BabyDoge Unveils New DEX: A Game-Changer for DeFi Enthusiasts

BabyDoge’s new DEX is available for users on BNB Chain, offering tools for token swaps, liquidity provision, and other DeFi activities.

UC Hope

September 23, 2025

Table of Contents

BabyDoge has updated its Decentralized Exchange (DEX), which went live on September 22, as detailed in an announcement from the project's official X account. The platform operates on the BNB Chain, offering users tools for token swaps, liquidity provision, and other Decentralized Finance (DeFi) activities.

This development enhances the BabyDoge ecosystem, which centers on the memecoin BabyDoge and features designed for traders and liquidity providers in the cryptocurrency space.

Overview of the BabyDoge DEX Launch

The BabyDoge DEX represents an update to the project's trading infrastructure, positioned as the largest exchange within the BNB Chain ecosystem based on available metrics. It uses an automated market maker model for handling swaps of BEP-20 tokens, which are standard on the BNB Chain.

New BabyDoge DEX is now live 👇https://t.co/huQ8MBxdAH

— Baby Doge (@BabyDogeCoin) September 22, 2025

Users connect their wallets to the platform to perform transactions without relying on centralized intermediaries. The interface has been redesigned for ease of use, enabling both experienced and new participants to navigate swaps and other functions with ease.

The launch aligns with BabyDoge's broader activities, which include charitable contributions focused on animal welfare, specifically dog rescue efforts. Part of the project's tokenomics involves allocating portions of transaction fees to support these causes, integrating social impact into its operations.

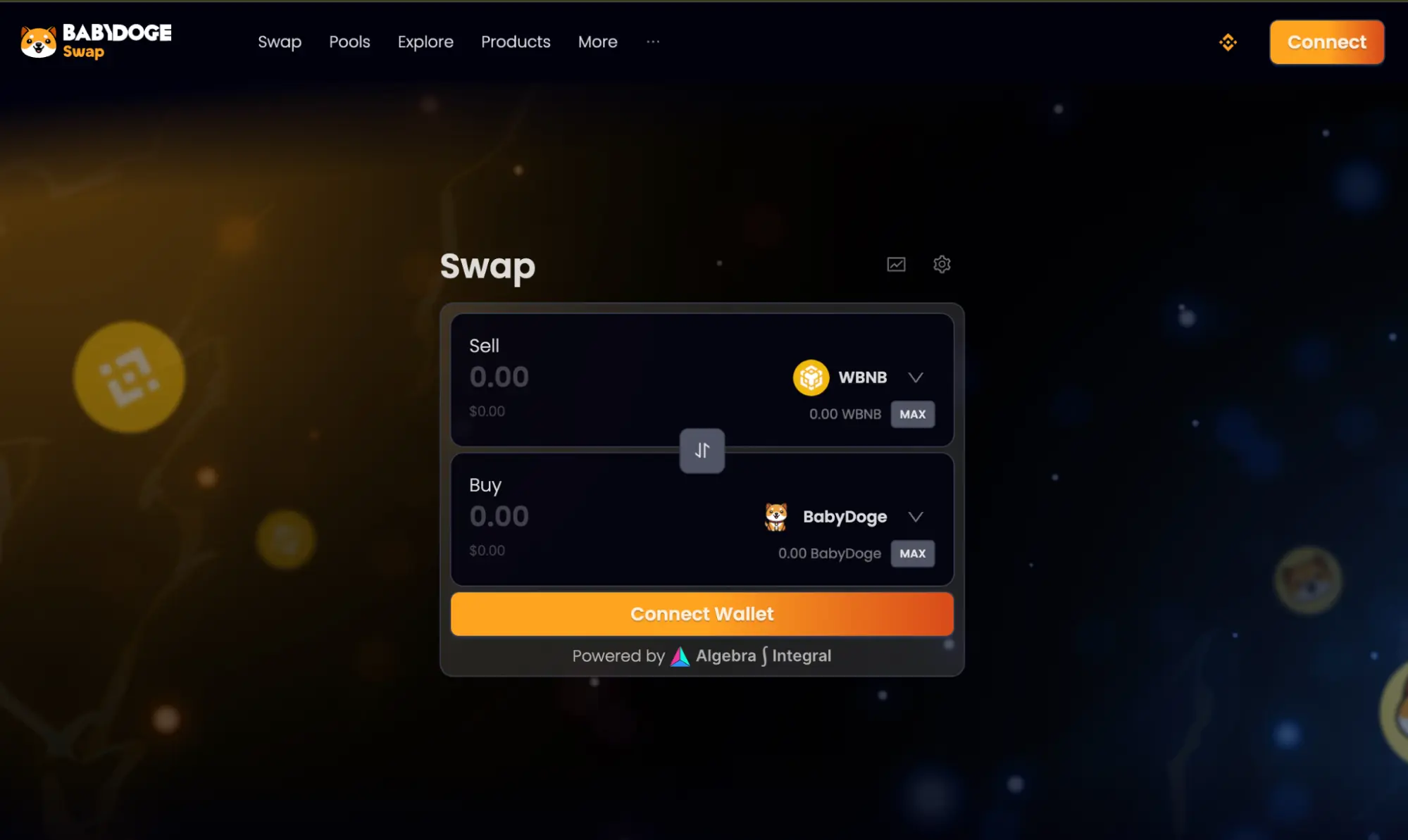

Swapping Functions on the BabyDoge DEX

The swapping interface forms the primary user-facing component of the BabyDoge DEX. Users can select tokens to sell or buy, with the site displaying examples involving Wrapped BNB (WBNB) and BabyDoge.

In the default view, input amounts show as 0.00 for quantities and $0.00 for values, allowing users to enter custom figures before executing trades. The platform uses an automated market maker model, where swaps rely on liquidity pools to determine prices based on available reserves.

Here’s a quick overview of the swap interface:

- Swaps occur directly on the BNB Chain, requiring users to connect a compatible wallet, such as MetaMask or WalletConnect, to sign transactions.

- The interface includes buttons for approving tokens and confirming swaps, with gas fees paid in $BNB.

- Pricing during swaps adjusts in real time via algorithms that balance pool reserves.

- For less liquid pairs, this can lead to slippage, where the executed price differs from the quoted one due to changes in supply and demand.

In the meantime, there is no option for fiat on-ramp, and limit orders have not been added yet. Hence, users need to hold cryptocurrency to explore the DEX swap, while also trading at market value.

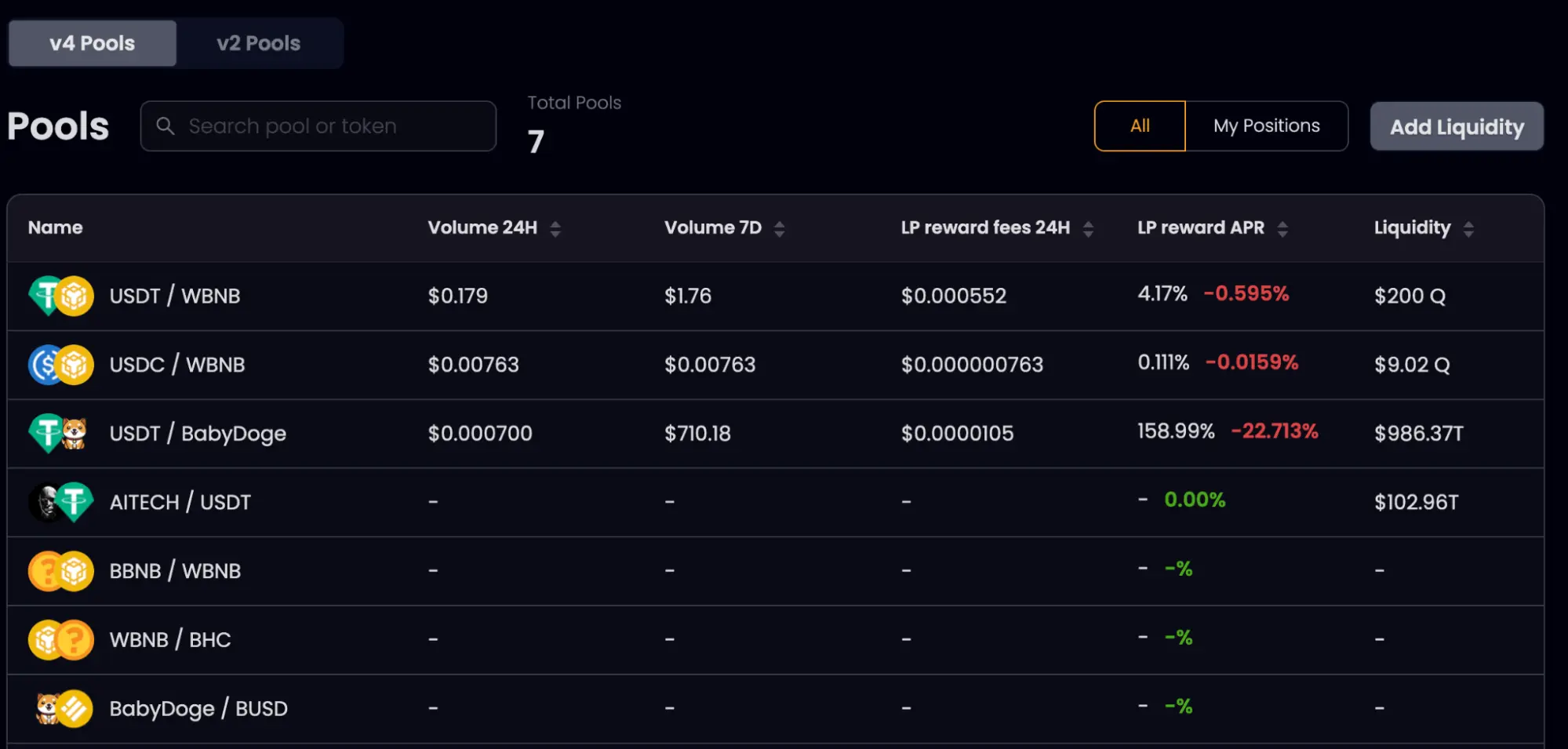

Liquidity Provision and Pool Metrics

Liquidity providers can add funds to pools listed on the DEX, accessible via a dedicated pools page at https://swap.babydoge.com/pools. The page displays top pools with detailed statistics, including 24-hour volume, 7-day volume, LP reward fees over 24 hours, LP reward APR, and total liquidity.

Providers earn fees from trades proportional to their share of the pool, with APRs calculated based on recent activity. Higher APRs, such as the 158.99% for USDT/BabyDoge v4, reflect potential returns but also carry risks, including impermanent loss, where the pool value changes due to price volatility.

To add liquidity, users select a pool, approve tokens, and deposit balanced amounts. Withdrawals follow a similar process, with providers receiving LP tokens as receipts.

Security and Technical Aspects

The BabyDoge DEX does not explicitly outline security measures on its website. As a decentralized platform on the BNB Chain, it relies on smart contracts for operations, which users interact with via their wallets. This non-custodial approach means the DEX does not hold user funds, reducing certain risks associated with centralized exchanges. However, participants must verify contract addresses to avoid phishing or fake sites.

Transactions incur standard BNB Chain fees, and the site advises users to ensure sufficient BNB for gas. The absence of features like token lockers or on-chain orders points to a basic implementation focused on core swapping and liquidity functions.

Integrations Within the BabyDoge Ecosystem

The DEX is connected to several other components within the BabyDoge ecosystem. These include:

- The BabyDoge Bridge enables the conversion of BabyDoge tokens on BNB Chain to SOL, TON, and BASE.

- Puppy.fun, a meme token launch platform for the BabyDoge community. Other products listed on the DEX include makenow.meme and GasPump.tg.

- PAWS, a Telegram-based game where users click to collect points, upgrade cards, and potentially receive airdrops.

These links suggest the DEX serves as an entry point to broader ecosystem activities, including token bridging, memecoin launches, gaming, and real-world asset purchases. In the future, BabyDoge plans to integrate wallets and Properties to the DEX.

Conclusion

The BabyDoge DEX currently supports token swaps on the BNB Chain with LP providers earning rewards. It also integrates with ecosystem elements, including the BabyDoge Bridge for token transfers, Puppy.fun for memecoin launches, the PAWS Telegram game, and forthcoming wallet and properties platforms.

As BNB Chain activity continues to surge, with active addresses and transactions increasing, BabyDoge is poised to introduce additional features, positioning its DEX as a leading product in the blockchain ecosystem.

To stay updated with the latest developments across the protocol’s ecosystem, visit the BabyDoge Repository on BSCN.

Sources:

BabyDoge DEX: https://swap.babydoge.com/

BabyDoge Announcement: https://x.com/BabyDogeCoin/status/1970245942700806234

Read Next...

Frequently Asked Questions

What functions does the BabyDoge DEX provide for token swaps?

The BabyDoge DEX offers an interface for swapping tokens like WBNB and BabyDoge on the BNB Chain, using liquidity pools for pricing with real-time adjustments.

How do liquidity providers earn rewards on the BabyDoge DEX?

Liquidity providers earn through fees and APRs in pools, such as 158.99% APR for USDT/BabyDoge v4, based on trading volume and pool activity.

What other tools integrate with the BabyDoge DEX?

The DEX links to ecosystem tools including the BabyDoge Bridge for token transfers, Puppy.fun for memecoin launches, and PAWS for Telegram gaming.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

UC Hope

UC HopeUC holds a bachelor’s degree in Physics and has been a crypto researcher since 2020. UC was a professional writer before entering the cryptocurrency industry, but was drawn to blockchain technology by its high potential. UC has written for the likes of Cryptopolitan, as well as BSCN. He has a wide area of expertise, covering centralized and decentralized finance, as well as altcoins.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens