How Low Can XRP Go?

XRP trades near $1.50 after a 57% drop from its $3.65 peak. Key support sits near $1 and $1.15 as XRP/BTC tests a major breakout level.

Soumen Datta

February 17, 2026

Table of Contents

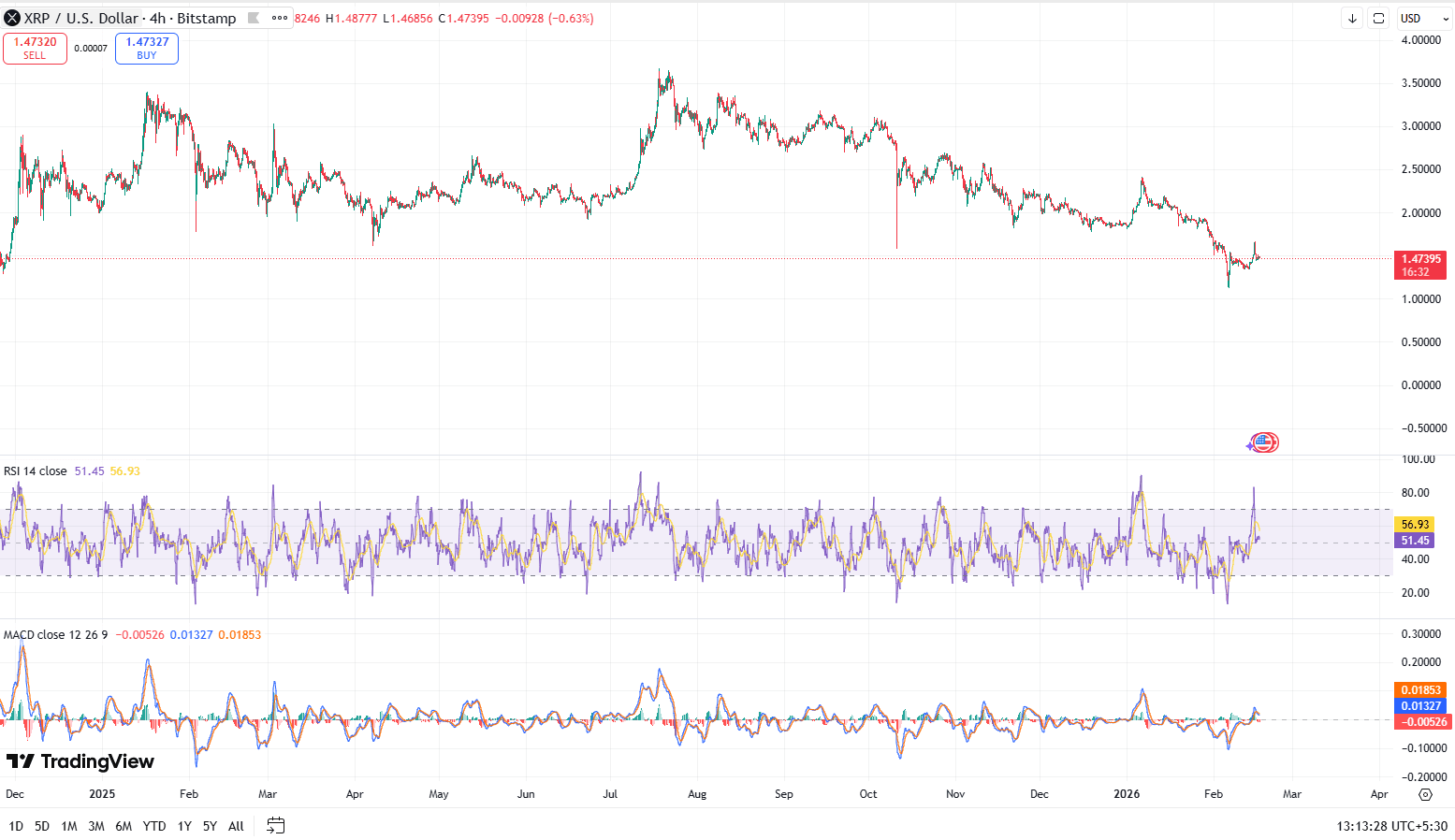

XRP could fall toward $1 or slightly below if selling pressure continues and Bitcoin remains weak. The chart shows clear support near $1.15 and a major psychological level at $1.00. A break below $1 would likely depend on broader market stress, not just XRP-specific news.

XRP is trading around $1.46 after declining 57% from its July 2025 peak of $3.65. The daily chart shows a series of lower highs and lower lows since that top. Momentum remains fragile, even as the XRP/BTC pair tests a key resistance level.

What Does The Current Chart Structure Show?

The daily structure against the US dollar remains corrective. After peaking at $3.65 in July 2025, XRP entered a downtrend. The recent low near $1.15 in early February marked the weakest level since the October crash.

Key observations from the chart:

- Lower highs since July 2025

- Repeated rejection below $1.90 and $2.10

- Strong reaction near $1.15 support

- RSI hovering near neutral around 50

- MACD flattening but not yet strongly bullish

The October event is still relevant. XRP fell 45% intraday from $2.83 to $1.53 during tariff-related fears. That kind of volatility shows how quickly liquidity can disappear when risk sentiment turns.

Since then, XRP has experienced two major selloffs within four months. January closed at $1.50, its lowest monthly close since October. February began with another 6% decline.

Could XRP Fall Below $1?

Yes, it could, but it would likely require continued macro pressure.

Analyst Adam Spatacco wrote that XRP may “normalize” toward $1 or lower during periods of macroeconomic stress. His argument centers on liquidity. In uncertain markets, investors often reduce exposure to volatile assets. Even assets with real-world utility can be sold when capital rotates into safer instruments.

Several factors support this cautious view:

- Bitcoin trading below $75,000

- Roughly $6 billion in crypto liquidations year to date

- Profit-taking after ETF launches

- Exhausted short-term catalysts

The SEC lawsuit has concluded. Spot ETFs attracted $1.23 billion in inflows, as of Feb. 13. Ripple expanded in Singapore. The RLUSD stablecoin launched. Yet the price did not hold above $2.00.

That suggests recent bullish developments were already priced in.

If $1.15 breaks on strong volume, the next major level is the psychological $1.00 mark. Below that, technical support becomes thinner until the $0.85 to $0.90 region, which acted as a consolidation base before the mid-2025 rally.

Why Is The XRP/BTC Level Important?

XRP’s performance against Bitcoin often signals whether capital is rotating into XRP specifically.

The key level on the XRP/BTC chart is 0.00002168. The last time this level broke decisively, XRP/BTC surged about 40% in one week. XRP/USD followed with a 52.9% move over eight days, rising from the low $2 range to above $3.60. Volume expanded sharply during that period, and XRP printed a new all-time high of $3.65.

That rally was driven by XRP strength, not Bitcoin weakness.

Currently, XRP/BTC is testing this same level again. A recent daily candlestick closed green, which signals short-term outperformance versus Bitcoin.

If XRP/BTC closes convincingly above 0.00002168:

- $1.90 becomes the first resistance on XRP/USD

- $2.10 becomes the next technical target

- Momentum traders may re-enter

If it fails at this level, downside pressure may resume.

Are Fundamentals Enough To Support Price?

XRP’s tokenomics include a large circulating supply with controlled escrow releases by Ripple. Over time, markets tend to price XRP more like infrastructure than a speculative asset.

Spatacco argued that during stress periods, utility does not guarantee price support. Investors demand measurable adoption growth. That means transaction volume, cross-border payment usage, and institutional integration matter more than headlines.

Meanwhile, Ripple CTO David Schwartz has pushed back against extreme price forecasts such as $50 or $100. He acknowledged that crypto markets can defy expectations, but he does not publicly endorse aggressive price targets.

That stance contrasts with retail speculation. It also reflects how unpredictable liquidity cycles can be.

What Levels Should Traders Watch Now?

Short term focus areas include:

- $1.50 as immediate resistance

- $1.15 as confirmed support

- $1.00 as psychological support

- 0.00002168 on XRP/BTC

The RSI near 50 suggests no strong momentum bias. MACD remains close to the zero line, indicating consolidation rather than expansion.

Volatility has increased across the crypto market. Ethereum and Bitcoin have led liquidations, especially during late January’s sharp drop. XRP has followed broader risk flows rather than moving independently.

Conclusion

XRP can fall toward $1 if macro conditions remain weak and if $1.15 support fails. The chart structure remains corrective, with lower highs intact. At the same time, the XRP/BTC pair is testing a historically important level that previously triggered a strong rally.

Price direction now depends less on headlines and more on liquidity, Bitcoin stability, and whether XRP can outperform BTC again. The technical levels are clear, and the market is reacting to them in real time.

Resources

XRP on TradingView: XRP price action

Report by CoinDesk: XRP outruns bitcoin, ether after investors piled into the recent crash

Analysis by Adam Spatacco from fool(.)com: Is XRP Headed to $1?

Report by Reuters: SEC ends lawsuit against Ripple, company to pay $125 million fine

Read Next...

Frequently Asked Questions

Can XRP realistically drop below $1?

Yes. If $1.15 breaks with strong selling volume and Bitcoin weakens further, a move toward or slightly below $1 is technically possible.

What Is The Importance Of 0.00002168 On XRP/BTC?

It is a prior breakout level. The last confirmed break above it led to a 40% weekly gain in XRP/BTC and a 52.9% rally in XRP/USD.

Does The End Of The SEC Case Guarantee Higher Prices?

No. Legal clarity helps reduce uncertainty, but price still depends on liquidity, market sentiment, and broader crypto conditions.

Disclaimer

Disclaimer: The views expressed in this article do not necessarily represent the views of BSCN. The information provided in this article is for educational and entertainment purposes only and should not be construed as investment advice, or advice of any kind. BSCN assumes no responsibility for any investment decisions made based on the information provided in this article. If you believe that the article should be amended, please reach out to the BSCN team by emailing [email protected].

Author

Soumen Datta

Soumen DattaSoumen has been a crypto researcher since 2020 and holds a master’s in Physics. His writing and research has been published by publications such as CryptoSlate and DailyCoin, as well as BSCN. His areas of focus include Bitcoin, DeFi, and high-potential altcoins like Ethereum, Solana, XRP, and Chainlink. He combines analytical depth with journalistic clarity to deliver insights for both newcomers and seasoned crypto readers.

Crypto Project & Token Reviews

Project & Token Reviews

Comprehensive reviews of crypto's most interesting projects and assets

Learn about the hottest projects & tokens