BNB Chain Surpasses Expectations with Strong Revenue Growth in Q1 2025

BNB Chain surpassed expectations with its strong revenue growth in Q1 2025, achieving impressive milestones and reinforcing its position in the crypto market. This surge signals continued growth and solidifies its status as a leading blockchain.

Soumen Datta

April 30, 2025

Table of Contents

BNB Chain, one of the leading blockchain networks in the cryptocurrency ecosystem, has posted impressive growth in Q1 2025, even as broader market conditions continue to be volatile.

According to the latest Messari report, BNB Chain’s network revenue surged by 58.1% in Q1, reaching $70.8 million. This growth has occurred despite BNB’s market cap falling by 14.8%, a trend observed across the crypto market during the same period. Despite the broader downturn, BNB Chain's performance in the first quarter of 2025 reveals significant strides in on-chain activity, fee generation, and infrastructure improvements.

Revenue Growth Amid Market Challenges

BNB Chain's revenue growth in Q1 2025 stands out as a notable achievement. Total fees collected reached $70.8 million, marking a significant 58.1% increase from $44.6 million in the previous quarter (Q4 2024). This increase was not only in monetary value but also in terms of the volume of BNB tokens collected, which grew by 58.0%, from 69,500 BNB in Q4 to 109,800 BNB in Q1.

The growth in revenue was particularly noteworthy considering that the BNB market cap experienced a decline of 14.8% during the same period, dropping to $86.2 billion. This decline was in line with broader market trends, as Bitcoin’s market cap fell by 11.8%, and other cryptocurrencies, like Ethereum and Solana, experienced even steeper drops of 45.2% and 29.6%, respectively.

Strong Performance in Gas Fees and Transaction Growth

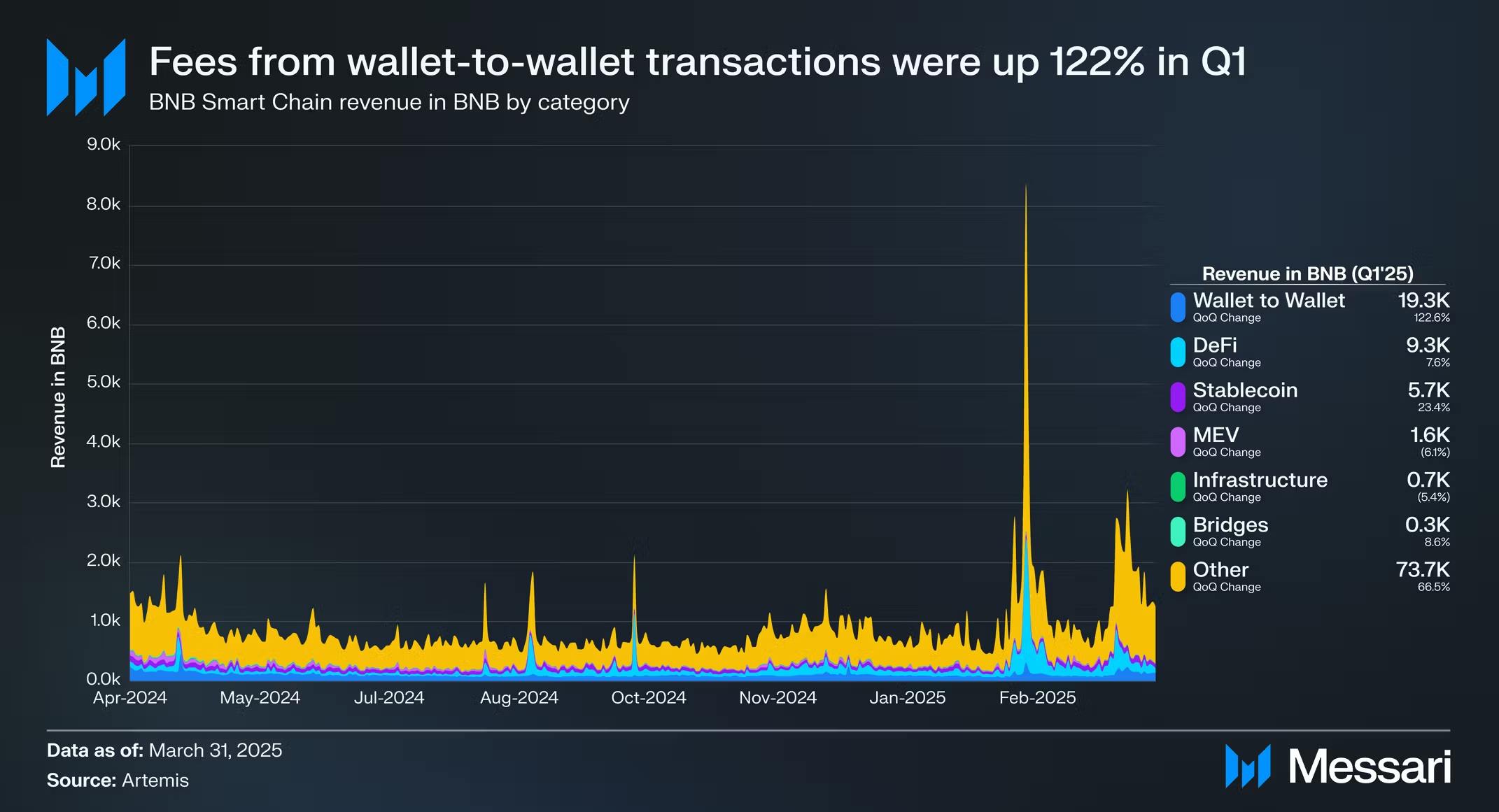

A significant contributor to BNB Chain’s revenue growth in Q1 2025 came from gas fees. Wallet-to-wallet transactions saw a substantial increase of 122.6% QoQ, generating 19,266 BNB, which accounted for 17.4% of the total revenue. This performance overtook the decentralized finance (DeFi) category as the largest individual contributor to revenue.

In comparison, DeFi’s revenue share fell to 8.4%, although it still generated 9,274.9 BNB, representing a 7.6% increase from the previous quarter.

Stablecoins also played a significant role, generating 5,745.1 BNB, a 23.4% increase from Q4 2024. However, their revenue share declined to 5.2% due to a broader decrease in stablecoin activity. Other categories, such as the MEV (Maximal Extractable Value) and Infrastructure, saw a slight decline in fees for the quarter, down by 6.1% and 5.4%, respectively. Bridge transactions experienced a modest increase, growing by 8.6% QoQ to 275.1 BNB.

Supply Dynamics and Token Burn Mechanisms

BNB Chain continues its deflationary approach to token supply, with the circulating supply of BNB tokens standing at 142.5 million by the end of Q1 2025. This represents an annualized deflation rate of 4.6%, down from 12.9% QoQ.

The decrease in supply is driven by a combination of burn mechanisms, including the Auto-Burn mechanism, the Pioneer Burn program, and gas fees burn.

- Auto-Burn: A mechanism that burns a varying amount of BNB each quarter based on token price and block generation on the network.

- Pioneer Burn: This program accounts for BNB tokens lost by careless or new users, with the project team reimbursing users for accepted cases.

- Gas Fees Burn: According to BEP-95, 10% of all gas fees on BNB Smart Chain are burned automatically, while the remaining 90% is rewarded to validators and stakers.

In April 2025, the 31st quarterly BNB burn took place, with 1.58 million BNB burned, equivalent to $916 million at the time. A significant portion of this burn came from the Auto-Burn and BTokens programs, with Pioneer Burn contributing 6.7% of the total burn.

On-Chain Activity and Transaction Growth

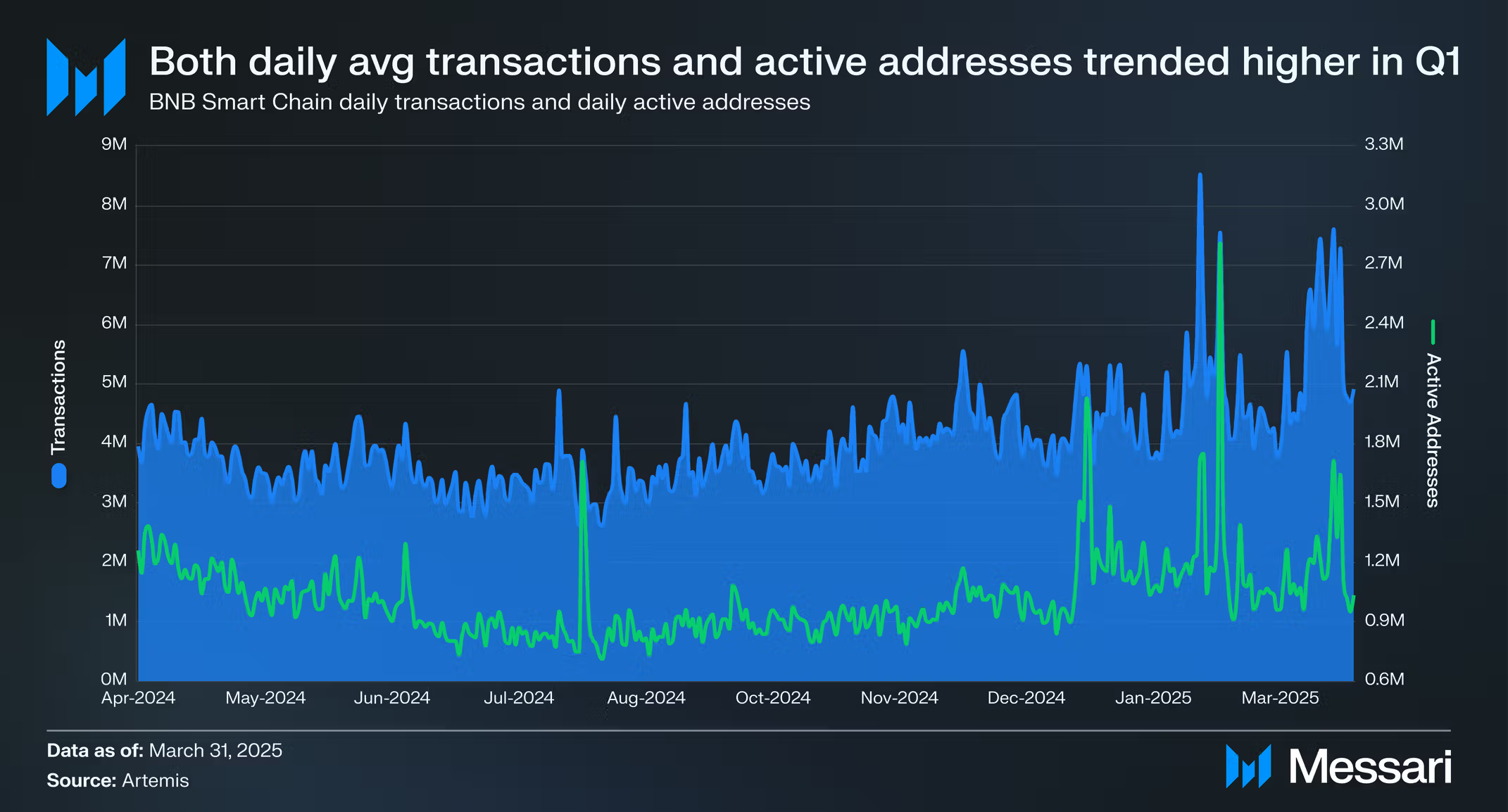

BNB Chain saw a continued increase in on-chain activity in Q1 2025. Average daily transactions rose by 20.9% QoQ, from 4.0 million in Q4 2024 to 4.9 million in Q1 2025. Similarly, average daily active addresses also saw a notable increase of 26.4%, from 941,600 to 1.2 million. These metrics demonstrate a growing user base and increasing engagement with the BNB Smart Chain.

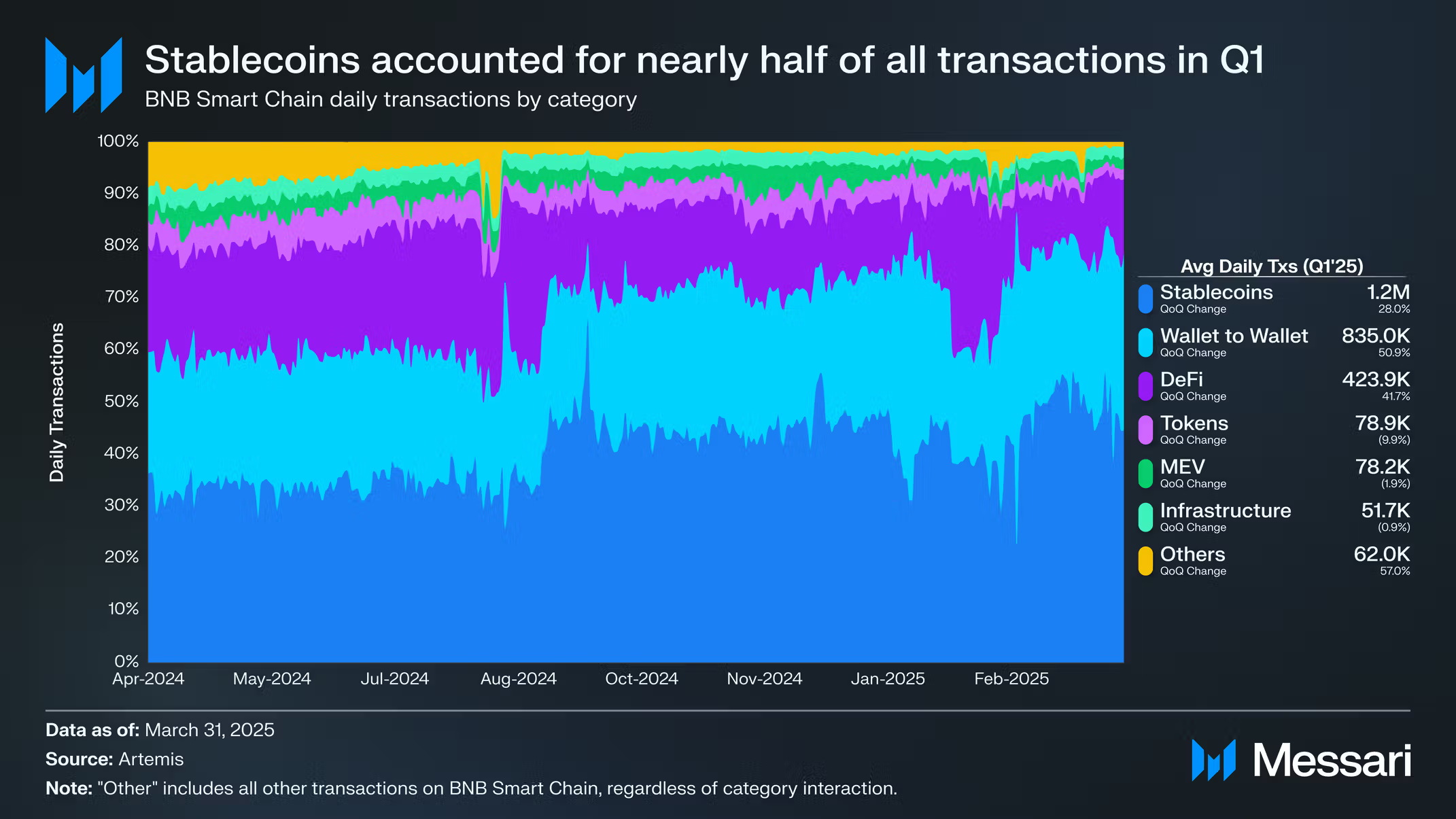

Stablecoins represented nearly half (45%) of all transactions on the network in Q1 2025. Stablecoin transactions averaged 1.2 million daily, marking a 28% increase from the previous quarter.

Wallet-to-wallet transactions also experienced significant growth, rising by 50.9% to 835,000 daily transactions. Combined, stablecoin and wallet-to-wallet transactions accounted for 74.4% of all transactions on BNB Smart Chain during Q1 2025.

The DeFi sector also showed a healthy increase, with daily transactions rising 41.6% QoQ to 423,900. Other categories that saw positive growth in Q1 2025 included gaming (up 11.9% QoQ) and non-stablecoin token transactions (up 57.1%). However, the MEV and Infrastructure categories experienced a decline in daily transaction counts during the quarter.

Security and Decentralization: A Strong Network Backbone

BNB Smart Chain operates under a Proof-of-Staked Authority (PoSA) consensus mechanism, which ensures that 45 validator nodes are elected every 24 hours to participate in consensus. The top 21 validators with the highest staked BNB are selected as "Cabinets," while the remaining 24 are "Candidates." These validators take turns producing blocks based on Ethereum’s Clique consensus design.

In Q1 2025, BNB Chain completed the Feynman upgrade, increasing the number of active validators from 40 to 45. This upgrade represents a commitment to network security and decentralization, providing a strong foundation for future growth. With 45 active validators, BNB Chain ensures a healthy and competitive environment for its network participants.

The total amount of BNB staked on the network rose by 2.4% QoQ, from 29.6 million to 30.4 million BNB. However, due to the decline in BNB's price during the quarter, the dollar value of the staked BNB decreased by 11.8%, from $20.8 billion to $18.4 billion. Despite this, BNB Smart Chain still ranked as the third-highest PoS network by the total dollar value of staked funds, surpassing Sui.

Pascal Hard Fork: Enhancing Ethereum Compatibility and Developer Flexibility

In February 2025, BNB Chain executed the Pascal hard fork, a critical upgrade designed to improve Ethereum compatibility and enhance developer flexibility. The Pascal fork introduced several key features aligned with Ethereum's Pectra roadmap, including EIP-7702 and BEP-439.

- EIP-7702: This Ethereum Improvement Proposal allows externally owned accounts (EOAs) to temporarily behave like smart contracts, enabling the creation of more flexible and user-friendly wallet interfaces. Features such as multi-signature support, account abstraction, and gas fee abstraction are now possible, reducing friction for dApp onboarding.

- BEP-439: This upgrade introduced cryptographic support for the BLS12-381 curve, enabling more efficient and secure signature aggregation. This feature will be critical for scaling decentralized applications in the future.

Additionally, the Pascal hard fork boosted BNB Chain’s performance capabilities, increasing the gas limit from 120 million gas units to nearly 140 million gas units. The network’s internal transaction pool logic was also refined to better handle edge cases and zero-gas transactions.

Looking Ahead: Future Upgrades and Ecosystem Developments

The first quarter of 2025 marked a significant milestone for BNB Chain, but there are more upgrades planned throughout the year. Following Pascal, the Lorentz upgrade is scheduled for April 2025 and aims to reduce block intervals to just 1.5 seconds, further improving the speed and efficiency of the network. In June 2025, the Maxwell upgrade will take this further, reducing block times to 0.75 seconds.

These upgrades are part of BNB Chain’s broader strategy to enhance its scalability and usability, positioning itself as a leading contender in the Ethereum Virtual Machine (EVM) ecosystem.

DeFi Growth and TVL Trends

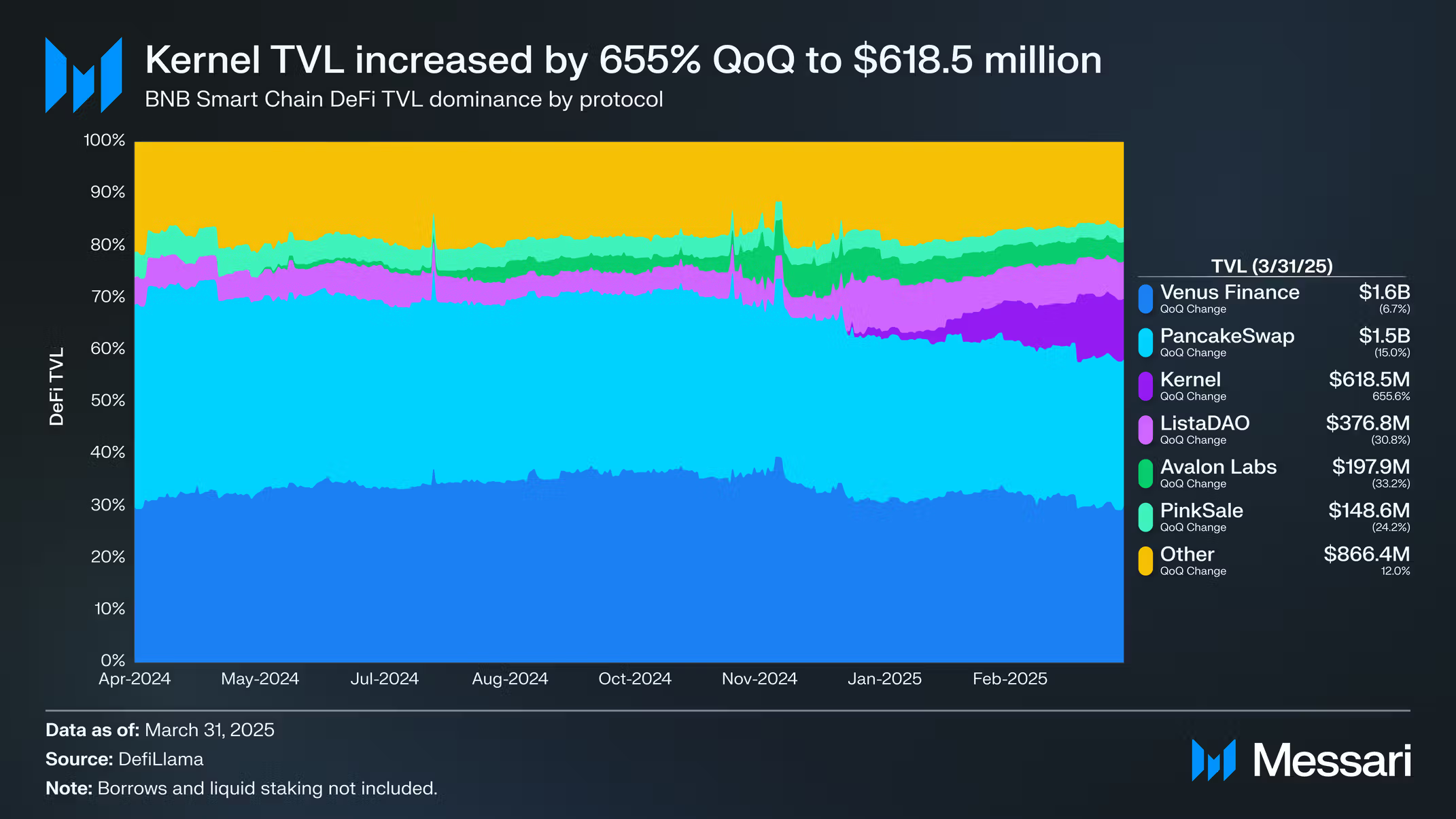

BNB Chain’s DeFi sector has shown steady growth in Q1 2025, with Total Value Locked (TVL) holding steady in USD terms. The TVL decreased slightly by 1.2% QoQ, from $5.4 billion to $5.3 billion. However, the TVL in terms of BNB increased by 14.7%, from 7.6 million BNB to 8.7 million BNB. This suggests that the decline in USD-denominated TVL was due to the price of BNB, rather than a decrease in on-chain activity or ecosystem engagement.

The top two protocols by TVL on BNB Smart Chain are Venus Finance and PancakeSwap. Venus Finance, despite a 6.4% QoQ decrease in TVL, remained the largest protocol by TVL, holding a dominant 30.1% share. PancakeSwap also experienced a decline in TVL, falling by 15% QoQ to $1.5 billion. However, PancakeSwap’s dominance in the AMM space remains strong, and its TVL distribution across different AMMs (AMM).

Read Next...

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens