Avalanche Deep Dive: Technical and Ecosystem Analysis

Complete Avalanche deep dive covering consensus mechanisms, subnet architecture, ecosystem projects, and how it solves blockchain scalability challenges.

Crypto Rich

August 1, 2025

Table of Contents

Avalanche tackles one of blockchain's biggest challenges - the persistent trade-off between speed, security, and decentralization that has kept the technology from reaching its full potential. Most blockchains can achieve two of these qualities but struggle with the third. Avalanche's design breaks this pattern through its innovative three-chain structure and subnet system, which lets organizations build custom blockchain networks without sacrificing security.

This approach has attracted applications ranging from DeFi protocols managing hundreds of millions in assets to gaming platforms handling millions of daily transactions. The platform proves that blockchain networks don't have to choose between performance and principles.

What Is Avalanche's History and Development Journey?

The story begins in the halls of Cornell University, where computer science professor Emin Gün Sirer spent years wrestling with the limitations of existing blockchain systems. His research led to a breakthrough in 2018 - a new way to achieve consensus that didn't rely on energy-hungry mining or potentially centralizing stake-weighted voting.

Sirer's academic work caught the attention of investors and engineers who recognized its practical potential. Together, they founded Ava Labs with a mission to turn theoretical research into a blockchain platform that could actually scale without compromising on security or decentralization.

Major Development Milestones

Avalanche's journey from research paper to production blockchain happened remarkably quickly:

- 2018: Initial whitepaper outlined theoretical framework for a new consensus mechanism that caught the crypto community's attention

- 2019: Prominent investors including Polychain Capital and Andreessen Horowitz provided seed funding, validating commercial potential

- 2020: Mainnet launched after a $42 million token sale that sold out in hours, with the network delivering on performance promises from day one

- 2021-2023: Rapid expansion years saw subnet launches, DeFi protocol migrations, and gaming platforms discovering smooth blockchain integration

- 2024-Present: Maturation phase focuses on institutional adoption, real-world asset tokenization, and enterprise blockchain solutions

The Avalanche Foundation, established to oversee community development and grant programs, has played a crucial role in ecosystem growth. Through structured funding programs and developer incentives, the foundation has supported hundreds of projects across DeFi, gaming, infrastructure, and enterprise applications.

How Does Avalanche's Technical Architecture Work?

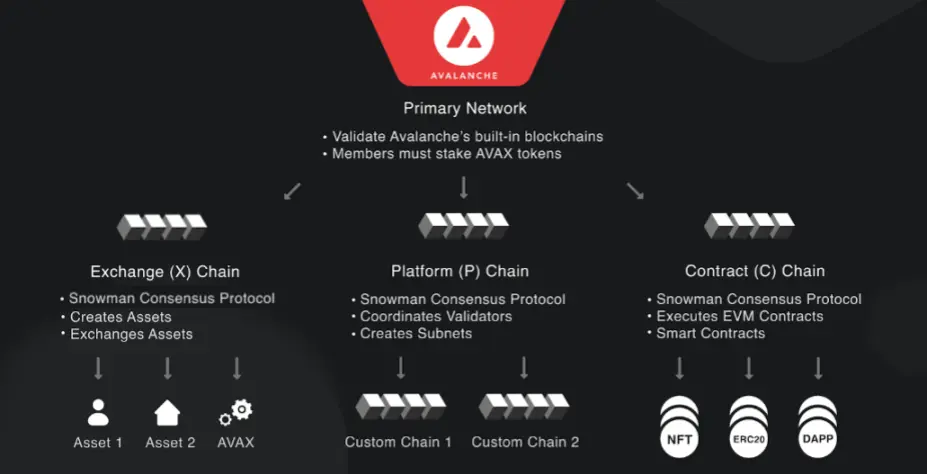

Most blockchains try to do everything on one network, creating bottlenecks and forcing compromises. Avalanche takes a different approach by splitting work across three specialized chains, each designed to excel at specific tasks while sharing security through a unified validator network.

Think of it like a well-organized company where different departments handle different functions, but they all work toward the same goals and share the same security infrastructure.

