into active participation via Launchpool, airdrops, and governance. Historical incentives outperformed peers, with 15 to 20 percent annual enhancements, fostering decentralization and retention. This one-token engagement spanned lending, trading, and gaming, strengthening the ecosystem.

Strategic Highlights of the BNB Ecosystem

BNB's ecosystem functioned as a high-efficiency platform for Web3 asset issuance and trading, integrating centralized and decentralized elements. Incentives encouraged long-term holding through programs offering rewards and access, while the deflationary model aligned usage with value.

Venture participants like YZi Labs supported projects from proof-of-concept to global trading, establishing top token pairs and facilitating growth via BNB Chain and exchanges. This full-cycle hub covered incubation, deployment, liquidity, and participation.

Launchpool mechanisms drove lockups and generated 15 to 20 percent annual value enhancements during peaks, outperforming SOL (6.5 percent) and ETH (4.5 percent) by leveraging native integrations. Characterized as a Web3 "tech platform," BNB combined Binance's traffic with robust infrastructure and utilities like Alpha, distinguishing it from BTC's store-of-value role or ETH's DeFi focus.

BNB's Position in Advancing Web3

BNB encapsulates access, utility, and supply stabilization, granting holders exposure to Web3's full spectrum—from blue chips to emerging tokens. While ETH focuses on DeFi infrastructure and BTC on value storage, BNB operates as an efficient trading engine for the global Web3 economy. Its on-chain growth, incentives, and compression mechanisms position it as a key allocation tool for investors navigating this space.

Sources:

- BNB: the Core Engine Behind the Global Economy (YZi Labs): https://www.yzilabs.com/blog/bnb-the-core-engine-behind-the-global-web3-economy

- Franklin Templeton Integration (BNB Chain Blog): https://www.bnbchain.org/en/blog/franklin-templetons-benji-technology-platform-onboards-bnb-chain-unlocking-the-next-era-of-tokenized-finance

- DEX: Spot Volume by Blockchain: https://blockworks.com/analytics/dex-volume/dex-blockchain-12748

Read Next...

Frequently Asked Questions

How has BNB's user adoption evolved in 2025?

User growth surged with integrations in DeFi, AI, memes, real-world assets, and consumer apps. Stablecoin expansion and partnerships like Ondo Finance and Circle's USDC boosted liquidity and engagement.

What is BNB's historical performance and cycle resilience?

From 2017 to October 2025, BNB achieved up to 113% annualized price increase, outperforming ETH, BTC, and SOL. It showed resilience in 2018 and 2022 downturns through utility, integrations, and deflationary burns of over 64 million tokens ($72 billion value).

How does BNB balance the crypto asset trilemma?

BNB uses Proof-of-Staked-Authority for economic throughput, security, and liquidity. It enables active participation via Launchpool, airdrops, and governance, with historical yields of 15-20% annually.

What future upgrades are planned for BNB Chain?

2026 upgrades include near-instant confirmations, Nasdaq-level capacity, parallel execution VMs, privacy features, and simplified controls, positioning it as a modular stack for asset issuance and settlement.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Miracle Nwokwu

Miracle NwokwuMiracle holds undergraduate degrees in French and Marketing Analytics and has been researching cryptocurrency and blockchain technology since 2016. He specializes in technical analysis and on-chain analytics, and has taught formal technical analysis courses. His written work has been featured across multiple crypto publications including The Capital, CryptoTVPlus, and Bitville, in addition to BSCN.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens