What is Bluefin on Sui Network & How Does It Work?

Bluefin is a hybrid perpetuals and spot exchange on Sui, offering up to 50x leverage, concentrated liquidity pools, lending, and yield vaults.

UC Hope

December 4, 2025

Table of Contents

Decentralized exchange Bluefin on the Sui blockchain has become one of the more prominent trading platforms in Sui’s growing DeFi ecosystem. The protocol supports spot markets, perpetual futures, lending, borrowing, and concentrated-liquidity pools, combining on-chain settlement with off-chain order management to maintain speed without sacrificing transparency.

As a non-custodial protocol, users keep control of their assets while trades and risk processes are handled by Sui smart contracts. This deep dive examines how Bluefin works, why its architecture matters within today’s blockchain landscape, and how the protocol has evolved from a derivatives-focused venue into a broader on-chain trading and liquidity platform.

How Bluefin Started?

Bluefin originally launched on Arbitrum before releasing its Version 2 architecture on Sui. This move was announced publicly in late 2023, when Bluefin introduced its Sui-based exchange infrastructure with a hybrid model that stores and matches orders off-chain but settles transactions on-chain. According to a Sui case study, the platform recorded approximately USD 3.2 billion in trading volume during December 2023, shortly after its Version 2 deployment.

From the outset, Bluefin has maintained a focus on replicating orderbook-based trading workflows commonly used in centralized venues, while keeping custody and settlement on-chain. Its migration to Sui aligned with Sui's ability to process transactions in parallel and to support low-latency finality. These characteristics are essential for orderbook-based systems, where failure to confirm or update positions quickly can lead to liquidation errors or inaccurate risk calculations.

Publicly available documentation shows that Bluefin’s infrastructure relies on off-chain order management for efficiency, with margining, liquidations, and settlement handled through Sui Move smart contracts. This architecture allows users to access derivatives trading, spot trading, and other services while maintaining an on-chain audit trail.

What is the Bluefin Core Exchange Architecture?

Bluefin operates using a hybrid settlement model. While order placement and order matching occur off-chain for speed, the protocol routes all position maintenance, liquidations, and trade settlements on-chain. This means the risk management engine, responsible for leverage rules, maintenance margin calculations, and liquidation triggers, is executed by smart contracts rather than a centralized operator.

On-chain settlement

Settlement and margin updates occur on Sui. When a trade is filled, the protocol adjusts collateral balances, updates positions, and recalculates margin requirements. Bluefin documents outline that balances, funding payments, and liquidation processes all execute within smart contracts.

Off-chain order handling

Bluefin's orderbook operates off-chain. This approach allows the system to avoid congestion that slows down blockchains during peak periods. Users sign orders using their wallet, but submission does not require gas. The exchange’s operator processes these orders and submits filled trades to the blockchain.

The separation allows Bluefin to operate at a pace more consistent with professional trading venues, without discarding the transparency benefits of on-chain accounting.

Spot Trading and Concentrated-Liquidity AMM on Bluefin

Bluefin’s spot trading module, launched in 2024, operates as a full concentrated-liquidity automated market maker (CLMM) built directly on Sui. The design follows the same core principles as Uniswap v3 and similar implementations, but benefits from Sui’s object-centric data model, parallel execution, and sub-second finality.

Concentrated-Liquidity Mechanism

Liquidity providers deposit pairs of assets (for example, SUI/USDC, BTC/USDC, or SOL/USDC) and define a custom price range in which their capital will be active. Unlike traditional constant-product AMMs that spread liquidity evenly across the entire 0-to-infinity price curve, Bluefin’s CLMM concentrates capital only within the chosen range.

When the market price moves outside a provider’s range, their position becomes inactive and earns no fees, but it also incurs no impermanent loss during that period. This range-based approach typically achieves 200–400× higher capital efficiency compared with classic AMM designs on the same volume.

Liquidity Positions as Sui NFTs

Every liquidity position is minted as a native Sui non-fungible token (NFT). The NFT object contains all relevant data:

- Lower and upper tick boundaries

- Amount of liquidity provided

- Accumulated fees owed

- Token IDs of the underlying assets

Because Sui treats NFTs as first-class objects, these positions can be transferred, sold, or used as collateral in other protocols without unwrapping the liquidity first. As of December 2025, several lending and vault protocols on Sui already accept Bluefin spot NFTs as collateral, and the composability layer continues to expand.

Fee Tiers and Pool Selection

Bluefin offers multiple fee tiers per trading pair to match different risk and volume profiles:

- 0.01 % – reserved for stablecoin-stablecoin pairs (e.g., USDC/USDT)

- 0.05 % – most common tier for major pairs such as SUI/USDC and BTC/USDC

- 0.20 % – used for medium-volatility pairs

- 1.00 % – applied to highly volatile or low-liquidity pairs

Liquidity providers select the pool and fee tier when adding liquidity. Fees are calculated in real time and automatically compounded into the position or claimable separately. As of late 2025, the majority of spot volume flows through the 0.05 % SUI/USDC pool, which consistently ranks among the top five pools by TVL across the entire Sui ecosystem.

Trading Execution and Order Types

Spot trades on Bluefin execute directly against the aggregated liquidity curves of all active ranges. The routing engine automatically splits large orders across multiple ticks to minimize slippage.

In addition to standard market swaps, Bluefin supports on-chain limit orders for spot pairs. These limit orders are not matched against a traditional orderbook; instead, they are placed as “range orders” that sit inside the CLMM itself. When the market price reaches the specified level, the order executes against the concentrated liquidity at that tick. This mechanism provides limit-order functionality while remaining fully compatible with the AMM structure.

BluefinX Aggregator Integration

Since the BluefinX request-for-quote (RFQ) aggregator went live in April 2025, all spot trades , both market and limit, are automatically routed through multiple liquidity sources on Sui (including Cetus, DeepBook, and Aftermath) as well as Bluefin’s own CLMM pools. The aggregator selects the best price and executes the trade in a single transaction, typically in under one second. Users see the final execution price upfront with no hidden slippage.

Recent Asset Additions

On December 2, 2025, LayerZero-wrapped Bitcoin (WBTC) was added to Bluefin Spot with one-click bridging from Ethereum, Arbitrum, and other supported chains. The same day, liquidity mining incentives were activated for the WBTC/USDC pool, further deepening available depth.

As of December 2025, Bluefin Spot handles more than 30 % of all decentralized spot volume on Sui and consistently ranks in the top three protocols by daily active users for spot trading. The combination of NFT-based positions, multiple fee tiers, native limit-order support, and cross-protocol aggregation makes it one of the most capital-efficient and user-friendly concentrated-liquidity venues currently operating on any layer-1 blockchain.

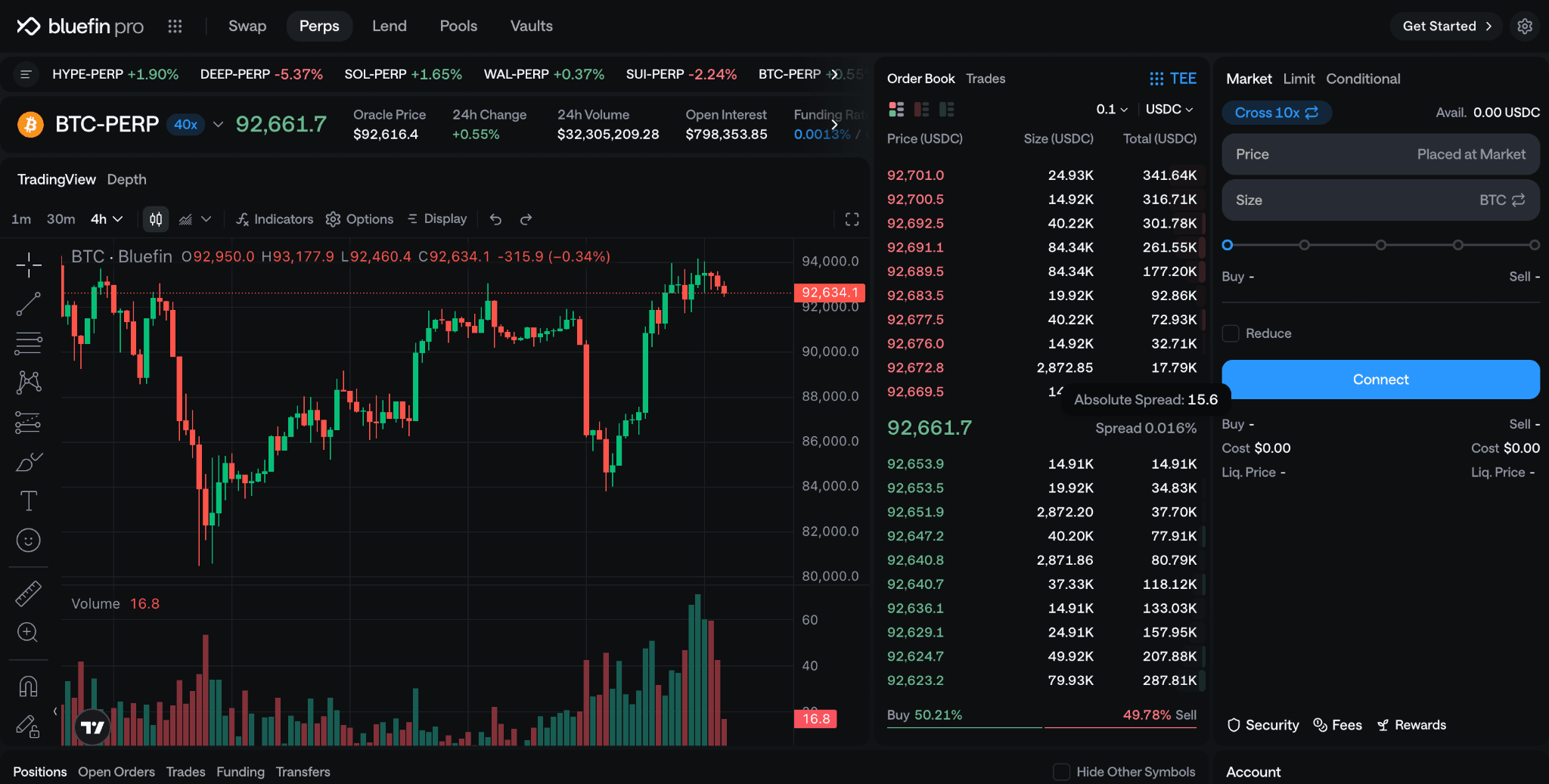

Perpetual Futures Trading on Bluefin

Bluefin Pro serves as the core perpetual futures exchange within the Bluefin ecosystem on the Sui blockchain. Perpetual contracts, or perps, enable traders to take long or short positions on underlying asset prices, such as BTC, ETH, SUI, or SOL, with leverage ranging from 1x to 50x, without fixed expiration dates. This structure allows for ongoing speculation tied to spot market movements, with positions maintained as long as margin requirements are met.

As of writing, Bluefin supports over 50 perpetual markets, including major cryptocurrencies like BTC-USDC, ETH-USDC, and ecosystem-specific pairs such as SUI-USDC and SOL-USDC, alongside emerging assets like Arbitrum, Avalanche, Aptos, Walrus, DeepBook, and Sei.

Collateral and Margin Requirements

Trading on Bluefin Pro requires users to deposit collateral, primarily in the form of wrapped USDC (wUSDC), into a unified cross-margin smart contract. This contract pools collateral across all open positions, allowing for efficient capital allocation without the need for isolated margins per trade.

The initial margin represents the minimum collateral percentage required to open a position, calculated as the notional value of the trade divided by the selected leverage multiplier. For example, opening a $10,000 notional position at 10x leverage demands $1,000 in initial margin (10% of notional).

Margin levels directly influence maximum leverage and liquidation thresholds. Bluefin employs a tiered margin system based on position size and market conditions, with higher leverage available for smaller positions to manage risk.

Real-time margin health is monitored via on-chain oracles, primarily Pyth Network, which feeds external spot prices every 400 milliseconds to ensure accurate valuation. Users can monitor their margin ratio through the Bluefin dashboard, where a ratio below 100% signals approaching liquidation. Cross-margining extends to integration with Bluefin's spot and lending products, permitting borrowed assets or spot holdings to bolster perp collateral, subject to protocol-defined risk parameters.

Funding Payments Mechanism

To anchor perpetual contract prices to underlying spot markets and prevent divergence, Bluefin implements periodic funding payments exchanged between long and short position holders. These payments occur every 8 hours at 00:00, 08:00, and 16:00 UTC, aligning with industry-standard intervals for consistency.

Payments are settled automatically on-chain: the smart contract debits or credits collateral balances directly, with no manual intervention required. Unsettled funding accrues continuously and compounds into the position's unrealized PnL.

Liquidation Process

Liquidation safeguards protocol solvency by closing under-margined positions before losses deplete collateral below maintenance levels. When a position's margin ratio falls below the required threshold, triggered by adverse price movements or negative funding, the on-chain risk engine, powered by Chaos Labs, automatically initiates liquidation.

This engine runs continuous health checks using real-time oracle data, evaluating every open position against dynamic parameters adjusted for market volatility (e.g., higher thresholds during high IV periods).

Supported Order Types

Bluefin's documentation outlines a suite of standard order types tailored for derivatives trading, enabling granular risk management. These include:

- Market Orders: Execute immediately at the best available price from the off-chain orderbook, ideal for quick entry or exit in liquid markets. No price specification; fills prioritize speed over precision.

- Limit Orders: Set a specific price threshold for execution, with buys only filling at or below the limit and sells at or above. Post-only variants ensure the order adds liquidity without crossing the book, earning maker rebates (0.02% vs. 0.05% taker fee).

- Stop-Limit Orders: Trigger a limit order once the market reaches a stop price, useful for stop-losses or take-profits. For example, a trailing stop adjusts dynamically with favorable moves, maintaining a fixed distance from the price.

- Reduce-Only Orders: Restrict execution to reducing existing position size only, preventing accidental increases during volatile swings. Combines with limits or stops for precise scaling out.

Additional advanced types include dollar-cost averaging (DCA) sliders, refreshed in November 2025 for automated laddered entries, and iceberg orders that hide large sizes to avoid market impact. All orders are client-signed via wallets like Sui Wallet or zkLogin, broadcast gas-free to the matcher, and settled on-chain in under 390 milliseconds. These tools, standard in derivatives venues, support strategies from simple hedging to complex arbitrage, with real-time PnL tracking in the interface.

Lending and Borrowing

Bluefin includes lending and borrowing functionality. Users can supply assets to lending markets and earn interest based on utilization rates. Borrowers post collateral and pay interest depending on demand for a given asset.

Collateralization and liquidation

Lending follows over-collateralization rules. If the collateral value falls too far behind the borrowed value, the protocol liquidates the position via smart contracts. These mechanisms are documented in Bluefin’s lending tutorials and technical references.

Integration with trading

In some cases, assets supplied to lending markets may be used as collateral for trading activities, depending on asset type and protocol risk parameters. This allows for more flexible capital usage across Bluefin’s product suite.

Vaults and Yield Strategies

Bluefin offers vaults designed for users seeking passive strategies. Public documentation references:

- A “Stable Vault,” which aggregates stablecoin yield

- A “BLUE Vault,” which distributes incentives tied to ecosystem activity

Vaults pool user funds and deploy them into predefined strategies. Returns are distributed proportionally based on deposits. Vault mechanics vary by asset and strategy type and are defined in smart contract specifications.

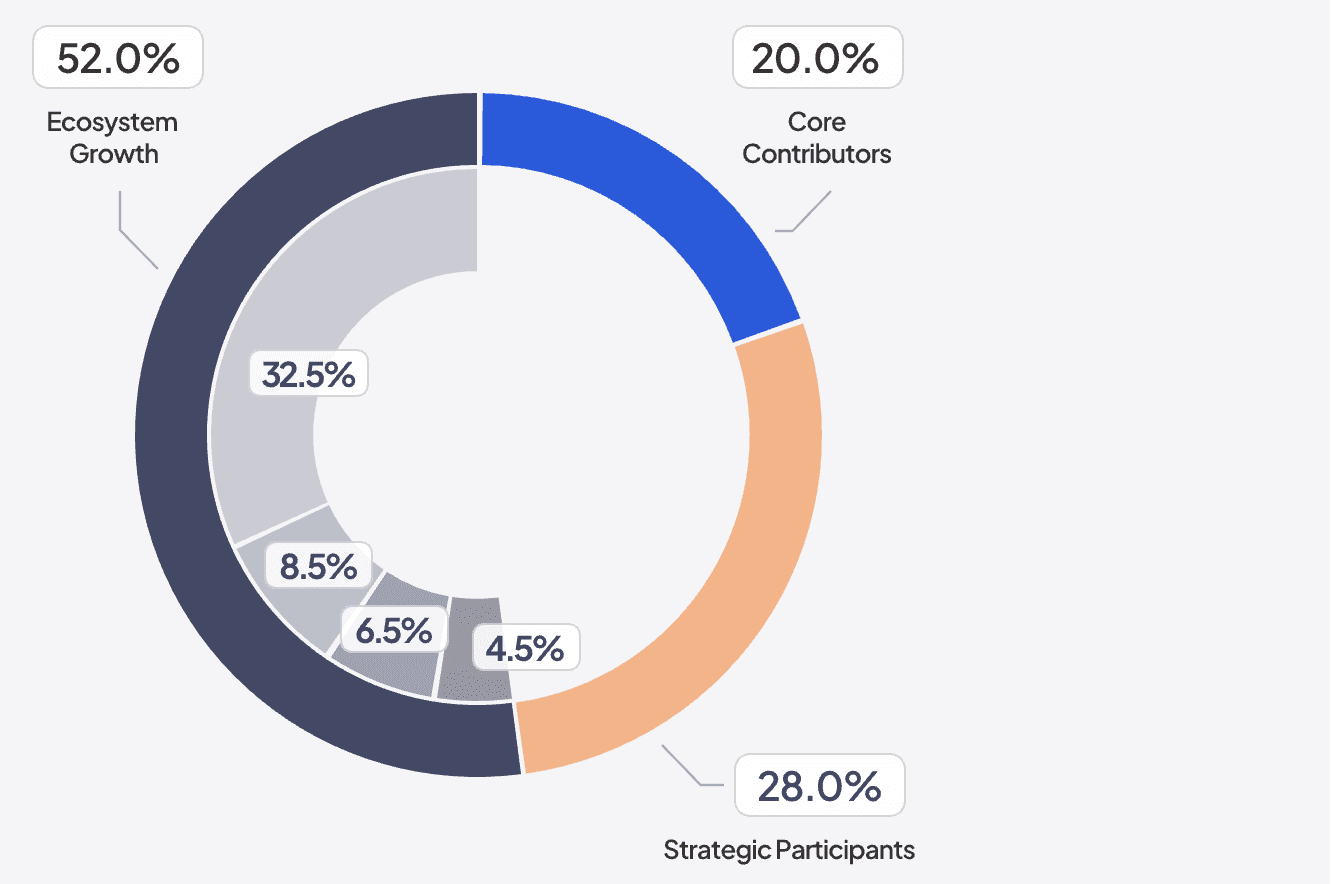

The BLUE Token and Tokenomics

The native BLUE Token Generation Event (TGE) went live on December 11, 2024, with a fixed maximum supply of 1 billion tokens and an initial circulating supply of 150 million. The primary utility is governance: staked BLUE allows holders to create and vote on proposals that affect fees, market listings, and risk parameters.

A total of 19.68 percent of the supply was allocated to an airdrop, with 80 percent claimable at TGE and the remaining 20 percent released over two months. Unclaimed airdrop tokens revert to the treasury.

Distribution breakdown:

- 52 percent ecosystem and community (including incentives and airdrop)

- 28 percent strategic partners and investors (one-year cliff, two-year linear vesting)

- 20 percent core contributors (same vesting schedule)

Current role

Bluefin identifies BLUE primarily as a governance token. Holders may vote on protocol decisions, including:

- Changes to fee structures

- Listing of new markets

- Adjustments to risk parameters

- Distribution of incentives

Governance proposal thresholds, voting windows, and quorum requirements are documented in the foundation’s governance materials. Additional token utilities may be introduced through governance decisions, but the protocol’s published materials emphasize governance as the immediate function.

Security Architecture

Bluefin states that its contracts undergo audits from third-party security firms. Smart contracts are publicly accessible, and users interact with the system directly through signed transactions. The hybrid execution model isolates trade execution from core custody, which is maintained via Sui smart contracts that process collateral, open positions, and liquidations.

The protocol emphasizes non-custodial design: users retain control of their assets except when collateral is locked for trading or lending. Security considerations include the risk of smart contract vulnerabilities, the availability of off-chain order handling, and the underlying blockchain's performance.

What are the Protocol’s key Developments and Institutional Activity?

In November 2025, SUI Group (SUIG), a publicly traded firm associated with the Sui ecosystem, announced a strategic arrangement with Bluefin. Under the agreement, SUIG provides Bluefin with a loan of 2 million SUI tokens. In return, SUIG receives 5% of Bluefin’s protocol revenue, paid in SUI.

The partnership is described as a liquidity and adoption initiative. Reporting surrounding the announcement noted that Bluefin recorded approximately USD 4.2 billion in monthly trading volume by mid-2025.

Product updates announced between November 11 and 14, 2025, included refreshed risk engines for perpetuals, improved vault analytics with profit-and-loss charts, fixes to the lending interface, and DeFiLlama yield tracking.

On December 2, 2025, Bluefin launched Agent Trader in partnership with Beep Labs: five autonomous AI agents, including one powered by Grok, each trade perpetuals with $2,000 in protected capital over a 14-day competition.

1/ Introducing Agent Trader by Beep Labs (@0xbeepit), powered by Bluefin.

— Bluefin (@bluefinapp) December 2, 2025

Season one: Grand Prix experiment places five autonomous AI traders into a live perps trading arena, each operating with a fixed amount of capital provided by Beep Labs.

Learn more about how Agent Trader… pic.twitter.com/4GhN0NSm5i

Users who deposit at least $100 USDC on the Beep platform earn yield and leaderboard points if their chosen agent performs well.

Bluefin’s Role Within the Sui Ecosystem

Bluefin is one of the most developed decentralized trading systems operating on Sui. Because Sui supports parallel execution, low-latency finality, and composable smart contract standards, Bluefin is positioned as a primary anchor for DeFi activity within the ecosystem.

A diversified product suite comprising spot trading, perps, liquidity provision, lending, and vaults gives Sui users a broader range of financial tools than blockchains that rely exclusively on AMMs or basic swap protocols. Because Bluefin handles multiple functions on a single platform, liquidity and user attention remain concentrated rather than fragmented across many small protocols.

The exchange’s growth also contributes to network-level metrics such as trading volumes, TVL, and transaction throughput, which are benchmarks commonly used to assess a blockchain’s DeFi viability.

Conclusion

Bluefin is a decentralized exchange built on Sui that provides access to spot markets, perpetual futures, lending, borrowing, and concentrated-liquidity pools. It uses a hybrid model combining off-chain order management with on-chain settlement, allowing users to trade through a familiar orderbook interface while maintaining non-custodial control of their assets.

The platform’s token, BLUE, underpins its governance and incentive mechanisms. Documented activity and partnerships indicate that Bluefin has become a central component of DeFi on Sui, with a product suite that supports various trading and liquidity functions. Its design emphasizes transparent settlement, defined risk controls, and integration with the broader Sui environment.

Sources

- Website: BLUE Tokenomics

- BusinessWire Press Release: SUI Group Partners with Bluefin

- Bluefin X Account: Recent Key Developments

- Defillama: Bluefin TVL and metrics

- Sui Case Study: How Bluefin achieved billions in trading volume by moving to SUI

Read Next...

Frequently Asked Questions

What is Bluefin's hybrid architecture on the Sui Network?

Bluefin uses off-chain order matching for low-latency execution (under 30ms) and on-chain Sui smart contracts for settlements, margins, and liquidations, ensuring transparency and non-custodial control.

How does Bluefin handle perpetual futures trading?

Bluefin Pro offers 50+ perp markets with up to 50x leverage, cross-margin USDC collateral, 8-hour funding payments, automatic smart contract liquidations, and order types like market, limit, stop-limit, and reduce-only.

What is the BLUE token used for on Bluefin?

BLUE is a governance token with a 1B max supply; holders stake it as eBLUE to vote on fees, listings, and parameters, with airdrop allocations and vesting for ecosystem growth.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens

Latest Crypto News

Get up to date with the latest crypto news stories and events

Buterin's 10,000 $ETH Selling Spree: Why Now?

February 24, 2026

February 24, 2026