The Three-Chain System

Each chain handles different aspects of blockchain operations:

- X-Chain (Exchange): The trading specialist that manages asset creation and transfers using a web-like structure called a directed acyclic graph, processing transactions in parallel for just 0.001 AVAX per transaction

- P-Chain (Platform): The backbone that handles validator management and subnet creation, requiring validators to stake at least 2,000 AVAX to ensure they're committed to network security

- C-Chain (Contract): The Ethereum-compatible workhorse that runs smart contracts, letting developers use familiar tools like MetaMask without learning new systems

The Consensus Breakthrough

Here's where Avalanche gets really interesting. Instead of using Bitcoin's energy-intensive mining or Ethereum's stake-weighted voting, Avalanche uses something called probabilistic sampling. It sounds complex, but the concept is elegant.

How It Works

When validators need to agree on transactions, they don't all process everything. Instead, the system randomly selects small groups to vote on validity. These groups report back, then the process repeats with different random samples. It's like taking multiple opinion polls with different groups of people - if they consistently agree, you can be confident in the result.

The magic happens through repeated queries where each validator samples a small, random subset of others. If enough validators agree a transaction is valid, the system adopts that view. This continues until consensus emerges, typically within seconds.

Performance Results

The result? Transactions can finalize in under one second while the network can process over 4,500 transactions per second under optimal conditions. Even better, adding more validators strengthens and speeds up the system rather than slowing it down. The network could theoretically support millions of validators since each only talks to a small subset rather than everyone.

What Are Subnets and How Do They Enable Customization?

If Avalanche's three-chain architecture is impressive, subnets are where the platform truly shines. Imagine if every organization could create their own custom blockchain network, tailored to their exact needs, while still benefiting from the security of a major network. That's exactly what subnets provide.

A financial institution might create a subnet with strict privacy controls and regulatory compliance built in. A gaming company could prioritize lightning-fast transactions over privacy features. A supply chain company might focus on transparency and data integrity. Each subnet operates like an independent Layer 1 blockchain but draws its security from Avalanche's main network.

Connecting the Network

Subnets don't operate in isolation. Avalanche Warp Messaging acts like a universal translator, enabling secure communication between different subnets without the risky bridge protocols that have lost billions to hackers. The Inter-Chain Token Transfer feature lets assets move seamlessly between subnets while maintaining the security guarantees of the underlying system.

This creates a network of interconnected but customizable blockchains - each optimized for specific needs while remaining part of a larger, secure ecosystem.

What Projects and Applications Build on Avalanche?

The real test of any blockchain platform isn't its technical specifications - it's what people actually build on it. Avalanche has attracted a diverse ecosystem that spans everything from experimental DeFi protocols to enterprise applications managing billions in real-world assets.

Key ecosystem sectors include:

- Decentralized Finance: Lending protocols, DEXes, and yield farming platforms managing hundreds of millions in total value locked

- Gaming and NFTs: Real-time gaming experiences and digital asset marketplaces that benefit from fast, cheap transactions

- Enterprise Solutions: Real estate tokenization, supply chain tracking, and regulatory compliance applications using custom subnets

- Emerging Technologies: AI-powered applications and cross-chain infrastructure projects pushing blockchain boundaries

Decentralized Finance Takes Off

Avalanche's DeFi scene looks familiar at first glance - lending, trading, yield farming - but dig deeper and you'll find innovations that other networks can't support.

LFJ represents Avalanche’s primary DEX, handling millions in daily volume with concentrated liquidity features that make trading more efficient than simple constant-product models. The platform auto-compounds rewards and offers sophisticated trading tools that would be prohibitively expensive elsewhere.

Benqi does double duty as both a lending protocol and liquid staking provider. Users can borrow against their crypto while simultaneously earning staking rewards through sAVAX tokens - something impossible without Avalanche's architecture.

Yield Yak automatically hunts for the best yields across multiple protocols, offering auto-compounding features that take advantage of what Avalanche can do uniquely well.

These aren't just copies of Ethereum DeFi - they're products optimized for the network's speed and low costs.

Gaming Finally Works

For years, blockchain gaming meant clunky experiences and expensive transactions. Avalanche changed that math completely.

Key gaming successes demonstrate the platform's capabilities:

- DeFi Kingdoms: Proved the concept with an RPG where players quest, battle, and earn while actually owning their game assets, processing millions of transactions during peak popularity

- MapleStory Universe: Achieved over 1 million daily transactions in June 2025, showing how blockchain games can reach mainstream scale with smooth user experiences

- Ascenders: Building AAA-quality experiences that use blockchain for asset ownership while keeping gameplay smooth through hybrid architectures

What makes this possible? When minting an NFT costs cents instead of tens of dollars, and transactions happen instantly, blockchain stops being a barrier and starts being an advantage. Players focus on having fun instead of managing transaction fees.

Enterprises Get Serious

The enterprise story tells itself through the numbers. Billions in real estate assets now live on Avalanche subnets, with real businesses managing real value through blockchain infrastructure.

Real-World Asset Tokenization

Platforms like Balcony and Grove Finance make fractional property investment accessible to regular investors while meeting institutional compliance standards. These aren't pilot programs - they're production systems handling substantial capital flows.

But real estate is just the beginning. Energy companies tokenize carbon credits with full regulatory compliance, creating transparent markets for environmental impact. The scale demonstrates blockchain's practical value beyond speculative trading.

Industry-Specific Solutions

Different industries leverage Avalanche's customization capabilities for their unique requirements:

- Pharmaceutical: Private subnets for drug authentication that provide blockchain transparency while protecting sensitive data from public exposure

- Supply Chain: Custom tracking systems that follow products from factory to consumer using blockchain rules tailored to specific industry regulations

- Consulting: Deloitte's blockchain practice has built multiple proof-of-concepts showing how large organizations can adopt blockchain without rebuilding entire technology stacks

- Compliance: Direct integration of KYC and AML requirements into blockchain logic, automatically enforcing regulatory standards without external systems

The pattern is clear: enterprises don't want general-purpose blockchains. They want blockchain networks that work exactly like their business does, with their compliance rules and their access controls. Avalanche's subnets deliver that customization while maintaining the security and interoperability benefits of public blockchain infrastructure.

Artificial Intelligence Integration

Emerging AI applications use Avalanche's infrastructure to create decentralized AI services, agent-based systems, and machine learning marketplaces. The platform's performance characteristics support AI workloads that require frequent on-chain computation and data storage.

Recent developments include Octane's AI-powered security integration launched in July 2025, which demonstrates how artificial intelligence can enhance blockchain security and monitoring capabilities. These implementations show Avalanche's growing role in next-generation AI infrastructure.

What Recent Developments Are Driving Avalanche's Growth?

2025 has brought significant momentum to Avalanche's ecosystem, with major institutional partnerships and innovative applications demonstrating the platform's real-world utility. These developments span traditional finance integration, enterprise-scale asset tokenization, and cutting-edge AI implementations.

Recent key developments highlight Avalanche's expanding adoption:

- Visa Stablecoin Integration (July 31): Payment giant added Avalanche for USDC and PYUSD settlements, enabling real-world payments through cards like Rain and Avax Card, unlocking mainstream payment and remittance applications

- Grove Finance Launch (July 28): Platform targeting $250 million in tokenized real-world assets through partnerships with Centrifuge and Janus Henderson, bringing institutional-grade credit products on-chain

- Youmio AI Agent Blockchain (July 24): First AI agent Layer 1 blockchain launched on Avalanche, showcasing the platform's suitability for next-generation AI applications

- Balcony Real Estate Tokenization (May 28): Platform brought $240 billion in property assets on-chain, demonstrating Avalanche's capacity for institutional-scale asset digitization

- Enterprise Developer Support: Space and Time offered $250,000 in developer credits for data-driven applications, while various enterprise integrations expanded throughout the summer

These developments reflect broader trends in blockchain adoption - from experimental implementations to production systems managing substantial capital and serving mainstream users. The pace of institutional integration suggests growing confidence in Avalanche's technical capabilities and regulatory compliance features.

How Does Avalanche's Governance and Tokenomics Function?

AVAX isn't just another cryptocurrency - it's the fuel that powers the entire Avalanche ecosystem. Users pay transaction fees with AVAX, validators stake it to secure the network, and subnet creators use it to anchor their custom blockchains to the main network.

Token Economics That Make Sense

$AVAX has a maximum supply of 720 million tokens, but the distribution shows thoughtful planning:

- Foundation Operations (9.26%): Funds development, marketing, and ecosystem growth

- Community Programs (7%): Supports grants, hackathons, and developer incentives

- Validator Rewards: Ongoing emissions compensate those securing the network, though emission rates decline over time

- Deflationary Mechanism: Transaction fees get burned, reducing total supply, but actual deflation depends on network usage levels exceeding new token issuance

This structure creates incentives for long-term network health rather than short-term speculation. However, the long-term tokenomics depend on sustained network activity to maintain deflationary pressure as emission rates naturally decline.

Staking and Community Participation

Running an Avalanche validator isn't cheap - you need 2,000 AVAX staked, which can represent tens of thousands of dollars. That high bar filters out casual participants but ensures validators take their job seriously.

Validator Economics

The rewards come from multiple streams. Transaction fees provide immediate income based on network activity, while staking rewards distribute new AVAX tokens based on validator performance. Stay online and respond quickly to consensus queries, and you earn more. Go offline or mess up, and your rewards suffer accordingly.

The system has teeth too. Validators who sign conflicting transactions or disappear for extended periods can lose part of their staked AVAX through slashing. It's designed to make honest operation the most profitable strategy.

Subnet validation adds another layer of complexity. Each subnet can set additional requirements - more AVAX, specific hardware, or compliance certifications. This flexibility lets subnets balance their need for decentralization against performance and regulatory requirements.

Delegation and Accessibility

Smaller holders can still participate through delegation, staking as little as 25 AVAX with existing validators for proportional rewards minus a commission. This creates a professional validator class while keeping the network accessible to regular users.

The delegation system helps address the high validator barrier by allowing broader community participation in network security. However, it also concentrates operational control among validators who meet the technical and financial requirements.

Community Engagement

The broader community stays engaged through foundation governance, developer grants, and regular hackathons that attract thousands of participants. With over 1.1 million social media followers, the ecosystem maintains active discussion about upgrades, partnerships, and technical developments.

However, Avalanche's governance remains more centralized compared to other blockchain networks. While the community provides input on ecosystem development, major protocol decisions still largely flow through the Avalanche Foundation and Ava Labs rather than fully decentralized governance mechanisms like those found in other blockchain ecosystems.

What Challenges Does Avalanche Face?

No blockchain platform operates in a vacuum, and Avalanche faces real competitive pressures in an increasingly crowded market.

Market Competition

The biggest challenge comes from multiple fronts:

- Ethereum Layer 2 Networks: Offer familiar development environments with dramatically improved performance and access to established ecosystems.

- High-Speed Alternatives: Platforms like Solana provide proven approaches to blockchain scaling with growing developer adoption.

- Enterprise Solutions: Traditional tech companies increasingly offer blockchain-as-a-service products targeting the same enterprise clients.

- Developer Mindshare: Convincing developers to learn new tools and platforms when existing solutions continue improving.

These Layer 2 solutions benefit from Ethereum's massive developer community, extensive tooling, and established application ecosystem. For many developers, improving Ethereum feels safer than switching to an entirely new platform, regardless of technical advantages. Ethereum's ecosystem also offers deeper liquidity pools and more mature DeFi protocols, making it attractive for applications that depend on established financial infrastructure.

Meanwhile, high-speed platforms like Solana prove that alternative approaches to blockchain scaling can work at massive scale. Each platform competes for the same developers, users, and enterprise clients, creating pressure for continuous innovation.

Technical Trade-offs and Concerns

That 2,000 AVAX validator requirement cuts both ways. It keeps validators committed but also prices out many potential participants. When AVAX hit its peak price, becoming a validator cost over $200,000 - hardly accessible to most people.

This creates geographic concentration risks. Wealthier regions naturally have more validators, while developing economies get shut out. The delegation system helps by letting smaller stakeholders participate indirectly, but the fundamental barrier remains.

The subnet model brings its own headaches. More subnets mean more fragmentation - users might need to bridge assets between multiple networks to access different apps. Each bridge introduces security risks and user friction.

Network effects also get diluted. A DeFi protocol on one subnet can't directly access liquidity from another subnet without additional infrastructure. This breaks the composability that makes DeFi powerful in the first place.

Meanwhile, validators need reliable internet, backup systems, and monitoring tools to maintain high uptime. These operational requirements favor professional operators over casual participants, potentially centralizing the network despite its decentralized design.

The Adoption Challenge

Perhaps the biggest hurdle is simply getting people to try something new. Enterprises move slowly and developers often stick with familiar tools. Even when Avalanche offers clear technical advantages, switching costs and organizational inertia create significant barriers.

Building developer education programs and tooling that matches or exceeds more established platforms requires ongoing investment. The ecosystem must balance rapid innovation with the stability that attracts serious long-term development commitments.

What Does the Future Hold for Avalanche?

Avalanche's development team focuses on improving what already works rather than chasing shiny new features. The consensus mechanism gets ongoing optimizations while subnet deployment becomes more accessible to organizations without blockchain expertise.

Current Development Focus

The roadmap emphasizes practical improvements over experimental features:

- Performance Tweaks: Consensus refinements target even lower latency while maintaining the security that's proven reliable in production

- Developer Tools: Better documentation, debugging tools, and automated deployment reduce the learning curve for new teams

- Subnet Simplification: One-click deployment tools make custom blockchain creation feasible for non-technical organizations

- Bridge Security: Improved cross-chain protocols enable safer asset movement between networks

- Enterprise APIs: Better integration tools help traditional businesses add blockchain capabilities without major system overhauls

The Avalanche9000 upgrade exemplifies this approach - it reduced subnet costs and improved efficiency based on real user feedback rather than adding untested features.

Where Traction Is Building

Current adoption patterns show clear momentum in specific areas. Traditional finance companies explore blockchain for payment processing and asset tokenization where the benefits clearly outweigh the complexity.

Gaming shows the strongest product-market fit among consumer applications. Fast transactions and low costs finally make blockchain gaming practical for mainstream audiences, with several projects achieving substantial daily user numbers.

Enterprise adoption accelerates in sectors where customization matters most - supply chain tracking, identity verification, and compliance reporting where Avalanche's flexibility addresses problems that standard blockchains can't solve.

Conclusion

Avalanche has proven that blockchain networks don't have to choose between performance and principles. The platform's subnet architecture enables unlimited customization while maintaining security, opening blockchain adoption to industries and use cases that previous platforms couldn't serve effectively.

From DeFi protocols managing hundreds of millions in assets to gaming platforms processing millions of transactions, Avalanche's ecosystem demonstrates the practical benefits of thoughtful technical architecture. The platform has moved beyond experimental implementations to support real businesses with real requirements.

Avalanche's approach of enabling customized solutions while preserving interoperability may prove to be exactly what the industry needs to achieve mainstream adoption. The platform invites builders to stop compromising and start creating blockchain networks that actually fit their specific needs.

For more information about Avalanche's ecosystem and technical documentation, visit avax.network and follow @avax on X for updates.

Recent Avalanche Coverage:

- Avalanche Powers Onchain Prize Redemptions for MyPrize Social Casino Platform

- Avalanche Brings Stablecoin Payments to NYC’s Oldest Holiday Market

- Avalanche Enables KBank and StraitsX to Streamline Payments Between Thailand and Singapore

- Avalanche Powers Securitize New EU Wide Trading and Settlement Platform

- Avalanche Expands Support for Game Developers with a Dedicated Accelerator

Sources:

- Avalanche Whitepapers - Consensus Protocol and Technical Architecture

- Ava Labs Technical Documentation - Subnet Architecture and Implementation

- Cornell University Research - Distributed Systems and Consensus Mechanisms

- CoinMarketCap - market data

- Ava Labs Github - Technical data

- Cryptorank.io - Funding data

Read Next...

Frequently Asked Questions

How does Avalanche's consensus mechanism differ from proof-of-work and proof-of-stake?

Instead of computational mining or stake-weighted selection, Avalanche validators repeatedly poll random subsets of other validators to reach agreement. This probabilistic sampling approach enables sub-second finality and scales efficiently as more validators join, without high energy consumption or concentrated control among large stakeholders.

What advantages do Avalanche subnets offer over traditional blockchain networks?

Subnets are customizable Layer 1 blockchains with their own governance, compliance rules, and performance settings. They inherit security from the Primary Network while operating independently, allowing organizations to build tailored solutions for finance, gaming, supply chain, and other specific use cases. This flexibility addresses enterprise needs that one-size-fits-all public blockchains cannot accommodate.

How does Avalanche scale compared to Ethereum Layer 2 solutions?

While Ethereum Layer 2 solutions offload transactions to secondary layers, Avalanche scales through independent subnets—each a full Layer 1 blockchain with direct Primary Network security. Subnets can achieve thousands of TPS with sub-second finality, offering more sovereignty and customization without the complexity of bridging between different trust models.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Crypto Rich

Crypto RichRich has been researching cryptocurrency and blockchain technology for eight years and has served as a senior analyst at BSCN since its founding in 2020. He focuses on fundamental analysis of early-stage crypto projects and tokens and has published in-depth research reports on over 200 emerging protocols. Rich also writes about broader technology and scientific trends and maintains active involvement in the crypto community through X/Twitter Spaces, and leading industry events.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens